William_Potter

Background

In an October 24, 2022 article in Apple Insider, TSMC said efforts to rebuild the US semiconductor industry are doomed to fail. When US House Speaker Nancy Pelosi visited Taiwan in August, she met with Morris Chang and Mark Liu, chair of TSMC. Chang told Pelosi that Washington’s efforts to rebuild its chip manufacturing were doomed to fail, according to Taiwan’s Financial Times (paywalled).

U.S. shares of TSMC (NYSE:TSM), which had fallen as much as 6% in regular trading, closed down 3.9% at $61.29 on Monday following the Financial Times report.

This begs the question. Why would TSMC shares drop if “Washington’s efforts to rebuild its chip manufacturing were doomed to fail?” This article probes this and other factors of the Chips Act, its biggest advocate Intel (INTC), and the impact on TSMC.

Rationale for Chips Act

According to an August 2022 release from the White House:

“The CHIPS and Science Act provides $52.7 billion for American semiconductor research, development, manufacturing, and workforce development. This includes $39 billion in manufacturing incentives, including $2 billion for the legacy chips used in automobiles and defense systems, $13.2 billion in R&D and workforce development, and $500 million to provide for international information communications technology security and semiconductor supply chain activities. It also provides a 25 percent investment tax credit for capital expenses for manufacturing of semiconductors and related equipment. These incentives will secure domestic supply, create tens of thousands of good-paying, union construction jobs and thousands more high-skilled manufacturing jobs, and catalyze hundreds of billions more in private investment.”

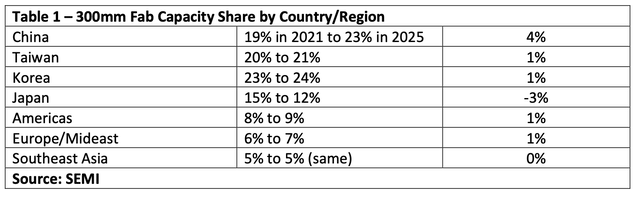

Fab Growth 2022-2025

The Chips Act is intended to provide $50 billion to semiconductor companies planning to build a fab in the U.S. However, a shocking forecast presented by SEMI, the industry consortia, stated that Americas’ global share of 300mm fab capacity is forecast to rise from 8% in 2021 to 9% in 2025, driven partly by U.S. Chips Act funding and incentives. That means that all the hyperbole associated with the Chips Act will increase the U.S. fab capacity JUST 1%.

In the meantime, other countries/regions forecasts are shown in Table 1.

SEMI

Say It Ain’t So Joe

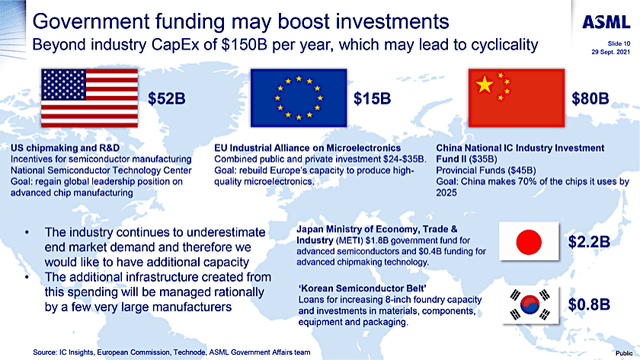

To reiterate a phrase attributed to a reporter speaking to Shoeless Joe Jackson (not Joe Biden) about Jackson’s admission that he cheated in the 1919 World Series, how can this be? Chart 1, according to ASML (ASML), shows that ALL companies are moving forward to increase government and private funding to increase fab capacity. So, Chart 1 presents funding data to SEMI growth in Table 1 with similar results.

ASML

Chart 1

Do We Need the Chips Act?

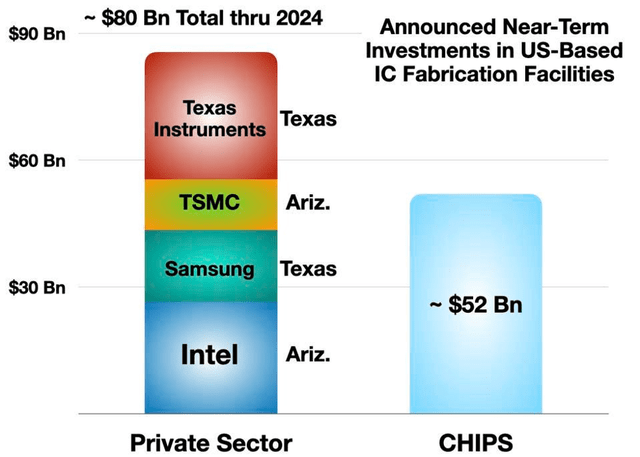

Below is a list of chip companies that are in the process of building these fabs:

Intel – $20 billion for two fabs in central Ohio, under construction in summer 2022, to make advanced logic chips. Intel broke ground in 2021 on two new fabs in Chandler, Arizona, a $20 billion investment. An advanced packaging facility is underway in New Mexico.

Micron (MU) – A $15 billion fab for its Boise HQ to make memory chips. Active prospects for billions of dollars more in fabs, including near Austin, Texas. In October, Micron committed to build four fabs on a site in central New York over 20 years at a cost of $100 billion.

Samsung (OTCPK:SSNLF) – A $17 billion fab for Taylor, Texas, was announced in late 2021. The South Korean company laid out preliminary long-term plans in July for 11 fabs in Texas over coming years worth nearly $191 billion.

Texas Instruments (TXN) – A potential $30 billion investment plan includes four fabs in Sherman, Texas. Ground was broken in May for new 300mm wafer fabs.

TSMC – Taiwan-based TSMC has multiple fabs, including one in Camas, Washington, with a $12 billion fab under construction in Phoenix to make chips on the 5nm process.

Wolfspeed (WOLF) – $5 billion for a silicon carbide wafer fab in central North Carolina

An excellent November 2021 Forbes article asks the question “The CHIPS Act – Is It Really Necessary?” Chart 2 shows compiled data for the fabs previously listed above, which includes $80 billion to construct these fabs.

The Chip’s Act contribution of $52 billion is clearly a catalyst for fab construction, particularly for non-U.S. companies Samsung Electronics and TSMC, whose capex spend for their fabs (construction and equipment).

Forbes

Chart 2

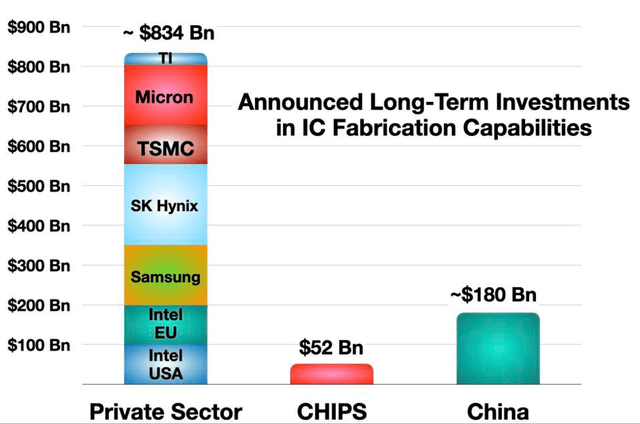

But the $80 billion near-term spend coinciding with the Chips Act + Private Funding, pales in comparison to long term plans of $834 billion in the U.S. (plus Intel Europe) which is Private Funding. The $834 billion is 5X times larger than China’s long-term capex plans of $180 billion, as shown in Chart 3.

Forbes

Chart 3

The promotion piece for my report “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends” was picked up by AsiaTimes, which of course I had to reference in this article, and note that my forecast was two years earlier but pretty similar to China’s spend in Chart 3.

The Information Network, a market research company focused on microelectronics, predicts that “investments in new [semiconductor] fabs or capacity expansion will exceed US$160bn in China over the coming 5-7 years; we expect this will drive an increase in China’s equipment spending to more $40 billion in 2025.”

I Give to You, You Give Back to Me – 50 Fold

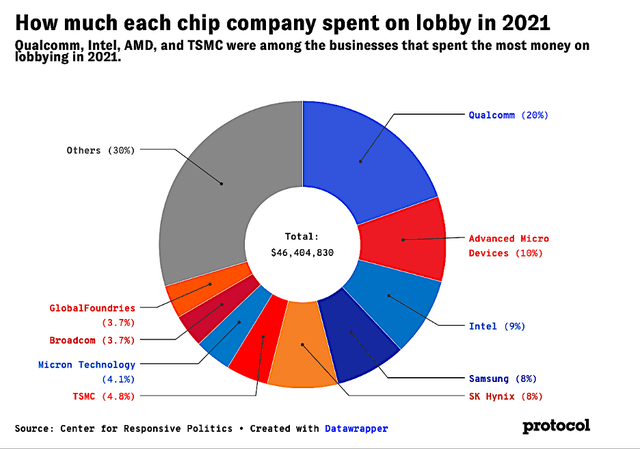

According to Protocol, “Chip companies spent $100 million lobbying Congress. They’re about to get $52 billion in subsidies.” Chart 4 partially shows how much each chip company spent on lobbying in 2021.

protocol

Chart 4

Intel Corp. spent $2 million to deploy lobbyists to Capitol Hill, the Pentagon, Commerce Department and President Biden’s office in the third quarter of 2022, according to a report filed with Congress.

Micron Technology (MU) shelled out $1.3 million on lobbying in the third quarter, a year-over-year increase of 155 percent.

Taiwan’s TSMC spent $2.2 million on lobbying in 2021, up from $2 million the year earlier — the first lobbying outlay from TSMC since 1998, according to CRP data.

Qualcomm (QCOM) spent $9.1 million on lobbying last year,

KLA (KLAC) spent roughly $700,000 in 2021

ASML, which is based in the Netherlands, spent $820,000 in 2021.

Taiwan-based chip designer MediaTek spent $650,000, though it doesn’t manufacture chips.

Even Arizona State University spent nearly $250,000 lobbying for the Chips Act and will receive federal funding for research and development.

Why did TSMC say the Chips Act was doomed to fail?

The Fin Times article quoted some “experts” to interpret TSMC’s comments. Dick Thurston, former general counsel for TSMC and consultant, warned that “several multiples of the money committed over a period of 10 to 15 years” will be needed for domestic chip making to succeed.

Let me try to expand on that comment. It’s about market forces. A state-of-the-art fab can cost $20 billion. The $52 billion could make just 2½ fabs but significantly more companies are lobbying to get handouts from the government. In other words, $52 billion is a drop in the bucket. But if we look at Chart 3 above, the $834 billion in long-term investments are market forces that will increase wafer capacity beyond the 1% forecast from the Chips Act.

In other words, the Chips Act gets the U.S. just a 1% increase in capacity through 2025. But it expands a much needed infrastructure in the U.S., which expands by 10X the private expansion of the fabs started by the Chips Act.

Short term, the Chips Act is too little, too late, as TSMC’s commentary of “several multiples of the money committed over a period of 10 to 15 years.” Unfortunately the government giveaway of the past two years has driven inflation to a 40-year high, and giving more money to chip companies at this time adds insult to injury.

However, the positive effect of the Chips Act is that it is an incubator for long-term investment. Thus, it should not be interpreted as a “quick fix”, but a catalyst for long term growth.

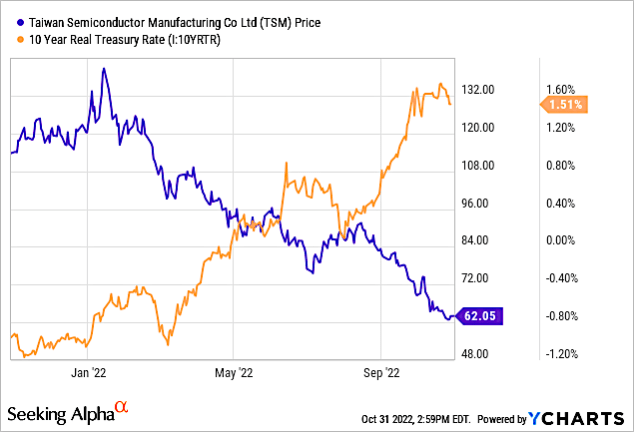

I’ve written numerous articles on TSMC. Currently, I have a Buy on the stock, despite TSM share price being negatively impacted by a Fed-driven economy, primarily its inverse relationship to the rising 10-year Treasury Rate. It is my top semiconductor manufacturing pick.

Chart 5 shows that TSM’s share percentage change over the past 1-year period. The poor performance of TSM over the past year is a direct result of a Fed-driven market with rising bond rates because of high inflation, and increasing interest rates. Any more money given to chip companies will intensify inflation and result in increased Fed tightening and lower share performance.

YCharts

Chart 5