RiverNorthPhotography/iStock Unreleased via Getty Images

As one of the most prominent traded restaurants, Yum! Brands, Inc. (NYSE: YUM) remains an industry staple. It holds some well-loved QSRs, including KFC, Taco Bell, and Pizza Hut. With its reputation and popular holdings, YUM maintains a stellar performance.

Amidst inflationary pressures, it sustains revenue growth while keeping costs and expenses manageable. Even better, it remains secure with its stable returns and cash flows. Hence, it has adequate capacity to suffice and raise dividend payments.

However, it must be careful with its financial leverage to stay liquid. Also, investors must wait for an ideal entry point or look for better alternatives. It trades at 28x earnings multiple, so it might not be worth the risk for now.

Company Performance

Yum! Brands, Inc. has faced external pressures in the last two years. Being a company in the consumer discretionary sector, it had to endure the toll of pandemic restrictions. It had to deal with supply chain disruptions and limited physical transactions. Today, it faces more potential drawbacks as it operates in a high-inflation environment. Even so, it has remained one of the most enduring traded QSRs with its stable revenues and margins.

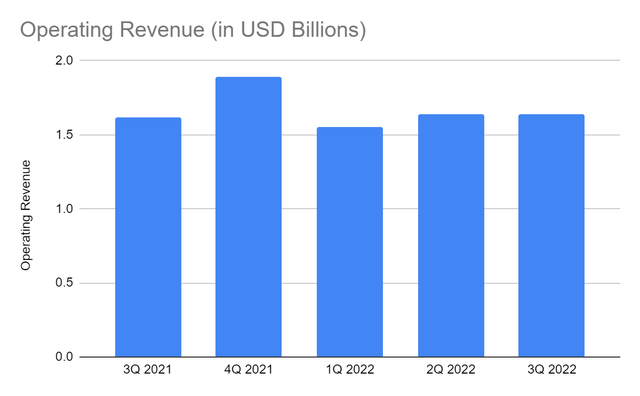

Yum continues to prove its durability, being worthy of being considered an industry staple thanks to its popular QSR brands fueling its market engagement. This quarter, YUM remains on a solid footing with its sustained revenues. The operating revenue amounts to $1.64 billion, a 2% year-over-year growth. Thanks to the strong demand for its iconic brands, helping it to stay afloat amidst inflation. Even better, it continues to take advantage of its strong positioning with its increased store openings. This quarter has 979 gross unit openings, leading to 644 net-new units. It helped offset the unfavorable impact of its divestment in Russia. If we exclude the impact of foreign currency translation, the actual growth will be 7%, with a 5% same-store sales increase and a 4% unit increase.

Operating Revenue (MarketWatch)

Another primary growth driver is accelerating its digital adoption and unit development. This move is timely and efficient as digital transformation peaks. Indeed, it has already realized how the pandemic led to drastic changes in the market landscape. For instance, digital transactions rose as an alternative to physical transactions. It helps brick-and-mortar stores adapt to the restrictions and limited customer transactions. It includes food delivery, online marketing, and cashless transactions. In the US alone, cash transactions dropped to 22% in 2020. More studies today are consistent with the increased preference for cashless transactions. Indeed, the company is consistent with the market landscape changes.

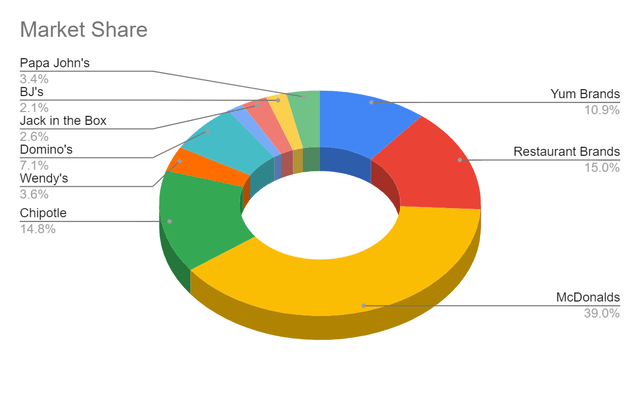

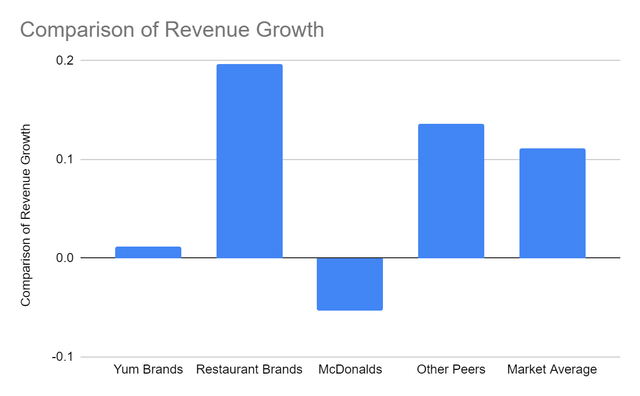

With regard to its peers, YUM remains one of the largest brands in the industry. It ranks fourth, holding a 10.9% market share with a 3% gap from Domino’s Pizza (DPZ). Yet, YUM must not be complacent about maintaining its market standing. Its revenue growth is way below the market average of 11%. Although it continues to grow, many of its peers appear to be moving faster.

Market Share (MarketWatch)

Revenue Growth (MarketWatch)

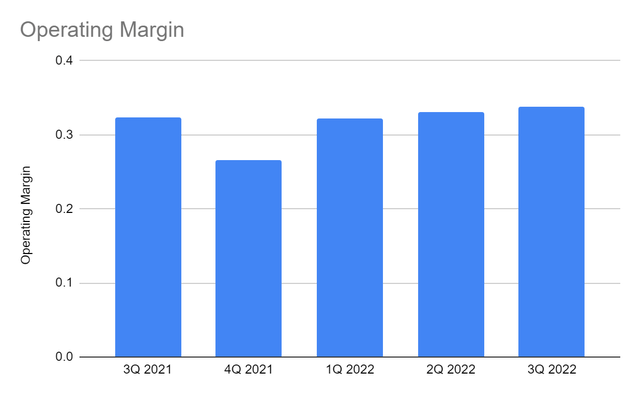

But it proves that it prefers to be more conservative while expanding. Its costs are lower while expenses are still manageable. So, amidst the rising prices, it ensures efficient asset management. Its production inputs consistently increase store openings to match the solid market demand. Hence, revenues are adequate to cover costs and expenses. The operating margin remains high and stable at 34%. It slightly increased from 32% in 3Q 2021 and a solid rebound from 26% in 4Q 2021. Also, the operating margin has had a consistent quarterly increase since the start of the year. Net income is also stable, showing the consistency between the core and non-core operations. Note that its international operations are experiencing the impact of unfavorable foreign currency translation. Relative to its competitors, YUM has the most efficient and stable core operations. Except for McDonald’s (MCD), with a 48% operating margin, YUM has a better operating margin than its peers. Restaurant Brands (QSR) has 32%. Other large competitors like Chipotle (CMG) and DPZ have 17%.

Operating Margin (MarketWatch)

Another noticeable factor to consider is the changes in the revenue components. Its segment mix remains consistent, mainly composed of KFC. In recent years, there has been a decline in KFC and a substantial increase in Taco Bell sales and store openings. These trends appeared to affect business margins. Nevertheless, the company continues to fuel its performance. There is a sustained increase in same-store sales and stable income. Indeed, its global brands have all delivered impeccable system sales growth. It proves that a globally diversified business like YUM can stay afloat and flourish in any landscape.

Yum! Brands On Staying Solid And Sustainable

Amidst the macroeconomic pressures and segment mix changes, YUM remains a secure and durable company. With its solid customer base and innovation, it is geared towards more enticing growth prospects. Yet, it has to ensure it can sustain its current size and capacity. It also has to cope with the market trend, especially now that economic volatility remains high.

Thankfully, inflation appears to be approaching a winter lull. After peaking at 9.1%, it decreased during the third quarter. It continues to lose momentum as it cooled down to 7.7% recently. Although YUM thrives even in a high-inflation environment, the downtrend may help it do better. Lower inflation means lower costs of production expenses. It also means higher purchasing power, driving more potential demand and operating revenue.

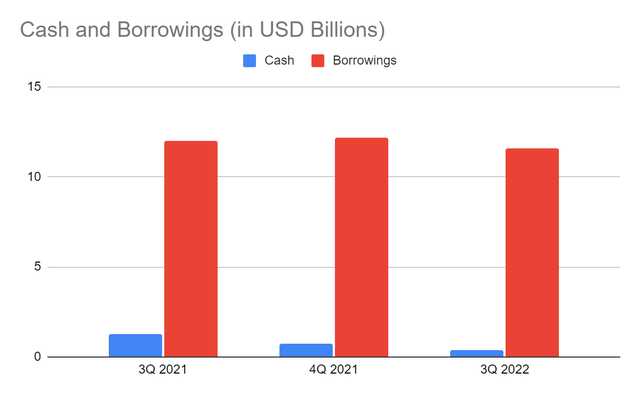

Moreover, its operations are sustainable. Its operating cash flows are stable enough to cover CapEx, leading to impressive FCF. FCF/Sales Ratio also remains above 10%, which is reasonable for a capital-intensive company. Currently, the ratio is 24%, so almost one-fourth of the revenues can be used for dividend payments and borrowing repayments. Likewise, its Balance Sheet shows adequate financial capacity with a current ratio of 1.29x. But it has to be more careful with its borrowings. The negative equity shows a potential deficit and overleveraged operations. Its Net Debt/EBITDA Ratio of 4.8x is higher than the typical range of 3.5x-4x. So even if the company generates high EBITDA, borrowings remain high. It must also consider the series of interest rate hikes, making the cost of borrowing higher. Overall, the company is liquid with stable cash flows but overleveraged.

Cash And Equivalents And Borrowings (MarketWatch)

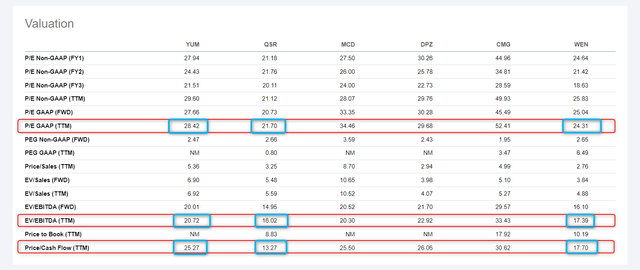

Stock Price Assessment

The stock price of Yum! Brands, Inc. had a continued downtrend earlier this year. But it has rebounded in the last month, although still lower than the peak. At $124-125, it is still 8% lower than the starting price. Also, the current trend is consistent with its fundamentals. However, the price does not seem to be enticing at this time. It is traded at a P/E Ratio of 28x, which is quite high. Although it appears to be within the market average, there are still better alternatives, such as QSR at 21x and Wendy’s (WEN) with a 21x earnings multiple. The same comparison is in Price/Operating Cash Flow and EV/EBITDA.

Meanwhile, YUM has consistent dividends. Dividend growth has been smooth over the years. Its current Dividend Payout Ratio of 49% shows that it can sustain dividend payments. Also, its dividend yield of 1.86% is higher than the S&P average of 1.82%. But it is lower than many of its peers, like QSR with 3.24%, MCD with 2.22%, and WEN with 2.39%. It may show that payouts are less enticing than the close peers. To assess it further, we can use the DCF Model.

Dividend Yield (Seeking Alpha)

Price Metrics (Seeking Alpha)

FCFF $1,410,000,000

Cash $410,000,000

Outstanding Borrowings $72,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 281,689,000

Stock Price $124

Derived Value $108.08

The derived value confirms the supposition of overvaluation. The stock price may decrease 12-14% in the next twelve months. So, investors must be more careful before buying the stocks of the company.

Bottom line

Yum! Brands, Inc. maintains a stable performance in a volatile market. It remains profitable with adequate cash inflows and a current ratio. Yet, it must watch out for its overall liquidity and sustainability as it appears to be overleveraged. Also, the stock price appears overvalued, although the dividend yield is reasonable. The recommendation, for now, is that Yum! Brands, Inc. is a hold.