Based on the Nationwide Retail Federation, the back-to-school buying season kicked off sooner than ever in 2025, with two-thirds (67%) of households beginning their purchases as of early July—a document since 2018. This enhance is carefully tied to issues over tariffs and inflation, which have motivated half (51%) of consumers to get a soar on the season, hoping to sidestep potential worth hikes.

One of many defining tendencies this yr is the rise of low cost shops as a go-to vacation spot for back-to-school consumers. Whereas on-line buying stays dominant, particularly for faculty college students (48%), almost half (47%) of Okay-12 households are turning to low cost retailers for offers.

The Rise of Low cost

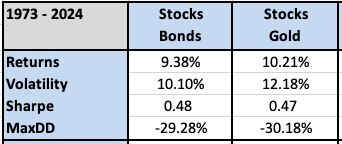

Current NRF information reveals that low cost shops have climbed in reputation for back-to-school buying. Whereas on-line channels stay the best choice for Okay-12 consumers (55%), shops comply with at 48%, and low cost shops are usually not far behind at 47%. Amongst faculty consumers, low cost shops noticed a notable enhance of 5 proportion factors over final yr. For a lot of households, particularly these looking for higher offers, low cost shops signify actual financial savings and supply reduction throughout a time of financial uncertainty.

How Customers Are Navigating Worth Pressures

As a result of back-to-school buying is taken into account an enormous spending occasion, customers are altering their buying habits to unfold out bills. And it’s not simply value-conscious households both, customers throughout all revenue ranges are shifting their buying habits to maximise worth:

- 67% of households had begun buying in early July in comparison with solely 55% final year- principally because of the anticipation of upper tariffs.

- Customers are buying and selling down from branded to store-brand and private-label gadgets.

- Many are spreading out purchases, ready for the perfect offers (47%), or sticking to necessities to manage spending.

For faculty consumers, the transfer towards low cost shops is much more important. This shift is very notable amongst higher-income households, marking a broader shopper pivot from conventional shops to retailers emphasizing worth and affordability.

“Shoppers are being conscious of the potential impacts of tariffs and inflation on back-to-school gadgets, and have turned to early buying, low cost shops, and summer time gross sales for financial savings on faculty necessities,” stated Katherine Cullen, NRF Vice President of Business and Shopper Insights.

Key Again-to-Faculty Spending Figures

- Okay-12 households common spend: $858.07 (down from $874.68 in 2024) on clothes, sneakers, provides, and electronics.

- School households common spend: $1,325.85 (down from $1,364.75 in 2024)—but whole spending is up because of broader participation.

- The most typical classes for financial savings: electronics, clothes/equipment, and faculty provides, with deep promotional occasions and summer time gross sales driving purchases.

As budget-conscious households look to set college students up for fulfillment, the low cost retailer has solidified its place on the coronary heart of the back-to-school season. Whereas at this time’s consumers are all about stretching their {dollars} with out compromising on necessities, retailers and types can nonetheless profit too.

Unlocking Worth within the Secondary Market

Because the back-to-school buying surge brings an inflow of returns, exchanges, and overstock, manufacturers and retailers face the daunting job of rapidly and effectively managing this aftermath. Mishandled, these extra items can disrupt regular operations, tie up priceless warehouse area, and diminish margins.

Whereas retailers and producers should anticipate, strategize, and handle to reduce disruptions to regular operations, many retailers and types have begun to leverage B2B recommerce platforms to maneuver out returned and extra merchandise throughout each back-to-school class into the secondary market. The advantages of this method are threefold:

- The unique model or retailer can recuperate among the worth locked away in its unsold items

- Small enterprise house owners maintain their cabinets stocked with high-quality, brand-name items

- Finances-conscious customers should purchase these items at cheap costs

B-Inventory permits manufacturers and retailers to maximise restoration and preserve operational effectivity, whereas supporting the broader group by inexpensive provide. The secondary market is not simply an afterthought—it’s a essential, strategic lever for contemporary retail success.

Able to study extra?