Godji10

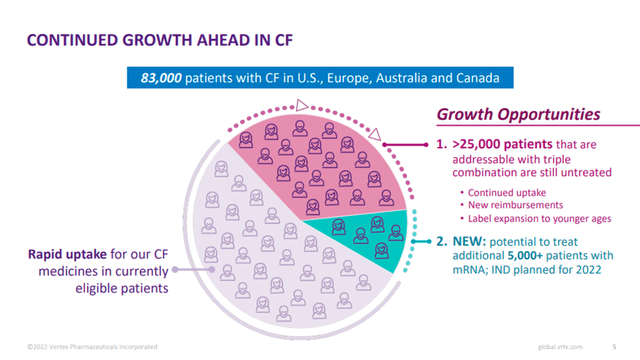

Cystic fibrosis (CF) is a progressive genetic disorder that often causes persistent lung infections that eventually cause respiratory depression. More than 83,000 people worldwide suffer from cystic fibrosis, and about 1,000 new diagnoses are made each year.

In this specific context sales of Vertex (NASDAQ:VRTX) CF treatment continues to grow with Trikafta/Kaftrio triple therapy. CF treatments represent the Vertex core market and the Company has, at the moment, very low competition.

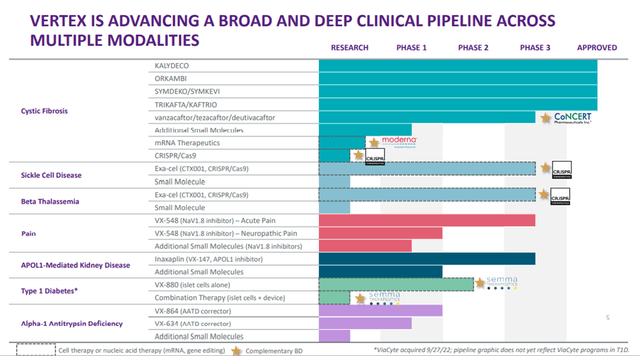

Vertex also has a broad clinical pipeline in six disease areas and it is developing rapidly.

Also for the reasons above the stock has outperformed the industry and the general market so far this year with an impressive +39% on the share price.

In this article, I outline the case about why I believe Vertex is a Buy today and has the potential to deliver 18.6% returns yearly over the next years.

Company Overview

Vertex Pharmaceuticals is a biotechnology company that has developed several medicines to treat patients suffering from cystic fibrosis. Vertex also has a pipeline of therapies for other diseases, including sickle cell disease, beta thalassemia, muscular dystrophy, and type 1 diabetes.

Vertex didn’t start on drugs for genetic diseases like CF. Its early success was from products treating hepatitis C and HIV. The company’s Incivek drug (for hepatitis C) was one of the fastest new product launches ever in the biopharma industry.

Successive development targeted other areas in which genetic mutations resulted in malformed protein production.

Today Vertex’s business is mainly concentrated on CF therapy and we can see one of their main targets is to maintain and expand CF Leadership. On the other side, the company is fully committed to maintaining a strong, stable, and growing financial profile through a rich R&D pipeline and new business opportunities.

Vertex Q3

Financial Highlights

Revenue Growth

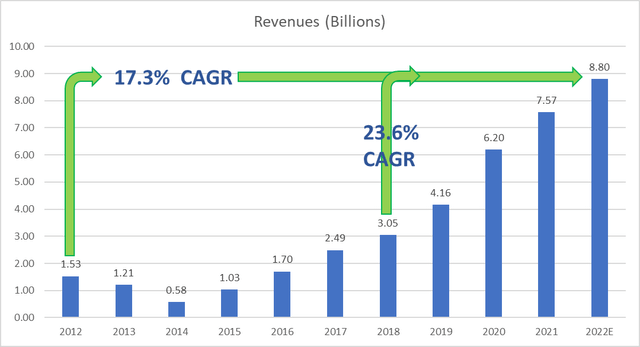

A strong track record of revenue growth is poised for continued expansion in 2022 and beyond.

Author Graphics + Vertex QR

Revenue Growth mainly due to CF drugs has been of 17.3% in the last 10 years and 23.6% in the last 5 years. This underlines a strong acceleration related to sales in the closest period.

Related to 2022 and beyond is expected Continued Growth in CF for the following reasons:

- Younger Age Groups

- New Reimbursements

- New Markets

Vertex expects revenue growth as more than 25,000 patients remain who are available for CF treatments.

Vertex JP Conference

In addition, Vertex expects also to expand addressable patient population commercialization in several new serious diseases, starting with sickle cell disease and beta-thalassemia.

Related to the past data and the new company target I think the future growth rate will be very close to what we have seen in the past 5 years.

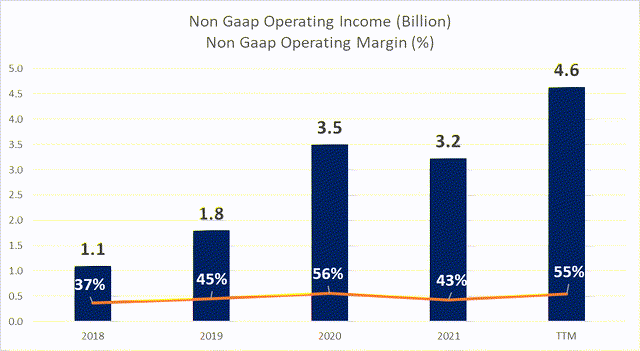

Profitability Growth and Cash Flow

Vertex’s business model sustains high levels of profitability, cash flow, and great reinvestment in research.

Author Graphics + Vertex QR

As we can see, the operating margin has more than quadrupled in 5 years, going from 1.1B to 4.6B. In % terms, 2022 should show a recovery bringing the data to a level of around 55%. These are great signs of strong sustainability of the business in the medium to long term.

Author Graphics + Vertex QR

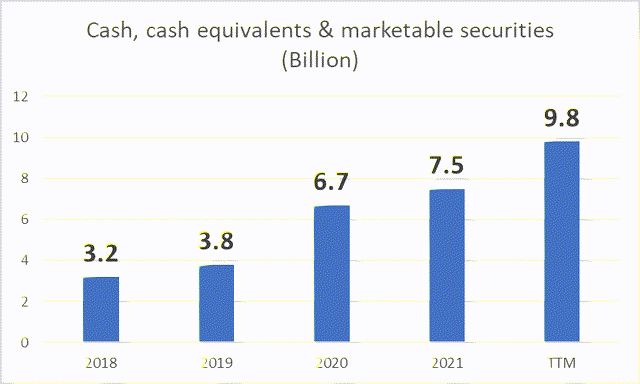

In Q3 2022, Vertex reported $482.0 million in long-term debt. As we can see from the table Cash and cash equivalents in 2022 are about $9.8 billion. This underlines that the company is more than sufficient to pay all the long debt. Q3 Vertex’s current ratio is 4.7 and if compared with Q2 which was 4.5 or with 4.4 as of FY21 we can note an important improvement. A bigger ratio indicates lower financial risk.

Pipeline

Vertex Q3

Vertex is evaluating its CF treatments in younger patient populations and is involved to grow little molecule treatments for about 90% of individuals. The company is also following genetic therapies to handle the full 100 percent of patients, as well as an RNA partnership with Moderna. Vertex and Moderna could be in the clinical development of their medical care in 2022/2023.

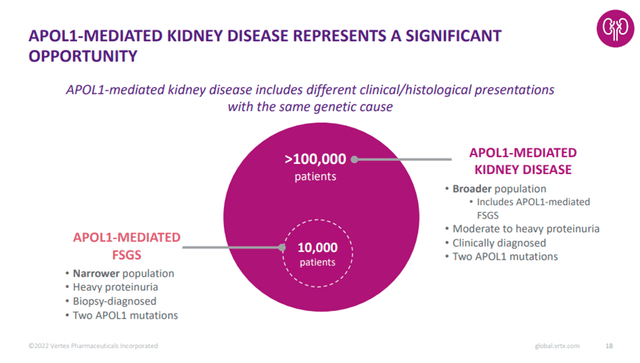

Beyond CF, the company also has a great pipeline set in six additional disease treatments: sickle cell disease, beta-thalassemia, acute pain, APOL1-mediated kidney diseases, type I diabetes, and Alpha-1 Antitrypsin Deficiency. Many of these programs could become multibillion-dollar businesses.

Vertex JP Conference

As you can see in the previous pipeline picture, programs in four diseases are entering late-stage clinical development.

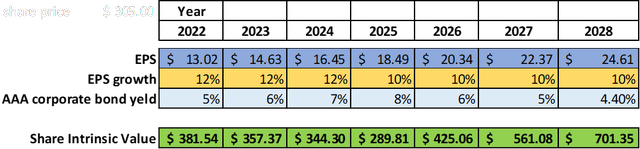

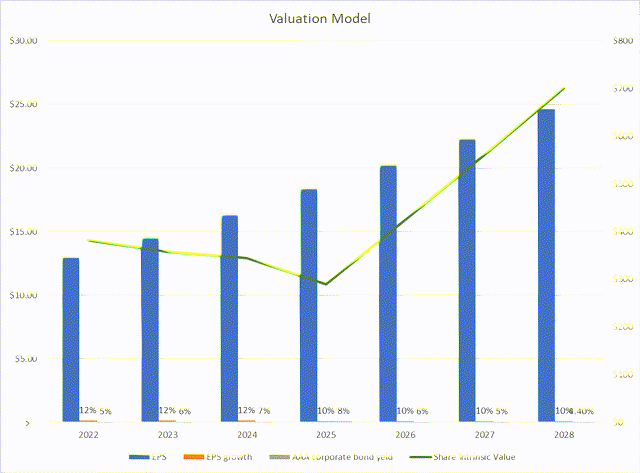

Valuation Model

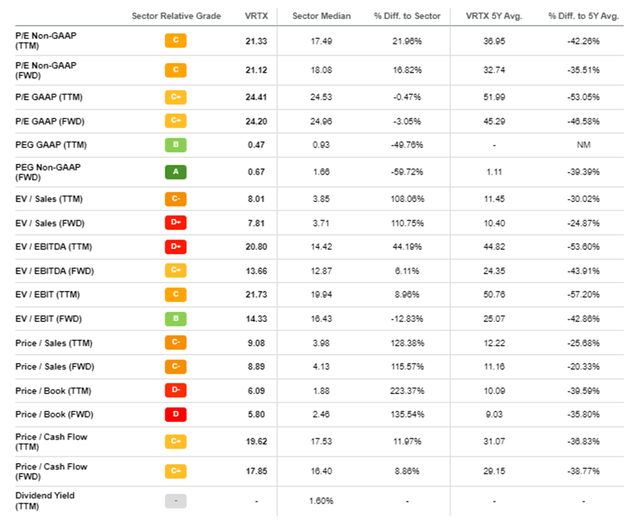

In order to evaluate Vertex we could use the standard metrics where we can see that in quite all data Vertex is over the Sector Median. This could mean that Vertex is vastly overrated at this stage. But if we go deeper into the characteristics of the company, we can see how a fundamental metric, that is the PEG ratio, highlights the extraordinary potential of Vertex for the years to come.

Seeking Alpha

With the target to capture the real strength (and the real value) of the Company in the future in terms of a Growth stock, I like to focus the attention mainly on the EPS growth rate.

I use an alternative formula that is based on growth parameters and profitability. This formula was written by popular investor Benjamin Graham in Chapter 39 of the 1962 edition of Security Analysis:

Intrinsic value per share = EPS x (8.5 + 2 g) x 4.4/y

Where

EPS = earning per share

g = EPS growth rate

y = yield on AAA corporate bonds (if yields > 4.4)

Evaluation of growth companies requires the application of Graham’s formula also to estimate the future intrinsic value.

And estimating a company’s future value requires the following steps:

1. Calculate the normalized earnings per share

2. Forecast the long-term earnings per share growth rate

3. Calculate normalized earnings in the future (7 years)

4. Calculate the future intrinsic value

Related to point 2 I used the CAGR rate of the last 3 years (from 2020 to 2022) to estimate future growth up to 2024. From 2025 onwards I have used a conservative growth rate of 10%.

Related to the yield on AAA bonds I assumed a linear growth of 1 point until 2025 and then a normalization until 2028.

Author Valuation Model

Example of calculation for 2023:

Intrinsic value per share = EPS x (8.5 + 2 g) x 4.4/y = 14.63x(8.5+2×12)x4.4/6=357.37

The last intrinsic value of $ 701,35 for 2028 underlines a compounded annualized return (CAGR) of 18.6% if compared with the trading price of about $ 305.

Author Valuation Model

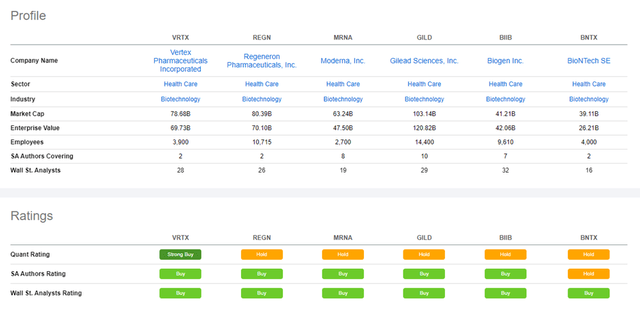

Peers comparison

I compared Vertex with the following Biotechnology Company:

- Regenereon Pharmaceutica, Inc (REGN)

- Moderna, Inc (MRNA)

- Gilead Sciences Inc (GILD)

- Biogen Inc (BIIB)

- BioNTech SE (BNTX)

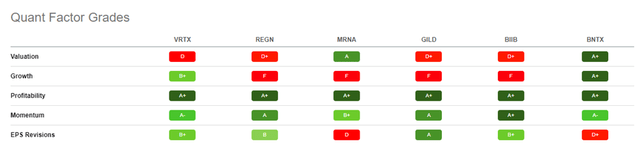

SA peer comparison SA Quant Factor Grades

Using Seeking Alpha’s Quant Factor Grades we can see how, in terms of Growth rate, Profitability, Momentum, and EPS Revision, Vertex is the best in class and represent the best opportunity in this specific sector.

Risks

Every Company is not risk-free and also Vertex has something that could be wrong.

At the moment Vertex is quite monopolistic in its core market (CF therapy) but we have to underline that companies like AbbVie, Eloxx Pharmaceuticals, Arcturus Therapeutics, and Krystal Biotech are developing programs involved in CF. The possible entry into the market of these companies could lead to a significant cut in revenues for Vertex.

The company’s revenue is completely dependent on CF therapy to maintain sustainable growth. While the company does have other therapeutic areas in its pipeline, they are not imminent and could be necessary for some years for sales and new revenue. Vertex’s non-CF pipeline represents important risks.

Conclusion

Vertex is a solid growth company with a Strong CF Portfolio. The Cystic fibrosis market represents huge potential for the next years. Vertex has a strong position in this market, the company was the first to successfully develop a drug (Kalydeco) that treats the underlying cause of the disease.

Vertex has a solid financial position with an impressive growth rate in revenue and earnings. The market has noticed this great and sustainable growth and has rewarded the company in the last year despite a very bearish general context.

The Pipeline programs represent a sort of risk but we can underline that four new high-potential treatments are close to the last stadium of commercialization.

If in this case, the past can be predictive, I do not doubt that Vertex can grow further and in a very important way in the coming years. With a potential 18.6% yearly return, I rate this investment as a Buy.