[ad_1]

3dmitry/iStock through Getty Pictures

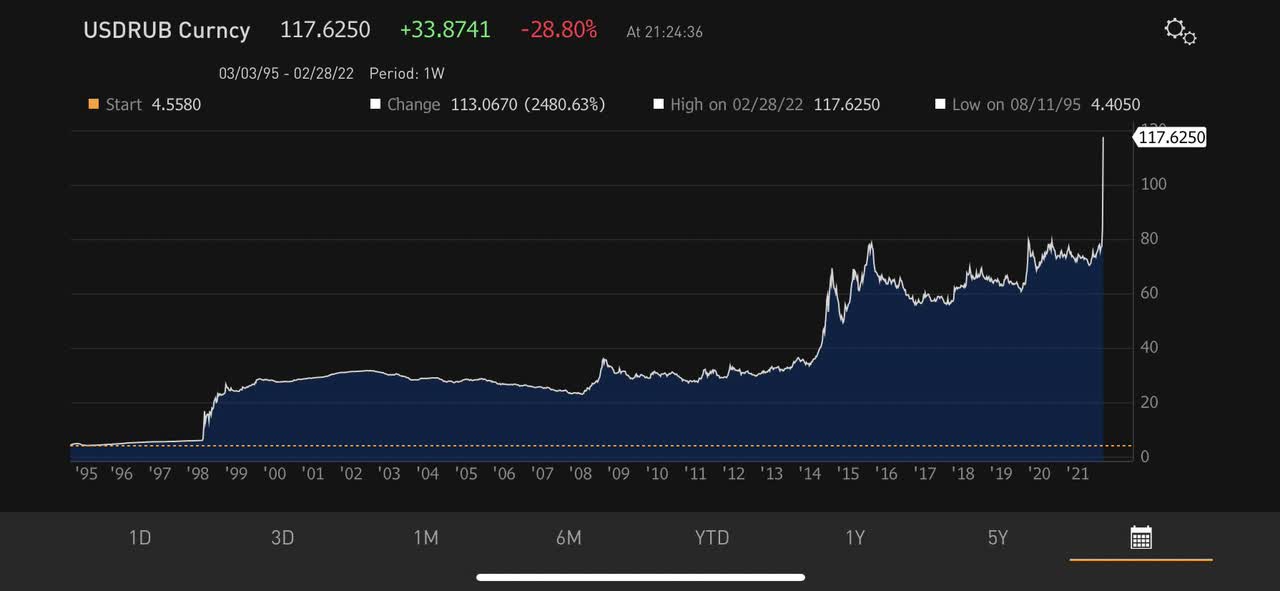

I am going to begin with a giant image opinion on Russia’s invasion. NATO has been very spectacular and coordinated of their response. SWIFT, central financial institution sanctions, RUB forex declines, shutting out their bond market from buying and selling, and sanctioning giant companies are all going to have an enormous impact in my view.

Ex-Goldman analyst Sergei Perfiliev has acknowledged it higher than I ever might and mirrors my view. He says:

This warfare is predicated on Putin’s battle to stay in energy. NATO is simply an excuse. To begin with, NATO has by no means been a difficulty for many years. Hell, Kaliningrad is surrounded by NATO. Latvia and Estonia are bordering Russia, and each are NATO members. NATO border is 76 miles from St. Petersburg and has been there since 2004. Why Ukraine? And why now? A free, democratic and affluent Ukraine is a direct menace to Putin’s rule of legislation. Full cease. As a result of it is a straightforward chain response. If Ukraine can develop and prosper, why cannot Belarus? Why cannot Kazakhstan? And naturally, why cannot Russia? No cause why – after all, they’ll! The explanation they do not is as a result of their corrupt and authoritarian governments is a big bottleneck standing between the nation and prosperity. Putin is aware of this, which is why he hangs for his life supporting dictatorships world wide.

Anne Marie Hordern

Moody’s Credit score Score Company downgrades Russian debt 6 ranges to junk territory with scope for additional downgrades. In an announcement the agency stated:

Extreme and coordinated sanctions imposed on Russia along with its retaliatory response in current days have materially impaired its means to execute cross-border transactions, together with for sovereign debt funds.

With the Russian central financial institution sanctioned, I feel it is going to be very troublesome to conduct ruble FX intervention in dimension in an effort to defend the forex. Russia will need to preserve greenback faucets open by means of USD-priced Russian power exports remaining comparatively unsanctioned in comparison with the remainder of Russia’s monetary system.

This permits the central financial institution of Russia to purchase ruble with {dollars} (from power exports) to prop up the trade fee.

The central financial institution of Russia can increase charges all they need however yield differentials aren’t going to matter as no person is carrying buying and selling into the ruble proper now neither is capital going to circulation into the Russian monetary system. Drastically elevating charges is just going to serve in weakening Russian development and employment.

Russia must defend the RUB, and they’re lower off from USD with half frozen in abroad central banks and the opposite half held domestically (in line with the Institute of Worldwide Finance) however sanctions on the central financial institution of Russia prevents transacting with almost each counter-party.

Russia holds substantial gold reserves, however how do they use these to defend the RUB? Promote them to China or Venezuela or whoever they’ll? China wants USD given their property developer USD-denominated debt issues with the PBOC decreasing charges whereas the Fed raises – resulting in capital outflows and sure yuan depreciation strain very quickly.

HKD is closing in on the higher band of its forex peg to the USD. Hong Kong and China ought to be hoarding {dollars}. In line with Bloomberg:

The Hong Kong greenback is poised for steeper losses as impending Federal Reserve fee hikes exacerbate capital outflows triggered by the deadliest Covid outbreak within the metropolis.

The forex prolonged its drop to the bottom in additional than two years this week and option-implied volatility signifies a 32% chance that it might fall to the weak finish of its 7.75-7.85 per greenback buying and selling band by the top of the second quarter.

BofA Securities Inc. and Daiwa Capital Markets Hong Kong Ltd. are amongst these betting on Hong Kong’s forex falling to 7.85 this yr as Fed hikes cut back the attractiveness of town’s belongings. To make issues worse the federal government’s efforts to stamp out Covid are pushing the financial system again into contraction this quarter.

“It might solely take weeks to hit the 7.85 stage after the Fed hike,” stated Kevin Lai, chief economist for Asia ex-Japan at Daiwa Capital Markets, including that “the largest shake-up is but to occur.”

If the Russian central financial institution does handle to monetize their gold reserves someway, would not all that gold promoting crater the value and actually be used ultimately to purchase USD? Many have stated this may all result in the demise of the USD as a reserve forex. I disagree. Russia is encouraging allies to promote euro and greenback holdings. My response, for one, what allies? Secondly – if you’re considering China, China’s property builders are engulfed in USD debt and are going to want {dollars} in addition to Hong Kong’s FX board. The EM greenback debt downside is not unique to Russia. In line with the Financial institution of Worldwide Settlements there’s 13.4T if international USD denominated debt. This implies there’s a robust underlying worldwide demand for US {dollars}.

Financial institution runs in Russia are ensuing. Russian banks are doubtless going to be bancrupt. What can the Russian authorities do? Print RUB to recap banks? This is able to result in additional depreciation within the ruble and better inflation. That is not an excellent possibility or the Russian authorities might watch their banks collapse and depositors lose funds, which might even be a nasty state of affairs. There may be not an excellent consequence for Russia’s financial system at this level. “This leaves Russia with a stark selection: Peace, a banking collapse or hyperinflation”.

Nearly each Russian company with any quantity of USD denominated debt can be in default. The ruble has collapsed, inflicting a surge in the actual burden of Russian company greenback debt. Not solely that, however the query is can they purchase any USD in any respect with being lower off from the worldwide monetary system? Probably not and, due to this fact, will doubtless find yourself bankrupt.

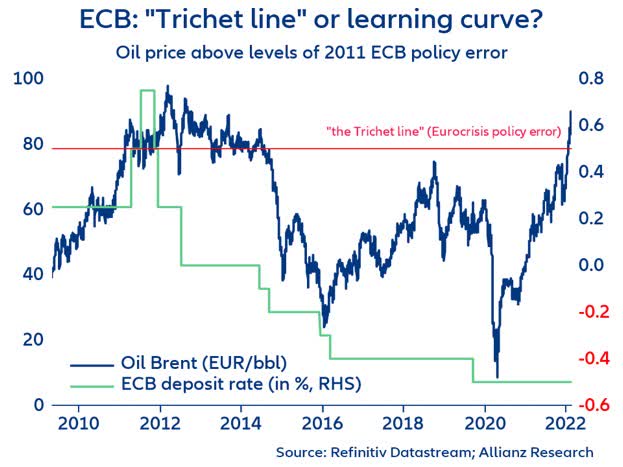

I additionally really feel many are making massive assumptions that oil goes to proceed rising. In 2014, there was a mixture of Russian sanctions, ECB/Fed fee coverage divergence, ramping of US shale manufacturing, and a robust greenback surroundings. This all contributed to a big decline in oil costs. Given these indicators are all occurring now, I can’t rule out the likelihood.

Capital outflows from rising markets, weakening rising market currencies and economies because the Fed strikes, ECB/Fed coverage divergence on account of completely different response features to Ukraine, a weak Japanese and Chinese language financial system, giant international USD denominated debt, and a comparatively robust US financial system all help the USD. Within the state of affairs of an OPEC ramp + shale manufacturing enhance (rig counts are steadily climbing) + SPR launch + Iran deal, it might offset misplaced Russian export provide.

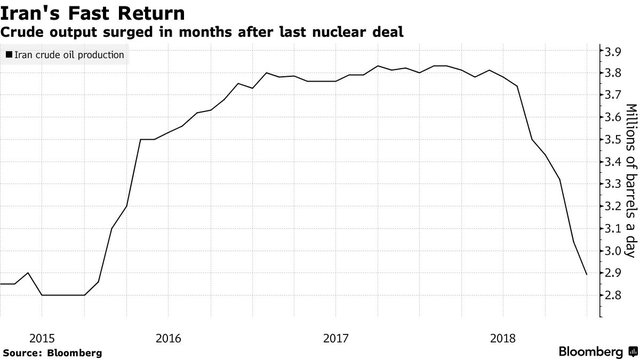

At present, Iran has 103M barrels of oil in floating storage on tankers prepared for export, in line with Bloomberg and oil intelligence agency Kpler. Russia exports 5M barrels per day, in line with the EIA. Oil will proceed to circulation, although bringing Iran again is essential. Many are anticipating an Iran deal inside days. Whereas a deal would doubtless repeal sanctions on some Iranian officers who’ve dedicated atrocities (my greatest situation), it might additionally stop Iran from growing a nuclear weapon and keep away from the state of affairs we’re in at the moment with Russia.

Bloomberg

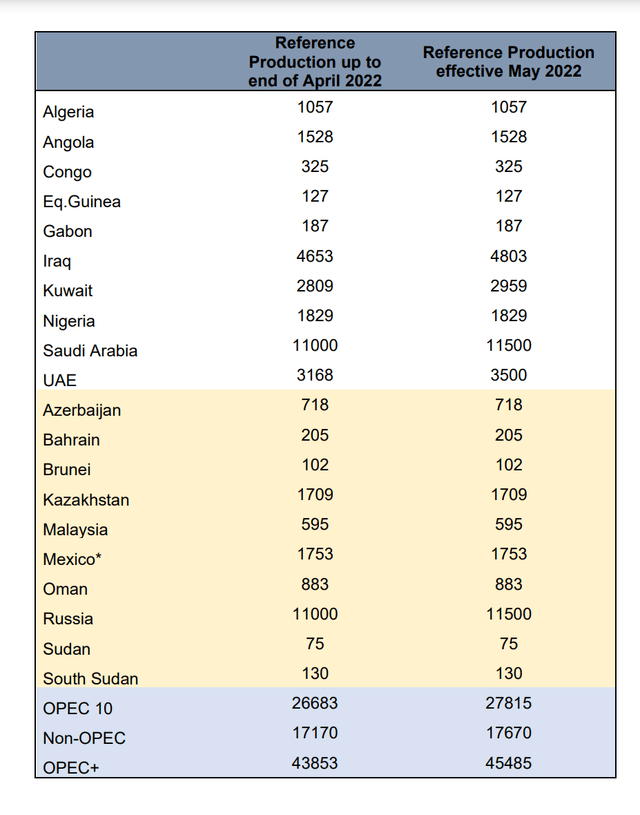

The UAE and OPEC encountered drama over Summer season 2021 although ultimately reached an settlement of revising the baseline manufacturing quotas increased, successfully permitting 1.63 million barrels per day further provide in Could 2022 (proven beneath). OPEC conveniently didn’t reply the essential query of how they’ll say they’re producing not more than +400k bpd per thirty days by means of 2022 once they successfully raised manufacturing quotas in Could 2022.

It was an enormous, but delicate shift in OPEC coverage that many analysts didn’t query. The chance of a UAE exit from OPEC have been very materials on the time and Saudi Arabia did what was essential to protect the alliance by means of satisfying the UAE’s cheap calls for. But, the results of the baseline revisions (increased manufacturing quotas) have been kicked to Could 2022, which is rapidly approaching. OPEC+ must face this sooner or later very quickly.

OPEC

The oil market is shifting into surplus in my view and that of the IEA. The variety of analysts completely sure oil goes increased is a purple flag. Fundamentals for the USD are very robust, and I anticipate continued appreciation of the greenback throughout the board. As I’ve acknowledged earlier than, I do not consider the world is definitely seeing an oil shortage. Fairly merchants are being incentivized to run very low ranges of inventories forcing the WTI futures curve into excessive backwardation, making a semblance of a scarcity.

Backwarded futures curves are a sign of a scarcity, but in addition the underestimated level that I make is as backwarded (downward-sloping) futures value curve dis-incentives rebuilding of inventories and storage of oil. The backwarded curve means the market thinks oil is scarce now however can be alleviated later, so it’s higher to restock at a future date. This results in giant and continued stock drawdowns.

Iranian manufacturing may very well be the provision set off wanted to alleviate near-run scarcity issues and to flip the curve to contango (upward sloping), thereby permitting merchants to restock oil for spot or near-term supply whereas locking into increased longer-dated promoting costs making a constructive stick with it holding or storing oil. This is able to result in increased inventories in storage depots akin to Cushing, Oklahoma and change into self-reinforcing in the wrong way of the acute backwardation we’re seeing now. Larger oil inventories are sometimes related to decrease costs.

World oil demand is just not as sturdy as many consider and can disappoint expectations and forecasts in my view partially as a result of demand destruction from excessive present costs. The weakening and fragile Chinese language financial system is a large danger for oil demand. From the linked article above, I wrote:

I’ve defined earlier than my points with China’s macroeconomic stability. In abstract, China development since 2000 was very sturdy. A lot of this was as a result of the truth that Chinese language financial authorities launched into large infrastructure, development and supply-side pushed stimulus. This required big quantities of credit score into the financial system. At first the returns on funding, that’s development, have been robust sufficient it wasn’t working up company debt/GDP to excessive ranges. Because of the growing incremental capital output ratio or diminishing return impact of supply-side pushed development and development buildouts fashions, each RMB enhance in debt is now not making a corresponding quantity of financial development to offset it. In essence, the mannequin has change into inefficient. The demand-side of the financial system significantly shopper demand has not come by means of robust both, which means development is reliant on company and enterprise funding. The statistic extensively used for this in Chinese language financial knowledge is Fastened Asset Funding or FAI.

The big quantities of FAI additionally created an overcapacity downside. China used creating and setting up an enormous provide facet of the financial system as a requirement enhance for the financial system as properly by means of increased employment, and commodity demand amongst different channels.

I’m anticipating stock builds resulting in narrowing of backwardation on the WTI futures curve. As soon as this flips and merchants can restock (oil now not anticipated to be cheaper sooner or later – resulting in deferred buying patterns), you may see a contango blowout the opposite approach and plenty of crude flowing into storage.

Allianz Analysis, Patrick Krizan

Powell and the Fed are full steam forward on their tightening cycle. The identical can’t be stated of the ECB. Many traders and merchants are anticipating stagflation in the USA resulting in downward strain on the US greenback. I disagree. A take a look at nominal US GDP developments versus these in India, Hong Kong or Brazil reveals rising markets are way more vulnerable to stagflation or damaging actual (inflation-adjusted) GDP development than the USA. Stick with it, Fed. The hit to US CPI can be a lot larger than US nominal GDP, the alternative of stagflation in the USA.

ECB tightening right here could be a repeat mistake in my view and dangers, stagflation in Europe or Japanification and lack of confidence. It might even have the alternative meant impact of elevating inflation by means of the robust EUR/weak USD channel pushing enterprise enter and commodity costs up whereas undermining exports – weakening development (stagflation). The ECB was already going to lag the Fed and err on the facet of warning. The warfare on their jap entrance simply provides all of them the extra cause to as increased charges cannot create pure fuel provide and would danger pushing the greenback down, offering a normal enhance to commodities.

In a robust euro state of affairs, Europe would go right into a present account deficit as a robust euro makes the export-dependent economies of Europe much less aggressive globally. Europe went into present account deficit in 08 and 2020 and this ought to be prevented. The ECB will prioritize help for development and the restoration somewhat than deal with bringing the CPI down. The Fed will handle that. Inflation solely proved to be persistent (not transitory) as a result of the Fed underestimated its personal impact of coverage on the financial system. The Fed thought inflation would go away by itself, however it could’t till they tighten. The ECB will wait to see results of upper US charges on rising markets.

In line with former Goldman Sach’s FX strategist and present IIF economist, Robin Brooks:

Markets have been sluggish to select up on simply how vital Russia’s warfare is for international macro, however they’re catching on now. It is a massive damaging shock for the Euro zone that is solely simply began. We count on EUR/$ to fall beneath parity. Transatlantic divergence is again in a giant approach

Allianz economist, Patrick Krizan, agrees. He states:

“Important a part of hawkish ECB shift priced out, rising divergence with anticipated US rate of interest path. Along with secure haven flows into USD and CHF, EUR parity to each is now not far-off”

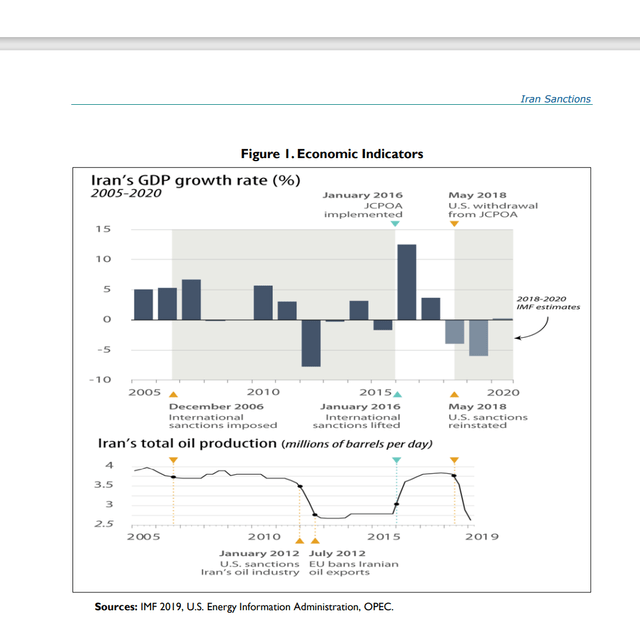

I researched the impact of US sanctions on the Iranian financial system to see a possible comparability because the sanctions are fairly comparable. The ramifications of sanctions on Iran’s financial system have been large. In line with the Congressional Analysis Service:

Throughout the interval of U.S. JCPOA implementation, the market worth of the rial was about 35,000 to the greenback. The reimposition of U.S. sanctions in 2018 induced the rial’s worth to plummet to 150,000 to the greenback by the November 5, 2018, and, in September 2020, to about 265,000 to the greenback. The trade fee was about 300,000 rials to the greenback in early December 2021.

The drop in worth of the forex induced inflation to speed up during2011-2013 to a fee of about 60%-a increased determine than that acknowledged by Iran’s Central Financial institution. As sanctions have been eased and importing items was due to this fact simpler for Iranian retailers, inflation slowed to the one digits by June 2016, assembly the Central Financial institution’s acknowledged objective. The U.S. exit from the JCPOA and reimposition of sanctions once more restricted the flexibility of Iran’s retailers to import items and inflation elevated to almost 40%. The inflation fee was about 45% in 2021, in line with the Statistical Heart of Iran”

Throughout 2011-2015, Iran’s financial system contracted roughly 20% over the interval, and the unemployment fee rose to about 20%, however the JCPOA-related sanctions aid enabled Iran to attain 7% annual development throughout 2016-201

Congressional Analysis Service

I maintain an extended place within the oil tanker sector. Ton miles are set to extend as Russian oil will get despatched to China or Venezuela as an alternative of Europe. Whereas Europe will doubtless fulfill demand by means of imports from North and South America and Africa. Russian crude is promoting at a steep low cost regardless of not being sanctioned as a result of there’s political danger in transacting with Russian power firms. This all provides ton-mile demand to tanker routes. Tanker charges are up, and this is a significant component in my opinion. Additionally, an Iran nuclear deal and return to the JCPOA would require a big enhance in authorized tanker utilization. Iran has been exporting on unlawful tankers. With compliant manufacturing, comes the necessity for compliant tankers.

In conclusion, the market ramifications of Russia’s aggressive invasion of Ukraine are big and wide-ranging. The world is altering at a quick tempo. This text is basically a extra formal and complete compilation of the notes I’ve taken on the consequences of present occasions on the Tri-Macro portfolio. Please reference the disclosure for present positioning.

“There are a long time the place nothing occurs; and there are weeks the place a long time occur”

– Vladimir Lenin.

[ad_2]

Source link