[ad_1]

Turkey has loved robust financial development during the last 20 years. Sadly, a lot of this enlargement has been pushed by debt-fueled infrastructure spending. This extreme debt accumulation has had vital repercussions which have created extreme imbalances in Turkey’s economic system.

As the worldwide financial outlook has deteriorated within the face of rising inflation, the continued pandemic, and geopolitical instability, the headwinds Turkey is dealing with have solely grown stronger. Because of this, the nation’s present financial disaster is prone to intensify additional.

Infrastructure-Pushed Development

After a “misplaced decade” within the Nineties, Turkey launched into a protracted interval of sturdy financial development. Certainly, its GDP expanded at an annual charge of 4.6% from 2002 to 2020. Nonetheless, this enlargement was not generated by its typical driver — family consumption — however by infrastructure spending and different capital expenditures. Whereas this boosted development, it additionally saddled the economic system with a number of long-term issues:

1. Excessive and Rising Financial Imbalances

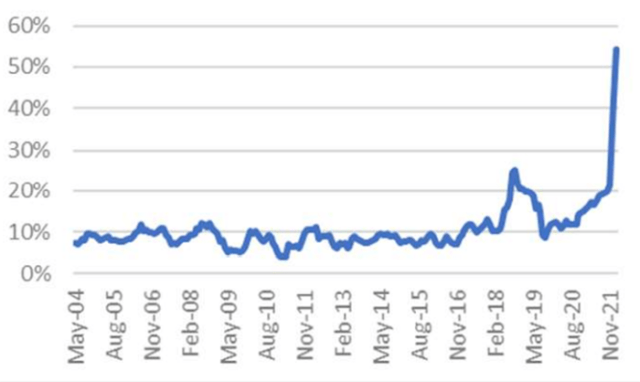

Turkey adopted unfastened financial and financial insurance policies to gas its financial enlargement. That development was achieved, however excessive inflation and extreme debt got here with it. Turkey’s CPI rose to an astounding 54.4% in February 2022 and remains to be climbing. This has diminished client buying energy and the general competitiveness of Turkish trade, to not point out the worth of the Turkish lira.

Turkey’s CPI, 12 months over 12 months

2. Elevated Debt

Turkey’s GDP development has been facilitated by extreme leverage. The nation’s gross non-financial-sector debt has greater than quadrupled, rising from $211 billion in 2000 to $871 billion in 2020. By comparability, the nation’s GDP solely expanded by 270% in US greenback phrases. As a consequence, the full debt burden of the economic system elevated from 77% of GDP in 2000 to 129% in 2020.

Turkey’s Non-Monetary-Sector Debt as a Proportion of GDP

Furthermore, a lot of this debt originates from overseas sources: The nation’s complete exterior debt provides as much as roughly 60% of GDP. For a rustic working on twin deficits, this debt trajectory is unsustainable.

3. Weak point in Conventional Financial Drivers

Turkey’s infrastructure spending hasn’t benefitted different sectors of its economic system all that a lot. The nation’s major financial driver, family spending, has really weakened in the course of the 20 years of enlargement, falling from 69% of GDP within the first quarter of 2000 to 55% of GDP in 2020.

Turkey’s Gross Mounted Capital Formation and Private Consumption Expenditures as a Proportion of GDP

Web exports have additionally stagnated as a proportion of GDP. Because of this, the economic system has develop into much more depending on infrastructure spending and increasing debt.

An Unsustainable Path

Turkey’s financial mannequin hinges on the provision of simple credit score, whatever the nation’s capability to repay it. Amid the darkening world outlook and the worsening home scenario, that credit score is not going to be so available. And that can solely additional warp Turkey’s economic system.

With the fast decline within the lira, the nation’s exterior debt is already rising dearer, and amid financial tightening in the US and Europe, credit score will likely be more durable and more durable to return by.

Turkey’s Present Account Steadiness as a Proportion of GDP

Rampant inflation, a heavy debt load, and excessive unemployment imply that the Turkish economic system faces appreciable instability. In the meantime, client spending is falling and the nation’s financial competitiveness appears to be declining because it trades much less with developed markets and extra with rising markets.

Persevering with on the present debt-driven development path will solely exacerbate Turkey’s issues: Certainly, it may result in a deeper recession or, even worse, extended stagflation. Exterior occasions like rising inflation and the Russia–Ukraine Conflict will represent additional drags on Turkish development.

Earlier financial crises in Turkey in 1958 and within the Nineteen Seventies and Nineties adopted an analogous sample of extreme inflation, elevated present account deficits, and a cratering lira. Historical past suggests a necessity for warning.

Authorities Is Not Serving to

The Turkish authorities’s financial insurance policies don’t point out the required course correction is being made. The nation’s leaders look to be prioritizing political aims over financial stability. Furthermore, a scarcity of unbiased establishments makes a balanced coverage tougher to realize.

A Cautionary Story?

Turkey’s financial development path affords a lesson for different growing nations that depend upon debt for development: An overreliance on leverage creates financial distortions that may have profound penalties.

If you happen to preferred this publish, don’t neglect to subscribe to the Enterprising Investor.

All posts are the opinion of the creator. As such, they shouldn’t be construed as funding recommendation, nor do the opinions expressed essentially replicate the views of CFA Institute or the creator’s employer.

Picture credit score: ©Getty Photos/Sami Sert

Skilled Studying for CFA Institute Members

CFA Institute members are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Members can report credit simply utilizing their on-line PL tracker.

[ad_2]

Source link