[ad_1]

winhorse/iStock Unreleased via Getty Images

The AXS TSLA Bear Daily ETF (NASDAQ:TSLQ) provides daily inverse leverage to Tesla Inc. (TSLA) through total return swaps. Inverse funds on highly volatile stocks like Tesla are most likely going to underperform. I would avoid these single stock ETF products.

Fund Overview

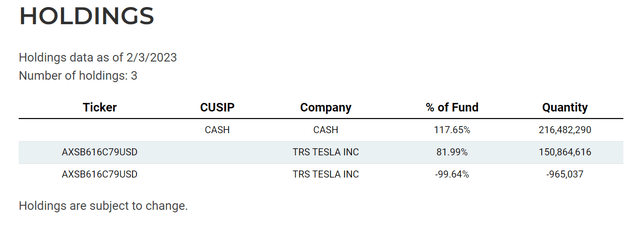

The AXS TSLA Bear Daily ETF provides daily inverse exposure to Tesla Inc. The TSLQ ETF is a ‘innovative’ single stock ETF that allows investors to short Tesla through the use of total return swaps struck with investment banks. Figure 1 shows the TSLQ ETF’s holdings, which are simply cash plus total return swaps.

Figure 1 – TSLQ holdings (axsinvestments.com)

Please note that the TSLQ ETF is only designed to provide -1x exposure to Tesla on a 1-day basis. For holding periods longer than 1 day, the returns of the TSLQ ETF may differ materially from the inverse of the underlying due to ‘compounding risk’. According to the fund’s prospectus:

Compounding affects all investments, but has a more significant impact on funds that are inverse and that rebalance daily. This effect becomes more pronounced as TSLA volatility and holding periods increase.

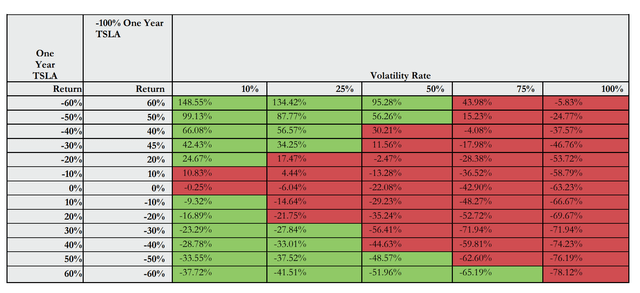

In fact, figure 2 shows the estimated returns of the TSLQ ETF depending on the returns of Tesla shares and the stock’s volatility. From AXS’s estimates, the TSLQ ETF can be significantly better than the inverse of Tesla’s returns if Tesla’s returns are negative and volatility is low (i.e. Tesla’s share price declines at a consistent pace for a long time).

Figure 2 – TSLQ estimated returns depending on underlying returns and volatility (TSLQ prospectus)

However, when volatility is high, TSLQ can perform significantly worse than expected. For example, if Tesla returned -20% over a year, but volatility was very high (i.e. 75% volatility), the TSLQ ETF is expected to lose -28%.

Returns

TSLQ was only launched on July 13, 2022, so the ETF has very limited operating history. However, in that short period of time, TSLQ has lost 3.1% despite TSLA declining -20.3% (Figure 3).

Figure 3 – TSLQ vs. TSLA returns (Seeking Alpha)

Distribution & Yield

The TSLQ ETF does not pay a distribution.

Fees

TSLQ charges a 1.15% net expense ratio after fee waivers that are in place until July 31, 2023. After the fee waivers expire, the fund is expected to charge 1.57% in net expenses.

What Is The Point Of TSLQ?

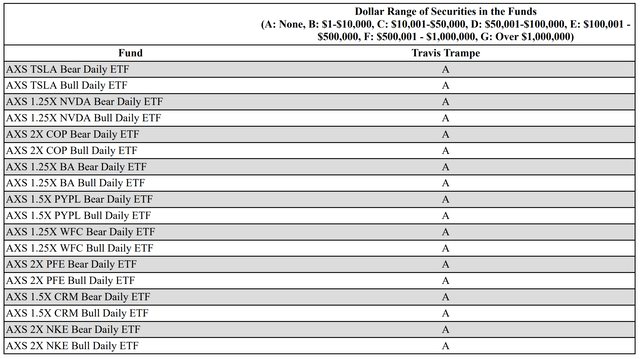

Provided there is investor demand, literally any asset class can be turned into an ETF product. For example, aside from single stock ETFs on Tesla, AXS have also launched leveraged ETFs on Pfizer and NVIDIA (Figure 4).

Figure 4 – Single stock ETFs managed by AXS (TSLQ prospectus)

The real question investors should ask is whether there is a point to all these single stock ETFs? Investors need to realize that making levered or daily inverse bets on highly volatile stocks like Tesla is just asking for trouble.

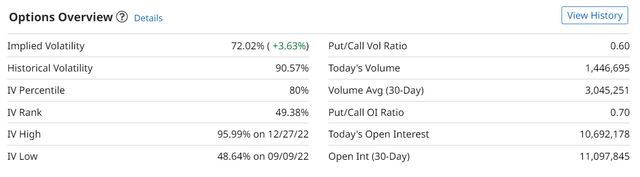

Tesla currently has option implied volatility (“IV”) of 72.0% and a 20-day realized volatility of 90.6% (Figure 5). Tesla’s IV has ranged from 48.6% to 96.0% in the past year.

Figure 5 – TSLA IV at 72% (barcharts.com)

In almost all scenarios from figure 2 above, TSLQ is going to underperform the inverse of the underlying due to its high volatility. For example, even at the low end of historical IV at ~50%, Tesla will have to fall 50% or more over 1 year for the TSLQ strategy to be superior to the inverse of the stock price, i.e. shorting the stock directly.

If investors truly want to have inverse exposure against Tesla, they may want to consider simpler strategies such as shorting the stock directly or buying long-dated put options. Please note I am not advocating for either strategy. I just think an inverse single stock ETF is a mousetrap designed to underperform.

Capped Vs. Uncapped Exposure

The only benefit that I can see on an inverse ETF like the TSLQ is it caps investors’ exposure to the capital invested in the ETF whereas a short position in the underlying stock can have potentially unlimited (uncapped) downside if the shares keep rallying. However, if properly managed, a direct short position in shares with stop loss levels should not have uncapped downside.

Conclusion

The TSLQ ETF provides daily inverse exposure to Tesla. An inverse ETF on a highly volatile stock like TSLA is almost guaranteed to underperform. I fail to see the reason for most of AXS’s single stock ETF offerings except for short-term gambling.

[ad_2]

Source link