Selman Keles/E+ through Getty Photographs

Broader Image: Value of Capital Weighing Heavy

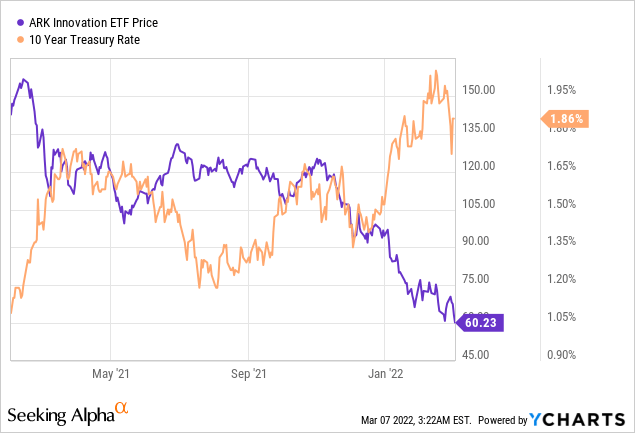

Simply as a caveat, the broader IT and tech indexes throughout giant and mid-cap have largely carried out according to the general market from 2021 by way of to 2022. Due to this fact, my underperformance right here refers to high-flying and glossy high-tech names that are ubiquitous to everybody e.g. Etsy, Zoom, Pinterest to call a couple of. I will probably be utilizing the benchmark ETF from Ark Make investments (ARKK) which is probably going one of the best consultant of the massive drawdown since Feb 2021.

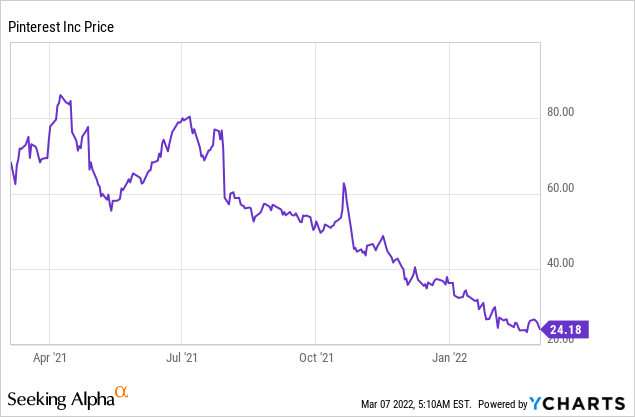

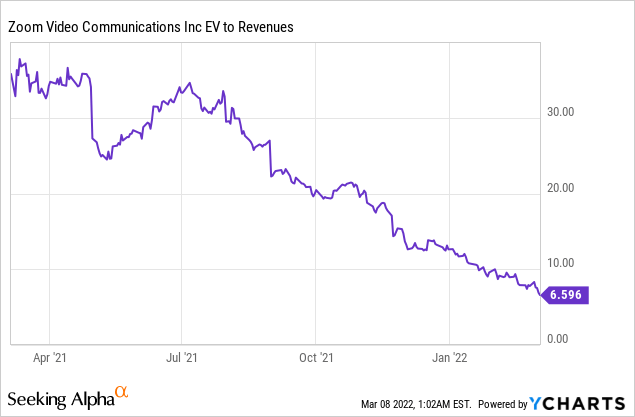

As might be seen from the chart, these names are extremely delicate to modifications in bond yield actions as the price of capital for these firms would disproportionately improve.

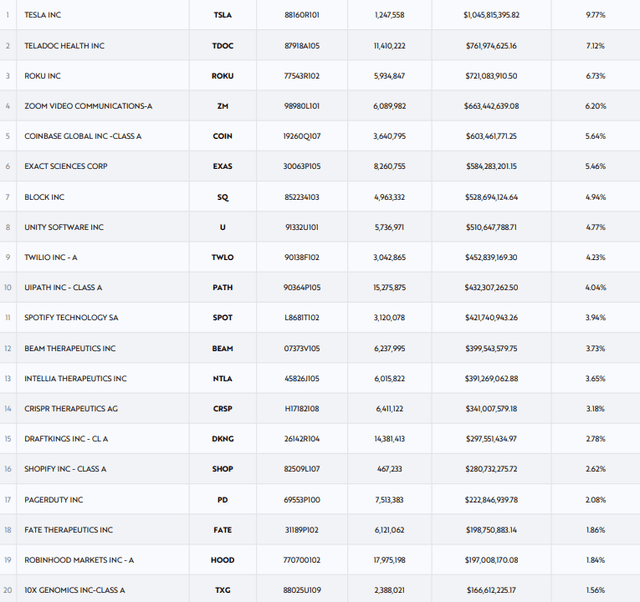

ARKK’s High 20 Holdings (Ark Make investments)

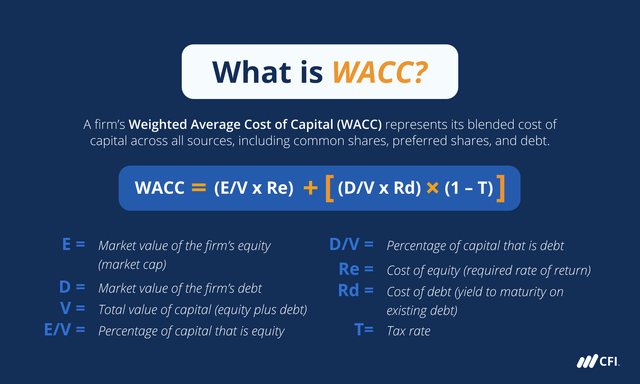

The bond yield rally considerably attracts down the truthful worth of those shares by rising the price of debt, and by extension the weighted common price of capital (OTCPK:WACC), which serves because the required price of return (NASDAQ:RRR) in DCF calculations.

Excessive flying tech names like those in ARKK are sometimes disproportionately affected as they pay little to no dividends because of the comparatively early stage nature of those firms, making the WACC considerably weighted by price of debt, since the price of fairness can be extraordinarily low.

WACC Components (CFI)

This presents an fascinating backdrop for bigger FAANG-like firms that may search a brand new avenue for inorganic development by way of M&As of those crushed down firms. I’ll assess a number of targets and its worth to the acquirer.

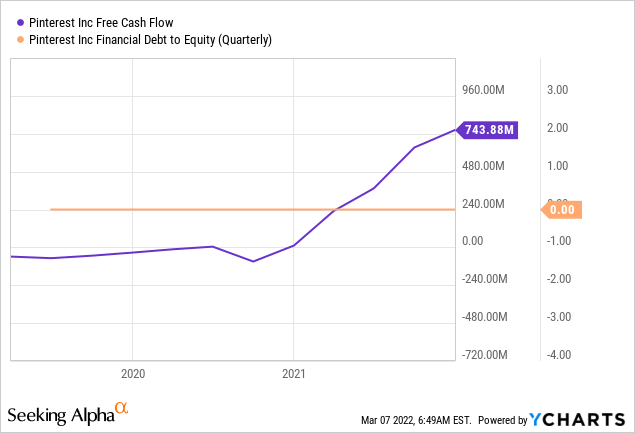

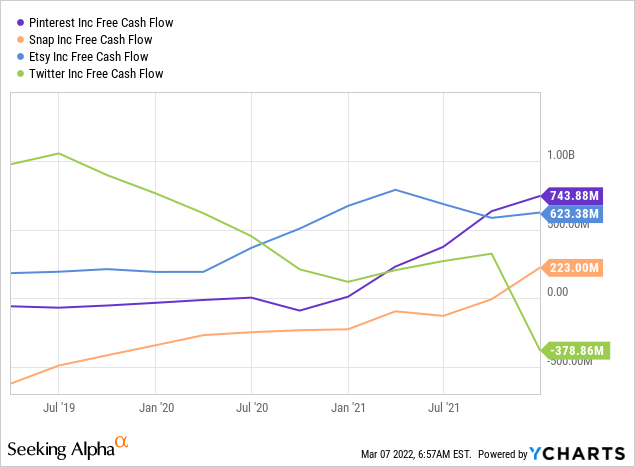

To evaluate potential M&A targets, I will probably be utilizing FCF and Debt/Fairness ratio as fundamental metrics, earlier than diving into every goal’s idiosyncratic advantages to the acquirer.

Goal 1: Pinterest

Why Purchase Pinterest?

From a monetary value-add as an acquisition perspective, Pinterest (PINS) is actually second to none, with an astounding FY2021 FCF of $740M. As in comparison with friends in the identical enterprise worth bracket it’s at the moment the chief.

Nevertheless, there’s a caveat in that Twitter (TWTR) and Snap (SNAP) are usually not precisely ‘pure’ friends and Etsy (ETSY) is the one actual peer to Pinterest. It is because these 4 social media firms might be categorized into 2 metrics which finest measure the efficiency of those firms: Month-to-month Energetic Customers (MAU) and Common Income Per Consumer (ARPU). Right here, MAU which is a metric that quantifies consumer engagement, is finest used to categorise Twitter and Snap. Alternatively, ARPU which quantifies income is extra applicable for Etsy and Pinterest. In any case, you seemingly can be utilizing Etsy and Pinterest as a result of you have got a particular objective in thoughts e.g. discovering out extra about knitting and to not mindlessly scroll like most individuals would with Twitter and Snap.

Regardless of constantly outperforming the Avenue’s expectations in each its prime and backside line, poor investor confidence over the previous yr or so might be largely pinpointed to 2 issues: a fall in working margin and a fall in MAU for FY2021. Nevertheless, on each counts, the over pessimism is unwarranted.

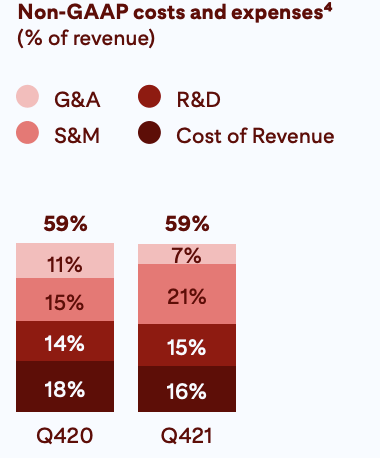

In the case of the autumn in working margin, a big a part of the autumn in margin was because of an increase in R&D prices and gross sales and advertising and marketing prices (S&M) which outcome from their aggressive development in headcount by 27% from 2020.

Pinterest Investor Presentation

The important thing factor is the rise in R&D prices, which drives dwelling the crux of the place Pinterest is now: Pinterest is correct in the course of a change in its enterprise mannequin. In its current enterprise mannequin, CEO Ben Silbermann stated within the This autumn earnings name that “In 2021, we made our publishing instruments out there in 37 markets and launched 150 new options” and the way it “helps our speculation that our investments in native content material might be engagement accretive over time”, exhibiting how there’s a pivot into sustaining engagement moderately than persevering with to give attention to the energy of its income. Even on the income aspect, they’re investing closely into seamless checkout and it’ll seemingly proceed to bear testing in 2022, earlier than being rolled out earliest by 2023. That is seemingly a revolutionary characteristic is Pinterest’s enterprise mannequin as now, customers are in a position to buy merchandise straight on the web site itself, moderately than having to go to the advertisers’ web sites to buy them.

In the case of the drop in MAU, I’ve already highlighted how Pinterest ought to be valued as an ARPU firm moderately than a MAU firm. The This autumn earnings name validates this because the drop in MAU customers primarily got here from desktop customers that are non-monetizable whereas monetizable customers has stayed resilient from 2020 by way of to 2021.

Total, the market has but to cost in Pinterest’s present transformation stage and is taking quarterly and annual earnings at largely face-value. Having stated that, these aforementioned transformations will seemingly happen within the mid-long time period and won’t be accomplished in 2022 and even 2023, which means that for now, on prime of what the market deems as ‘poor’ quarterly outcomes, the macroeconomic headwinds will current a major draw back threat for the short-term.

Potential Acquirers

To know Pinterest’s potential acquirers, we now have to first perceive the explanations for two of the final main acquisition makes an attempt of Pinterest, by PayPal (PYPL) and Microsoft (MSFT).

Within the case of PayPal’s tried acquisition, the principle synergy that may be recognized is that it pivots PayPal’s enterprise mannequin to a much more consumer-facing perform, versus its core funds facilitation enterprise which is far more back-end in nature. The important thing detriments of PayPal’s current enterprise mannequin is that it’s largely transactional in nature and isn’t precisely ‘sticky’ in participating its consumer base. By buying Pinterest, PayPal would have the ability to generate a considerable quantity of sustainable recurring revenues from its resilient ARPU numbers. That is additionally according to PayPal’s latest super-app providing, which highlights PayPal’s makes an attempt to pivot away from its core funds facilitation enterprise.

Within the case of Microsoft’s acquisition try, the principle synergy is extra elementary to Pinterest’s enterprise values, in that Pinterest was began as a platform for customers to showcase their creativity and encourage different customers. In that respect, Linkedin (beforehand acquired by Microsoft) and Microsoft Workplace can simply be built-in with Pinterest to provide these historically professionals-oriented platforms a brand new dimension. The advantages from cross-selling and cross-messaging would additionally drive higher synergies which translate into larger revenues in the long run.

In each circumstances, the explanation for the scrapped acquisition makes an attempt was the truth that the acquisition multiples have been merely far too excessive. That is precisely why Pinterest’s continued drawdown represents a major alternative for bigger corporations to accumulate Pinterest on a budget.

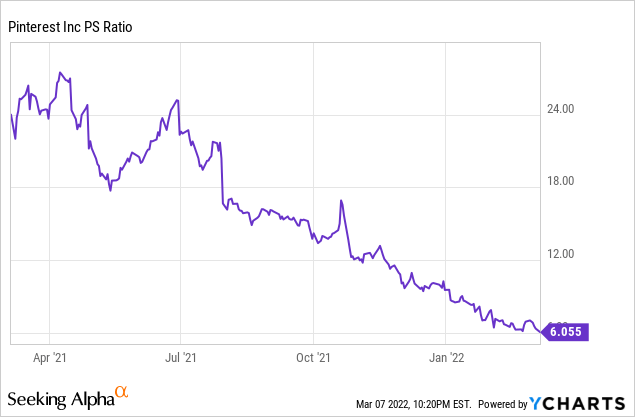

For context, PayPal’s acquisition at 70$ a share for Pinterest represented 18.5x TTM income which was then promptly rejected by the board. At present Pinterest’s TTM P/S ratio is at 6x, which makes any acquisition much more engaging. Even Linkedin was acquired by Microsoft at 7.2x TTM income.

(Pinterest’s TTM P/S ratio)

Pinterest represents a singular and reworking enterprise mannequin that’s in one of the best of each worlds between pure-play E-commerce firms like Amazon and social media firms resembling Snap and Twitter. In consequence, it seemingly has sturdy value-add for any large-cap tech firms in the event that they have been to accumulate Pinterest, as highlighted with PayPal and Microsoft. I’d not be shocked if each firms come round within the close to future to suggest one other acquisition bid, seeing as how a lot Pinterest’s multiples have contracted over the previous few months.

Goal 2: Zoom

Why Purchase Zoom?

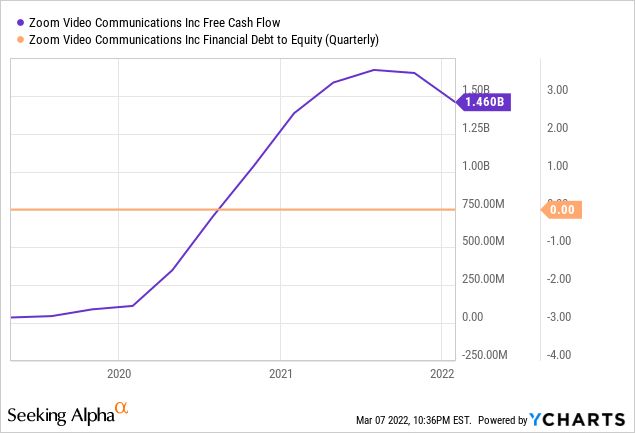

As soon as once more, Zoom (ZM) is powerful financially with $1.46B of annual FCF and no debt.

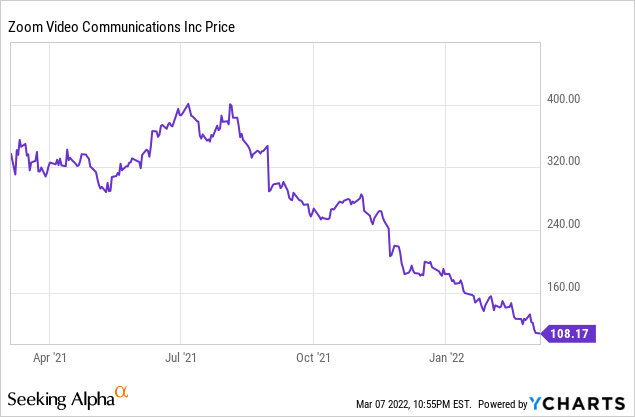

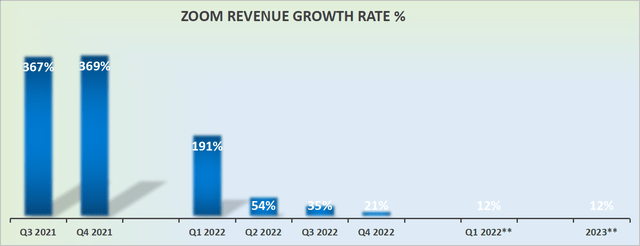

Not like Pinterest which continues to be in its transformation stage, Zoom’s income development and projected steerage spotlight that except Zoom does one thing radical to its enterprise mannequin, the expansion story for Zoom is probably going over, particularly with Covid-19 associated reopening of the worldwide economic system.

Zoom

Nevertheless, the principle worth proposition for Zoom is its model recognition and resilient development in enterprise clients even regardless of whole revenues which can be considerably decelerating.

Zoom’s enterprise enterprise is probably going its strongest enterprise unit which sells its providers resembling limitless cloud storage, internet hosting of as much as 500 individuals and transcript recording to companies.

We noticed 66% year-over-year development within the upmarket as we ended the yr with 2,725 clients contributing greater than $100,000 in trailing 12 months income. These clients represented 23% of income, up from 18% in This autumn of final yr.

In This autumn, the variety of enterprise clients grew 35% year-over-year to roughly 191,000. Income from enterprise clients grew 38% year-over-year and represented 50% of whole income, up from 44% in This autumn FY ’21.

(Zoom’s administration in its newest This autumn earnings name)

Potential Acquirers

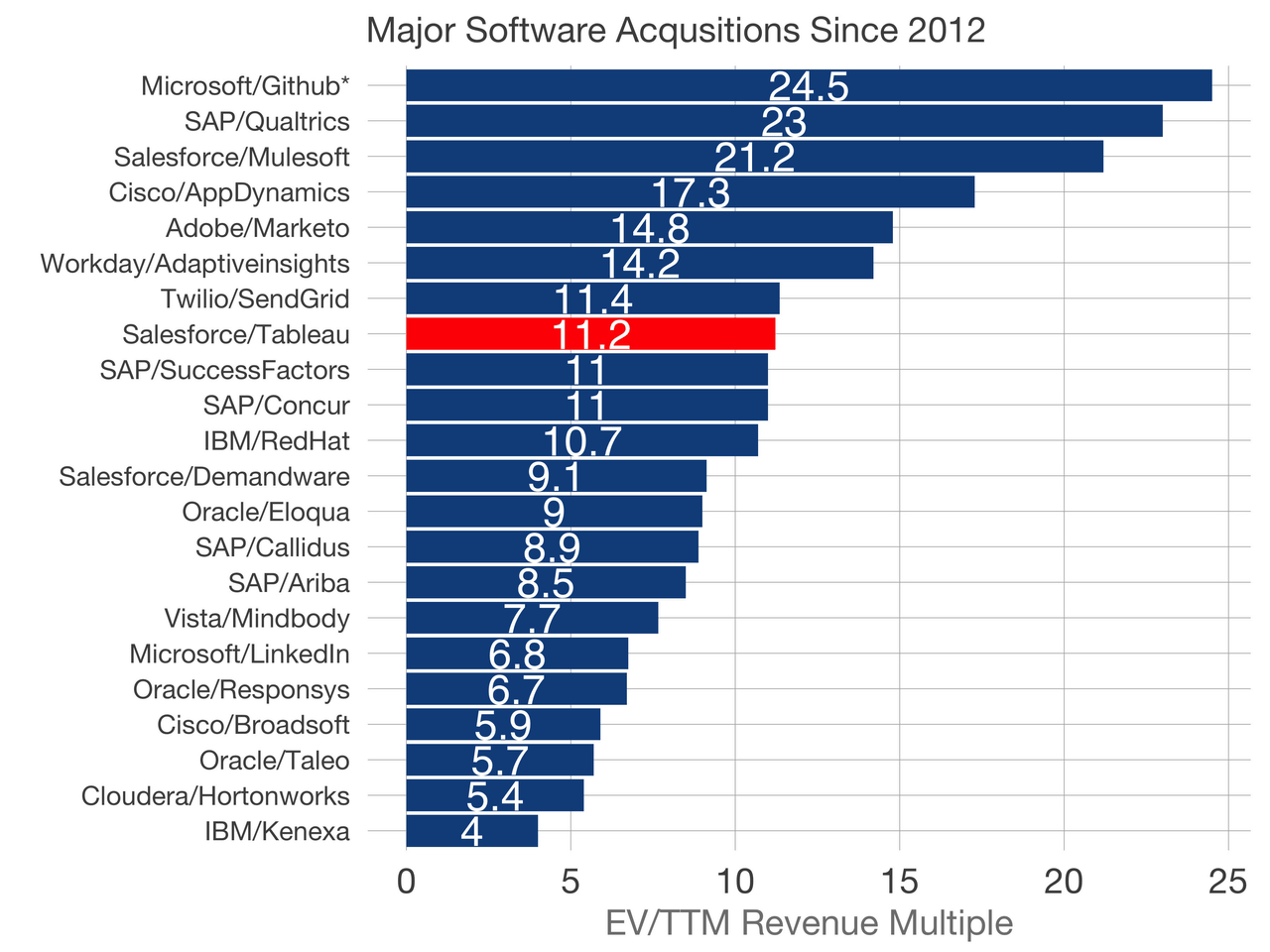

Tomasz Tunguz

Not like the case for Pinterest, Zoom’s potential acquirers are seemingly extra particular, largely enterprise companies resembling these for CRM or provide chain administration. Personally, Zoom can be a terrific match for Salesforce (CRM). Benioff has grown Salesforce over time with numerous savvy acquisitions. Within the case of Zoom, integration with Salesforce’s Slack platform would seemingly onboard lots of Zoom’s enterprise clients onto Slack and vice versa, and would additionally result in a extra seamless platform total for Slack with higher performance.

As for the monetary viability of the acquisition, the median EV/TTM income a number of for tech acquisitions can be roughly 10x from the infographic above. At present, the identical a number of is 6x for Zoom. Though the truthful worth of Zoom would nonetheless should be derived, it’s unlikely that any acquirer can be overpaying for Zoom’s enterprise, particularly when bearing in mind the intangible model recognition that Zoom has.