Terra has just lately made many headlines as a result of its meteoric positive aspects. Sadly, this may often result in affirmation bias in how we view the stats behind our most beloved crypto property.

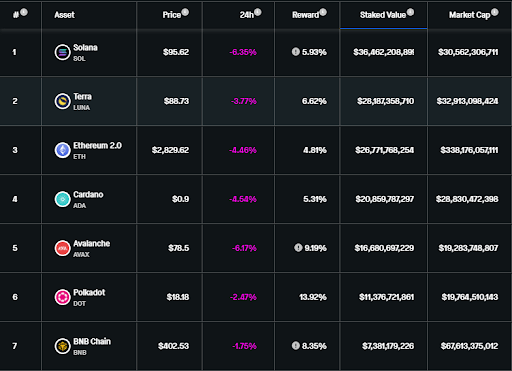

In case you’ve been studying across the cryptosphere this week, you may be forgiven for believing that Terra is now the second-largest asset by staking worth. For instance, stakingrewards.com tweeted this week how Terra has overtaken Ethereum 2.0 staking.

Terra $LUNA is now the 2nd largest PoS community by Staking market cap having overtaken Ethereum 2.0 $ETH 🔥

Supply: https://t.co/R9BVR4Ce4W pic.twitter.com/33CgPrr99a

— Staking Rewards (@StakingRewards) March 1, 2022

While it’s true that Terra has seen a rise within the staked worth in $USD over the previous few weeks, this doesn’t inform the entire story.

Staked Luna down 416 million from ATH

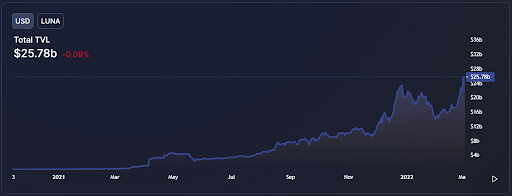

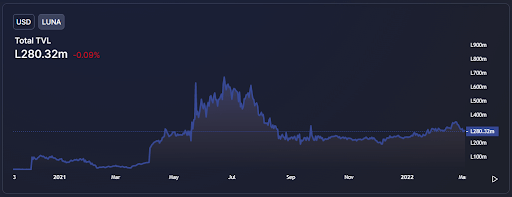

Most individuals solely take a look at crypto charts in $USD, making it simpler to know in ‘actual world’ phrases. Nevertheless, if we take a look at the present worth of Terra staked in $USD, we’re at the moment at an all-time excessive of round $25 billion. This paints an image that buyers are extra bullish than ever on staking Terra.

Nevertheless, after we look as an alternative on the precise quantity of Terra staked, we get a totally completely different story.

The all-time excessive for the quantity of Terra staked was again in July 2021 at round 667 million Terra while in the present day’s TVL sits at simply 280 million Terra. If we zoom in additional, it worsens as we aren’t even at an area excessive, with the locked worth dropping 19% since February 18.

This doesn’t instill the boldness that different headlines focusing solely on the $USD worth are purporting. Nevertheless, whether or not buyers are unstaking to take earnings from the current 78% positive aspects is anybody’s guess at this stage.

Has Luna overtaken ETH2.0?

Now, let’s take a look at the information that helps the speculation that Terra has overtaken ETH2.0 staking. As we are able to see, this primary chart from stakingrewards.com does in reality present Terra forward of ETH2.0 and second solely to Solana.

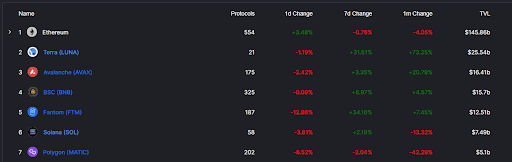

Nevertheless, an identical chart from defillama.com means that Ethereum has over $100b extra in locked worth and, in reality, Terra is forward of Solana by fairly some margin.

So. How can this be? Maybe, there’s a conspiracy to make Ethereum look inferior by some events? Is one dashboard extra dependable than the opposite?

The brief reply isn’t any. DeFI Llama seems to be at greater than Eth2.0 staking when calculating TVL figures. For instance, the than its counterpart, which seemingly explains the distinction in reported whole staking worth.

It’s important to look past simply the $USD worth when assessing crypto property. A pump corresponding to that skilled by Luna will trigger a correlating surge in staking values for the asset in query. Consequently, staking outflows can cover from the untrained eye. Moreover, not all dashboards use the identical knowledge, so there could be a lot to be discovered by exploring completely different platforms.

CryptoSlate Publication

That includes a abstract of an important day by day tales on this planet of crypto, DeFi, NFTs and extra.

Get an edge on the cryptoasset market

Entry extra crypto insights and context in each article as a paid member of CryptoSlate Edge.

On-chain evaluation

Value snapshots

Extra context

Be part of now for $19/month Discover all advantages

![Top 15 Bitcoin Cycling Betting Sites for the 2025 Tour de France [Bonuses, Odds & Features Compared] Top 15 Bitcoin Cycling Betting Sites for the 2025 Tour de France [Bonuses, Odds & Features Compared]](https://static.news.bitcoin.com/wp-content/uploads/2025/07/best-tour-de-france-betting-sites-july-2025.png)