fotokostic/iStock via Getty Images

One of the more interesting trading and distribution companies, particularly when talking about those with physical stores, is Titan Machinery (NASDAQ:TITN). Through its network of retail outlets, the company sells a vast portfolio of agricultural and construction equipment, as well as attachments and other devices. In the past, I was a bit cautious about the company. This was mainly because I anticipated a potential pullback because of the state of the economy and because of the rather lumpy operating history that the company demonstrated. But given where shares are priced today and considering how much the company has grown recently, I do believe that my prior call for caution was a bit too conservative.

Titan Machinery’s performance continues to improve

Back in early February of this year, I wrote my first article covering Titan Machinery. In that article, I talked about the company’s continued growth and how cheap shares were, particularly on a forward basis. I even said that the company could make for a decent prospect should fundamental performance deteriorate back to the levels that it was one year earlier. However, I was turned off by the company’s rather rocky operating history and, to a lesser extent, by the concerns about the economy moving forward. At the end of the day, I ended up rating the company a ‘hold’, reflecting my belief that it would likely generate returns that would more or less match the broader market for the foreseeable future. Since then, the company has significantly outperformed my expectations. While the S&P 500 has plunged by 19.2%, shares of Titan Machinery have actually created upside for investors of 1.1%.

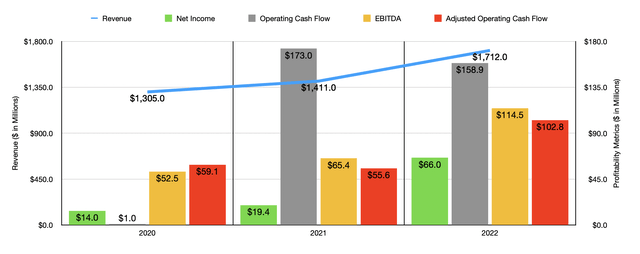

Author – SEC EDGAR Data

To see why my opinion has changed, we should touch on the company’s recent financial performance. To start with, we should cover how the firm ended its 2022 fiscal year. After all, when I last wrote about it, we only had data covering through the third quarter of that year. For 2022 as a whole, sales came in strong at $1.71 billion. That’s 21.3% higher than the $1.41 billion in revenue generated the same time one year earlier. During that year, the company saw revenue growth across three of its four key operating units. The biggest growth came from the equipment portion of the enterprise, with revenue shooting up 27.1% from $1.02 billion to $1.29 billion. Parts revenue grew a more modest 9.1%, while service revenue increased by 7.8%. The only weakness came from the rental and other category, with revenue falling by 12.9% Management attributed much of the increase in sales to a 23.5% surge in same-store sales. This was driven in large part by strong agriculture equipment sales thanks to higher commodity prices, higher net farm income, and good growing conditions in its international footprint.

As a result of this strong showing, net income jumped from $19.4 million in 2021 the $66 million last year. Truly, the company benefited from gross profit margin expansion across all four of its operating units, with a weighted average increase from 18.5% to 19.4%. Although this may not seem like much, that disparity spread across the company’s revenue added $15.41 million in pretax profit to the company’s bottom line. The company also saw operating expenses drop from 15.6% of sales to 14.1%. Other profitability metrics also fared well. Operating cash flow, for instance, fell from $173 million to $158.9 million. But if we adjust for changes in working capital, it would have risen from $55.6 million to $102.8 million, while EBITDA expanded from $65.4 million to $114.5 million.

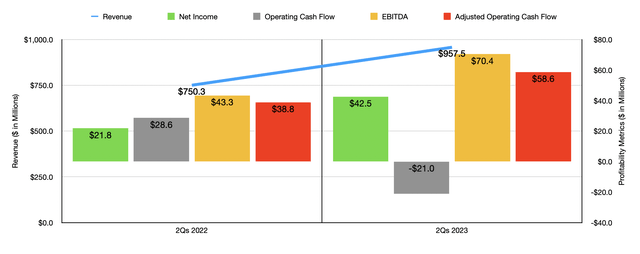

Author – SEC EDGAR Data

Growth for the company has continued into the 2023 fiscal year. Revenue of $957.5 million represents a significant improvement over the $750.3 million reported in the first half of the 2022 fiscal year. Once again, the biggest improvement for the company came from its equipment operations, with revenue rising by 33.3% from $548.7 million to $731.6 million. This 27.6% increase was driven primarily by a 27.1% rise associated with same-store sales and by a couple of acquisitions that the company had engaged in.

As can be expected, the rise in revenue also brought with it an increase in profitability. Net income nearly doubled from $21.8 million to $42.5 million. In addition to seeing the company’s gross profit margin inch up from 19.5% to 20%, we also saw operating expenses drop from 15.1% of sales to 13.9%. While strong demand and robust inventory help the company to essentially pass on more than any cost increases onto its customers, the operating expenses improvement was associated with the company’s ability to leverage its fixed operating costs thanks to higher sales volumes. Other profitability metrics largely followed. Yes, operating cash flow did worsen, declining from $28.6 million to negative $21 million. But if we adjust for changes in working capital, it would have risen from $38.8 million to $58.6 million. And over that same window of time, we also would have seen EBITDA rise from $43.3 million to $70.4 million.

When it comes to the 2022 fiscal year as a whole, management has been fairly detailed with guidance. For instance, revenue associated with its agricultural activities should grow by between 50% and 55%, driven by a combination of strong demand and some acquisitions the company has engaged in over the past year. Construction-related revenue, meanwhile, should drop by between 5% and 10%, while its international revenue should either flatline or decline by as much as 5%. Earnings per share, meanwhile, should come in at between $3.70 and $4. At the midpoint, that would translate to net income of $86.2 million. No guidance was given when it came to other profitability metrics. But if we assume that they would increase at the same rate that net income is forecasted to, we should anticipate adjusted operating cash flow of $134.3 million and EBITDA of $149.5 million.

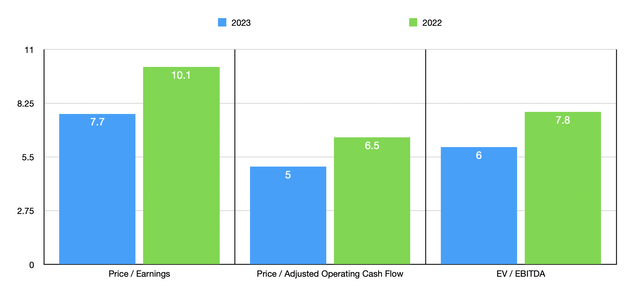

Author – SEC EDGAR Data

These numbers would imply a forward price-to-earnings multiple of 7.7, a forward price to adjusted operating cash flow multiple of 5, and a forward EV to EBITDA multiple of 6. These numbers compare favorably against the numbers that we would get using data from 2022. Those would come in at 10.1, 6.5, and 7.8, respectively. Also, as part of my analysis, I compared the company to five other trading and distribution firms. On a price-to-earnings basis, three of the companies had positive results, with multiples ranging between 3.2 and 60.8. And using the EV to EBITDA approach, the range for the five firms was between 2.4 and 31.8. In both scenarios, only one of the companies was cheaper than Titan Machinery. Meanwhile, using the price to operating cash flow approach, the range was between 6.6 and 34.5. In this case, our prospect was the cheapest.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Titan Machinery | 10.1 | 6.5 | 7.8 |

| MRC Global (MRC) | N/A | 10.1 | 22.6 |

| BlueLinx Holdings (BXC) | 3.2 | 6.6 | 2.4 |

| Transcat (TRNS) | 60.8 | 34.5 | 31.8 |

| DXP Enterprises (DXPE) | 30.7 | 13.7 | 11.1 |

| Alta Equipment Group (ALTG) | N/A | 15.2 | 10.1 |

Takeaway

Based on all the data provided, I do believe that Titan Machinery has been performing exceptionally well. Although I do expect financial performance to eventually worsen if market conditions deteriorate further, shares are cheap enough to warrant some upside from here. Given these factors, I do believe that it’s appropriate to increase my rating on the company from a ‘hold’ to a ‘buy’.