arlutz73

The Hershey Company (NYSE:HSY), together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

The firm has recently published strong Q3 results and the aim of our article today is to discuss these results and highlight what we like and what we don’t like about them.

Our previous thesis

In July, we have already published an article on Seeking Alpha, titled: “3 Reasons Why Hershey Stock Is A Buy”. Back then, our three reasons for buying the stock were:

1.) Financial performance is expected to be relatively unaffected by declining consumer confidence.

2.) It offers an attractive valuation and dividends.

3.) It reported strong financial performance in Q2 and a rosy outlook for the rest of 2022.

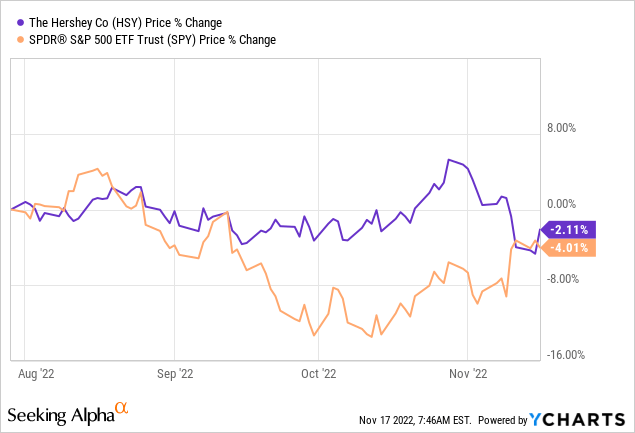

Since then, HSY stock has lost about 2% of its market value, about in-line with the decline of the broader market.

We believe that the previously mentioned reasons are still valid, especially in light of the strong Q3 results and the optimistic outlook presented by Hershey earlier in November, but we would like to highlight a few points that investors should keep an eye on.

Q3 results

While many firms have been struggling this year with low consumer confidence, inflationary pressures and the impacts of the geopolitical conflict between Russia and Ukraine, Hershey’s sales growth and the demand for their products show no signs of slowing down.

In Q3 consolidated net sales have totalled in $2,728.2 million, representing an increase of 15.6% year-over-year. Of this growth, 11.8% has been organic and 4.1% due to acquisitions. The unfavourable currency environment has created a 0.3% headwind. Important to note that the growth has been a combination of positive pricing and increasing volume:

[…] reflecting a favorable price realization of 7.7% primarily due to higher list prices and favorable price elasticities across our reportable segments, a volume increase of 4.1% driven by increased consumer demand […]

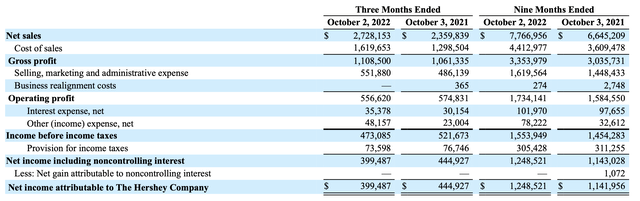

Income statement (Hershey)

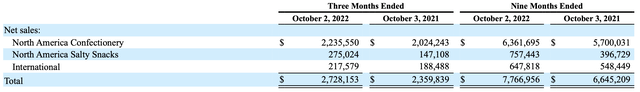

Also promising that all segments have been performing well, even the International one, despite the geopolitical tensions and the currency headwinds.

Net sales by segment (Hershey)

In our opinion, these are all good signs that despite the challenging macroeconomic environment, customers still want Hershey’s products.

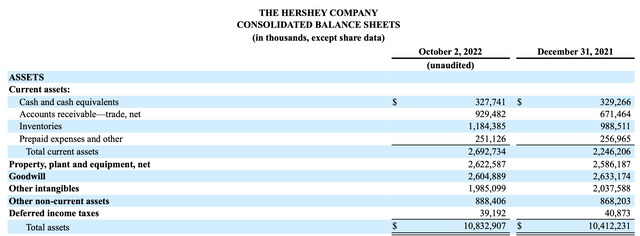

Along with sales, there has also been a substantial increase in account receivables. While sales have only grown by 15.6%, accounts receivables has increased by as much as 38%. When accounts receivable increase at a larger rate than sales, it could be a warning sign. A change in revenue recognition or sales on credit could lead to a much more optimistic picture about sales and demand and may distort the reality.

Balance sheet (Hershey)

On the basis of one quarter we are not aiming to draw far reaching conclusions, but it is necessary to monitor the developments around these figures, if you are an investor or potential investor. A short comment was provided in the 10-Q by the firm:

Net working capital (comprised of trade accounts receivable, inventory, accounts payable and accrued liabilities) consumed cash of $212.3 million in 2022, compared to $185.3 million in 2021. This $27.0 million fluctuation was mainly driven by a higher year-over-year build up of U.S. inventories to satisfy product requirements and maintain sufficient levels to accommodate customer requirements and an increase in cash used by accounts receivable due to the timing of customer payments, partially offset by the timing of vendor and supplier payments.

While sales have increased, the cost of sales along with the SM&A expenses have also grown substantially resulting in a lower net income figure than in the year ago quarter.

Cost of sales increased 24.7% in the third quarter of 2022 compared to the same period of 2021. The increase was driven by higher sales volume, higher supply chain inflation costs, including higher logistics and labor costs, and an incremental $47.7 million of unfavorable mark-to-market activity on our commodity derivative instruments intended to economically hedge future years’ commodity purchases. The increase was partially offset by favorable price realization and supply chain productivity.

This unfavourable development has caused the gross margin to contract by as much a 440 bps.

While an increase of almost 25% is dramatic, we believe that the easing inflationary pressure and the declining commodity prices are likely to lead to better financial results for Q4.

SM&A expenses increased $65.8 million, or 13.5%, in the third quarter of 2022 compared to the same period of 2021. Total advertising and related consumer marketing expenses increased 5.4% driven by advertising increases in our confectionery brands and increased investment in our salty snacks portfolio, which were partially offset by cost efficiencies related to new media partners.

2022 Full-year guidance

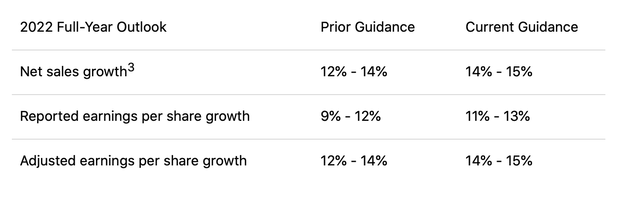

On top of the strong Q3 sales figures, HSY has published an updated guidance. All metrics presented, including net sales growth, reported earnings per share growth and adjusted earnings per share growth, have been adjusted upwards.

Updated guidance FY2022 (Hershey)

This update gives us confidence that the management sees high demand and decreasing inflationary pressure going into the last quarter of the year.

To keep in mind

The demand for Hershey’s products has remained high in the third quarter, proven by the high growth in net sales and the more than 4% increase in volume, despite the 7.7% price increase.

Over the same period, accounts receivable has grown by as much as 38%, which could be a warning sign that Hershey’s sales figures may look better on paper than in reality.

Like many other firms, Hershey is also being hit by the inflationary pressures, leading to skyrocketing COGS and SM&A expenses, resulting in lower earnings.

On the other hand, the firm has adjusted their full year outlook upwards, expecting low- to mid-teens growth across their presented metrics.

While Hershey’s results may not be as good as they first seem, we maintainability our “buy” rating on the stock.

:max_bytes(150000):strip_icc()/Health-GettyImages-1060820524-b9fd002a2a4b4506b7fbeafed4361931.jpg)