VioletaStoimenova

Thesis

Teladoc’s (NYSE:TDOC) Q2 was a large disappointment for the market, the media, and the Avenue. However, regardless of the underwhelming efficiency, and weak steering, TDOC held its July lows firmly and didn’t break its Might/June lows.

Due to this fact, we stay assured that TDOC has possible seen the worst of its sell-off, despite the fact that near-term volatility is predicted. We additionally highlighted in a June article (Speculative Purchase ranking) suggesting that TDOC has possible bottomed out in Might. TDOC additionally surged almost 46% from our article earlier than the post-earnings promote digested the restoration.

Nevertheless, the stakes appeared to have shifted for Teladoc, given the continuing macro challenges impacting shopper and company spending. Due to this fact, it’ll additionally possible have an effect on Teladoc’s income progress and profitability.

Our revised valuation mannequin additionally signifies that TDOC might battle to take care of a market-outperform ranking.

Whereas we consider that TDOC stays well-supported at its long-term backside, we’re not satisfied that it might outperform on the present ranges.

In consequence, we revise our ranking from Speculative Purchase to Maintain.

Teladoc’s Weak Execution And Weak Steering

Teladoc’s efficiency in 2022 has been subpar. It additionally highlights the inherently weak moats of its working mannequin, because it struggles to fend off competitors from lower-end gamers. Due to this fact, the corporate has continued to underperform, exacerbated by worsening macros, impacting shopper and company spending. CEO Jason Gorevic accentuated (edited):

We’re persevering with to see our pipeline of Continual Care offers develop extra slowly than we anticipated at first of the yr. It stays early within the promoting season, however offers proceed to progress at a slower tempo. We consider, no less than partly, attributable to aggressive noise because the market transitions from stand-alone level options to built-in whole-person digital care. Based mostly on what we’re at the moment seeing within the market, we additionally consider heightened financial uncertainty over the previous a number of months is more and more enjoying an element in delaying the decision-making course of within the employer market. (Teladoc FQ2’22 earnings name)

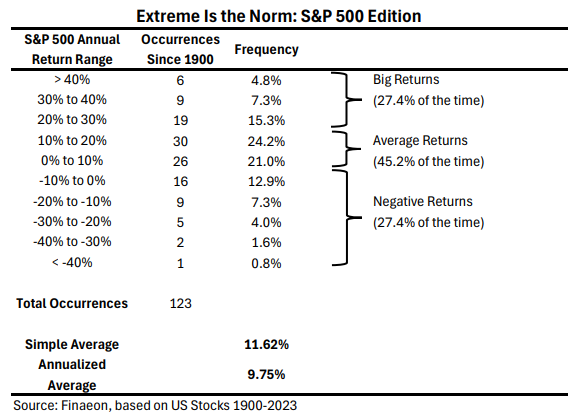

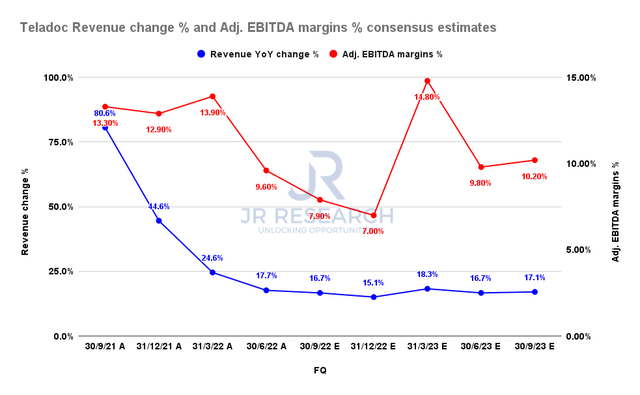

Teladoc income change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Accordingly, Teladoc posted income progress of 17.7% in FQ2 and an adjusted EBITDA margin of 9.6%. Nevertheless, given the gamut of headwinds, the Avenue consensus (impartial) signifies additional weaknesses by H2’22 earlier than a possible restoration from FY23. Due to this fact, Teladoc’s challenges might be transitory because it’s hobbled by the macro challenges however anticipated to enhance subsequently.

However, we did not observe confidence from administration’s commentary, because it proffered steering. CFO Mala Murthy articulated (edited):

We wish to pull again in This fall on advert spending. We have talked concerning the pricing dynamics within the vacation season. And I simply additionally wished to reiterate at this level, from a income perspective, we’re seeing some modest incremental strain on our yield on promoting spend within the BetterHelp enterprise. We are going to simply need to undergo the yr and see how the buyer dynamics play out and whether or not the buyer sentiment improves or it continues to be extra in direction of belt-tightening. (Teladoc earnings)

TDOC’s Valuation Is No Longer Engaging

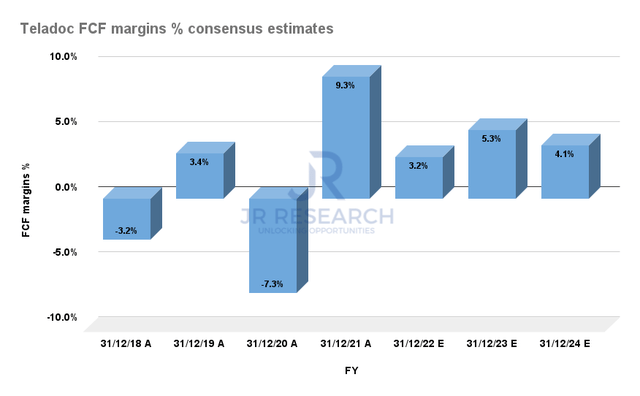

Teladoc FCF margins % consensus estimates (S&P Cap IQ)

Given the numerous revisions within the consensus estimates, Teladoc’s free money move (FCF) profitability can be projected to be affected markedly. Notably, TDOC is predicted to submit an FCF margin of 4.1% in FY24, down from its pre-earnings estimates of 9.3%. It is also more likely to affect its margins by 2024.

| Inventory | TDOC |

| Present market cap | $5.98B |

| Hurdle fee | 20% |

| Projection by | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 4.5% |

| Implied TTM income by CQ4’26 | $7.43B |

TDOC reverse money move valuation mannequin. Information supply: S&P Cap IQ, creator

In consequence, we revised our blended FCF margin to 4.5% however stored our mannequin’s market-outperform hurdle fee of 20%. Consequently, we require Teladoc to ship a TTM income of $7.43B by CQ4’26. It implies a income CAGR of 30.6% by CQ4’26, which we consider is extremely unlikely.

Due to this fact, TDOC might battle to fulfill our 20% hurdle fee, the minimal we demand for so-called high-growth shares. In consequence, we’re assured that TDOC is unattractive on the present ranges.

Is TDOC A Purchase, Promote, Or Maintain?

We revise our ranking on TDOC from Speculative Purchase to Maintain, as we consider it is possible at its long-term backside (subsequently not a Promote).

Nevertheless, we’re not satisfied that TDOC might outperform, given the considerably revised estimates and aggressive challenges to its working mannequin.

In consequence, we urge traders to rotate their publicity to different progress and tech shares.