[ad_1]

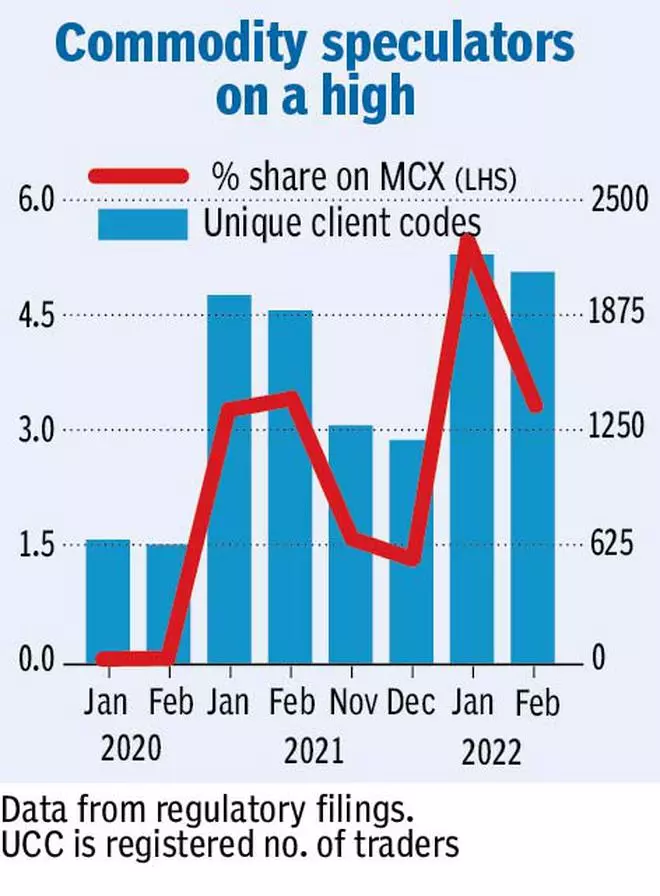

Sikkim, a tiny State with a inhabitants of 6.58 lakh, is now an abode for commodity market speculators due to its particular tax haven-like standing. . In February, the market share of Sikkim-based merchants on the Multi Commodity Change (MCX) in Mumbai climbed to five.5 per cent from nil simply over a few years in the past. Information present that MCX witnessed a complete quantity churn of over $110 billion on its platform throughout February, of which Sikkim’s share stood at over $6 billion. The variety of merchants from the State, based mostly on distinctive shopper code, has elevated to 2,217 in comparison with 674 in February 2020.

Compared, different densely populated States are seeing a lot much less quantity regardless of having a bigger variety of merchants. Bihar, for instance, has 2.88 lakh merchants however accounts for just one.51 per cent of the buying and selling volumes. Kerala has 2.04 lakh merchants however the volumes from the State is round 1.45 per cent. Even Madhya Pradesh, which has 4.67 lakh merchants, accounted for less than 3.2 per cent of volumes in February

Specialists informed BusinessLine that Sikkim’s newfound love for commodity hypothesis could possibly be as a result of exemption its residents get from the obligatory requirement of a Everlasting Account Quantity (PAN), which permits them to skip submitting tax returns.

Greater than 95 per cent of the buying and selling quantity on MCX is concentrated in crude oil, gold, silver and different base metals, the value discovery of which primarily occurs overseas. Therefore, the exercise of Sikkim-based merchants on MCX was primarily speculative, specialists say including that merchants in different States could also be utilizing Sikkim-based residents as a proxy to hold out these trades.

India’s tax haven

Sikkim, an erstwhile kingdom, was merged into India on situation its previous legal guidelines and particular standing as envisaged in Article 371(f) of the Structure stay intact. Thus, the state adopted its personal Sikkim Earnings Tax Guide 1948, which ruled the tax legal guidelines. Underneath it, no resident was imagined to pay taxes to the Centre.

Nonetheless, when Sikkim’s tax legal guidelines have been repealed in 2008, the Union Price range that yr exempted the State’s residents from tax by inserting part 10 (26AAA). Since an previous legislation was being changed with the Earnings Tax Act 1961 of India, a piece within the Act protected the particular standing given to Sikkim & “Sikkimese” as per Article 371(f) was inserted. Thus, underneath 26AAA, the earnings accrued to Sikkimese people within the State or by the use of dividend or curiosity on securities from elsewhere have been exempt. This, mixed with exemption of PAN necessities and lack of tax filings, makes it practically not possible to evaluate market speculators from Sikkim.

SEBI exempted PAN

Put up-2008, market regulator SEBI exempted Sikkim residents from the obligatory PAN requirement for investments within the Indian securities market and mutual funds. They gave a proof of residency to the custodians and exchanges in Mumbai.

SEBI’s round to exempt the PAN requirement for Sikkim people was issued following an order by the Sikkim Excessive Courtroom in 2007. In September 2015, the erstwhile commodity market regulator Forwards Market Fee that oversaw MCX was merged into SEBI. Therefore, the SEBI guidelines of PAN exemption to Sikkim residents might have additionally change into accessible to the commodity merchants on MCX. Specialists say this laxity of PAN requirement has now come in useful for Sikkim based mostly commodity market merchants, who face no urgency of tax filings and thus take pleasure in a tax haven like standing.

After demonetisation in 2016 and the imposition of GST in 2017, the movement of cash to Sikkim has been greater than earlier than, which successfully appears to have revamped speculative buying and selling actions in Sikkim. Tax specialists say that many gray areas, together with sensible and technical chances, have clouded the Earnings Tax Act in Sikkim.

Revealed on

April 03, 2022

[ad_2]

Source link