Win McNamee/Getty Photos Information

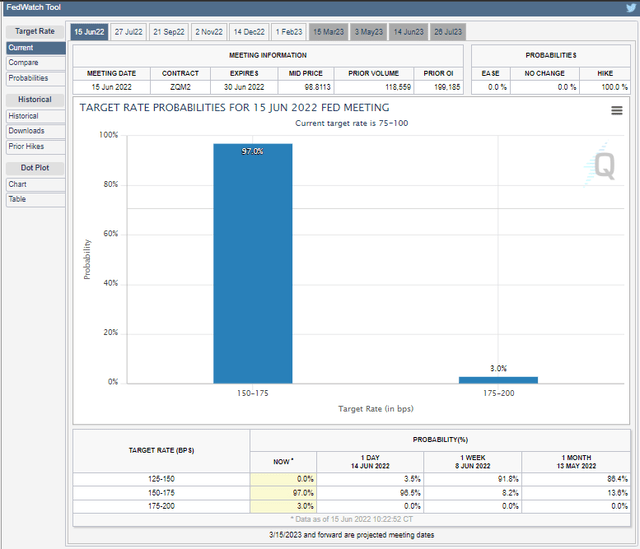

The so-called “most necessary Fed assembly ever” was kind of lackluster. Chair Jay Powell hiked charges by 75 foundation factors, proper what the market anticipated, in accordance with CME Fed Funds Futures pricing. We had been principally advised what would occur at this afternoon’s FOMC assembly late on Monday when the Wall Road Journal reported that there have been Fed whispers of a 75 foundation level upward change. Maybe essentially the most fascinating price-action of the week was then – the bond market turned extremely unfastened. Probably the most liquid market on this planet didn’t commerce prefer it.

CME Fed Watch: Futures Merchants Have been Assured A couple of 3/4-Level Coverage Price Hike

CME Group

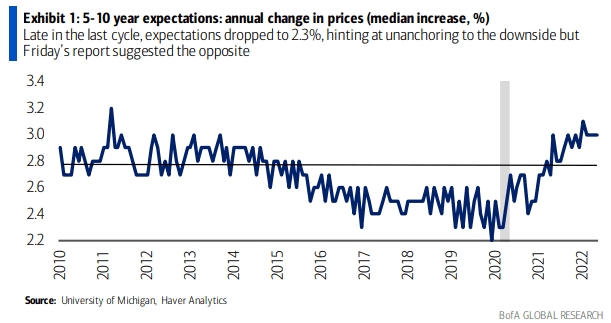

This all started final week. Shares started to sink Wednesday. Then Thursday afternoon was a catastrophe. Friday morning was when the fireworks started. The U.S. CPI report got here in a lot hotter than anticipated after which the ten a.m. College of Michigan Client Sentiment survey revealed big-time 5-10-year inflation expectations – one thing the Fed appears at. Finally, that led the Fed (possible) to leak that whisper to the WSJ. Markets had been in turmoil Monday grappling with a disintegrating fastened revenue market.

Customers’ Inflation Expectations Above the Lengthy-Time period Common

Financial institution of America International Analysis

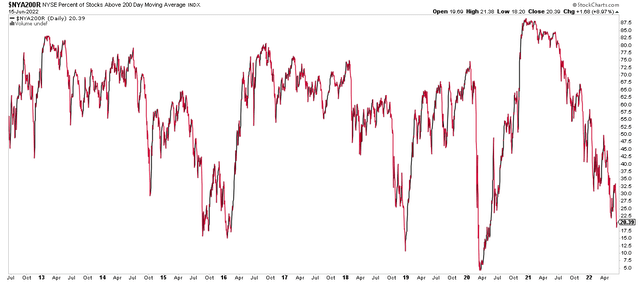

Furthermore, the European Central Financial institution held an emergency assembly to take care of an obvious impending disaster relating to surging yields and plummeting bond costs throughout the pond. Dangerous belongings continued to sink earlier than a respite rally forward of the two p.m. Fed resolution right now. With none stunning strikes this morning, after which a considerably uneventful convention, this afternoon featured possible some short-covering after oversold situations. Contemplate that simply 20% of NYSE shares traded above their 200-day shifting common going into Wednesday – the bottom determine since proper after the COVID Crash.

Oversold Circumstances: 20% of NYSE Shares Commerce Above Their 200-Day Transferring Common

StockCharts.com

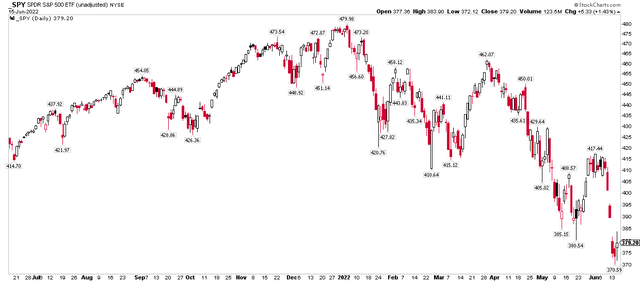

Digging deeper into the market response, SPY printed a small bullish actual physique on right now’s candle, but it surely was near a doji (which represents indecision). Tuesday’s low simply above $370 on SPY can be a key spot to observe. However recall what occurred the day after the prior Fed assembly bounce – shares plunged. Thursday’s value motion can be vital, however so too will Friday’s. Learn on.

Shares Settled About The place They Opened, Watching Tuesday’s Low For Assist

StockCharts.com

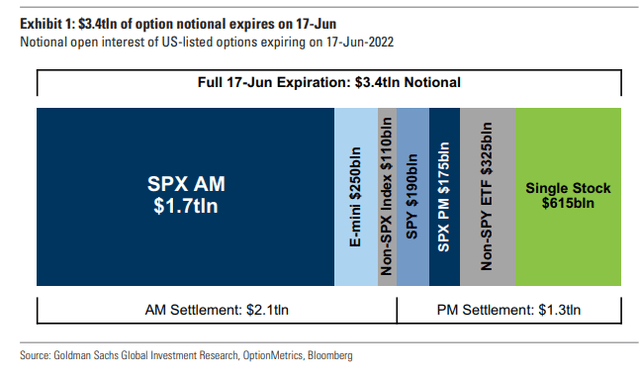

Friday is choices expiration which can be a doozy this time. Goldman Sachs studies that $3.4 trillion of choice notional will expire. It is also a three-day weekend, which might add to volatility.

Goldman Sachs: A Important OpEx on Friday Afternoon

Goldman Sachs Funding Analysis

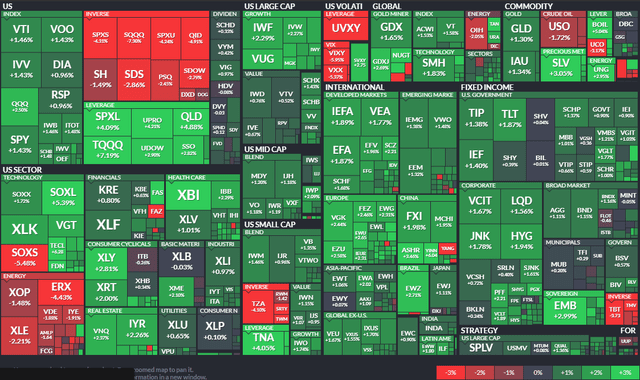

As for the bond market’s feeling concerning the Fed, it was a risky post-decision market. Quick-term charges had been sharply decrease because the Fed appeared to reassure the Treasury market. Corporates had been additionally bid. Funding-grade credit score (LQD) rallied 1.6% whereas junk bonds (HYG) had been up virtually 2%.

The Fed Day ETF Efficiency Warmth Map: Danger-On, Bonds Rally

Finviz

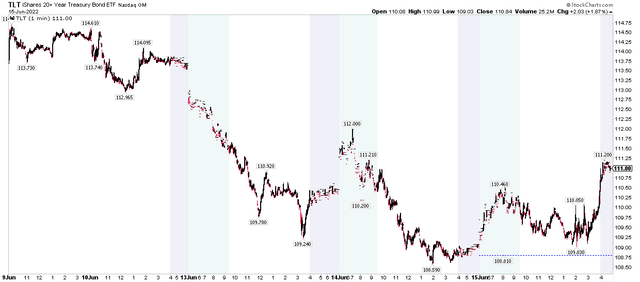

Curiously, the lengthy bond caught an enormous bid late within the day – perhaps that may be a signal of future progress considerations.

Lengthy-Time period Treasuries Rallied Sharply Late Wednesday

StockCharts.com

Commodities had been relatively weak on Wednesday sans treasured metals whereas crypto didn’t take part within the risk-on rally. The U.S. Greenback Index was down exhausting.

The Backside Line

Finally nothing actually modified right now in my opinion. Maybe the bond market discovered its footing after a fully wild few days that noticed the U.S. two-year fee bounce essentially the most over two days in virtually 40 years. The S&P 500 bulls have so much to show. For now, it is merely a countertrend inventory market rally.