[ad_1]

Area: The ultimate frontier. These are the voyages of the starship Enterprise…

Captain James T. Kirk says this at the beginning of each Star Trek episode.

The unique TV sequence began airing in 1966. Right now, it’s one of the crucial recognizable and highest-grossing media franchises of all time.

Star Trek was capable of earn money from the thought of outer area.

And in the true world, area tales appeared like an incredible thought with loads of investing promise…

Virgin Galactic is the world’s first business spaceline. Rocket Lab offers entry to area satellites. Astra Area is launching satellites into low Earth orbit.

Buyers grew to become suckers for a superb story. They purchased in … hook, line and sinker.

But it surely seems that these corporations attempting to capitalize on area exploration aren’t nice companies to put money into.

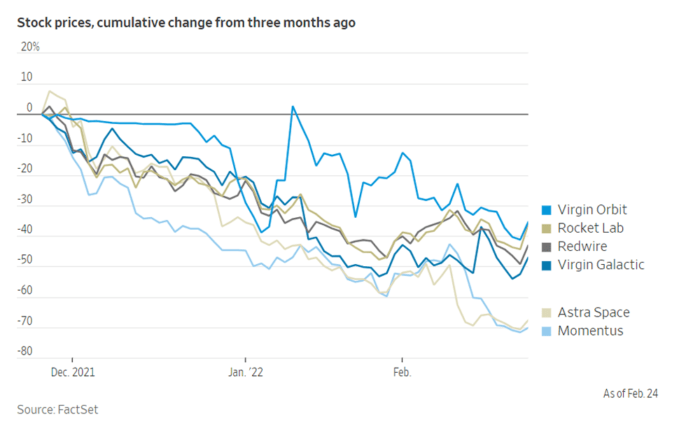

Within the final three months, gravity has pulled their inventory costs again to Earth.

Virgin Galactic is down 47%. Rocket Lab has dropped 36%. And Astra Area is down 70%.

(Click on right here to view bigger picture.)

I’ve seen this film so many instances earlier than…

Falling Again to Earth

A fantastic thought and promise of on the spot riches suck buyers in.

The funding banks and firm insiders promote their shares to a gullible public.

Wall Road’s advertising and marketing fuels the greed glands of common buyers. They will’t purchase shares of the shiny, new thought quick sufficient. Inventory costs soar to the moon.

However then, they arrive crashing again all the way down to earth. And common buyers are left holding an enormous bag of losses.

What most buyers don’t notice is that the inventory worth follows the worth of the enterprise, not the opposite manner round.

That, in a nutshell, is why I’ve by no means really helpful an area inventory. As a result of with area shares, there was no worth available…

A lot of them had been roach motels. Cash went in, and by no means got here out.

And those that invested in them discovered this the arduous manner: On the finish of the day, worth is what you pay, and worth is what you get…

Melting Ice Cubes

I don’t purchase shares like folks purchase lottery tickets — with a greenback and a dream.

And neither do you have to.

I’ve discovered this by watching Warren Buffett for the previous a number of many years.

Buffett and his enterprise companion Charlie Munger personal shares primarily based on the long-term worth of the companies. As they are saying:

We’re not stock-pickers; we’re business-pickers.

And in Alpha Investor, we’re the identical manner.

For those who purchase shares primarily based on valuations like we do, there’s a flooring built-in. The companies are value one thing of actual worth: money, prospects and earnings.

Most instances, story shares — like area startups — haven’t any flooring. Their companies are cash losers and deeply in debt.

They’re like melting ice cubes. Every day, they’re value much less and fewer … particularly within the risky markets we’re seeing now.

Even high quality corporations with actual worth and earnings are being discounted lately.

However that provides us an incredible alternative. It means we will purchase these companies at engaging costs that don’t come round typically.

For Alpha Buyers seeking to benefit from this, look no additional than my most up-to-date suggestion.

Yesterday, I gave all the small print on one firm that’ll profit from the semiconductor trade’s tailwinds and the chip scarcity. (And it’s not a chipmaker!)

For those who missed it, you may catch up proper right here.

And should you’re not an Alpha Investor but, it’s by no means too late to affix! Don’t miss out on this shopping for alternative. Discover out how one can entry my newest suggestion proper right here.

Regards,

Charles Mizrahi

Founder, Alpha Investor

[ad_2]

Source link