Nvidia (NVDA) was the highest S&P 500 inventory performer in 2023 and led the benchmark index via a lot of this yr. However not. Energy era agency Vistra (VST) skyrocketed in September to race previous Nvidia inventory.

Nuclear energy play Constellation Power (CEG) and knowledge analytics agency Palantir Applied sciences (PLTR) are additionally triple-digit winners, adopted by Howmet Aerospace (HWM). Howmet inventory is the one one of many top-five S&P 500 shares that is not a man-made intelligence inventory or an AI-adjacent play.

↑

X

How To Purchase Shares: IBD’s 4 Pillars Of Investing

Palantir inventory is among the many latest S&P 500 members, becoming a member of Sept. 23. Vistra inventory was added on Might 8.

Nvidia inventory is on Leaderboard. Nvidia, Palantir and Howmet Aerospace inventory are on the IBD 50. Palantir inventory is on the IBD Huge Cap 20.

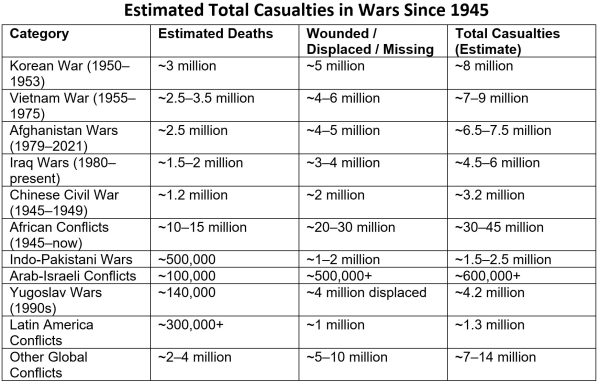

S&P 500 Shares: Prime 2024 Performers

| Firm | Inventory | YTD return |

|---|---|---|

| Vistra | VST | 243.85% |

| Nvidia | NVDA | 148.0% |

| Constellation Power | CEG | 137.3% |

| Palantir Applied sciences | PLTR | 128.5% |

| Howmet Aerospace | HWM | 86.2% |

Vistra Inventory

Vistra is a diversified electrical utility and energy era agency, with pure gasoline, nuclear, photo voltaic and battery storage amenities. Vistra and lots of different energy mills, together with Constellation Power, have grow to be AI-adjacent performs as a result of AI knowledge facilities have monumental energy wants.

Earnings have powered greater as electrical energy costs surge.

Vistra inventory has soared 243.85% in 2024 as of Oct. 3, surging 38.75% in September and persevering with to energy greater in October. In late September, VST inventory surged out of a base going again to late Might, in line with MarketSurge evaluation. Shares at the moment are prolonged from that 107.24 purchase level. Vistra was rallying on Constellation Power’s plan to reopen Three Mile Island.

Nvidia Inventory

Nvidia is the AI chip chief, with earnings and gross sales development within the triple digits for 5 straight quarters. These streaks might finish within the October-ended fiscal Q3. It is on the brink of shift to its next-generation AI course of, the Blackwell line.

Nvidia inventory has gained 148% in 2024, however down barely since mid-year. NVDA inventory has rebounded since early September. Shares have a 131.26 purchase level from an uncommon deal with, with 127.67 as a trendline entry.

Nvidia rose Oct. 3 after CEO Jensen Huang cited “insane” demand for the upcoming Blackwell AI chips.

Indexes Maintain Key Ranges As Nvidia Rallies, Tesla Slides

Constellation Power Inventory

Constellation Power is a nuclear energy large. Earnings are starting to energy up as electrical energy costs surge.

On Sept. 20, it introduced plans to restart Unit 1 of the Three Mile Island nuclear plant, aiming to convey that again on line in 2028. Constellation has a 20-year deal to promote all its energy to Microsoft (MSFT) for its knowledge middle wants.

Constellation Power inventory has surged 137.3% in 2024 via Oct. 3. Shares vaulted 22% Sept. 20 on the Three Mile Island information, racing previous a purchase level from a base going again to late Might.

Palantir Inventory

The info analytics play has historically gotten most of its income from the U.S. navy and different authorities businesses, however business income is booming. Income development has accelerated for 4 straight quarters, to 27% in Q2. Earnings development has been robust, at 80% in Q2.

Palantir inventory has jumped 128.5% in 2024, hitting a file shut on Oct. 3. That features a enormous run from the Aug. 5 low of 21.23. Information that PLTR inventory would be part of the S&P 500 fueled a 14% acquire on Sept. 9.

Regardless of greater than doubling, this S&P 500 inventory has been powerful to carry, with two highly effective breakouts that finally failed earlier than shares rebounded.

S&P 500: Howmet Aerospace Inventory

The maker of titanium alloy merchandise for Boeing (BA), Airbus (EADSY) and others is using the growth in jet demand. Earnings jumped 52% in Q2, the very best year-over-year acquire in years.

Howmet inventory has risen 86.6% in 2024, with earnings-gap breakouts in early Might and late July. The non-AI S&P 500 inventory chief lately cleared a seven-week vary, with a 98.15 three-weeks-tight entry providing a brand new shopping for alternative.

Please comply with Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for inventory market updates and extra.

YOU MIGHT ALSO LIKE:

Why This IBD Device Simplifies The Search For Prime Shares

Need To Get Fast Income And Keep away from Huge Losses? Strive SwingTrader

Finest Development Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation Immediately

Tesla Falls On Deliveries; BYD Soars As Gross sales Growth