IN 1989, AT the height of Japan’s financial and monetary heyday, few dared recommend the nation would possibly in the future be supplanted because the richest giant nation in Asia. Per particular person, South Korea was not even half as prosperous. However then mighty inventory and land bubbles popped in Tokyo, kick-starting a number of “misplaced” a long time for the Land of the Rising Solar. In the meantime South Korea’s financial system boomed. By 2018 its GDP per particular person, adjusted for buying energy, topped Japan’s.

Your browser doesn’t help the <audio> factor.

Similarities between the 2 economies lengthen past converging revenue ranges. Each constructed their wealth during times of export-led progress. Now South Korea’s working-age inhabitants is shrinking, as Japan’s did after the mid-Nineties. Most uncanny are echoes between the monetary dangers which emerged in Japan within the late Eighties and people mounting in South Korea at present. They, too, might entice Asia’s mightiest tiger within the doldrums for many years.

Tremendous-expensive homes have develop into a significant challenge in South Korea’s tight presidential election, which takes place on March ninth. The 2 front-runners—Lee Jae-myung, of the ruling Minjoo Social gathering, and Yoon Seok-youl, of the centre-right Individuals Energy Social gathering—have clashed over housing coverage all through the marketing campaign.

The outgoing authorities’s repeated efforts to rein within the property market, by tighter loan-to-value restrictions on mortgage-lending and steeper taxes on homeowners of a number of properties, have had little impact. Low rates of interest and an ageing inhabitants searching for rental revenue because it nears retirement have proved stronger forces. Within the Seoul metropolitan space, house to round half of South Korea’s 52m folks, property costs have virtually doubled prior to now ten years.

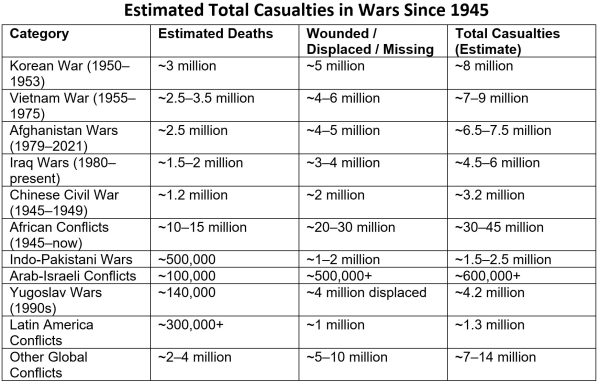

There is no such thing as a particular threshold past which the worth of all land in a rustic, relative to the dimensions of its financial system, suggests asset costs are unsustainable. However the ratio for South Korea is each excessive by worldwide requirements and relative to the nation’s current historical past. It now runs at 5 occasions its GDP, up from round 4 occasions in 2013. On the peak of Japan’s folly, the worth of all land rose to five.4 occasions GDP, earlier than collapsing by the Nineties.

Pricking South Korea’s obvious bubble could be much less harmful had liabilities not risen in tandem with asset values. South Korean folks and companies have been borrowing at a frantic tempo. In September final yr the nation’s family debt stood at 107% of its GDP, in contrast with 58% in Germany and 79% in America. Non-financial company debt runs to 114%, above the common for superior economies.

This, too, recollects Eighties Japan—and never in a great way. Richard Koo of the Nomura Analysis Institute in Tokyo warns of a potential “balance-sheet recession”. Throughout Japan’s increase years, asset values and liabilities surged collectively. When its land-and-stock bubble burst, asset values crumbled, however debtors nonetheless had the identical liabilities to repay. That left them in a state of detrimental fairness. As companies and households all rushed to deleverage, the financial system shrunk. “Individually they have been doing the suitable factor. Collectively they have been destroying the financial system,” says Mr Koo.

In 2020 the IMF flagged that South Korea was just one accident away from a harmful balance-sheet recession. Though lending to subprime debtors was restricted, it famous that about half of South Korea’s family credit score was both linked to floating rates of interest or required giant lump-sum repayments, that means it could must be refinanced at probably larger rates of interest. It additionally famous that the nation’s many small- and mid-sized companies, depending on shorter-term financial institution loans backed by property collateral, seemed uncovered.

Has the dreaded accident arrived? South Korea was one of many first main economies to lift rates of interest throughout the pandemic, and has now achieved so thrice. Most analysts anticipate the tightening to proceed: the central financial institution has mentioned it’s involved about each rising inflation and the financial-stability threat posed by hovering asset values. But once more, that has an Eighties flavour: Japan’s troubles started when the central financial institution began elevating charges quickly to pop the nation’s asset bubble.

The Financial institution of Korea’s coverage of “leaning in opposition to the wind”, as Jeong Woo Park of Nomura calls it, is having snowballing results that could be laborious to cease. On account of stricter credit score controls launched to chill down property costs, mortgage rates of interest are accelerating quicker than benchmark ones. After surging by pre-pandemic ranges, they flirted with decade-highs in January.

The parallel has limits. Japan’s monetary establishments have been famously poorly regulated, leaving policymakers always shocked by the extent of harm achieved to the monetary system as crises popped up repeatedly by the Nineties. South Korea’s uncommon Jeonse credit score system, by which households borrow to fund lump-sum rental funds, makes it troublesome to evaluate how dangerous family debt really is.

However the scary similarities will proceed to develop as South Korean politicians, central bankers and regulators endeavour to engineer a clean finish to the explosion in asset costs. They’ve the Japanese expertise to study from. However understanding the worst-case state of affairs might show simpler than avoiding it. ■

For extra professional evaluation of the most important tales in economics, enterprise and markets, signal as much as Cash Talks, our weekly publication.

This text appeared within the Finance & economics part of the print version below the headline “Kindred Seoul”