Luke Chan/E+ by way of Getty Pictures

Shares of social media firm Snap Inc. (NYSE:SNAP) have revalued decrease in 2022 on account of common market weak point and rising dangers of a recession. Nevertheless, Snap is making progress in its enterprise: The corporate is rising each day lively customers and revenues quickly and is now free money move worthwhile. Moreover, a robust income forecast has been submitted by the corporate for the second quarter and I anticipate Snap to develop its free money move margin going ahead!

Key Metrics Present Enterprise Power

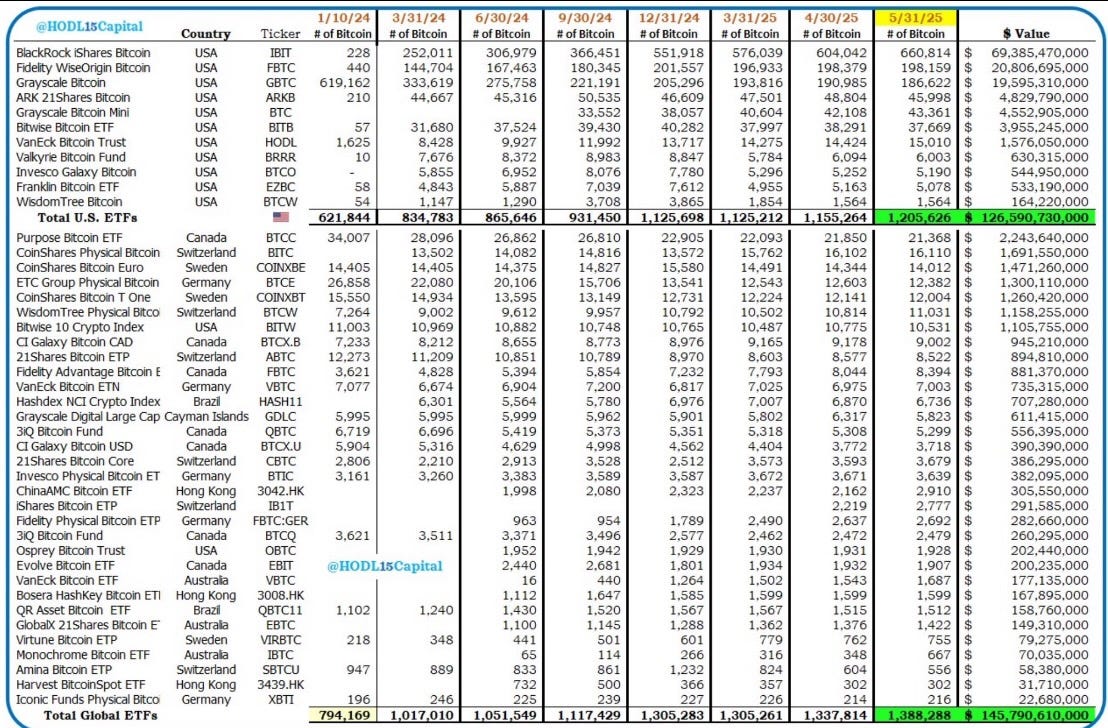

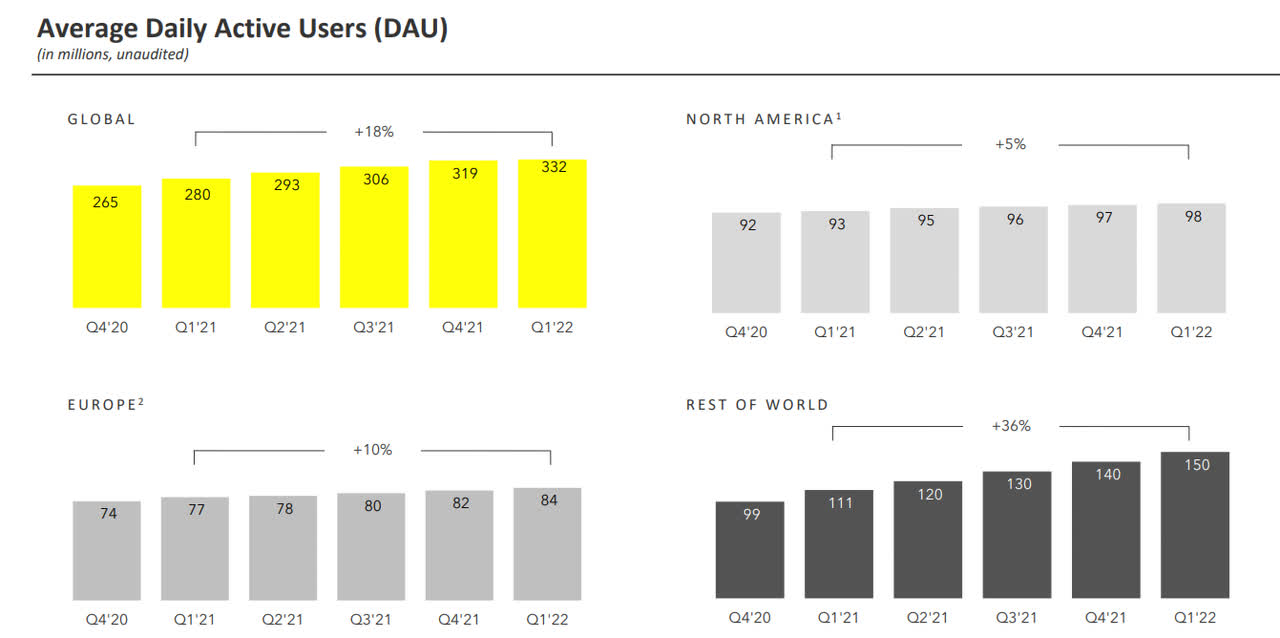

Snap noticed continuous power on its platform within the first quarter. In Snap’s Q1’22 earnings card, the social media firm revealed that its common each day lively customers — a very powerful key metric for platform companies — surged to 332M, displaying a rise of 18% 12 months over 12 months. Snap added 52M common each day lively customers during the last twelve months and in addition added 13M common each day lively customers simply within the final quarter, with 10M of these customers coming from markets exterior North America and Europe. Common each day lively consumer progress in North America and Europe saved moderating in Q1’22, implying that almost all of consumer and engagement progress will come from areas exterior of those two saturated markets going ahead.

Snap

Snap is increasing its content material providing and growing its companion ecosystem to develop engagement. In response to the social media firm, 250 million Snap chatters engaged with Snap’s augmented actuality daily on common in Q1’22. Augmented actuality merchandise are a means for Snap to have interaction particularly youthful customers which make up the core viewers for the platform: nearly all of customers are between 13 and 24 years of age. The usage of Augmented Actuality helps corporations promoting merchandise on the Snap platform enhance conversions and decrease the speed of delivery returns.

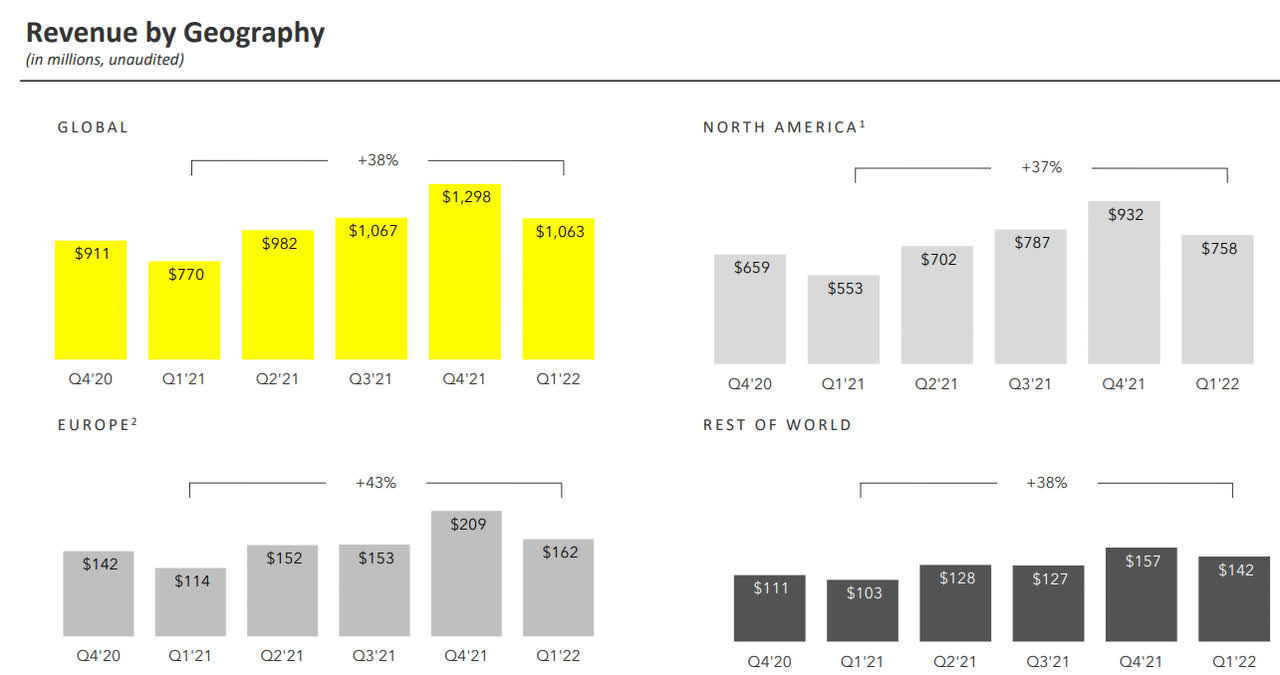

Snap’s revenues for Q1’22 surged 38% 12 months over 12 months to $1.06B with high line progress most pronounced in Europe at 43% 12 months over 12 months. Nevertheless, Snap’s income efficiency was sturdy all through the world, together with North America and the remainder of the world.

Snap

Sturdy Outlook For Q2 2022

Snap sees income progress of 20-25% 12 months over 12 months for Q2’22, which places Snap anticipated revenues into a variety of $1.18B to $1.23B. Momentum in income progress signifies that advertisers proceed to see Snap as a robust promoting platform.

Common Income Per Person

Snap’s common income per consumer/ARPU — the second most vital metric after each day lively customers for social media corporations — noticed a deceleration in Q1’22 with progress slowing from 36% within the year-earlier interval to 17% within the first quarter. Coming off a robust fourth quarter concerning advert spending, the primary quarter sometimes sees weaker efficiency metrics.

Common income per consumer progress has been moderating in all of Snap’s geographies during the last 12 months, however ARPU progress was nonetheless removed from being weak at 17% in Q1’22. North America continues to be probably the most profitable marketplace for Snap as advertisers pay excessive advert charges to advertise their services and products on the platform.

|

SNAP |

Q1’21 |

Q2’21 |

Q3’21 |

This autumn’21 |

Q1’22 |

|

ARPU |

$2.74 |

$3.35 |

$3.49 |

$4.06 |

$3.20 |

|

Development YoY |

36% |

76% |

28% |

18% |

17% |

|

North America |

$5.94 |

$7.37 |

$8.20 |

$9.58 |

$7.77 |

|

Development YoY |

66% |

116% |

49% |

33% |

31% |

|

Europe |

$1.48 |

$1.95 |

$1.92 |

$2.54 |

$1.93 |

|

Development YoY |

36% |

76% |

34% |

33% |

30% |

|

ROW |

$0.93 |

$1.07 |

$0.98 |

$1.12 |

$0.95 |

|

Development YoY |

(7)% |

20% |

3% |

1% |

2% |

(Supply: Creator)

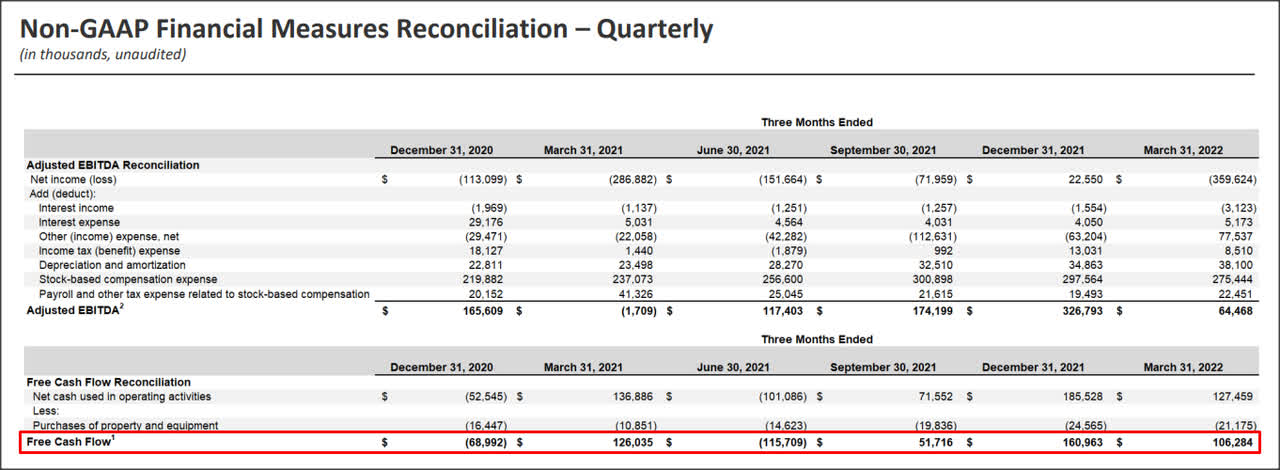

Free Money Movement Is Constructive

Regardless of declines in common income per consumer progress, Snap as soon as once more delivered optimistic free money move. Snap’s free money move in Q1’22 was $106.3M and the agency reported three consecutive quarters of optimistic FCF. Free money move on a last-twelve-months foundation was $203.3M which calculates to a free money move margin of 4.6%. Since Snap’s free money move is ramping up, I anticipate FCF margins to enhance going ahead as Snap’s Augmented Actuality merchandise proceed to see rising advertiser adoption.

Snap

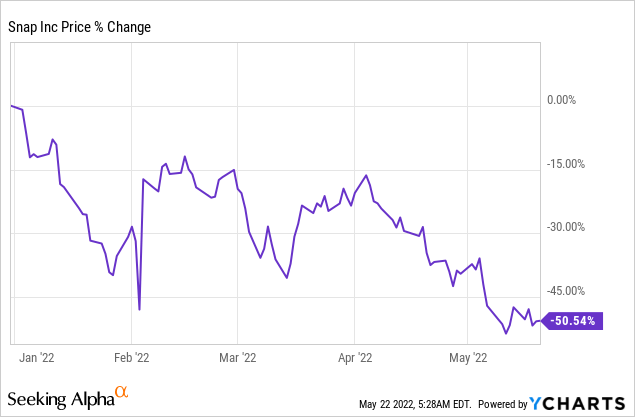

Snap’s Development Is Discounted Once more

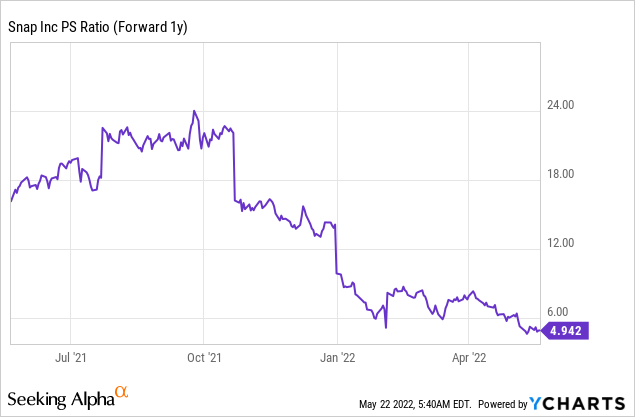

Snap has fallen again right into a down-trend in 2022 which creates a possibility to purchase the social media firm’s shares at a reduced valuation in comparison with its historical past. Primarily based off of FY 2023 anticipated revenues, shares of Snap have a gross sales multiplier issue of 4.9 X and revenues are anticipated to develop a minimum of 33% in every of the subsequent three years.

|

SNAP |

FY 2022 |

FY 2023 |

FY 2024 |

|

Gross sales |

$5.47B |

$7.70B |

$10.48B |

|

YoY Development |

32.9% |

40.8% |

36.1% |

|

P-S Ratio |

6.96 X |

4.94 X |

3.63 X |

(Supply: Creator)

Traditionally, Snap has achieved a a lot larger valuation based mostly off of revenues.

Dangers With Snap

Clearly, a deterioration within the progress outlook and cuts to promoting budgets characterize huge business dangers for Snap’s platform enterprise in addition to the inventory. A decline in each day lively customers and weakening ARPU traits additionally pose dangers for the social media platform.

Closing Ideas

Shares of Snap have proven weak point once more these days, which is basically the results of a deteriorating progress outlook for the worldwide financial system. Nevertheless, Snap is seeing sturdy progress in three of its most vital key metrics – each day lively customers, revenues, ARPU — and the agency is now a free money move optimistic enterprise with potential to develop its FCF margins. I consider the danger profile at this level continues to be closely skewed upwards and shares of Snap are a purchase!