mysticenergy/E+ by way of Getty Photographs

By Paul Wightman

At a look

- As China imports extra oil from the Center East and Atlantic Basin, merchants and refiners are watching the value unfold between Oman crude and people which might be priced on WTI or Brent.

- Imports of U.S. crude in China elevated over 620% from mid-2020 to mid-2021.

In an oil market that’s more and more globally interlinked, there’s a constant battle between producers within the Atlantic Basin and the Center East vying for market share in Asia.

Crude oil commerce flows into Asia are growing, partly as a result of retrenchment of many western-based refiners. On the similar time, China’s oil refineries have solid forward with capability expansions, resulting in better demand for imported volumes.

It’s more and more clear that China will change into the world’s largest oil refiner, with a complete capability of about 905 million tons per 12 months or 18.4 million barrels per day, in response to the most recent U.S. Vitality Info Administration knowledge.

The size of Asia’s refining community will see a better demand for imports from the Center East and the Atlantic Basin. Value threat administration performs an vital position to handle the value unfold relationships between these crudes priced towards Dubai and Oman and people which might be priced on a WTI or Brent-related foundation.

DME Oman stands on the middle of the Center East crude commerce, together with Dubai, with over 5.5 million barrels per day priced off the Oman benchmark. The Oman futures contract is well-suited as a worth threat administration software for this commerce.

China Diversifies its Crude Sources

The explosive development in China’s refining capability has its roots in a serious regulatory shift in 2015 when impartial refiners (often known as the “teapots”) have been first allowed to import crude oil.

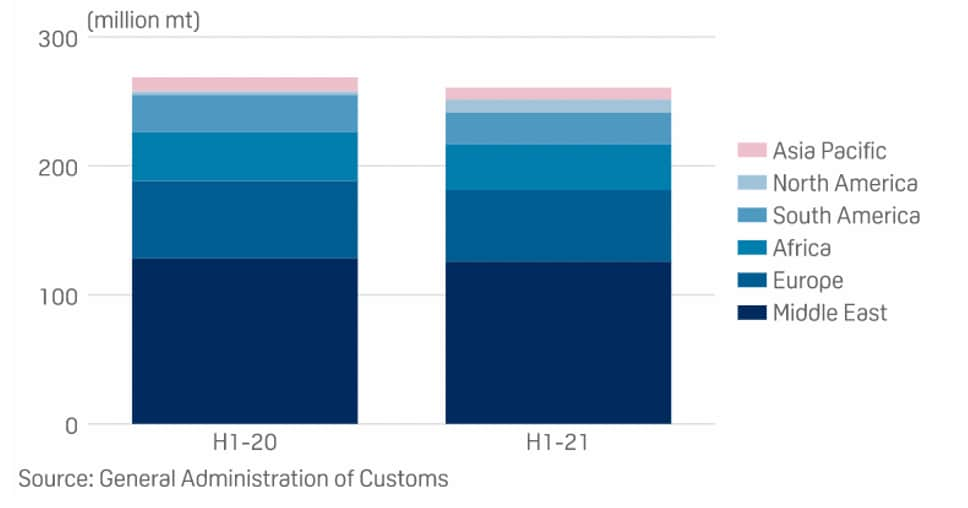

The newest knowledge from the Chinese language customs administration reveals that just about 50% of China’s crude purchases have been from Center East producers within the first half of 2021, up from 47% in the identical interval a 12 months earlier.

China can be a big purchaser of different Atlantic Basin crudes akin to these from the U.S. or U.Okay. North Sea. Merchants use the liquidity of the Brent and WTI futures contracts to handle a few of their related worth threat to the crude market. The value unfold relationship between Brent and WTI and the Oman or Dubai crude will be managed utilizing the liquid benchmark change contracts.

China’s Prime Crude Suppliers by Area

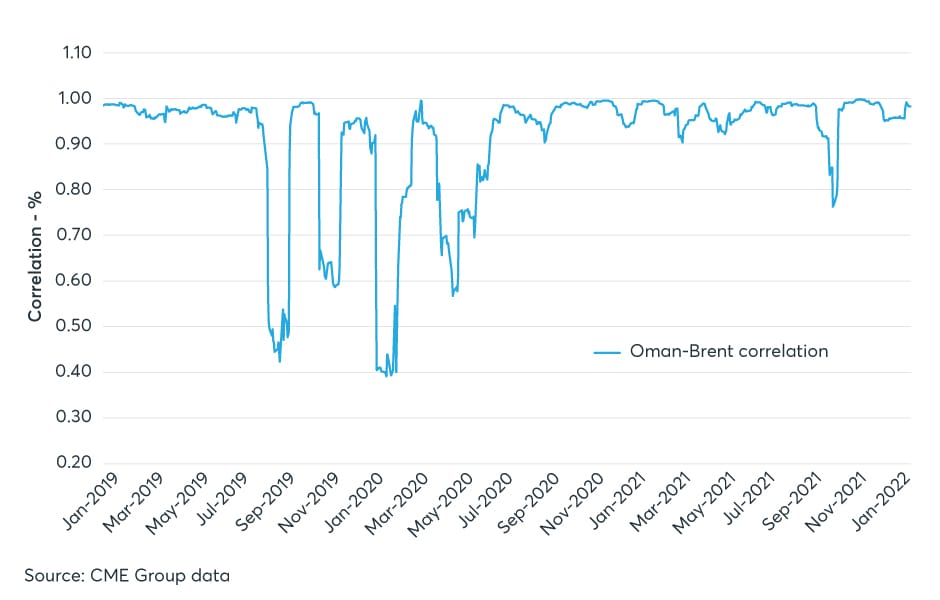

Brent-Oman Unfold Correlation Fluctuates

The crude spreads stay unstable, partly as a result of totally different provide and demand fundamentals affecting crudes in every area.

Oman and Dubai mirror the availability/demand fundamentals of the Asian market, whereas Brent and WTI are likely to mirror the broader fundamentals of the Atlantic Basin crude commerce.

Merchants within the Oman and Dubai markets wish to handle the sweet-sour crude unfold relationships. Because of the altering nature of worldwide crude flows, managing these unfold relationships is a rising necessity the place the correlation between these grades can drop to as little as 40% or 50%.

20-day historic correlation in Brent Oman stays changeable

Extra Unfold Buying and selling Alternatives

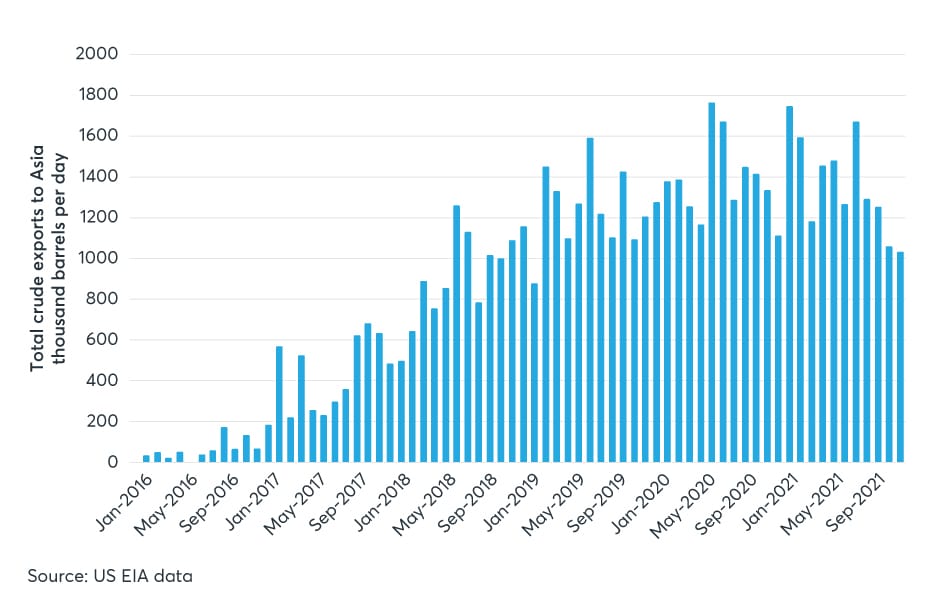

U.S. crude exports to Asia reached 50% in June 2021, the very best stage for round 12 months, in response to export knowledge from the EIA. Whole Asian imports of U.S. crude reached just below 1.4 million barrels per day in 2021, broadly unchanged from the prior 12 months 2020.

Chinese language customs knowledge confirmed that U.S. crude provides elevated over 620% to achieve 8.2 million tons between 1H 2020 and 1H 2021. The globalized nature of the crude commerce has created better buying and selling alternatives for spreads akin to Brent/Oman and WTI/Oman.

U.S. crude exports attain 1.6 million barrels per day

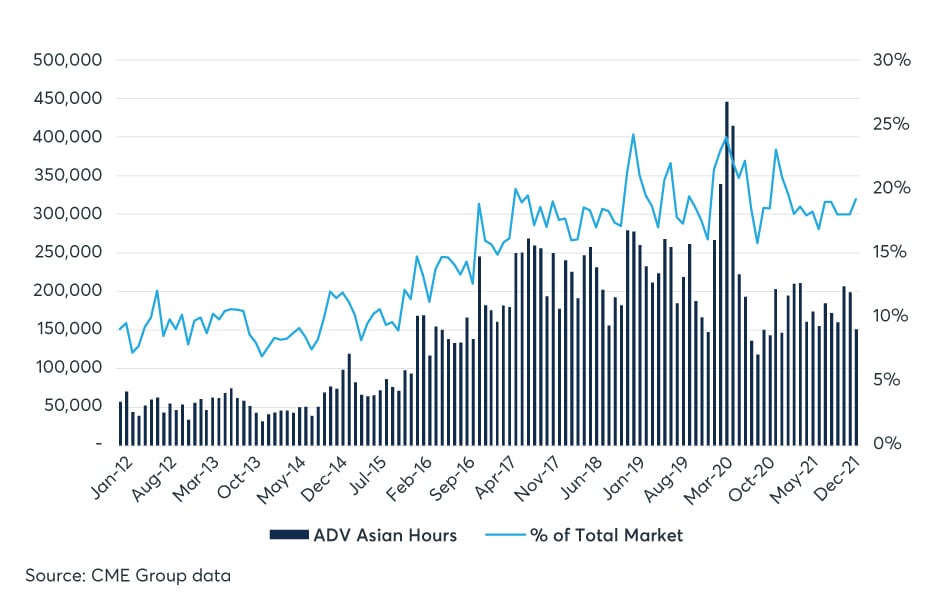

The expansion of WTI futures traded throughout Asian hours has remained sturdy, partly reflecting the rising demand from the area’s refiners to handle worth threat within the U.S. power benchmark throughout the Asian buying and selling day.

Change knowledge reveals that as much as 20% of the full each day traded quantity in WTI futures has been traded throughout Asian hours between January 2021 and January 2022, broadly flat in comparison with the identical interval one 12 months earlier.

Asian buying and selling liquidity sees 20% of WTI traded exterior U.S. hours

A Strong Value Setting Mechanism

The official promoting costs are set primarily based on the typical month-to-month Singapore Marker costs established at 4:30 p.m. native Singapore time. Liquidity throughout this key buying and selling interval has change into of paramount significance in establishing a strong base for setting the official promoting worth setting mechanism.

Change quantity reveals that in 2021, a median of 1,400 heaps was traded every day throughout the Singapore settlement interval, which equates to round 1.4 million barrels of crude oil (just below three commonplace cargos of 500,000 barrels). Within the July to December 2020 interval, a median of 1,200 heaps, or 1.2 million barrels, of oil have been traded throughout the Singapore settlement interval.

Oman Singapore marker commerce volumes stay sturdy

Asia’s insatiable demand for crude oil has seen a rising curiosity in buying and selling throughout the Asian buying and selling day. Exchanges like CME Group have developed marker costs which might be established at 4:30 p.m. native Singapore time.

Markers can be found for Brent and WTI futures to sit down alongside current Center East benchmarks to seize the value taker curiosity from the Asian refiners, a lot of whom are importing U.S. crude oil or Brent-related crude oil NYMEX foundation.

The position of DME Oman in Asia’s crude oil markets continues to develop, partly reflecting the rising crude oil demand from the area and the necessity to worth it successfully.

The expansion within the futures benchmark thus far has already seen a number of main Center East Nationwide Oil Corporations elect to make use of settlement costs to set the value of their official promoting costs to their key refinery consumers.

Refiners in Asia are additionally starting to additional undertake a benchmark reference worth as a result of rising flows of crude that worth towards it. Given the basics backdrop, DME Oman is prone to stay a powerful contender for Asia’s power pricing wants, and its rising traded volumes mirror the affect that the contract is having on the area.

Unique Publish

Editor’s Notice: The abstract bullets for this text have been chosen by In search of Alpha editors.