ipopba

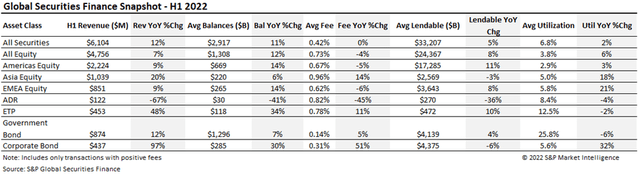

Securities finance income $6.1bn in H1 2022, finest half-year efficiency since 2008

- H1 income elevated 12% YoY

- ETP particular stability hit 4-year excessive

- Company bond revenues proceed to set blistering tempo

- US Fairness particular balances hit 4-year excessive

International securities finance revenues reached $6.1bn within the first half of 2022, a rise of 12% YoY. Utilization and lendable property noticed marginal will increase, whereas common mortgage balances proceed to surge, rising 11% YoY. Common charges confirmed combined outcomes however have been led by Asian Fairness specials in South Korea and Taiwan, along with company bonds pairing rising balances with rising charges. US fairness particular balances rebounded strongly from a poor H2 2021, posting a 4-year quarterly excessive. ETP common particular balances crossed the $2bn mark for the primary time in 4 years, driving a robust first half of the yr, leading to revenues rising 48% YoY. Company bond earnings climbed essentially the most YoY, rising 97% while ADR revenues faltered, declining 67% YoY.

Americas fairness finance revenues got here in at $2.2bn for H1 2022, a 9% YoY improve. Particular balances rebounded powerfully, crossing $18bn on common as Q2 set a 4-year quarterly excessive. Each US and Canadian Fairness balances rebounded, posting income features of 8% and 5%, respectively. The will increase have been pushed by rising balances (14% and 23% YoY) that offset the declines seen in common price spreads. Lucid Group, Inc. (LCID) was a prime performer in H1 2022, producing $150mn in revenues and rating as one of many highest income mills over the previous a number of years.

Fairness finance revenues in Europe rebounded strongly through the first half of 2022, rising 9% YoY. This development was supported by a restoration in specials and a rise of 14% in common balances which outweighed a decline of 6% in price spreads. Lendable property continued their rise, with a rise of 8% YoY, and very similar to balances, utilization rose a powerful 21%. Whereas two key markets within the area, France and the UK, noticed revenues lower 15% and 10% respectively, a number of markets prospered within the first half of 2022. Norwegian equities led the cost as revenues surged 60% over the earlier yr, whereas Swedish, Swiss, and Italian equities noticed their revenues develop in extra of 30% which was largely pushed by a mixture of great will increase in common balances and price spreads. German fairness revenues grew by a modest 16% over the interval, pushed by two of the highest three earners in European equities Varta AG (OTC:VARGF, OTCPK:VARTY) and Mercedes Benz Group AG (OTCPK:MBGAF, OTCPK:DMLRY).

Whereas APAC equities didn’t match the efficiency of H2 2021, the area returned over $1bn in income representing a 20% YoY improve. This was pushed largely by the price spreads leaping 14%. Particular balances retreated in contrast with H2 2021 ranges however maintained their robust restoration following the lifting of quick sale bans. South Korea and Taiwan delivered the best YoY returns, with returns near doubling in comparison with the prior yr. Australia was the one market to exceed returns in comparison with H2 2021 as price spreads jumped 68%. Australia’s prime earner, BHP Group Ltd (BHP) claimed the 4th place out of all Asian equities, producing $12.65mn in revenues whereas three Korean names, Krafton Inc, LG Vitality Resolution Ltd, and Kakaobank Corp grasped the highest 3 spots.

International ETP lending revenues have been $453mn for H1, persevering with to set new all-time highs, representing a 48% YoY improve. March set the mark as being the highest revenue-generating month, crossing $85mn. There have been a number of drivers contributing to the record-breaking numbers, however the rise of particular balances set the blistering tempo. ETP common particular balances in Q2 crossed the $2bn mark, setting a brand new excessive throughout a number of years and a 52% improve compared with Q2 of 2021. Mounted Earnings ETP lending generated $167mn in H1, representing 37% of worldwide ETP returns. Sustaining consistency, 9 of the highest 10 income producing property have been US ETPs because the iShares iBoxx $ Excessive Yield Company Bond Fund (HYG) held onto its prime rank as the very best earner for the third consecutive half-year interval producing $66mn in price unfold returns.

With no prime earner to guide the cost, in contrast to prior half-year durations, Depository Receipt returns fell to $164mn representing a 60% YoY lower. ADRs represented 74% of the full Depository Receipts revenues with $122mn generated, a 67% YoY lower. ADR underperformance was complete, as common balances decreased 41% alongside an identical lower in price spreads of 45%.

Company bond lending revenues continued their ascension within the first half of 2022, reaching $437mn, boasting a 97% YoY improve. Sparked by rising balances (up 30% YoY) and charges (up 51% YoY), H1 2022 marks the best lending income for company bonds for the reason that begin of the pandemic. Common mortgage balances reached $285bn, the best for the reason that 2008 monetary disaster. Q2 delivered stellar returns, with Could revenues reaching slightly below $74mn, the best month-to-month income in a number of years.

Price-based income for presidency bond lending got here in at $874mn for H1, the most important in a number of half-year durations and up 12% YoY. Authorities bond borrow demand remained sturdy, with $1.3bn in positive-fee international balances for H1, reflecting a 7% YoY Enhance enhancing upon 2021 H2’s lofty mark. Securities finance returns from lending US Treasury securities in H1 2022 represented 52% of the optimistic fee-spread revenue. Revenues from European sovereigns have been $317mn, up 27% YoY pushed by a strong improve in common balances and charges of 11% and 15%, respectively. Rising Market bond price unfold returns eclipsed $37mn posting a robust improve of 59% compared with the earlier yr. The best revenue-generating bond was the UST due Feb 2024 (CUSIP 91282CEA5) which generated $10.9mn in income, which was higher than any authorities problem over the previous 12 months. Very like H2 2021, 7 of the highest 10 revenue-generating bonds are USTs.

Conclusion

2022 is off to a powerful begin for Securities Finance revenues, clearing $6.1bn in price unfold returns, which is the best for a half-year interval since H1 of 2018. While not fairly on the tempo wanted to eclipse 2008 full-year revenues, 2022 is properly poised to ship the strongest efficiency for the reason that international monetary disaster. All core asset lessons supported sturdy returns apart from ADRs which declined. Alternate-traded merchandise and company bonds remained the highest performers for the second consecutive half-year interval, delivering appreciable returns. Mounted revenue property have been key, as the highest 3 performing ETPs have been bond associated. General, rising balances throughout the principle asset lessons have been the important thing linchpin to a robust H1 2022.

Unique Submit

Editor’s Notice: The abstract bullets for this text have been chosen by Searching for Alpha editors.