[ad_1]

The market has been as choppy as ever this week. Just looking at a weekly chart of the S&P 500 or NASDAQ is like looking at a silhouette of the Andes or Himalayas.

I wrote about how to approach these choppy seas of volatility earlier this week, but even though we’re trading smarter, faster, and a bit more conservative, that doesn’t mean we aren’t seeing MASSIVE gains in the Trade Room nearly every day.

I showed you some of the gains from Monday, but I want to take a few moments to share the biggest gains from the rest of the week.

All of these are triple digit winners reported in my morning sessions this week, and each of them are from a different member in a different ticker… That kind of consistent variety is amazing to see, great trading!

These folks are facing the storm head on, refusing to buckle with fear, and I want their bravery to be noted.

I also want to dedicate a huge shout out to my right-hand-man, Bryan Klindworth.

Bryan runs the coaching sessions in the Trade Room every weekday at noon and 3 PM EST. He also calls the opening bell on Friday mornings.

And as informational, educational, and extremely beneficial as his coaching sessions are, he’s one helluva signal caller, too. I’m talking Peyton Manning-esque.

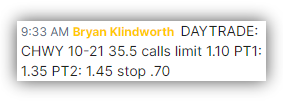

He called a DayTrade signal in CHWY this morning:

|

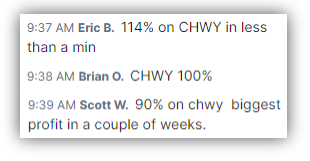

And less than FIVE minutes later… BOOM!

|

Bryan knows when to get out of a trade too, that’s why he recommended taking profits quickly and exiting this trade without being too greedy.

But take a look at some of the other messages Bryan received this morning:

|

These gains are phenomenal! Winners all across the board!

This just goes to show how valuable being a member of Trade Kings really is… Not only do you get my morning bell calls (during which the profits are well documented), Bryan’s coaching sessions (perfect for beginner and seasoned options traders), but you also get Bryan’s Friday morning calls (potency showcased above)…

There are all kinds of resources available to folks who want to improve their trading and, in doing so, their lifestyle.

You don’t have to face this market alone. Click here to join our community today, and become a Trade King tomorrow!

Now, let’s see how my watchlist faired this week.

The Kings Corner Watchlist Recap

As I mentioned above, the market was constantly up and down this week.

Each of the stocks on my watchlist were up in value at some point after I mentioned them…

But as for the weekly glance, only one can be considered a winner.

HOOD fell 1.8% from $10.21 to $10.02.

PTON fell 6% from $7.75 to $7.29.

CTIC fell 8% from $4.89 to $4.48.

And the sole winner, APA, rose 6% from $40.09 to $42.54.

The free trade idea to Buy APA October 21, 2022 $41.50 calls for $0.77 was a huge success… By Thursday morning, these were trading as high as $1.86. If you sold at the peak, you could have netted a profit of 141%!

That makes six straight weeks that the free trade has been a winner!

I know some of you have been making money on these, and if you have, write to me at [email protected] and tell me about it.

That’ll do it for me this week. We did a great job of navigating this volatility storm together…

Let’s stay hot and keep rolling into next week.

Til then,

Andrew KeeneEditor, Kings Corner

[ad_2]

Source link