ThitareeSarmkasat/iStock by way of Getty Photographs

By Fei Mei Chan

The Federal Open Market Committee voted to boost the Federal Funds fee by 25 bps on March 16, 2022. This transfer was effectively telegraphed and under no circumstances surprising-but that does not imply that we can’t hear issues about how rising charges will influence fairness returns. Finance concept teaches us that, different issues equal, rising rates of interest are usually not good for the efficiency of shares, as rising borrowing prices and better low cost charges tends to translate to decrease future efficiency. For the a lot of historical past, empirical proof has aligned with the idea. However in newer information, we’ve got observed that “different issues” might not have all the time been equal.

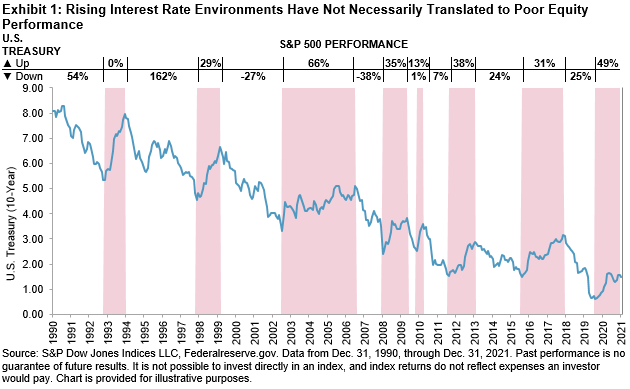

At a cursory look, rising charges haven’t essentially boded ailing for fairness efficiency, not less than within the interval from 1991 by means of 2021. There have been eight episodes when the 10-12 months U.S. Treasury yield rose. The S&P 500® declined in none of those; in two instances, equities had been flat, and the S&P 500 rose in six, in some cases fairly considerably.

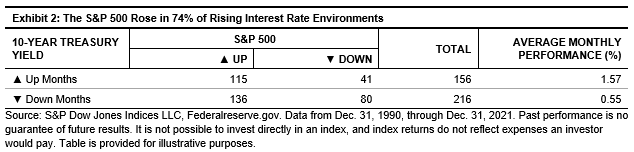

Breaking down the interval in Exhibit 1, there have been 156 months when the 10-12 months U.S. Treasury yield rose (and 216 months when it declined). Of the months when the 10-12 months U.S. Treasury yield rose, the S&P 500 gained in 115 (74%) and declined in 41; the S&P 500 rose almost 3 times as usually because it fell when rates of interest rose. On common, the S&P 500 gained 1.57% every month that charges rose, versus simply 0.55% in months when charges declined.

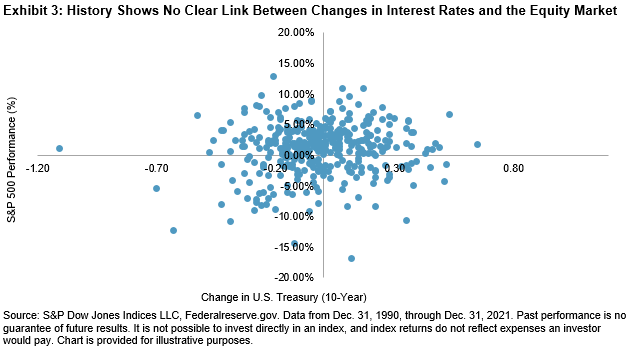

We will additionally take a look at these months graphically within the scatter plot in Exhibit 3. Right here we plot the change within the 10-12 months U.S. Treasury yield in opposition to the efficiency of the S&P 500 for a similar interval from 1990 by means of 2021. Every level represents a month-to-month commentary, and we see no discernible relationship. The blob speaks for itself-or quite, it does not. Historical past doesn’t present proof of a transparent hyperlink between adjustments in rates of interest and adjustments within the fairness market.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P World. All rights reserved. This materials is reproduced with the prior written consent of S&P DJI. For extra info on S&P DJI please go to www.spdji.com. For full phrases of use and disclosures please go to www.spdji.com/terms-of-use.

Authentic Submit

Editor’s Be aware: The abstract bullets for this text had been chosen by Searching for Alpha editors.