Mohammed Haneefa Nizamudeen/iStock through Getty Photos

Consistency is the playground of lifeless minds”― Yuval Noah Harari

We final took an in-depth take a look at Viking Therapeutics (NASDAQ:VKTX) again in February of 2021. We concluded that article with this conclusion,

Given the shortage of serious catalysts in 2021 and the gradual tempo of improvement in Viking’s pipeline, it’s onerous to see what may propel the inventory considerably greater over the subsequent 12 months. The almost certainly situation appears to be the inventory will stay vary certain at finest. Due to this fact, we’re passing on any funding advice on Viking right now.”

Given 14 months have elapsed since that piece and I get a query or two on the title each month it appears, it’s time to revisit this developmental concern. An up to date evaluation follows beneath.

Firm Overview

Viking Therapeutics is a clinical-stage biopharmaceutical firm headquartered in San Diego. The corporate’s pipeline is targeted on growing novel therapies for metabolic and endocrine problems. The inventory at present trades round $2.50 a share and sports activities an approximate market capitalization of $220 million.

Latest Developments:

Pipeline (March Firm Presentation)

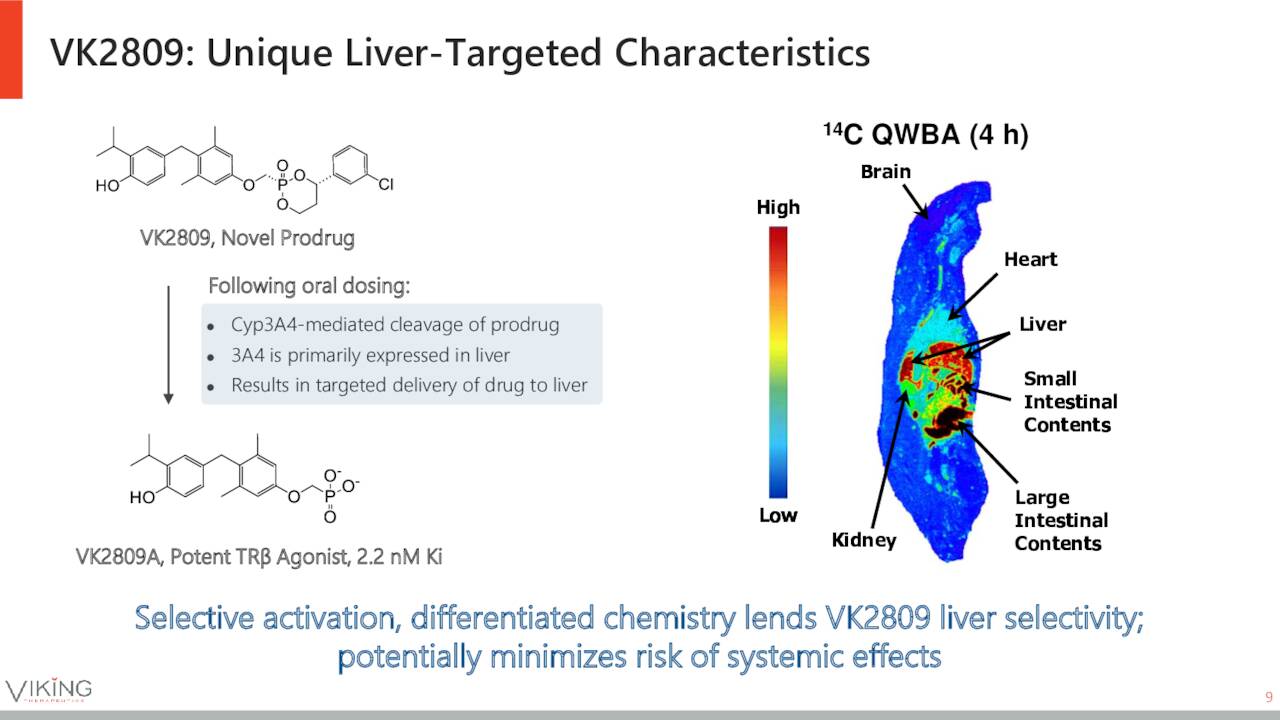

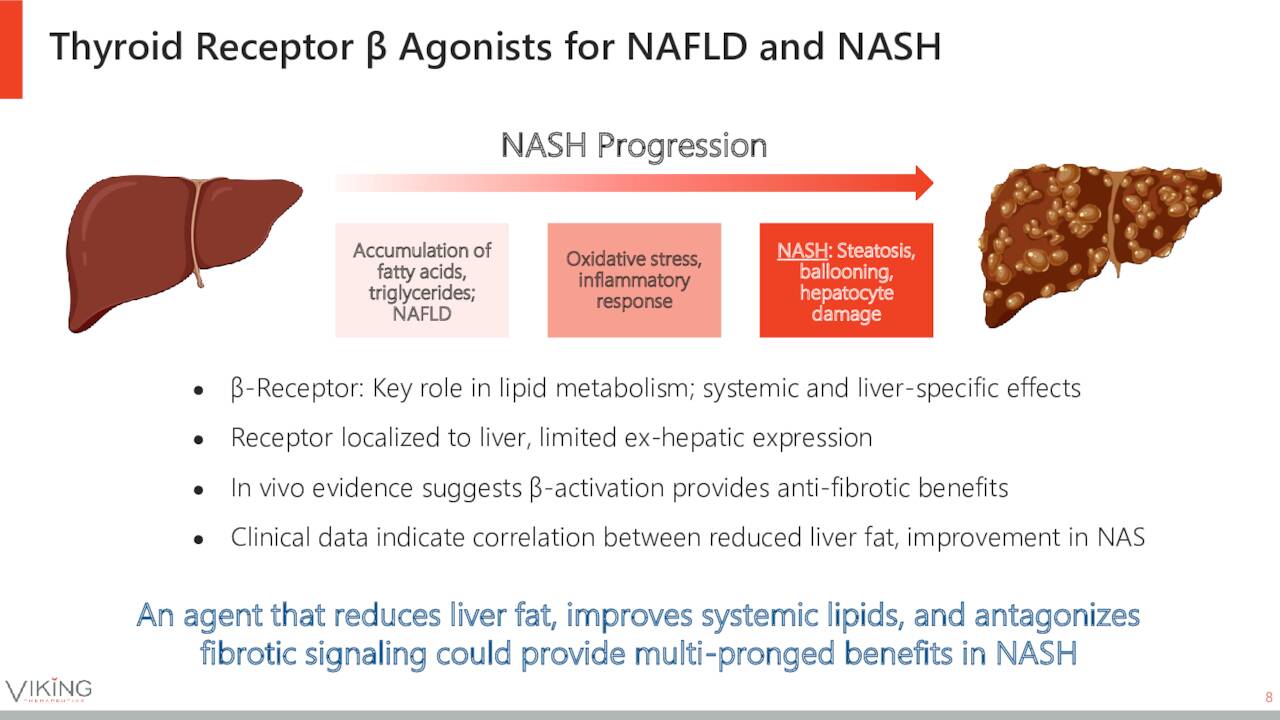

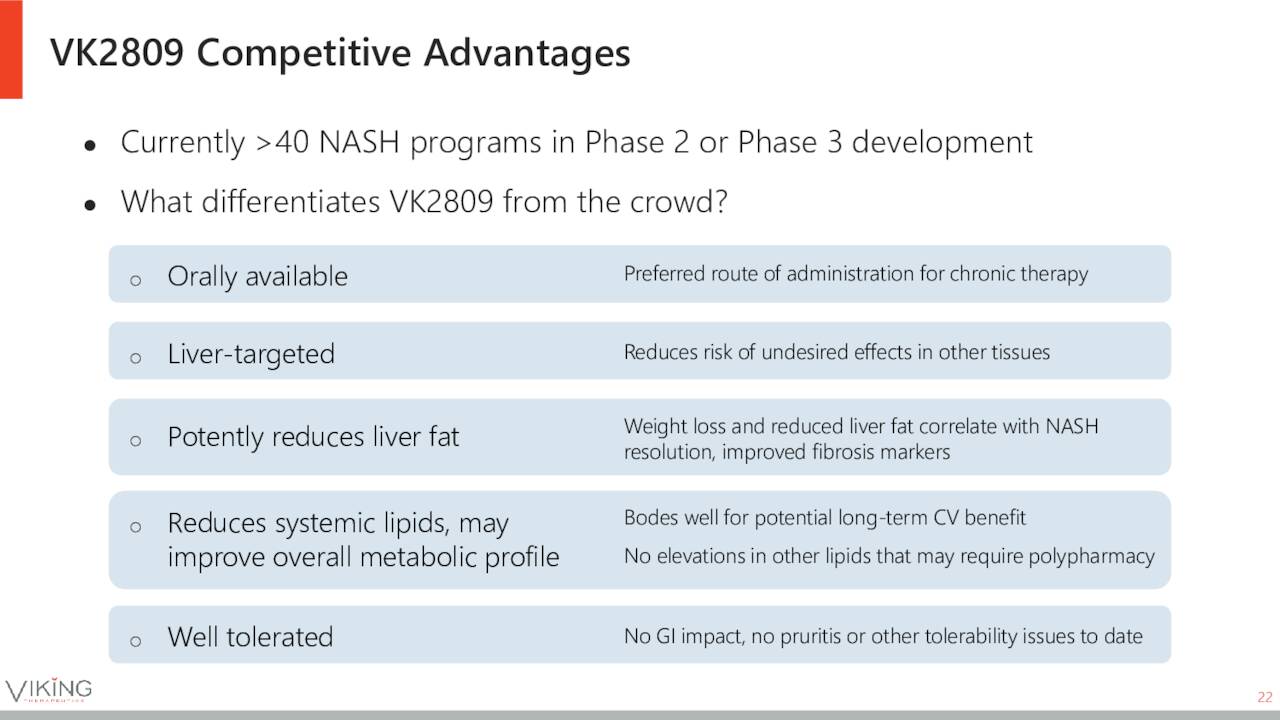

The corporate has a number of compounds in its developmental pipeline. One of the vital superior and an important is VK2809. That is novel and oral small molecule thyroid hormone receptor agonist that possesses selectivity for liver tissue. It has promise as a remedy for metabolic problems, together with most significantly Nonalcoholic steatohepatitis or NASH. This affliction impacts tens of millions. The key function in NASH is fats within the liver, together with irritation and harm.

March Firm Presentation

A Part 2a research confirmed VK2809 diminished liver fats by 45% in contrast with 19% within the placebo group. The compound is now being evaluated in a Part 2b trial referred to as ‘VOYAGE’. The first endpoint of this 12 month research is the change in liver fats on the three month level with a secondary endpoint being the change in histology on the 12 month level. Management expects to finish enrollment and report preliminary information on the first endpoint from VOYAGE by the tip of 2022.

March Firm Presentation

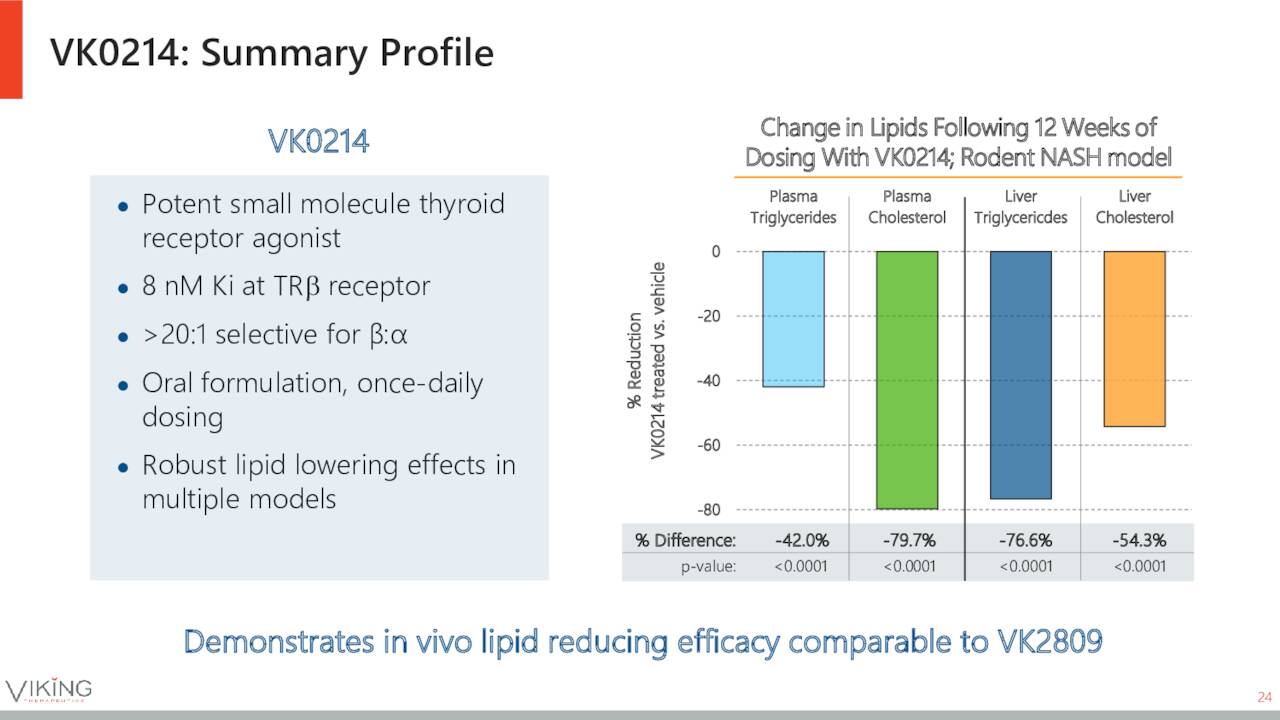

As well as, Viking can be growing VK0214 which it believes might be a potent small molecule thyroid receptor agonist.

March Firm Presentation

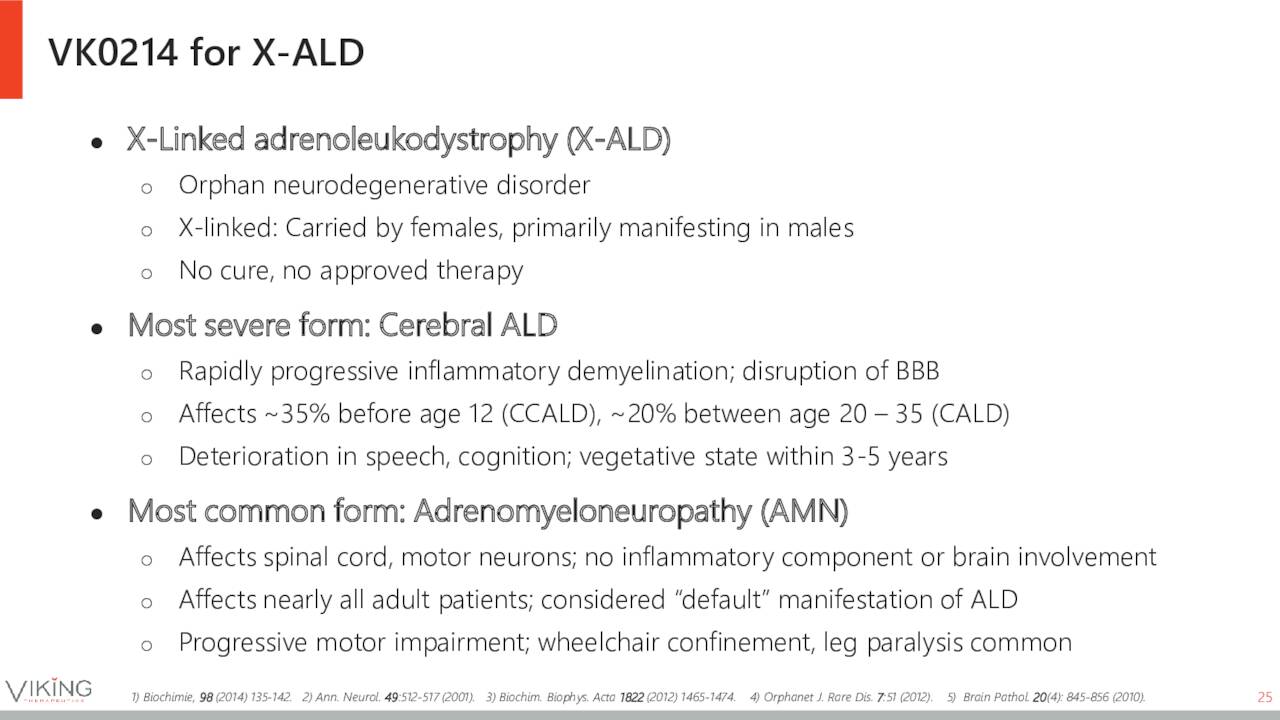

This compound is concentrating on X-Linked adrenoleukodystrophy or X-ALD in a Part 1b research and has obtained Orphan Drug standing from the FDA. This uncommon affliction has no present authorised remedy and is a neurodegenerative dysfunction which is current at start and impacts slightly below 20,000 people in the US. The corporate was lately knowledgeable that this research has been positioned on medical maintain by the FDA. Administration believes the request was not attributable to any findings from ongoing or beforehand accomplished research, they usually anticipate to submit the knowledge in a well timed trend to get the research restarted. An earlier research efficiently achieved its major and secondary aims, with VK0214 proven to be secure and well-tolerated in any respect doses evaluated.

March Firm Presentation

These are the 2 key belongings in Viking’s pipeline and those which can be germane to this evaluation, though the corporate has a number of different compounds in numerous levels of improvement inside its pipeline.

Analyst Commentary & Steadiness Sheet

Analysts are as bullish on this title as about any small cap improvement concern I do know based mostly on how far above worth targets are in comparison with the present buying and selling stage of the inventory. Since Mid-February, 5 analyst corporations together with Leerink Companions and BTIG have reissued Purchase rankings with worth targets proffered starting from $10 to $28 a share.

The corporate ended FY2021 with simply over $200 million on its stability sheet (virtually its total market capitalization) after posting a lack of $12.4 million within the fourth quarter. Viking has no long-term debt. Roughly six p.c of the general float within the shares are at present bought quick.

Verdict

March Firm Presentation

The corporate’s major asset VK2809 is concentrating on an enormous illness alternative in NASH. It’s hardly alone pursuing this goal. Nevertheless, Viking believes its compound has some distinctive traits that might make it extraordinarily aggressive on this space, supplied research are profitable and the compound is ultimately authorised by the FDA.

The corporate burned via simply over $45 million of money throughout FY2021 for all operations, so Viking is properly funded and shareholders ought to have little worries round dilution on the horizon. The corporate can be popular with the analyst group.

Nevertheless, the issue for Viking shareholders is twofold regardless of some constructive attributes described above. First, the sentiment on the biotech sector has been fairly damaging for at the very least three quarters now. As well as, the corporate has solely a few milestones on the horizon in 2022. These being the restart of the Part 1b research for VK0214 and enrollment completion and preliminary information round VOYAGE.

I do imagine Viking deserves a small ‘watch merchandise‘ holding given the pipeline just isn’t promoting a lot above money worth right now. Due to this fact, I’ve initiated such through some lined name orders this week. Choices across the fairness are fairly liquid and profitable for this technique and supply strong draw back safety.

The one danger is the one by no means taken.”― Lizbeth Davis

Bret Jensen is the Founding father of and authors articles for the Biotech Discussion board, Busted IPO Discussion board, and Insiders Discussion board

:max_bytes(150000):strip_icc()/Health-GettyImages-1060820524-b9fd002a2a4b4506b7fbeafed4361931.jpg)