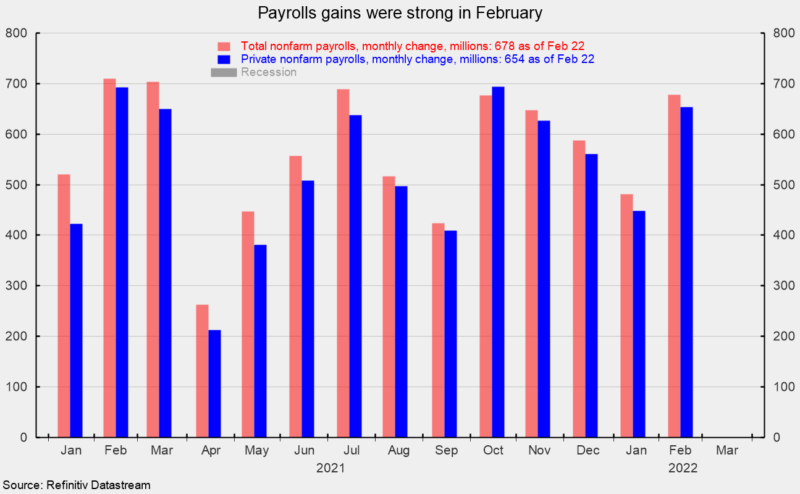

U.S. nonfarm payrolls added 678,000 jobs in February, extending a run of 10 consecutive months and 13 of the final 14 months with good points above 400,000. The common month-to-month achieve during the last 14 months is 564,000 (see first chart).

Personal payrolls posted a 654,000 achieve in February, the ninth in a row and 12th within the final 14 months above 400,000 (see first chart). The common achieve during the last 14 months is 528,000. Each whole nonfarm payrolls and personal payrolls are lower than 1.5 p.c under their February 2020 peaks with whole nonfarm down by 2.1 million and personal payrolls down by 1.4 million (see second chart).

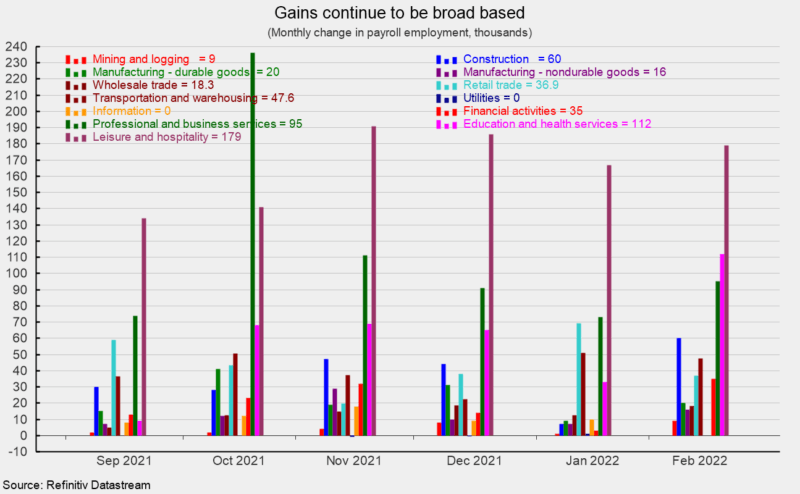

Features in latest months have been broad-based. Throughout the 654,000 achieve in personal payrolls, personal companies added 549,000 versus a 12-month common of 460,900 whereas goods-producing industries added 105,000 versus a 12-month common of 62,300.

Inside personal service-producing industries, leisure and hospitality added 179,000 versus a 12-month common of 181,800 for the month, schooling and well being companies elevated by 112,000 (versus 52,500), enterprise {and professional} companies added 95,000 (versus 90,600), transportation and warehousing gained 47,600 (versus 36,100), retail employment rose by 36,900 (versus 34,100), and wholesale commerce gained 18,300 (versus 13,200; see third chart).

Throughout the 105,000 achieve in goods-producing industries, development added 60,000, whereas durable-goods manufacturing elevated by 20,000 and nondurable-goods manufacturing added 16,000 and mining and logging industries elevated by 9,000 (see third chart).

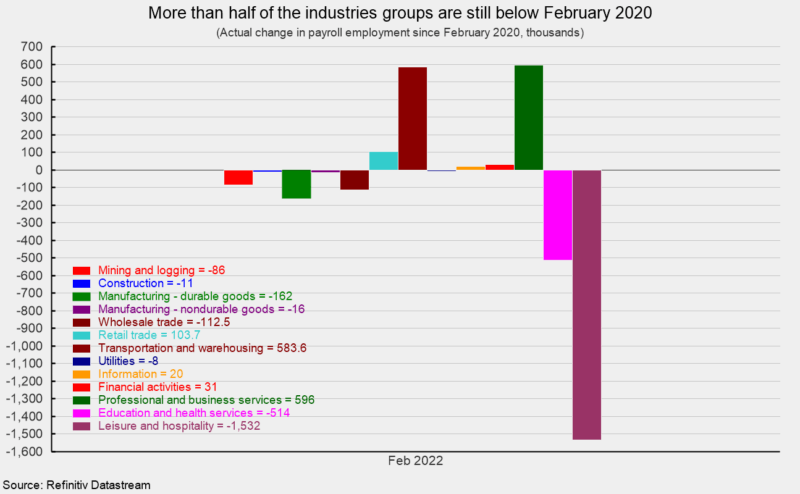

Regardless of the robust, broad-based good points over the previous yr, lower than half of the trade teams within the employment report are above their pre-pandemic ranges (see fourth chart).

Common hourly earnings have been flat in February, placing the 12-month achieve at 5.1 p.c. Nonetheless, the typical hourly earnings for manufacturing and nonsupervisory staff rose 0.3 p.c for the month and are up 6.7 p.c from a yr in the past. The common hourly earnings knowledge needs to be interpreted rigorously, because the focus of job losses and restoration for lower-paying jobs through the pandemic distorts the mixture quantity.

The common workweek rose to 34.7 hours in February whereas the typical workweek for manufacturing and nonsupervisory staff rose 0.1 hour to 34.1 hours. Combining payrolls with hourly earnings and hours labored, the index of mixture weekly payrolls gained 0.8 p.c in February and is up 10.8 p.c from a yr in the past whereas the index for manufacturing and nonsupervisory staff rose 1.0 p.c and is 12.3 p.c above the yr in the past degree.

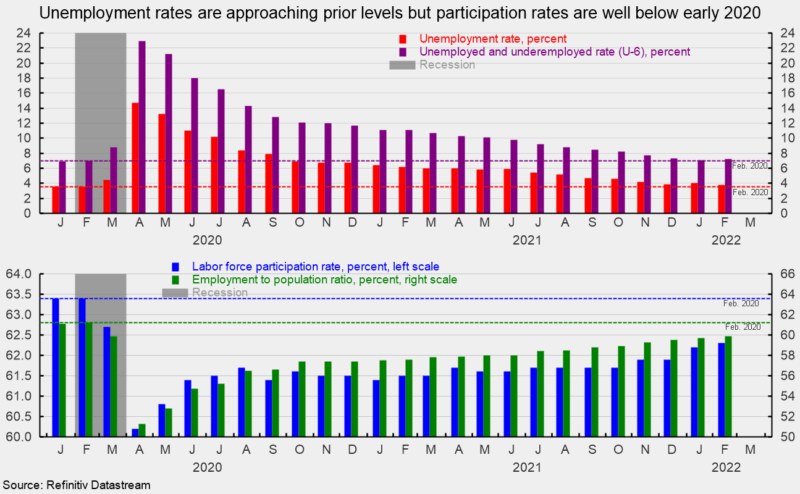

The entire variety of formally unemployed was 6.270 million in February. The unemployment charge got here in at 3.8 p.c whereas the underemployed charge, known as the U-6 charge, was 7.2 p.c in February. In February 2020, the unemployment charge was 3.5 p.c whereas the underemployment charge was 7.0 p.c (see high of fifth chart).

The employment-to-population ratio, one among AIER’s Roughly Coincident indicators, got here in at 59.9 for February nonetheless considerably under the 61.2 p.c in February 2020 (see backside of fifth chart).

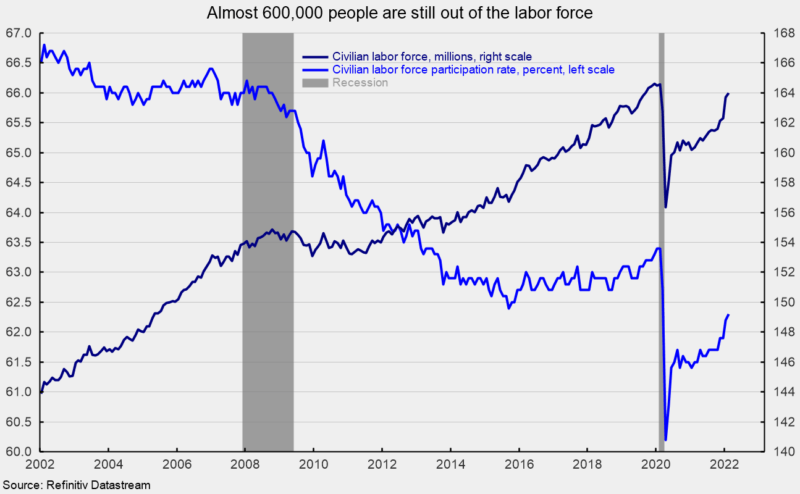

The higher progress on reaching the pre-pandemic unemployment charge is basically resulting from individuals dropping out of the labor power. Roughly 592,000 staff are nonetheless out of the labor power in comparison with February 2020 (see sixth chart). The general participation charge was 62.3 in February versus a participation charge of 63.4 p.c in February 2020 (see backside of fifth and sixth charts).

The February jobs report exhibits whole nonfarm payrolls posted one other robust achieve. Personal payrolls have been additionally robust. Nonetheless, each stay under pre-pandemic ranges as does the civilian labor power. Getting workers again on payrolls ought to assist ease ongoing supplies shortages and logistical issues, thereby easing upward stress on client costs. Slowing client spending would additionally assist ease pressures.

General, the outlook is for continued restoration. Nonetheless, even with favorable indicators resembling stronger payroll progress, upward worth pressures are prone to proceed for some time longer. These pressures are resulting in a brand new cycle of Fed coverage tightening, elevating the chance of a coverage mistake. Moreover, geopolitical turmoil surrounding the Russian invasion of Ukraine has had a dramatic affect on capital and commodity markets, launching a brand new wave of potential disruptions to companies. The outlook has develop into extremely unsure and excessive warning is warranted.