balloons of pink color, pink background.3D illustration.

chekyfoto/iStock via Getty Images

Retailer and party goods wholesaler Party City’s (NYSE:PRTY) fate hangs, to a large extent, on Halloween season. This is especially true given the company’s relatively high leverage, with much of the debt trading below par.

However, there are reasons to think that the company may have a good Halloween season, making the stock potentially mispriced at current levels. However, the equity is trading as a stub, and should be sized accordingly.

Historical Performance

Here is the company’s operating income (with my adjustment for exceptional charges and write-downs during the 2015-2019 calendar years). It is worth noting that 2019 was a bad year even after adjusting for write-downs and this was pre-Covid.

Party City Pre-Covid Operating Income By Year

| 2015 | 2016 | 2017 | 2018 | 2019 |

| $272M | $274M | $280M | $278M | $117M |

source: SEC filings, author’s analysis

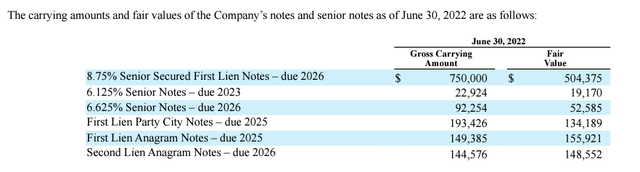

Now, as we move on to the debt, we should note that the company pays approximately $100M in annual interest expense, today so the debt load, though high, may be manageable in a historic context. $23M of debt is due in 2023, but a material refinancing is not needed until 2025 (see below).

Debt Below Par

That said, fixed income investors do not necessarily have confidence, if you look at Party City’s debt, much of it trades below par as you can see from the delta between the gross carrying about and “fair value” below (this snapshot is from June 30, 2022).

SEC Filings

Current Trading

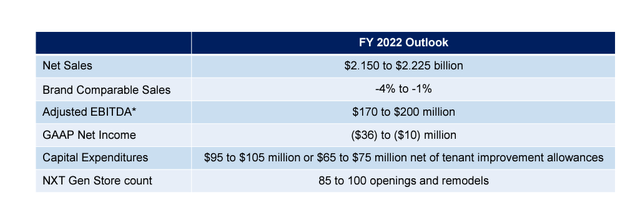

Then 2022 is forecast to be relatively weak on Q2 management guidance, the company expects around $2.2B of revenue. That’s on the low end of 2015-2019, where the company typically achieved $2.3-2.4B in sales. Then they expect $170M-$200M in EBITDA which is, again, on the low-end of pre-Covid history.

I also have visited various Party City stores and they are currently well stocked for Halloween with a number of high-margin products presenting well. However, this may have come at the cost of elevated freight and inventory holding costs for Q3.

Company guidance

Risks and Valuation

Still the company may be somewhat less risky than it appears.

| EBITDA 2022 (mid-point) | $185M |

| interest expense | $100M |

| capex (net of allowances for tenant improvements) | $70M |

| tax (20%) | $37M |

| Free Cash Flow 2022 | -$22M |

The start to 2022 has been tough in terms of higher freight and helium costs and a rocky Q1 due to omicron. As I wrote previously, freight and helium may have knocked 3% off gross margins. That in very round numbers is perhaps another +$60M to FCF taking the company closer to $40M FCF in a normalized year. Indeed, even taking the numbers up to the top-end of the guidance and being a little less aggressive on tax puts Party City at FCF break-even without much in the way of heroic assumptions.

An Equity Stub

Hence investors should be clear that Party City is trading as an equity stub, ahead of material debt refinancing in 2025. It is, to some extent at the mercy of the credit markets, which is not a good place to be in the current rising rate environment.

Still, it’s not too hard to see a scenario where with strong Q4 trading, Party City moves from looking distressed to merely challenged and FCF comes closer to $40M or so, either from a stronger-than-expected Q4 this year or a more robust 2023 free from major headwinds such as freight and helium. If the market were willing to put a 15x multiple on $40M of FCF, that would imply a valuation of $600M or about $5.31/share. If the company can pull off several quarters of strong trading, that valuation may even be conservative. There is still some time between now and 2025.

Some Moat

Lastly, I believe Party City has some degree of moat. Helium balloons are tricky to buy from Amazon (AMZN) and buying all the small items you need for a party is easier at their stores than online. I believe Amazon has clearly taken some of their business (such as Halloween costumes and other higher ticket items) and will continue to, but Party City may be better positioned than many other retailers given their niche positioning in the party space.

Risks

- The primary risk to Party City is leverage in both senses. First off their debt load is high and it’s unclear they could refinance on similar terms in 2025.

- Secondly, some of their business has gone to Amazon and their cost base remains largely fixed.

- Like most retailers they need a strong Q4 and especially Halloween need to have robust execution, though currently falling gasoline prices, and the lack of any deep recession (for now), may be a mild tailwind there.

- Even at the midpoint of guidance, the company may be FCF negative this year.

Conclusion

Party City is likely somewhat cheap, but a few false steps and their need to refinance much of their debt in 2025 will further weigh on the equity. There is likely upside with moderately good execution getting them to positive FCF either this year or in 2023, which could provide a foundation for equity and debt markets to view the business more optimistically. Still the clock is ticking as the need to refinance approaches.