Seiya Tabuchi/iStock through Getty Pictures

By Mark Barnes, PhD, head of funding analysis (Americas)

In Half 1 of our weblog sequence highlighting the findings of our Australia World Alternative analysis paper, we centered on the efficiency of an index-based answer using a rigorous, rules-based ESG-centric screening and exclusion course of. Right here, we present the affect of that course of in additional element, once more utilizing the FTSE Australia 300 Alternative index for instance.

The outcomes are intuitive in that the screening can have a major affect on the precise industries or sectors instantly related to excluded merchandise and actions, however the total composition of the index shouldn’t be vastly modified.

Whereas this course of varies throughout the World Alternative index suite, the FTSE Australia 300 Alternative Index excludes shares utilizing the complete suite of product- and conduct-related screens, besides these for Range. These vary from such vice merchandise as playing and tobacco and weapons manufacturing to governance points comparable to an organization’s anti-corruption insurance policies and procedures, as detailed in our analysis paper.

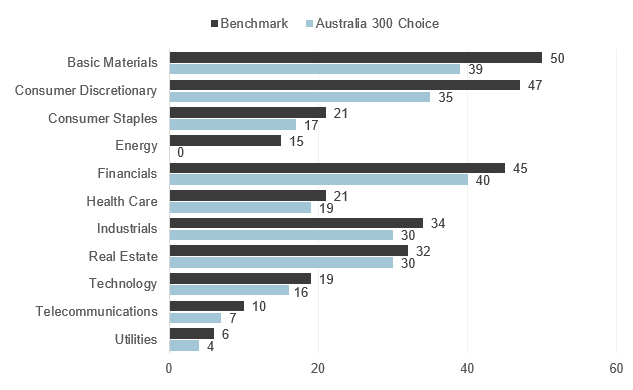

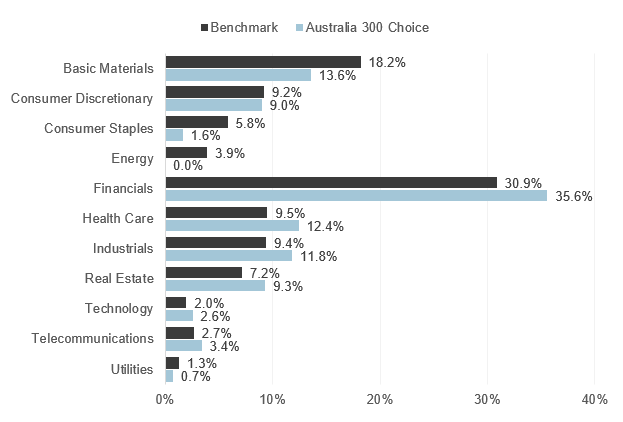

As proven within the two charts that comply with, whereas the variety of shares throughout industries within the Australia 300 Alternative index (mild blue bars) is under that of the benchmark (black bars), business weights had been pretty related between the 2 indexes.

Variety of shares – FTSE Australia 300 benchmark vs FTSE Australia 300 Alternative Index

FTSE Russell. Based mostly on Business Classification Benchmark (NYSE:ICB) month-to-month return information from April 1, 2015, by way of March 31, 2021. Previous efficiency is not any assure of future outcomes. Please see finish for necessary authorized disclosures.

Business weights – FTSE Australia 300 benchmark vs FTSE Australia 300 Alternative Index

FTSE Russell. Based mostly on Business Classification Benchmark (ICB) month-to-month return information from April 1, 2015, by way of March 31, 2021. Previous efficiency is not any assure of future outcomes. Please see finish for necessary authorized disclosures.

As anticipated, the largest adjustments had been in industries most intently associated to the excluded merchandise. For instance, all 15 Vitality shares had been excluded, so the Vitality business ended up with no weight. This occurred as a result of the entire shares within the business had been within the Oil, Fuel and Coal sector, whereas the benchmark had no shares within the Various Vitality sector. After all, some business weights will rise: the Australia 300 Alternative exposures to Financials, Well being Care, Industrials, and Actual Property elevated modestly versus these of the benchmark.

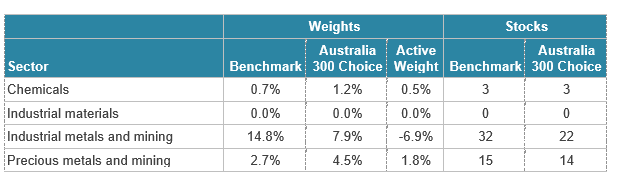

Whereas the complete Vitality business was eradicated by the screening, it began with a comparatively small weight of three.9% within the benchmark. An business that noticed a much bigger lower was Primary Supplies, which is dominated by the Industrial Metals and Mining sector. The Alternative screening eliminated 10 of the 32 shares in that sector, together with some massive shares comparable to BHP Group, Rio Tinto Ltd. and South32.

Weights and variety of shares – Primary Supplies sectors, earlier than and after exclusions

FTSE Russell. Based mostly on Business Classification Benchmark (ICB) month-to-month return information from April 1, 2015, by way of March 31, 2021. Previous efficiency is not any assure of future outcomes. Please see finish for necessary authorized disclosures.

© 2022 London Inventory Trade Group plc and its relevant group undertakings (the “LSE Group”). The LSE Group contains (1) FTSE Worldwide Restricted (“FTSE”), (2) Frank Russell Firm (“Russell”), (3) FTSE World Debt Capital Markets Inc. and FTSE World Debt Capital Markets Restricted (collectively, “FTSE Canada”), (4) FTSE Mounted Earnings Europe Restricted (“FTSE FI Europe”), (5) FTSE Mounted Earnings LLC (“FTSE FI”), (6) The Yield E book Inc (“YB”) and (7) Past Scores S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a buying and selling identify of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield E book®”, “Past Scores®” and all different emblems and repair marks used herein (whether or not registered or unregistered) are emblems and/or service marks owned or licensed by the relevant member of the LSE Group or their respective licensors and are owned, or used below licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE Worldwide Restricted is authorised and controlled by the Monetary Conduct Authority as a benchmark administrator.

All data is offered for data functions solely. All data and information contained on this publication is obtained by the LSE Group, from sources believed by it to be correct and dependable. Due to the potential of human and mechanical error in addition to different components, nevertheless, such data and information is offered “as is” with out guarantee of any type. No member of the LSE Group nor their respective administrators, officers, workers, companions or licensors make any declare, prediction, guarantee or illustration by any means, expressly or impliedly, both as to the accuracy, timeliness, completeness, merchantability of any data or of outcomes to be obtained from using FTSE Russell merchandise, together with however not restricted to indexes, information and analytics, or the health or suitability of the FTSE Russell merchandise for any specific objective to which they may be put. Any illustration of historic information accessible by way of FTSE Russell merchandise is offered for data functions solely and isn’t a dependable indicator of future efficiency.

No duty or legal responsibility will be accepted by any member of the LSE Group nor their respective administrators, officers, workers, companions or licensors for (A) any loss or injury in complete or partially attributable to, ensuing from, or regarding any error (negligent or in any other case) or different circumstance concerned in procuring, amassing, compiling, decoding, analysing, enhancing, transcribing, transmitting, speaking or delivering any such data or information or from use of this doc or hyperlinks to this doc or (B) any direct, oblique, particular, consequential or incidental damages by any means, even when any member of the LSE Group is suggested upfront of the potential of such damages, ensuing from using, or lack of ability to make use of, such data.

No member of the LSE Group nor their respective administrators, officers, workers, companions or licensors present funding recommendation and nothing on this doc needs to be taken as constituting monetary or funding recommendation. No member of the LSE Group nor their respective administrators, officers, workers, companions or licensors make any illustration concerning the advisability of investing in any asset or whether or not such funding creates any authorized or compliance dangers for the investor. A call to put money into any such asset shouldn’t be made in reliance on any data herein. Indexes can’t be invested in instantly. Inclusion of an asset in an index shouldn’t be a advice to purchase, promote or maintain that asset nor affirmation that any specific investor might lawfully purchase, promote or maintain the asset or an index containing the asset. The final data contained on this publication shouldn’t be acted upon with out acquiring particular authorized, tax, and funding recommendation from a licensed skilled.

Previous efficiency is not any assure of future outcomes. Charts and graphs are offered for illustrative functions solely. Index returns proven might not characterize the outcomes of the particular buying and selling of investable property. Sure returns proven might mirror back-tested efficiency. All efficiency introduced previous to the index inception date is back-tested efficiency. Again-tested efficiency shouldn’t be precise efficiency, however is hypothetical. The back-test calculations are primarily based on the identical methodology that was in impact when the index was formally launched. Nonetheless, back-tested information might mirror the applying of the index methodology with the good thing about hindsight, and the historic calculations of an index might change from month to month primarily based on revisions to the underlying financial information used within the calculation of the index.

This doc might include forward-looking assessments. These are primarily based upon plenty of assumptions regarding future circumstances that in the end might show to be inaccurate. Such forward-looking assessments are topic to dangers and uncertainties and could also be affected by numerous components that will trigger precise outcomes to vary materially. No member of the LSE Group nor their licensors assume any obligation to and don’t undertake to replace forward-looking assessments.

No a part of this data could also be reproduced, saved in a retrieval system or transmitted in any kind or by any means, digital, mechanical, photocopying, recording or in any other case, with out prior written permission of the relevant member of the LSE Group. Use and distribution of the LSE Group information requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Authentic Submit

Editor’s Notice: The abstract bullets for this text had been chosen by Looking for Alpha editors.