Warchi/iStock by way of Getty Pictures

Written by Nick Ackerman. This text was initially revealed to members of Money Builder Alternatives on September third, 2022.

It hasn’t been too lengthy since we final touched on Paramount World (NASDAQ:PARA). Simply over a month in the past, we had been discussing how we had places expiring nugatory, locking within the choice premium. Nicely, it has been a wild experience of a month, however we as soon as once more have places expiring nugatory.

With no earnings introduced from our final replace on PARA, the numbers have not modified a lot. The subsequent FQ3 earnings are anticipated to be introduced on November 4th. Analysts predict an EPS of $0.49, with income of $7.15 billion. That will end in year-over-year development of -36.10% for the EPS and eight.10%. The EPS right here is taking a big hit resulting from vital spending for content material on their streaming platform. That is one thing we commented on beforehand, and nothing has modified on that entrance.

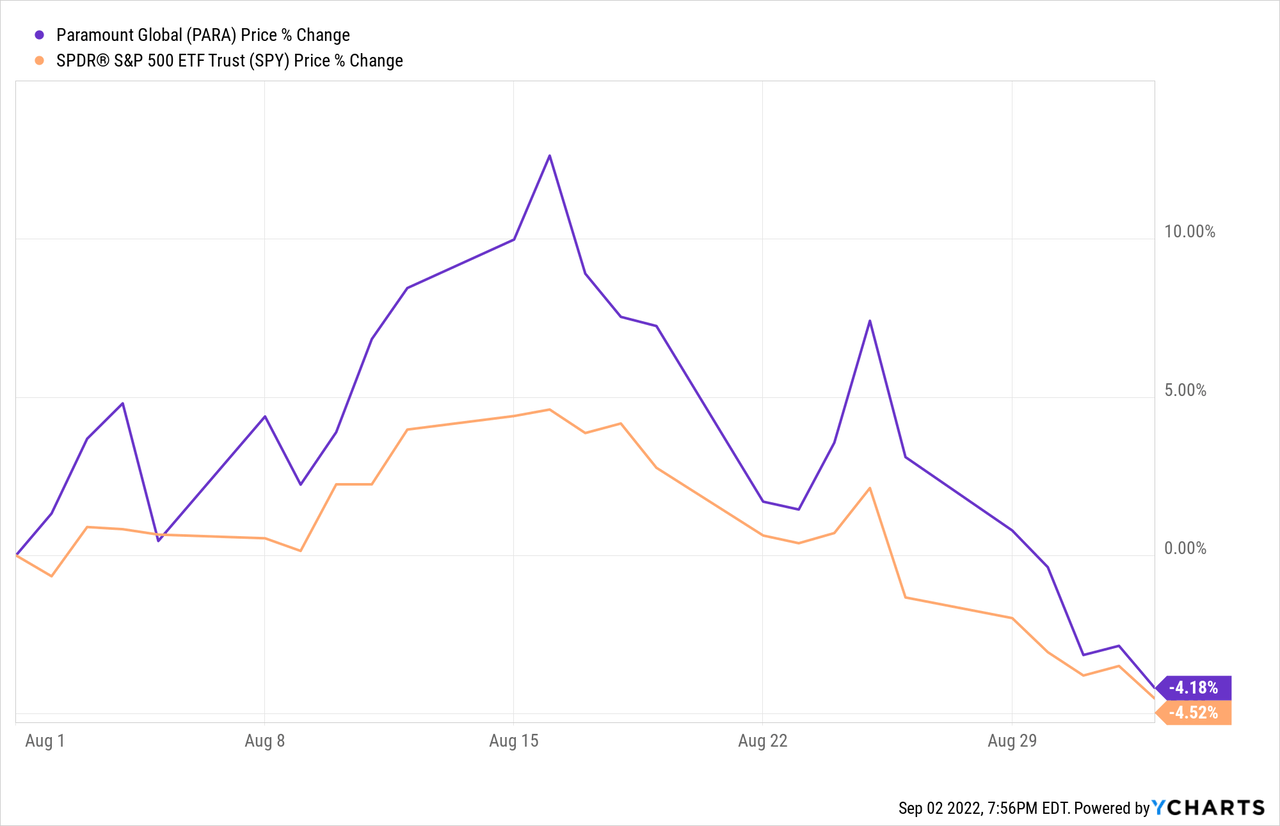

Total, it could seem that the inventory is in the end simply following together with the market volatility. After Powell’s “some ache” remark, the market has been struggling since.

Not even a jobs report that got here in keeping with expectations might prop the market up, which had indexes falling as soon as once more on Friday. That was after initially rallying on the opening and fading within the afternoon. A protracted U.S. weekend might imply some traders did not need capital to be tied up over the vacation. A shaky geopolitical world means an extended weekend might deliver absolutely anything.

With that, simply because there weren’t any new earnings to debate, that does not imply there wasn’t any worthwhile information within the final month price declaring for PARA extra particularly. There have been two noteworthy developments because the final commerce that hasn’t been mirrored within the inventory value in any respect because the inventory makes new lows.

The most important factor in regards to the new info on PARA, for my part, was teaming up with Walmart (WMT) on their Walmart+ to supply Paramount+ as a streaming service. That ought to present a monetary profit to Paramount. Plus, it offers a aggressive edge for WMT in opposition to Amazon (AMZN), too. It appears a pure match. I am hoping we get extra particulars with the subsequent earnings because the monetary phrases weren’t disclosed.

There are 11 million Walmart+ clients within the U.S. Paramount+ at present has 43 million subscribers, in order that’s fairly the brand new viewers that may stream their content material. That was with an extra 4.9 million further subscribers for the most recent quarter and eradicating 1.2 million Russian customers.

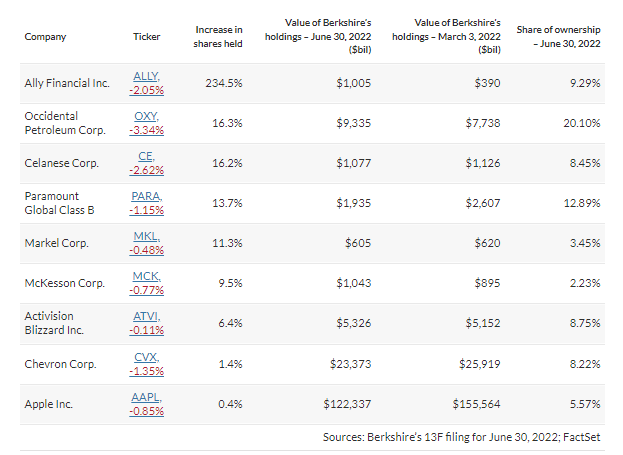

The second was Warren Buffett’s Berkshire rising their stake in PARA. That does not present any basic adjustments to the inventory. Nevertheless, it does not damage to get the backing of one of many biggest traders of all time.

Berkshire Place Adjustments (MarketWatch)

I believe that if Berkshire (BRK.A) is on this place, they see the dividend as a reasonably protected wager. Contemplating they had been including to it, it could make me extra assured. Here’s a fast remark from our earlier final PARA put up.

When requested in regards to the dividend beforehand in This fall earnings, they sounded assured that it was a precedence for them.

We’re very nicely outfitted to speculate to seize the expansion on D2C and to proceed to satisfy all of our monetary priorities, which as I’ve articulated earlier than, embrace investing in natural development by means of streaming. It consists of funding our dividend and it consists of deleveraging our stability sheet. I believe you may truly see us doing all three of these issues in 2022.

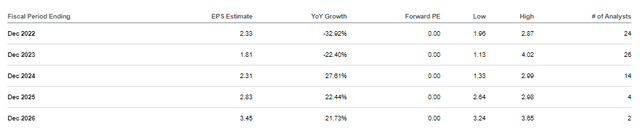

That being stated, a adverse improvement is that analysts now count on fiscal 2023 EPS to return in at $1.81. That is a reasonably substantial decline from the $2.04 they had been estimating a month in the past. That would take the EPS payout ratio to 53%, which places it at a big margin of security.

PARA EPS Estimates (In search of Alpha)

Regardless of these principally constructive developments, the inventory has hit a brand new 52-week low after it began making some robust runs greater. Once more, a variety of this appears to be enjoying out primarily because of the general market reversing.

YCharts

PARA is on the mercy of the general market, so we positively might see the inventory run decrease. Analysts nonetheless have a mean value goal of $29.10 for PARA. With the excessive estimate at a lofty $58 and a low estimate of $19. The ahead P/E is at ~10x, presenting an attractively valued place.

The Commerce

With the most recent weekly choices expiration passing, we have now our commerce expiring that we entered on August 1st, 2022. We had chosen a strike value of $22, accumulating $0.80 over the course of 32 days. That labored out to three.333x the precise quarterly dividend – and we did it in a couple of month. The potential annualized return for this commerce got here to 41.48%.

As talked about above, regardless of the worth coming down fairly aggressively in the direction of the expiration date, the draw back cushion was sufficient that we did not have shares assigned. To be fairly truthful, although, taking project of PARA at these ranges is one thing that I am definitely ready to do.

That is why it units it up as extra of a win-win situation when promoting places. You both find yourself receiving the premium, otherwise you obtain the premium and may personal a inventory you would not thoughts shopping for anyway.

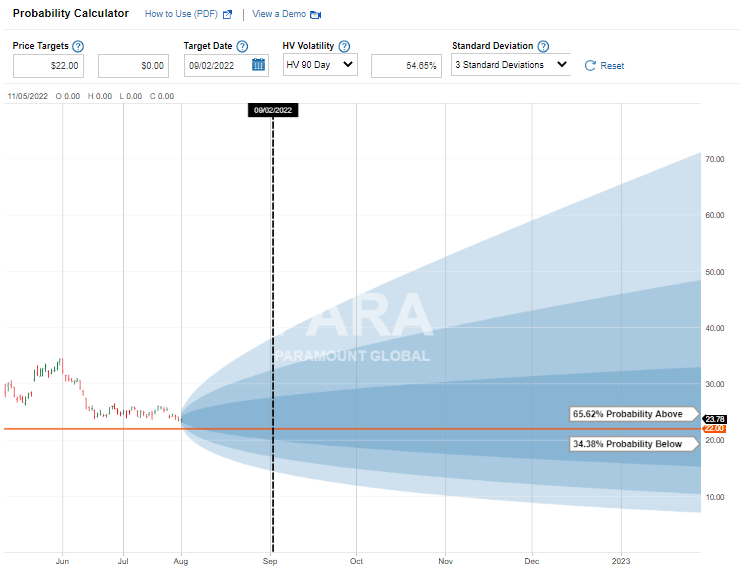

It was noteworthy that the likelihood of project was pretty excessive on this case. Increased than fairly a number of of the opposite trades that we have entered into beforehand anyway. I believe that reinforces my private emotions of seeing project in PARA, at this level, as fairly a pretty proposition. This was the calculation on the time the commerce was entered from Constancy.

PARA Task Likelihood (Constancy)

What’s Subsequent?

With that commerce expiring nugatory, we have now some money freed up. Nevertheless, this can be a time after I entered into new written put contracts earlier than expiration even occurred. As shares slid, that was the chance I used to be searching for to promote extra places. Seeing a brand new 52-week low on a inventory that I truly need to personal is an thrilling factor.

That is why the day earlier than expiration day on September 1st, I took the chance to promote places with an expiration of September thirtieth, 2022. For this commerce, I had gone with a barely diminished strike value of $21, accumulating $0.58 in premium. On the time of the commerce, it labored out to a cushion of 9% earlier than the inventory would hit that stage, which was additionally a bit wider of a cushion than the unique commerce.

The likelihood of project right here was additionally decrease than that authentic commerce. Only a ~25% likelihood, which makes no shock that the PAR on this commerce got here to 34.76%. That was fairly a significant deduction from our earlier commerce, but additionally fairly an elevated stage, for my part.

On Friday’s shut, the final commerce got here in at $0.45, so there may be nonetheless a possibility at that stage. The PAR, on this case, drops to round 27.93% now.

For some additional draw back safety ought to shares proceed to fall, I consider the $20 strike on the identical expiration date can be pretty engaging and provides a better quantity of quantity. The final bid at that strike got here in at $0.33. That will nonetheless work out to a pretty PAR of ~21.5%.