bjdlzx

By Alex Rosen

Summary

We rate ProShares K-1 Free Crude Oil Strategy ETF (BATS:OILK) as a Buy. At a time when pipelines are being sabotaged, global demand for oil is greatly exceeding production, and two of the world’s largest suppliers of fossil fuels (Venezuela and Russia) are under severe sanctions, investing in oil futures is an attractive situation to us.

An added bonus is that come tax time, investors don’t have to be bothered with K-1 filings to the IRS. Long term, the demand for oil should decrease as more and more countries turn towards renewable energy sources, but that day is far off in the horizon.

Strategy

OILK holds West Texas Intermediate (WTI) oil futures in an open-ended ETF. The portfolio is divided into three parts. With two segments holding futures contracts that expire in June and December and the third segment renews monthly.

By being structured as an open-ended ETF that purchases its futures through a Cayman Islands subsidiary, OILK avoids having to provide K-1 forms for tax filing purposes. This has become an increasingly common practice for commodities.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Commodities

-

Sub-Segment: Energy

-

Correlation (vs. S&P 500): Low

-

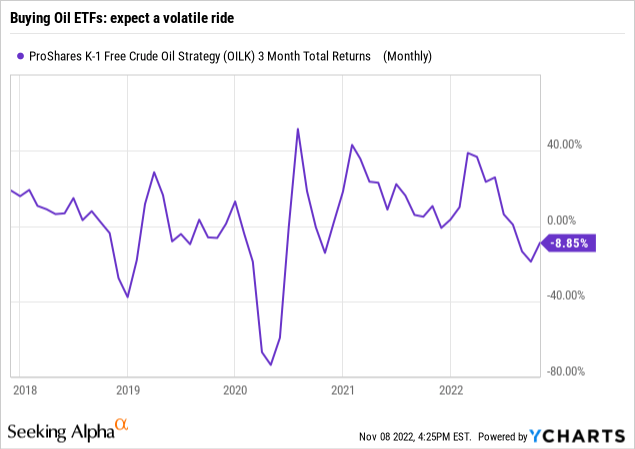

Expected Volatility (vs. S&P 500): High

Holding Analysis

OILK holds three different WTI futures contracts. Two reset semi-annually and one rests on a monthly roll. This is a very clear methodology. One asset, three contracts.

Strengths

The overwhelming strength of this ETF is that it is based on a single inelastic good. Regardless of the price, the demand will remain. In fact, as winter approaches in the Northern Hemisphere, demand for oil will increase. Most heating oil is kerosene, which is a distillate of petroleum oil. With sanctions on Russia, and the Nord Stream pipelines being sabotaged/shut down, the demand for alternative suppliers will not go down anytime soon. Additionally, the rolling contract segment ensures that price increases are captured.

Weaknesses

As a single-item fund, OILK is highly susceptible to changes in the market, including seasonal demand variances as well as political and other exogenous factors. Additionally, oil production is controlled by a cartel (OPEC), which can increase supply as it sees fit. As a result, prices are not set only by market demands but by other factors as well.

Opportunities

Winter is coming, and the world needs to heat itself. As of this writing, OILK is up 8% over the last month, and over 30% year to date. There is no indication that this trend will reverse itself anytime soon. Any technological breakthroughs will not create a significant change in demand, especially when pitted against the diminished source of providers.

Threats

One of the biggest threats to the fund is if Russia and Ukraine suddenly broker a peace deal, and in an effort to recoup the losses from Putin’s boondoggle, they open the oil tap fully, and flood the market as a result. Another potential area of concern is the recent maritime border agreement between Lebanon and Israel over the Qana-Sidon gas field, which contains over 100 billion cubic meters of natural gas. Within hours of signing the agreement, the Israelis were already extracting natural gas.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

OILK’s straightforward oil-only investment strategy makes it very appealing to us. The downside risk of oil is always present. But we think that risk is more likely to take the form of ever-present price volatility, rather than a sustained, long-term decline in the price of oil. Furthermore, the three-part model described above helps protect against sudden market shocks.

ETF Investment Opinion

We value OILK as a strong commodity purchase for both the near term and long term. Even if geopolitical disputes suddenly resolve themselves and the market is flooded with oil, it will take months for futures contracts to reflect that. This is a solid Buy for those looking to invest in a well-known commodity. The added bonus of no K-1 filings makes it even more appealing to seasoned investors. We rate OILK a Buy.