denizunlusu/iStock through Getty Pictures

The This autumn Earnings Season for the Gold Miners Index (GDX) is sort of full, and one of many first firms to report its outcomes was OceanaGold (OTCPK:OCANF). The corporate had a a lot better 12 months total, with manufacturing up greater than 20% to ~362,800 ounces, and the restart of Didipio, a mine with industry-leading prices, has undoubtedly improved the funding outlook.

Nonetheless, the Didipio restart was overshadowed by a sobered outlook at Haile, with value estimates up greater than 30% vs. the 2020 outlook. If OceanaGold can ship on its restoration plan, the inventory within reason valued. Nonetheless, I do not see the present reward/danger profile as engaging sufficient to justify paying above US$2.20 for the inventory with the inventory prolonged from key assist from a technical standpoint.

Haile Mine Operations (Firm Presentation)

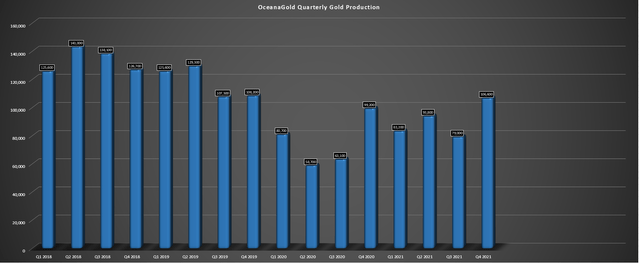

OceanaGold launched its This autumn and FY2021 outcomes final month, reporting quarterly manufacturing of ~106,600 ounces of gold, marking the very best quarter for the corporate in almost two years. This stable efficiency helped to push annual gold manufacturing to ~362,800 ounces, a 20% enhance year-over-year regardless of a troublesome 12 months for Macraes as a consequence of COVID-19 associated restrictions. The opposite main optimistic information was the restart of the corporate’s high-margin Didipio Mine within the Philippines, which is anticipated to ramp as much as full manufacturing and 1.6 million-tonne every year mining charges in Q2. Let’s take a more in-depth take a look at the outcomes beneath:

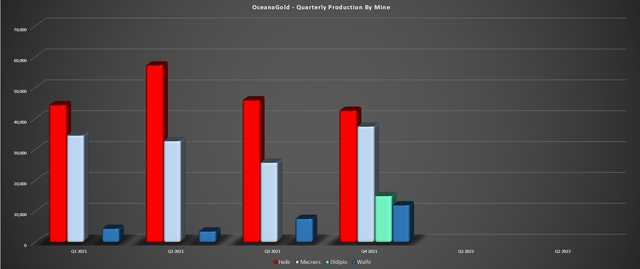

OceanaGold Quarterly Manufacturing (Firm Filings, Creator’s Chart)

Trying on the chart above, we will see that OceanaGold has had one of many worst manufacturing traits sector-wide over the previous couple of years (output down 16% vs. This autumn 2018). Nonetheless, not like Iamgold (IAG), the poor efficiency was largely out of the corporate’s management. It is because the corporate’s Didipio Mine was in care & upkeep, placing a significant dent in manufacturing. Luckily, with Didipio again on-line and contributing ~14,900 ounces in This autumn, it was a a lot better quarter, helped by a stable end to the 12 months for Macraes and Waihi (mixed for ~49,300 ounces).

Primarily based on 2022 estimates, Didipio is projected to contribute considerably extra on a quarterly foundation, with annual manufacturing anticipated to come back in at ~105,000 ounces of gold and ~12,000 tonnes of copper. Whereas this can be a stable bump to the manufacturing profile vs. the ~60,000 annualized run fee in This autumn 2021, the most important profit will come from a value standpoint, with Didipio’s all-in sustaining prices [AISC] anticipated to come back in beneath $600/oz. In comparison with OceanaGold’s value profile that is available in north of $1,200/oz, this can definitely assist to enhance this mid-tier producer’s value profile on a consolidated foundation going ahead.

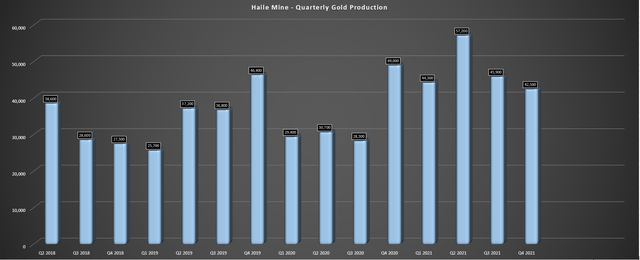

Haile

Digging into the corporate’s largest contributor, Haile, the mine had a a lot better 12 months, reporting document annual manufacturing of 190,000 ounces at respectable prices of $1,060/oz. This was helped by greater throughput, grades, and recoveries, with ~3.15 million tonnes processed at 2.21 grams per tonne gold in 2021. This was a significant enchancment from grades of 1.52 grams per tonne gold in FY2020 at a a lot decrease restoration fee of 79.5%. The efficiency is a welcome enchancment, provided that manufacturing statistics have been miles away from preliminary estimates for the reason that mine started manufacturing in Q1 2017.

Haile Mine – Quarterly Manufacturing (Firm Filings, Creator’s Chart)

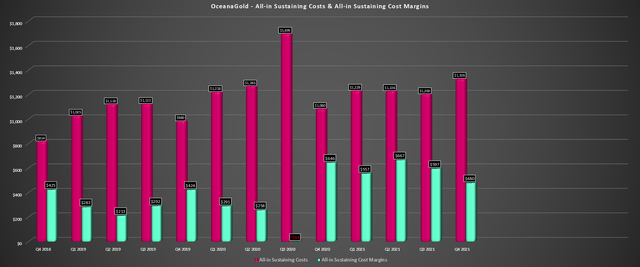

prices beneath, it is clear that mine had a a lot better 12 months from a value standpoint, particularly when adjusting for inflationary pressures sector-wide. That is evidenced by no quarters with prices above $1,300/ozvs. FY2021, when almost each single quarter noticed prices above $1,400/oz. On a full-year foundation, AISC got here in at $1,060/oz, with money prices of $649/oz. Sadly, whereas this was definitely higher than FY2020 ranges, the mine is about up for a a lot higher-cost 12 months in FY2022, with OceanaGold guiding for ~155,000 ounces at all-in sustaining prices of $1,550/oz.

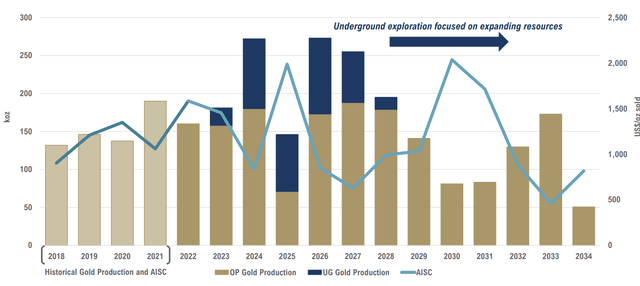

That is associated to elevated capex in 2022, with a rise in capitalized mining prices. If the gold worth had been nonetheless hugging the $1,800/ozlevel, this could paint a bleak outlook, however a minimum of the mine will take pleasure in affordable margins if the gold worth can stay above the $1,950/oz. The unfavorable information, although, is that whereas prices will decline sharply in 2023 and 2024 because the operation advantages from higher-grade underground ore, the Lifetime of Mine Plan [LOMP] has outlined a a lot much less strong operation than initially envisioned relative to pre-construction and the 2020 Technical Report.

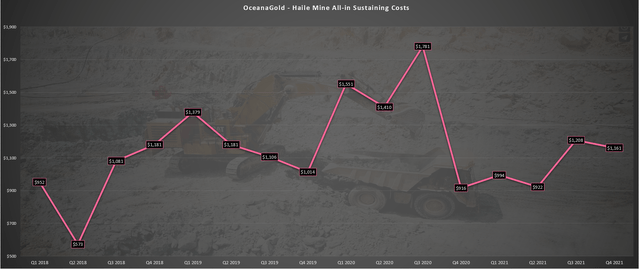

Haile Mine – All-in Sustaining Prices (Firm Filings, Creator’s Chart)

Following a technical evaluate of the Haile Mine that was lately accomplished, the cut-off grade has been elevated to 0.50 grams per tonne gold. Luckily, reserves stay at 2+ million ounces regardless of the elevated cut-off grade, translating to a mine life out to 2034. The unhealthy information is that mining prices have elevated from ~$2.00/tonne to ~$2.50/tonne; processing prices are up sharply, and the mine is anticipated to have greater capex than initially anticipated. The latter is expounded to elevated pre-strip prices and extra probably acid-generating [PAG] storage necessities.

These new inputs have pushed the up to date all-in sustaining value estimates over mine life to $1,080/oz, a greater than 30% enhance from the 2020 technical report, which projected prices of ~$800/oz. So, the view that Haile can be a low-cost mine relative to the {industry} common seems to be useless until the corporate can optimize the operation. A number of alternatives have been outlined, however a few of the anticipated positive aspects could possibly be partially offset if inflationary pressures persist. Total, this has overshadowed a greater 12 months for the corporate, and a $180 million impairment expense was taken at Haile in 2021.

Haile – Up to date Mine Plan (Firm Filings, Creator’s Chart)

Mine-by-Mine Manufacturing & Margins

Trying on the the rest of the portfolio, Macraes had a greater 12 months and is anticipated to provide ~147,000 ounces this 12 months at comparatively excessive prices of $1,350/oz. In the meantime, Waihi ought to contribute simply over 60,000 ounces this 12 months at AISC of $1,425/oz, enhancing to ~95,000 ounces in FY2022. This has set the corporate up for a a lot greater value 12 months total, with present steering set at ~470,000 ounces at $1,325/oz. Whereas manufacturing definitely compares favorably with almost 30% manufacturing development, prices will enhance greater than 6%, and that is regardless of the good thing about greater margin ounces from Didipio.

OceanaGold – Quarterly Manufacturing by Mine (Firm Filings, Creator’s Chart)

Transferring over to margins, we will see that AISC margins got here in at $480/ozin This autumn 2021, down from $646/ozwithin the year-ago interval. This was partially associated to troublesome year-over-year comps as a result of decrease gold worth however was additionally associated to a pointy enhance in consolidated AISC. If we look forward to FY2022, the wild card would be the gold worth, which might assist to spice up margins in what can be a higher-cost 12 months for the corporate. The excellent news is that if OceanaGold can ship on its long-term objectives, margins ought to enhance meaningfully in 2024 FY2024 and prices enhance at Haile and Waihi.

All-in Sustaining Prices & AISC Margins (Firm Filings, Creator’s Chart)

Lengthy-Time period Outlook

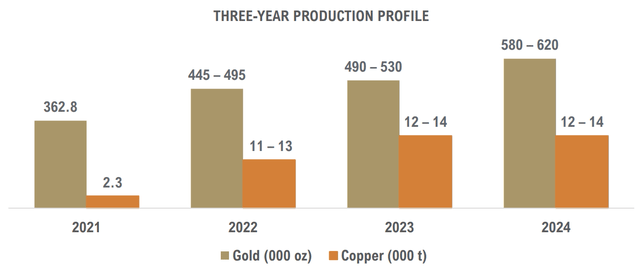

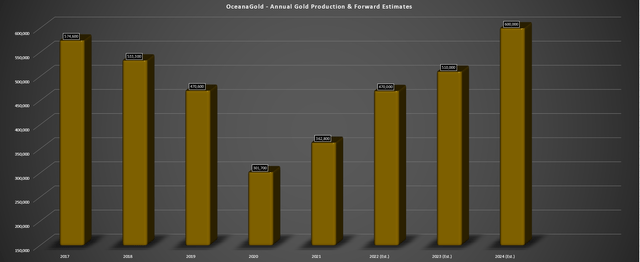

If we take a look at the 3-year outlook supplied by the corporate, one would possibly come to the conclusion that OceanaGold is likely one of the finest development tales sector-wide, set to take pleasure in 70% development if it might meet the excessive finish of its FY2024 steering. Nonetheless, this chart omits the previous 5 years of manufacturing, which clearly signifies that this isn’t development, however merely a restoration to only above 2017 manufacturing ranges (~575,000 ounces). Therefore, whereas manufacturing is rising, manufacturing per share just isn’t, and the long-term manufacturing development is anemic relative to a few of Oceana’s friends.

OceanaGold Three-Yr Outlook (Firm Presentation)

That is evidenced by the chart beneath, highlighting the expansion being achieved from a really low watermark, provided that annual gold manufacturing declined ~37% from FY2017 to FY2021. As famous earlier, a few of the decline in manufacturing was out of the corporate’s management as a consequence of Didipio transferring into care & upkeep after the provincial authorities blocked the license renewal for the mine. Clearly, this restoration remains to be bullish for the inventory if it is achieved efficiently, however this can be a very totally different enterprise than FY2017, with working prices more likely to be 70% greater, even when FY2024 steering is met. Let’s check out the technical image:

OceanaGold – Annual Manufacturing & Ahead Steering (Firm Filings, Creator’s Chart)

Technical Image

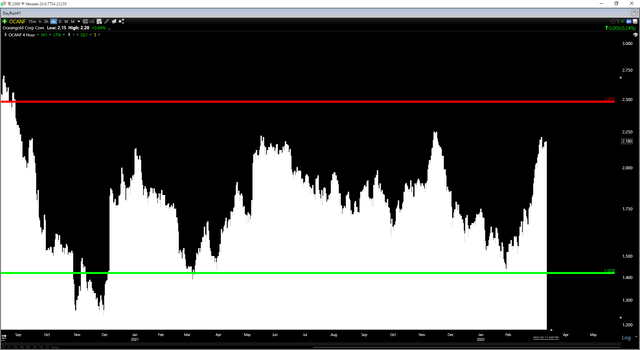

As famous in my earlier article on OceanaGold, the outlook was enhancing, and dips beneath US$1.60 had been possible to supply low-risk shopping for alternatives. It is because there was key assist close to US$1.45 and no robust resistance till the US$2.40 degree. Nonetheless, after a 40% rally off the lows, OceanaGold’s reward/danger ratio is far much less engaging, with $0.25 in potential upside to resistance and almost $0.80 in potential draw back to assist. This unfavorable reward/danger ratio of 0.25 to 1.0 doesn’t suggest that the inventory cannot proceed greater, nevertheless it does counsel that this isn’t a low-risk purchase level right here at US$2.20.

OCANF Every day Chart (TC2000.com)

OceanaGold had a a lot better 12 months in 2021 and has highlighted that it has the potential to develop manufacturing 70% from FY2021 ranges. Whereas that is a formidable headline quantity, it is necessary to notice that this development is merely a restoration, provided that even when the mid-point of FY2024 steering is met, it’ll translate to a ~1% compound annual development fee (FY2017-FY2024). From a manufacturing development per share standpoint and adjusting for ~15% dilution within the interval, we’ll see zero manufacturing development per share.

This does not imply that OceanaGold cannot do properly because it ramps up manufacturing, and the share worth is definitely properly off its FY2017 highs, particularly if the gold worth stays above $1,950/oz. Nonetheless, with AISC anticipated to come back in nearer to $1,050/ozin FY2024 (FY2017: $~620/oz), the corporate is nowhere close to the market chief that it was in 2017. Mixed with the truth that OceanaGold has an unfavorable reward/danger profile technically (short-term), I do not see any approach to justify chasing the inventory right here above US$2.20. In truth, if the inventory had been to rally above US$2.55 earlier than Might, I might view this as a possibility to guide some earnings.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.