Allieca/iStock by way of Getty Photographs

The This autumn and FY2021 Earnings Season for the Gold Miners Index (GDX) is lastly coming to a detailed, and one of many first corporations to report its outcomes was Northern Star Sources (OTCPK:NESRF). Total, the corporate put collectively a strong quarter in fiscal Q2 2022 (CY This autumn-2021), reporting gross sales of ~393,000 ounces of gold, quarterly income of A$950 million, and a slight enchancment in all-in sustaining price margins on a sequential foundation. Nonetheless, the true story for Northern Star is its development, which may high 2 million ounces every year in FY2026. Given this favorable mixture of rising manufacturing at increased margins, I’d view any pullbacks under US$6.95 as low-risk shopping for alternatives.

Northern Star trades important quantity every day on the Australian Inventory Trade (NST.ASX) however trades very restricted quantity on the OTC Market. Subsequently, one of the simplest ways to commerce the inventory is on the Australian Inventory Trade. There’s a important danger to purchasing on the OTC as a consequence of broad bid/ask spreads, low liquidity, and no assure of future liquidity. All figures on this article are in Australian {Dollars} except in any other case famous.

Northern Star Operations (Firm Presentation)

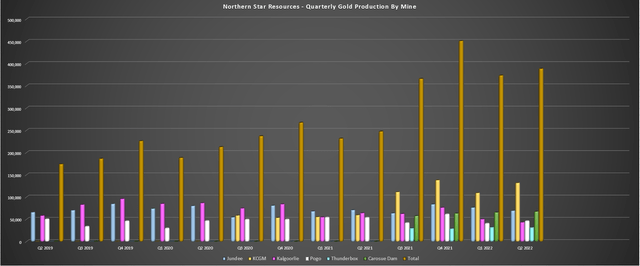

Northern Star Sources (“Northern Star”) launched its fiscal Q2 2022 outcomes (calendar 12 months This autumn 2021 outcomes) earlier this 12 months, reporting quarterly gold manufacturing of ~388,600 ounces, a 4% enhance on a sequential foundation. The upper manufacturing was pushed by one other strong quarter from the newly consolidated KCGM (Australian Tremendous Pit), one other robust quarter from Carosue Dam, and enhancing manufacturing at Pogo, although manufacturing is monitoring effectively behind full-year steering at this asset. Let’s take a more in-depth take a look at the quarter under:

Northern Star – Quarterly Manufacturing by Mine (Firm Filings, Creator’s Chart)

As proven within the chart above, Northern Star has seen a strong begin to FY2022, with H1-2022 manufacturing of ~762,000 ounces and H2 gold gross sales of ~780,000 ounces. This has positioned the corporate on observe to fulfill its steering mid-point of ~1.60 million ounces of gold this 12 months, on condition that manufacturing is back-end weighted, with increased mining charges anticipated at Pogo and better grades at Jundee. Whereas prices are monitoring above steering at A$1,613/oz [US$1,194/oz], we must always see an enchancment in prices in H2 as effectively.

Taking a look at particular person operations, it is clear that it was one other strong quarter from KCGM, with the operation contributing ~131,700 ounces, its second-best quarter because the Saracen/Northern Star merger. This was helped by increased throughput at improved grades, with ~3.57 million tonnes processed at a mean grade of 1.4 grams per tonne gold. In the meantime, at Carosue Dam, quarterly manufacturing additionally improved sequentially, growing greater than 3% to ~67,400 ounces.

Just like KCGM, this was pushed by increased throughput, with a not too long ago accomplished mill enlargement to three.2 million tonnes every year. As is obvious from the manufacturing outcomes (~1.02 million tonnes processed), the mill is working effectively above nameplate capability and is on observe to course of over 3.8 million tonnes this 12 months on the present charge. Transferring south to Kalgoorlie, manufacturing dipped sharply to ~43,100 ounces, with a a lot decrease mined grade within the interval (2.5 grams per tonne gold). Thankfully, KCGM and Carosue Dam greater than picked up the slack for the Kalgoorlie Manufacturing Centre, with complete manufacturing coming in at ~244,000 ounces.

Northern Star Operations (Firm Report)

On the Yandal Manufacturing Centre, it was a weaker quarter, with Jundee manufacturing dipping to ~69,200 ounces and Thunderbox manufacturing sliding almost 2% sequentially to ~31,500 ounces. Nonetheless, ignoring the headline numbers of ~7% decrease manufacturing sequentially, the Thunderbox Mill Enlargement stays on observe for H1 2023, and document stopping manufacturing was achieved for the quarter. In the meantime, Jundee additionally reported a document quarterly improvement advance of 6,800 meters. Regardless of the upper working prices and capex (A$77 million development capital), internet mine money move was flat in fiscal Q2 2022.

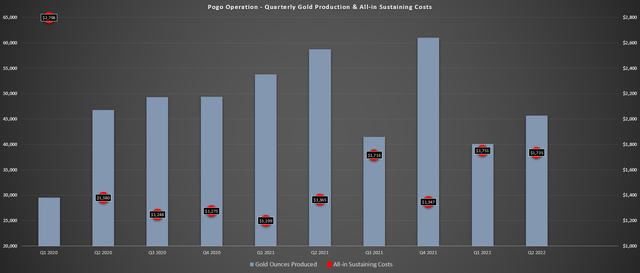

Lastly, at Pogo in Alaska, this asset had one other delicate quarter, despite the fact that manufacturing did enhance on a sequential foundation. Because the chart under reveals, manufacturing elevated greater than 10% sequentially (~45,700 ounces) however was up towards straightforward comps. It’s because the tie-in and commissioning of the processing plant led to 24 days of downtime in fiscal Q1 2022. Throughout fiscal Q2 2022, Pogo processed ~255,100 ounces at a mean grade of 6.6 grams per tonne gold, a big enchancment in throughput following the mill enlargement to 1.3 million tonnes every year, however at decrease processed grades.

Whereas it is clear that manufacturing is down sharply from year-ago ranges (fiscal Q2 2021: ~53,400 ounces), it is essential to notice that Pogo can have a a lot better H2, and prices will drop materially within the second half. Notably, whereas manufacturing was decrease year-over-year, mining charges improved in December, growing to 1,470 meters. Sadly, prices have been up sharply, partially associated to a lot fewer ounces bought, with prices growing greater than 20% year-over-year to US$1,735/oz. As of the top of H1, Pogo is monitoring miles behind its steering mid-point of ~235,000 ounces, with simply ~90,000 ounces produced year-to-date.

Pogo Mine – Manufacturing & Prices (Firm Filings, Creator’s Chart)

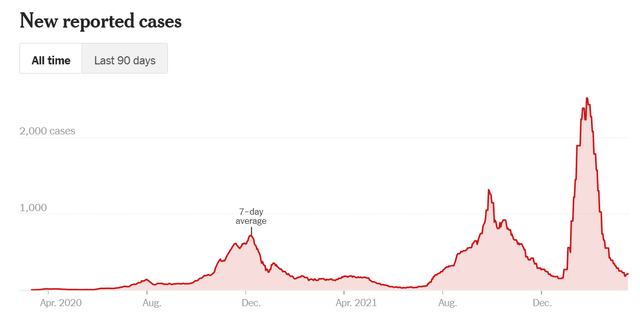

The excellent news is that the mixture of a pointy decline in COVID-19 circumstances in Alaska and Western Australia’s border restrictions being relaxed ought to assist the operation going ahead (ex-pat journey availability), with the aim of a lot increased mining charges in H2 2022 (January by way of June). On condition that Pogo continues to tug Northern Star’s working prices increased with all-in sustaining prices effectively above the trade common, development to 300,000 ounces every year at a lot decrease prices would assist enhance the corporate’s price profile relative to friends. For now, the mill enlargement to 1.3 million tonnes every year is full, and the following key will likely be sustaining improvement charges of 1,500 meters per 30 days (almost achieved in December).

Alaska COVID-19 Instances (NYTimes.com, US Division of Well being & Human Providers)

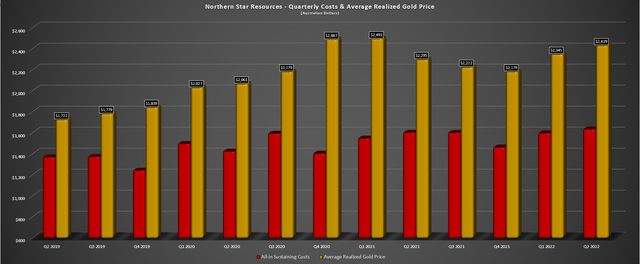

Transferring over to prices and Northern Star’s common promoting worth, we will see that prices elevated sequentially in fiscal Q2 2022, up from A$1,594/oz (Q1 2022) to A$1,631/oz. The corporate noticed increased prices at Carosue Dam, Kalgoorlie, and Jundee, with the latter processing a lot decrease grades, offset by very respectable prices at KCGM (A$1,344/oz). Thankfully, the corporate benefited from the next common realized gold worth (A$2,429/ouncesvs. A$2,345/oz), so AISC margins improved by greater than 4% to A$798/oz. Given the power within the gold worth mixed with back-end weighted manufacturing/gross sales, Northern Star ought to see significant margin enchancment in H2 2022.

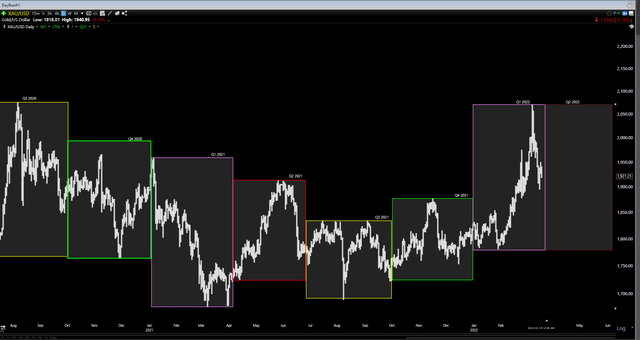

Northern Star – Quarterly Prices & Common Realized Gold Value (Firm Filings, Creator’s Chart) Gold Futures Value (TC2000.com)

Monetary Outcomes

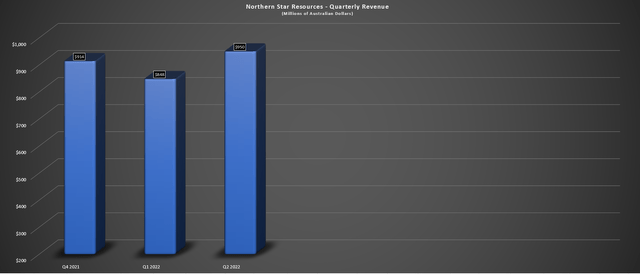

Let’s check out Northern Star’s monetary outcomes under. As proven under, we will see that quarterly income improved to A$950 million, helped by a 2% enhance in ounces bought on a sequential foundation and the next common realized gold worth. It is price noting that income additionally benefited from fewer ounces being bought into hedges within the interval, evidenced by ~197,000 ounces delivered in Q1 2022 in comparison with ~117,000 ounces in Q2 2022. Primarily based on the upper common realized gold worth to date in fiscal Q3 2022 (March quarter) and expectations of upper manufacturing, we must always see one other quarter for income within the upcoming quarter.

Northern Star – Quarterly Income (Firm Filings, Creator’s Chart)

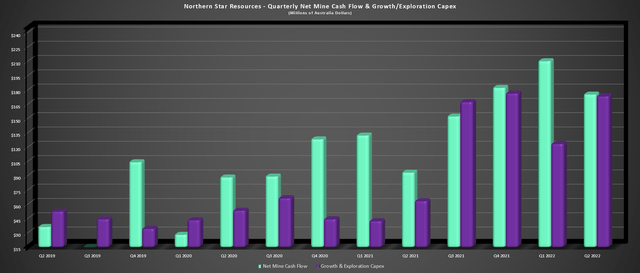

Transferring over to quarterly internet mine money move and development/exploration capex, Northern Star additionally had a strong quarter. This was evidenced by Q2 internet mine money move of A$175 million, regardless of important spending within the quarter (A$173 million). Yr-to-date, Northern Star has generated working money move of A$622 million and EBITDA of A$926 million. The rise in income and money helped the corporate enhance its steadiness sheet, ending H1 2022 with A$588 million in money and bullion, up from A$345 million within the year-ago interval, and complete liquidity of A$1.29 billion.

Northern Star – Quarterly Internet Mine Money Circulation & Capex (Firm Filings, Creator’s Chart)

Negatives

The 2 negatives price reporting within the quarter have been the truth that ounces hedge elevated but once more, with the corporate including one other ~405,000 ounces to its hedge e book at a mean worth of A$2,506/oz [US$1,854/oz]. That is considerably under present gold costs, and whereas that is in keeping with the technique employed by many gold producers, it offers Northern Star barely much less publicity to rising gold costs than lots of its friends. It’s price noting that this solely represents ~20% of gold manufacturing searching to FY2024, but it surely’s nonetheless a big proportion of annual manufacturing after we examine this to 0% hedging for many million-ounce producers.

The opposite damaging information was that Osisko Mining (OTCPK:OBNNF) has introduced that it will likely be going forward at Windfall with out Northern Star, which removes what would have been a pleasant increase to development outdoors of the corporate’s present development plan. It’s because Windfall appears prefer it may produce over 330,000 ounces of gold in its first few years of manufacturing, which might have translated to almost 8% manufacturing development for Northern Star, assuming a 50/50 joint-venture. Even with out Windfall, Northern Star nonetheless has a really respectable development profile. Nonetheless, for a barely higher-cost producer (AISC: ~$1,130/oz), the addition of a sub $700/ouncesAISC mine would have definitely offered a significant margin increase.

Valuation & Technical Image

Primarily based on ~1.17 billion shares excellent and a share worth of US$7.85, Northern Star trades at a market cap of ~US$9.2 billion, a really affordable valuation for a corporation with a path to ~2.0 million ounces of manufacturing every year. That is very true on condition that Northern Star has arguably the perfect jurisdictional profile sector-wide with 100% of manufacturing coming from Tier-1 jurisdictions and is among the few 1.5+ million-ounce producers with 25% development searching to 2025. Assuming the corporate can ship on its development plans, I’d not be shocked to see the inventory commerce above US$10.50 within the subsequent 18 months, translating to greater than 35% upside from present ranges.

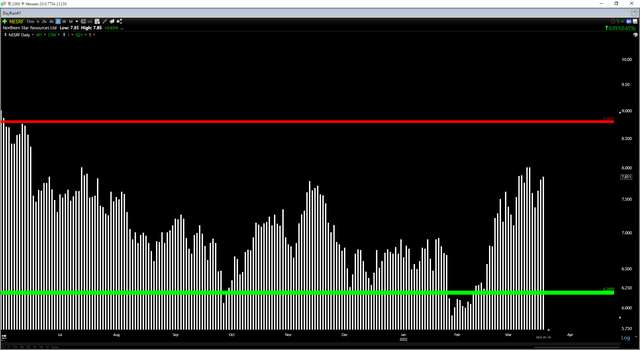

NESRF Day by day Chart (TC2000.com)

Nonetheless, whereas Northern’s valuation of lower than 1.20x P/NAV is sort of affordable, the inventory has rallied sharply off its lows since I famous that the inventory had dropped right into a low-risk purchase zone under $6.60 in January. In reality, the inventory is now up 30% off these lows in lower than 40 buying and selling days. This has degraded the reward/danger short-term, with the inventory now having US$1.65 in potential draw back to help (US$6.20) and fewer than US$1.00 in upside to resistance. So, with a present reward/danger ratio of 0.61 to 1.0, I do not see this as a low-risk purchase level from a buying and selling standpoint.

For Northern Star to dip again into a good purchase zone, the inventory would wish to say no to US$6.95 or decrease, the place the reward/danger ratio would enhance to ~2.5 to 1.0. dip of this magnitude could not happen given the latest power within the gold worth, however I favor to purchase when shares are hated, and I’m inflexible with my most well-liked purchase factors. Therefore, if I have been trying so as to add to a place or begin a brand new place within the inventory, this is able to be the world I’d be watching carefully.

KCGM Operations (Firm Presentation)

Northern Star put collectively a strong efficiency in H1, and with ~780,000 ounces bought in H1, the corporate stays on observe to fulfill its steering of ~1.6 million ounces in FY2022. If we glance forward over the following few years, a mix of upper manufacturing and declining prices ought to translate to significant development in earnings. Notably, there appears to be some upside to its ~2.0 million-ounce goal. Given this favorable mixture of rising manufacturing at increased margins and a horny dividend framework, I’d view any pullbacks under US$6.95 as low-risk shopping for alternatives.