[ad_1]

Tomas Ragina

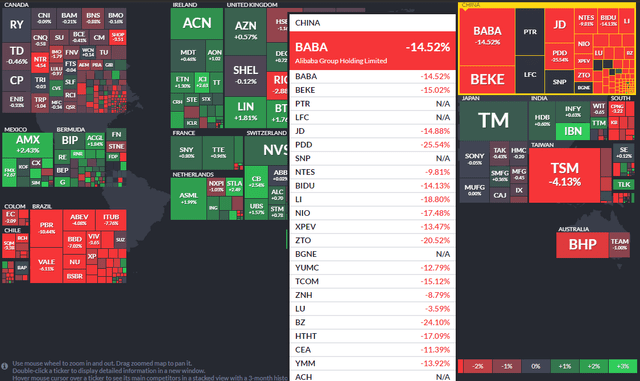

Chinese equities cratered on Monday following the weekend news that President Xi won re-election. Many big-name tech and consumer-related stocks notched multi-year lows, but one name remains well above its 2022 bottom. And it might be worth a look here as a speculative play.

China Stocks Dropped Huge On Monday

Finviz

According to Bank of America Global Research, New Oriental Education & Technology Group Inc. (NYSE:EDU) is a leading private education service provider in China, with exposure to overseas test preparation, domestic test preparation, Grade 9-12 academic tutoring, language training, K-12 non-academic tutoring, among other activities. The company was founded in 1993 and went public in 2006.

The China-based $3.4 billion market cap Diversified Consumer Services industry company within the Consumer Discretionary sector does not have positive GAAP earnings over the past 12 months and does not pay a dividend, according to The Wall Street Journal.

EDU has endured a trying past two years to put it lightly. The education and technology industries in China have been the epicenter of harsh administrative controls that are extremely harmful to equity holders. The ADR has further downside risks should President Xi take further steps to prevent growth in the industry. Still, there is upside potential from a strong online live-streaming platform.

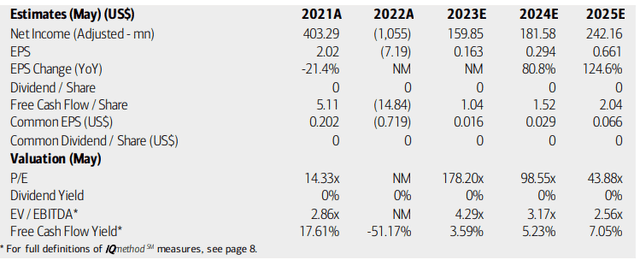

On valuation, analysts at BofA see earnings turning back positive in 2023 with strong EPS growth rates seen in 2024 and 2025. Don’t expect a dividend payment in the near future with New Oriental, though. With such low common EPS, the forward P/E ratio appears extremely high. I would rather look at the EV/EBITDA multiple, which suggests a cheap stock. Free cash flow should also turn positive in the coming quarters. Moreover, Seeking Alpha rates EDU with an A+ on valuation, highlighted by very cheap EV/Sales ratios (trailing and forward). With high volatility and risk to the valuation, I suggest looking to price trends to see if there is a buying opportunity with a favorable risk/reward setup.

New Oriental Earnings, Valuation, And Free Cash Flow Forecasts

BofA Global Research

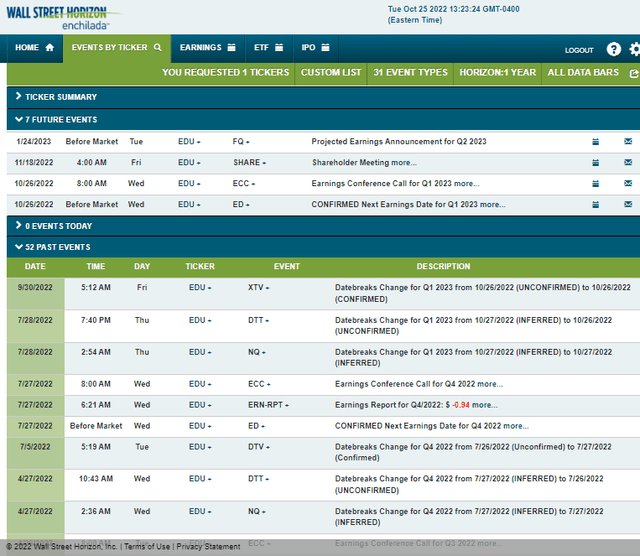

Looking ahead, EDU has a confirmed Q1 2023 earnings date of Wednesday, Oct. 26 before the open, with a conference call immediately after results hit the tape. You can listen live here. There could be additional share price volatility around its shareholder meeting on Friday, Nov. 18 during the overnight hours in the U.S.

Data from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $0.10 which would be a sharp drop from $0.43 earned in the same quarter a year ago. ORATS also reports that the expected share price move post-earnings using the nearest-dated at-the-money straddle is 9.0%, which is actually slightly lower than previous earnings releases.

Corporate Event Calendar

Wall Street Horizon

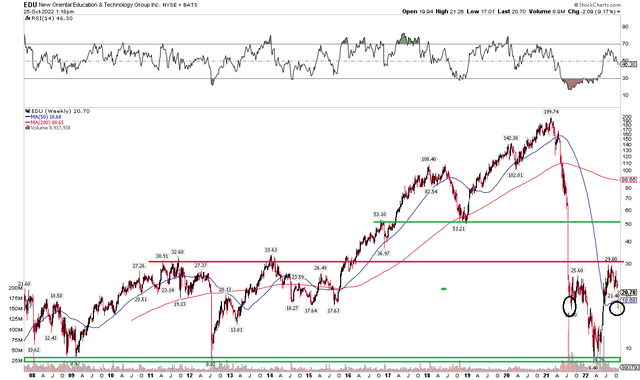

The Technical Take

EDU shares plunged more than 95% from the high in early 2021 to the low under $9 earlier this year. Shares managed to hold their bounce during the recent stock market plummet in China earlier this week. I now see a tradeable low in place with some key prices to monitor.

First, notice how the $16 to $18 area has the potential to turn out to be shoulders within a broader inverse head and shoulders pattern. A break above $34 (which has confluence with resistance seen from 2011 through early 2014) on a closing basis would lead to a measured price move objective to the low $50s (the early 2019 low). In the near term, being long with a stop under $16.80 (also just below the 2014 to 2015 range lows) makes sense. Take note that the stock’s 2022 low matches bottoms over the past 15 years.

From a risk management perspective, investors should put a limited amount of capital into this highly volatile stock.

EDU: Major Drop, But Shares Well Above The Year’s Low

StockCharts.com

The Bottom Line

Taking a flyer long on this China stock could prove to be a lucrative investment in the coming months. Earnings are also expected to inflect positive, but much uncertainty and uneasiness remain for any China-related stock.

[ad_2]

Source link