Alistair Berg

Very few authors cover NetEase Inc (NASDAQ:NTES) at Seeking Alpha and other sites. This $44.41 billion, well-diversified company reported excellent Q3 figures. Only one person commented on the impressive Q3 ER news. Let us appreciate NTES’s consistent profitability since Q1 FY 2009.

My reiterated buy rating for NTES is due to its persistent high profitability. The chart below explains why you should go long on NTES.

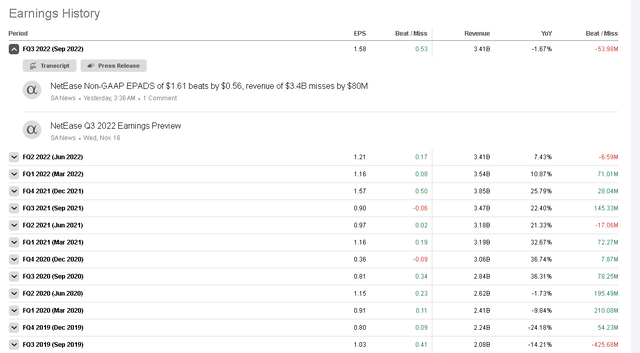

Seeking Alpha Premium

More often than not, NetEase reports quarterly earnings beats. Don’t worry about that miniscule -$54 million miss. The Q3 revenue of $3.41 billion is already impressive. Focus on the big picture. Start worrying only when NetEase reports a negative quarterly EPS. My fearless forecast is that NetEase will beat the F2023 EPS estimate of $4.97.

Big YTD Dip Made NetEase Undervalued

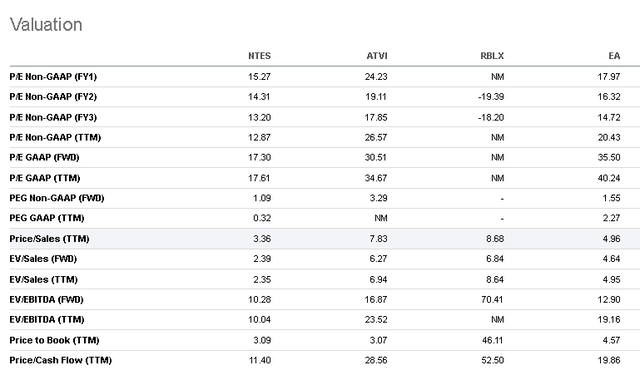

The -30.24% YTD beatdown has made NTES more affordable. The comparative chart below illustrates that NTES is relatively undervalued compared to its video games peers. NTES only touts a P/E GAAP TTM valuation of 17.30x. Its American partner, Activision Blizzard (ATVI) has 34.67x. Electronic Arts (EA) has 40.24x.

Seeking alpha Premium

This relative undervaluation is temporary. I opine you should act on this market aberration before others do. We can guesstimate that NTES can wrap up F2023 with a GAAP EPS of $5.0. Give this highly profitable Chinese company some slack and let it have a forward P/E of 20x. The forward price estimate for NTES should be $100. This is lower than Wall Street analysts’ average price target of $111.23. NTES currently trades at below $73.

Why Go Long?

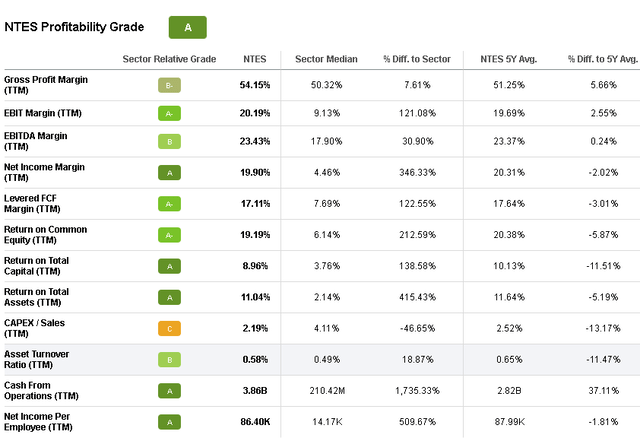

Consistent profitability should be your number one metric when evaluating NTES. Please refer to the chart below. NTES’s 5-year gross and net income margins have not deviated much from the last five years. The TTM net margin of 19.90% is not that much lower than its 5-year average of 20.31%. NetEase is not burdened by competition. It is not forced to lower its margins to grow its business.

Seeking Alpha Premium

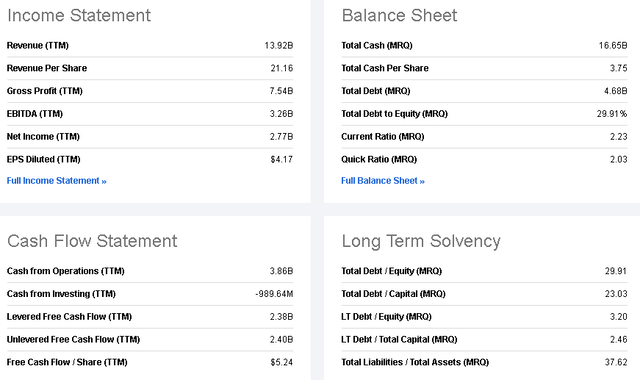

The high-margin business of NetEase helps it generate enough cash to pay dividends. Consistent profitability has also given NetEase a very robust financial moat. This company’s total cash reserve is $16.65 billion. This is more than three times its $4.68 billion total debt. NetEase has too much cash. It recently announced a $5 billion share buyback plan.

Seeking Alpha

The $16.65 billion cash hoard could allow NetEase to buy other companies. I prefer that this cash should be used to expand to more Artificial Intelligence online services and products. The video games industry is only worth $196.8 billion. The $422.37 billion global AI market is growing at 39% CAGR.

NetEase is a video games-heavy company that runs an AI-centric subsidiary called Youdao (DAO). AI-infused smart devices under the Youdao brand should be expanded. Some of that $16.65 billion cash could also go to developing NetEase’s own metaverse ecosystem for interactive entertainment, online education, skills training, and medical management/consultation.

Aside from its rising cloud music business, expanded AI-related products and services could be enough to help NetEase maintain its 3-year average revenue CAGR of 23.42%.

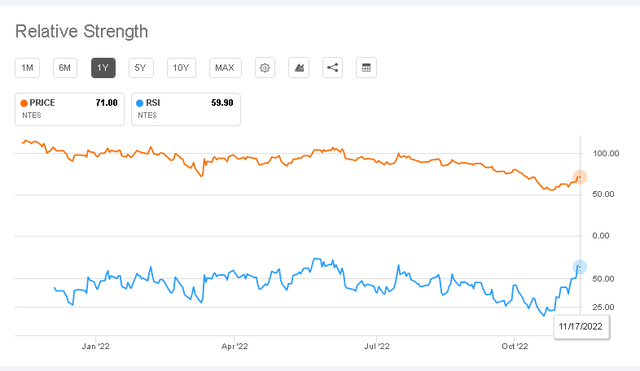

Technical Indicators Are Bullish

Retail investors should understand simple technical indicators. They are necessary to make timely buy and sell actions. Technical indicators are emotional barometers of the general investing public.

The Relative Strength Index chart below is clearly bullish for NTES. An RSI score of 59.90 is higher than the neutral score of 50, and lower than the overbought score of 70.

Seeking Alpha

Exponential Moving Averages or EMA is also an easy market emotional indicator. EMA indicator says NTES has triggered a mid-term bullish trade alert called 13-20EmaCrossover. It means NTES’s 13-day of $65.65 has crossed over its 20-day EMA of $65.45.

The Fast Stochastic of NTES is now also bullish at 85.79. The trade alert for this stock is Stochastic Overbought Buried. It is a short-term bullish signal. It means the fast stochastic is above 80 and has averaged above 80 for the past five trading days.

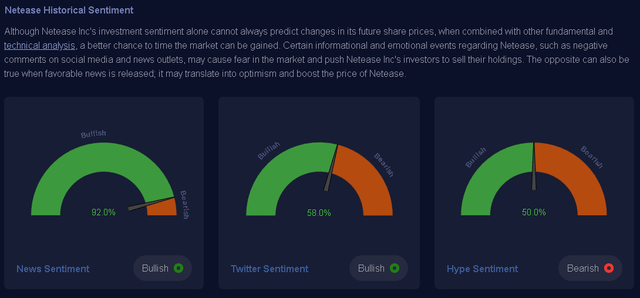

Stock investing is now influenced by the internet. It is compulsory to do a sentiment investigation of NetEase. The screenshot below shows NetEase has mostly positive news/propaganda.

Motek Moyen’s Account At Macroaxis.com

Downside Risk

The current licensing/publishing partnership with Activision Blizzard will expire on January 23, 2023. This could just be a clash of egos. NetEase President Simon Zhu blames a “jerk” for this dispute.

NetEase is China’s no. 2 gaming company. China is still the biggest video games market, with around $45.77 billion in annual revenue and 742 million gamers. There’s no news saying Activision Blizzard has chosen a new licensing/publishing partner for China. Let us just hope President Zhu and the “jerk” gets to settle their differences before January 23.

Activision Blizzard might find another China partner publisher for most of its games. NTES could tank hard if this scenario happens. The current licenses set to expire in January are Starcraft series, Diablo 3, Warcraft 3: Reforged, World of Warcraft, Overwatch, and Hearthstone. Losing the revenue streams from these popular Activision games could hurt NetEase’s topline and bottomline.

The TTM revenue growth of NetEase is 17.39%, down from its 3-year average of 23.42%. The probability is high that losing Activision Blizzard games could bring NetEase revenue CAGR to below 13%.

My Verdict

This buy thesis should not be taken as the gospel. Seeking Alpha Quant AI only gives NTES a hold rating. Do your due diligence and exercise your own critical thinking. NetEase is relatively undervalued when compared to its gaming peers. Technical indicators are bullish for NTES. Pray that the “jerk” and President Zhu make peace.

My number one metric in stock evaluation is Piotroski F-score. Steady high profitability is why NTES touts an F-score of 8. Persistent profitability is why NTES touts an Altman Z-score of 8.6. On the other hand, the high profitability of NetEase could weaken if it loses publishing rights to Activision Blizzard’s most popular games.

A part of that $16.65 billion cash reserve could be used to develop or buy third-party PC/mobile games. New games could offset the loss of revenue streams from Activision’s games. The other cash reserve could be used to expand more into the $422.37 billion AI industry. The video games industry is only growing at 12.9% CAGR. This is much lower than the global AI market’s CAGR of 39.4%.