Up to date on October ninth, 2024 by Aristofanis Papadatos

Pine Cliff Vitality (PIFYF) has two interesting funding traits:

#1: It’s a high-yield inventory based mostly on its 6.0% dividend yield.

Associated: Checklist of 5%+ yielding shares

#2: It pays dividends month-to-month as a substitute of quarterly.

Associated: Checklist of month-to-month dividend shares

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Pine Cliff Vitality’s mixture of a excessive dividend yield and a month-to-month dividend make it interesting to particular person traders.

However there’s extra to the corporate than simply these components. Hold studying this text to study extra about Pine Cliff Vitality.

Enterprise Overview

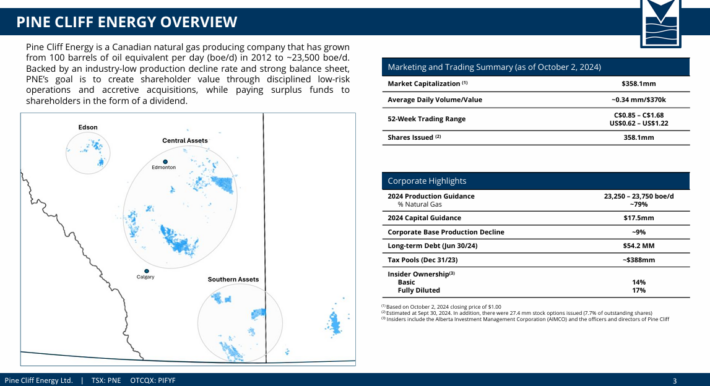

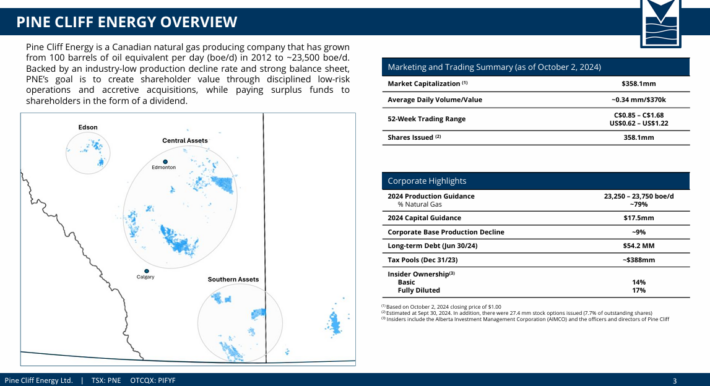

Pine Cliff Vitality engages within the acquisition, exploration, improvement, and manufacturing of oil, pure fuel, and pure fuel liquids within the Western Canadian Sedimentary Basin.

The corporate primarily holds curiosity in oil and fuel properties within the Southern Alberta, Southern Saskatchewan, and Edson areas, in addition to within the Viking and Ghost Pine space of Central Alberta. The corporate was fashioned in 2004 and is headquartered in Calgary, Canada.

Pine Cliff Vitality produces oil and fuel at a ratio of 21/79 and therefore it must be thought-about primarily a pure fuel producer. As a fuel producer, Pine Cliff Vitality is extremely cyclical because of the dramatic swings of the worth of pure fuel. Notably, the corporate has reported losses in 7 of the final 10 years and initiated a dividend solely in 2022.

Then again, Pine Cliff Vitality claims that it has some benefits when in comparison with the well-known oil and fuel producers.

First, the corporate claims that it has an honest stability sheet (extra on this later), which is paramount within the oil and fuel trade, as this trade is characterised by fierce downturns each few years.

Supply: Investor Presentation

As well as, the administration group of Pine Cliff Vitality owns 14% of the corporate and therefore it’s aligned with the shareholders. This is a crucial attribute, which shouldn’t be undermined by traders.

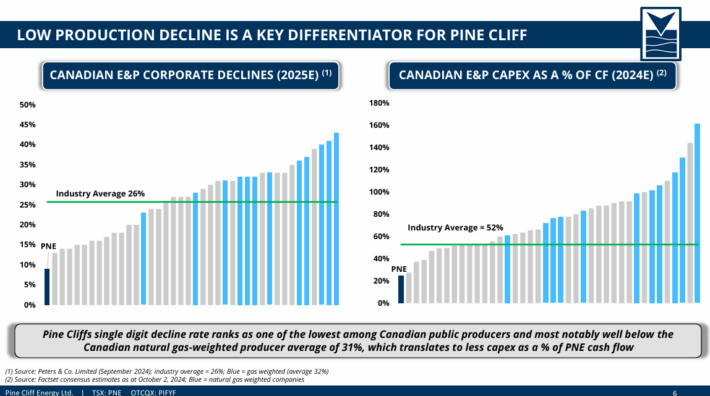

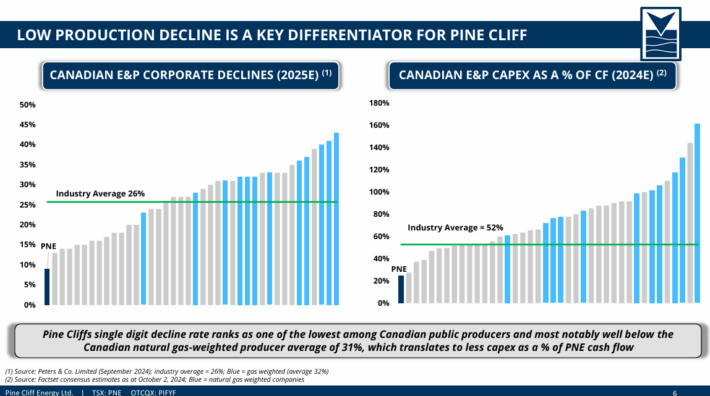

Furthermore, Pine Cliff Vitality has the bottom pure manufacturing decline charge amongst all Canadian public producers. This reduces the quantity of capital bills required to maintain a given stage of manufacturing.

Similar to virtually all of the oil and fuel producers, Pine Cliff Vitality incurred losses in 2020 because of the collapse of the costs of oil and fuel brought on by the coronavirus disaster.

Nevertheless, due to the huge distribution of vaccines worldwide, world demand for oil and fuel recovered in 2021 and thus the corporate grew to become worthwhile in that yr.

Even higher for Pine Cliff Vitality, the Ukrainian disaster triggered a rally of the costs of oil and fuel to 13-year highs in 2022. Consequently, the corporate posted 10-year excessive earnings per share of $0.22 in that yr. It additionally initiated a dividend in June of 2022, after greater than a decade with no dividend.

Nevertheless, the worth of pure fuel has slumped since early final yr as a consequence of abnormally heat winter climate for 2 consecutive years. This has resulted in exceptionally excessive fuel inventories in North America.

Consequently, Pine Cliff Vitality noticed its earnings per share collapse final yr, from $0.22 to $0.02. The corporate has additionally posted a marginal loss per share of -$0.02 within the first half of this yr.

Development Prospects

As talked about above, Pine Cliff Vitality has the bottom pure manufacturing decline charge amongst all Canadian public producers.

Supply: Investor Presentation

The pure decline of the manufacturing wells is paramount within the oil and fuel trade, as excessive decline charges end in extreme capital bills required to maintain a given stage of manufacturing. It’s thus evident that Pine Cliff Vitality has a major aggressive benefit when in comparison with its friends.

Then again, as an oil and fuel producer, Pine Cliff Vitality is extremely delicate to the inevitable cycles of the costs of oil and fuel. Extra exactly, as the corporate produces 79% fuel and 21% oil, it’s particularly delicate to the cycles of the worth of pure fuel.

Because of the rally of the costs of oil and fuel to 13-year highs in 2022, Pine Cliff Vitality posted 10-year excessive earnings per share in 2022. Nevertheless, each costs have plunged off their highs in 2022. Consequently, the corporate is more likely to submit a lot decrease earnings per share this yr.

Given the extremely cyclical nature of the oil and fuel trade but additionally our expectations for barely greater fuel costs within the upcoming years, we anticipate the earnings per share of Pine Cliff Vitality to develop by about 5.0% per yr on common over the subsequent 5 years, from $0.05 in 2024 to $0.06 in 2029.

Dividend & Valuation Evaluation

Pine Cliff Vitality is at the moment providing an above common dividend yield of 6.0%. It’s thus an fascinating candidate for income-oriented traders, however these traders must be conscious that the dividend is much from protected because of the dramatic cycles of the costs of oil and fuel.

Pine Cliff Vitality has a ahead payout ratio of 80%, which is very excessive, significantly for the vitality sector. The corporate additionally has an honest however considerably leveraged stability sheet, with web debt of $249 million. As this quantity is 94% of the market capitalization of the inventory, it’s manageable below regular enterprise circumstances.

Nevertheless, the stability sheet has weakened over the last 12 months. We additionally observe that the present belongings ($25.2 million) have grow to be decrease than the present liabilities ($50.3 million), that are due inside the subsequent 12 months.

General, the stability sheet has weakened in latest quarters and thus the corporate will likely be weak at any time when the subsequent downturn of the vitality sector reveals up.

Furthermore, it’s vital to notice that Pine Cliff Vitality initiated a dividend solely in 2022, amid multi-year excessive commodity costs. It failed to supply a dividend within the previous years, because it incurred materials losses in most of these years. Subsequently, it’s evident that the dividend of the corporate is much from protected.

In reference to the valuation, Pine Cliff Vitality is at the moment buying and selling for 14.6 occasions its anticipated earnings per share this yr. Given the excessive cyclicality of the corporate, we assume a good price-to-earnings ratio of 10.0 for the inventory.

Subsequently, the present earnings a number of is far greater than our assumed truthful price-to-earnings ratio. If the inventory trades at its truthful valuation stage in 5 years, it’s going to incur a -7.3% annualized drag in its returns.

Taking into consideration the 5.0% annual development of earnings per share, the 6.0% present dividend yield and a -7.3% annualized contraction of valuation stage, Pine Cliff Vitality might provide only a 3.8% common annual whole return over the subsequent 5 years.

This can be a low anticipated return, which ends from the truth that now we have handed the height of the oil and fuel trade. The inventory is extremely dangerous proper now and therefore traders ought to look ahead to the subsequent downturn of the vitality sector earlier than evaluating the inventory once more.

Remaining Ideas

Pine Cliff Vitality is providing an exceptionally excessive dividend yield of 6.0%, which is 5 occasions as a lot because the 1.2% dividend yield of the S&P 500. Consequently, the inventory is more likely to entice some income-oriented traders.

Nevertheless, the corporate has a excessive payout ratio of 80% and a weakening stability sheet. As well as, it has proved extremely weak to the cycles of the costs of oil and fuel.

As these costs appear to have peaked on this cycle, the inventory is extremely dangerous proper now. Subsequently, traders ought to look ahead to a a lot decrease entry level.

Furthermore, Pine Cliff Vitality is characterised by extraordinarily low buying and selling quantity. Because of this it’s exhausting to determine or promote a big place on this inventory.

Further Studying

Don’t miss the sources beneath for extra month-to-month dividend inventory investing analysis.

And see the sources beneath for extra compelling funding concepts for dividend development shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].