Up to date on April twenty first, 2022 by Quinn Mohammed

Enterprise improvement firms, or BDCs, are a beautiful funding automobile for these targeted on producing revenue. They often distribute most of their earnings to shareholders and because of this, sometimes have very excessive yields.

Gladstone Capital Company (GLAD) is a BDC with a present dividend yield above 6%. It’s one among greater than 100 shares with a 5%+ dividend yield. You possibly can see the total record of established 5%+ yielding shares right here.

And, together with Gladstone Capital, there are solely 50 shares that pay dividends every month, versus the extra conventional quarterly or semi-annual cost schedules.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Gladstone Capital’s dividend yield towers above the remainder of the market. The S&P 500 Index, on common, has a dividend yield of simply 1.3%, which is one-fifth the yield of Gladstone Capital.

However a excessive yield will not be sufficient if the underlying enterprise is weak, or the dividend is vulnerable to being minimize. This text will talk about whether or not or not Gladstone Capital is an effective funding choice for revenue buyers.

Enterprise Overview

Gladstone Capital operates as a Enterprise Growth Firm and invests in debt and fairness securities, producing revenue primarily from its debt investments. These investments are made by way of a wide range of fairness (10% of portfolio) and debt devices (90% of portfolio), usually with very excessive yields. Mortgage measurement is often within the $7 million to $30 million vary and has phrases as much as seven years.

Gladstone Capital chooses targets in secure industries with sustainable margins and money flows and favorable progress traits. The corporate focuses on non-cyclical and non-financial firms so as to keep away from peaks and valleys in its goal firms’ earnings. These are firms with management positions of their respective industries, progress potential, and annual EBITDA between $3 million and $15 million.

To ensure that Gladstone Capital to maintain paying its hefty dividends to shareholders, which is its main said purpose, it’s crucial that its funding portfolio continues to generate curiosity and dividend revenue and capital features in extra of its working and monetary bills.

It has a diversified portfolio, each when it comes to deal sourcing, and business teams.

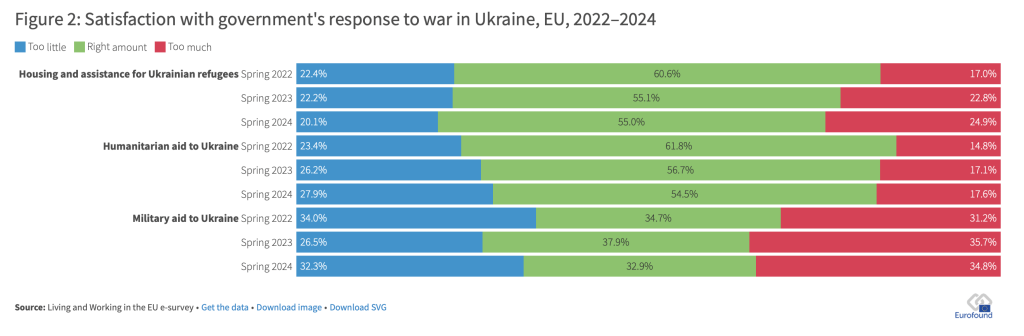

Supply: Investor Presentation

Fairness investments embrace most well-liked or widespread inventory. Gladstone Capital seeks to take care of a 90%-10% cut up between debt investments and fairness investments.

On the finish of 2021, Gladstone Capital’s portfolio had a good worth of $577 million, with diversification throughout 47 firms and 14 totally different industries. The asset combine is pretty conservative at 87% of investments in secured loans, with 69% in lower-risk first lien loans.

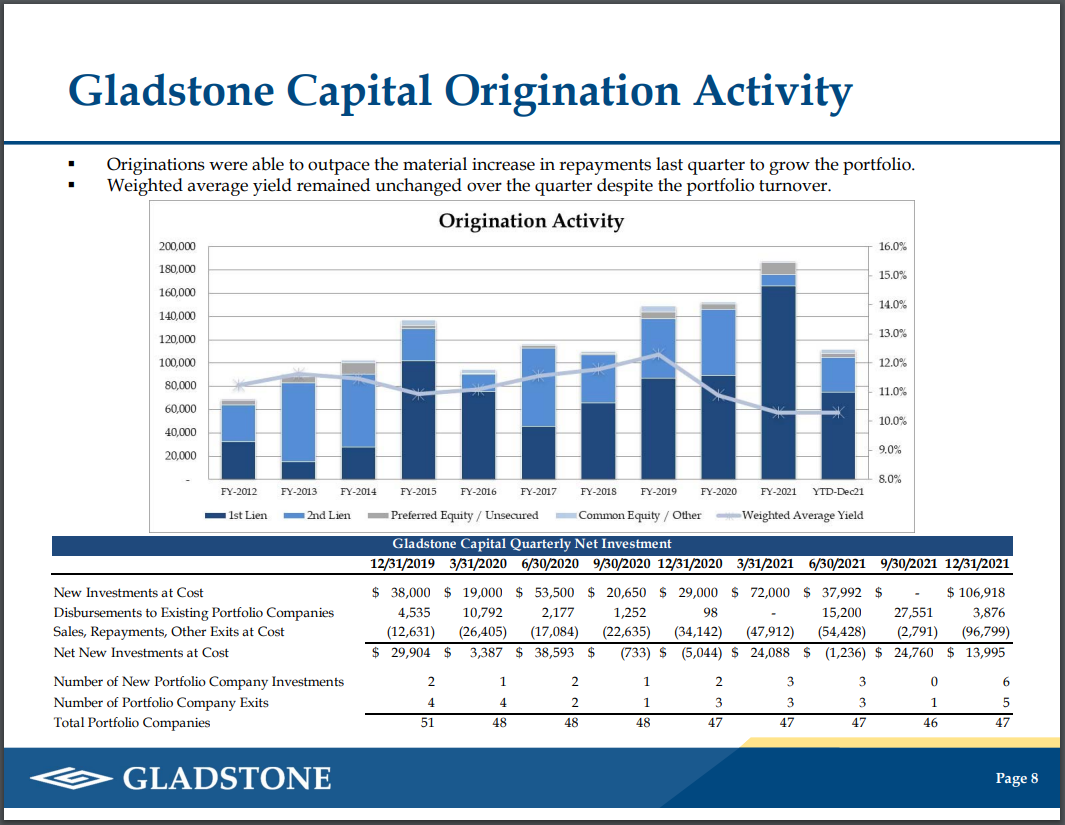

Gladstone reported first quarter outcomes on February 2nd, 2022, and outcomes had been largely in keeping with expectations. The corporate invested $111 million in six new portfolio firms, and after $97 million in repayments, posted web new originations of $14 million for the quarter.

Secured first lien belongings rose to 72% of the full portfolio and Gladstone maintained a weighted common yield on debt of 10.3%. Gladstone’s debt and fairness portfolios generated a web unrealized depreciation of $10.2 million in This fall. Nonetheless, complete investments at honest worth elevated 3.4% in comparison with the final quarter, to $577 million.

On a per-share foundation, NAV rose 1.7% quarter-over-quarter to $9.44. Web funding revenue was up 34% over the prior quarter to $9.2 million. Decrease bills helped enhance margins for Gladstone, driving a web enhance in belongings of 35 cents per share.

Because of the corporate’s funding technique, the corporate has appreciable progress alternatives to look ahead to.

Progress Prospects

Some of the compelling progress catalysts for Gladstone Capital is rising rates of interest. The corporate stands to learn from increased rates of interest as a result of nearly all of its debt portfolio is in variable-rate securities.

Wanting additional again, Gladstone has had a troublesome time producing progress. Gladstone’s share issuances have funded increased NII in greenback phrases however haven’t earned sufficient above its price of capital to maneuver the needle on NII-per-share. Given this historical past, we reiterate our estimate of Gladstone’s medium-term progress fee at 0%.

The yields on the corporate’s portfolio affect its capacity to earn revenue and due to this fact, cowl its bills and pay distributions to shareholders. Over time, the corporate’s portfolio yield has drifted increased to just about 11%. As of December 31st, 2021, the corporate’s funding portfolio had a weighted common yield of 10.3%. Nevertheless, increased bills have offset that progress just lately, which is a part of the explanation why NII-per-share continues to be flat over time.

Gladstone’s portfolio continues to develop in greenback phrases, however given its offsetting rising bills, and mortgage non-accruals, NII has struggled to develop.

Supply: Investor Presentation

Gladstone Capital will intention to proceed rising its new investments and including new firms to the full portfolio. In the newest years, the weighted common yield has fallen. The corporate has $100 million accessible on their financial institution line of credit score, which is also used to develop the funding portfolio and enhance web curiosity revenue.

Dividend Evaluation

Gladstone Capital pays a month-to-month dividend, which permits shareholders to obtain 12 dividend funds per yr, extra frequent than 4 quarterly distributions. It presently pays a month-to-month dividend of $0.0675 per share, after a 3.8% enhance to the dividend in April 2022. Beforehand in 2020, Gladstone Capital had minimize the dividend by about 7%. In consequence, the dividend continues to be not as excessive because it was pre-COVID.

We imagine it’s unlikely that Gladstone Capital will increase its distribution within the close to future. On an annual foundation, Gladstone Capital’s dividend represents a excessive yield of 6.3%.

Gladstone Capital has a strong monitor file of regular payouts, even throughout the Nice Recession of 2008-2009. The corporate can keep its excessive yield, due to its tax classification, and its favorable fundamentals. BDCs are required to distribute no less than 90% of any taxable revenue. This eliminates revenue tax on the company degree, permitting capital features to be handed via to shareholders, just like a REIT.

With a projected dividend payout ratio of 92% for 2022, Gladstone Capital’s dividend payout is safe however with out a lot cushion. BDCs will all the time have excessive payout ratios because of the tax rule of distributing almost all of their revenue, however it’s simple to see why Gladstone Capital hasn’t raised its payout for such a very long time.

It is a tight payout ratio, which suggests the corporate could not have the ability to maintain a significant financial downturn and keep its dividend. In consequence, had been one other vital monetary disaster to happen, Gladstone Capital’s dividend may very well be in jeopardy.

Assuming continued financial progress, its dividend seems to be sustainable. However the excessive payout ratio introduces comparatively excessive danger to the sustainability of the dividend, significantly throughout a recession.

Remaining Ideas

Buyers ought to strategy excessive dividend yields with warning. Excessive yields are commonplace within the BDC asset class, however many have minimize their dividends over the previous few years. For its half, Gladstone Capital decreased its dividend modestly in 2020. And in April 2022, the corporate introduced an upcoming a particular dividend, however it’s nonetheless beneath its pre-COVID degree. In the meanwhile, we don’t imagine one other dividend minimize is imminent.

Nevertheless, buyers might want to pay shut consideration to the corporate’s future earnings experiences. It has a really tight payout ratio and any vital deterioration within the efficiency of its funding portfolio may threaten the dividend.

Total, Gladstone Capital is probably going solely engaging for revenue buyers searching for excessive yields.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].