JazzIRT/E+ by way of Getty Pictures

Thesis

Actual Property Funding Belief (REIT) share costs have recovered because the pandemic subsided together with the resilience of the actual property sector. Medical Properties Belief (MPW) is a REIT, one of many largest house owners of hospitals on this planet. Working in an inelastic demand section, MPW affords an awesome return to long-term earnings traders.

Its inventory gained 8.5% in 2021 however has misplaced a little bit over 12.5% YTD. On the present share worth, the inventory’s dividend yield is about 5.45%, and with a TTM based mostly P/FFO Ratio of just about 12, the inventory seems to be extraordinarily enticing for future returns.

REIT Investments: Diversify your Portfolio

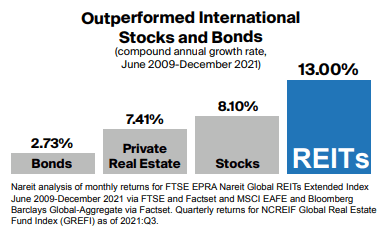

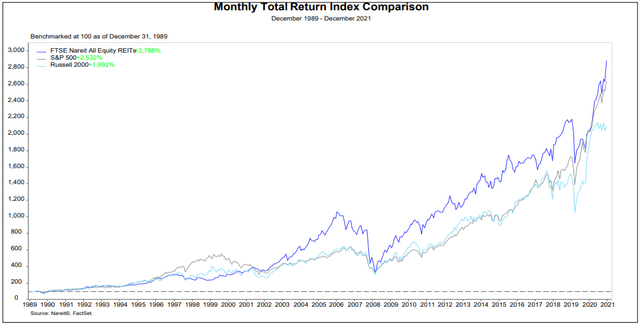

REITs should payout a minimum of 90% of their taxable earnings to shareholders. Due to this fact, the first motivation for traders to spend money on REITs is the dividend yield quite than progress. REITs ship complete aggressive returns based mostly on a gradual dividend earnings and reasonable long-term share worth appreciation. They’re additionally wonderful portfolio diversifiers that mitigate total portfolio threat and improve most returns due to their comparatively low correlation with different property.

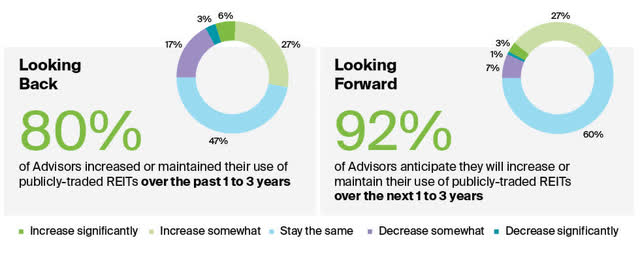

REIT.com REIT.com

REIT.com

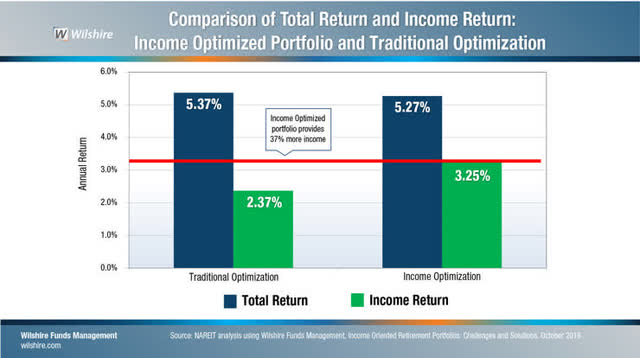

Based on a research by Wilshire Funds Administration, including a variety of excessive income-generating property, together with REITs, to mannequin retirement portfolios would have produced a virtually 40 % acquire in earnings returns – whereas sustaining almost the identical complete returns and threat profiles as retirement portfolios with extra conventional funding allocations.

reit.com

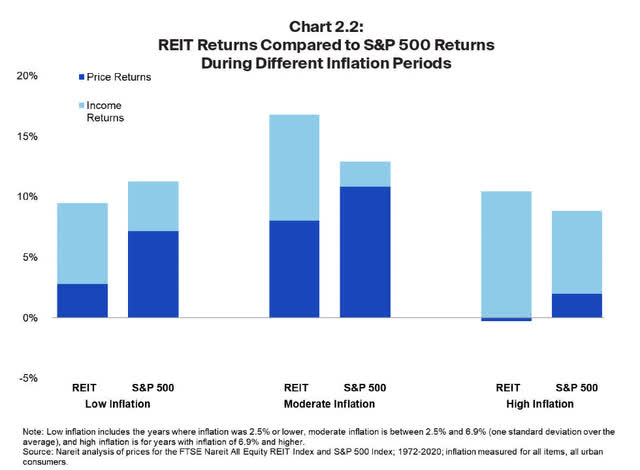

Furthermore, in these occasions of excessive inflation, REITs can be an excellent higher addition to funding portfolios. They’ve traditionally carried out properly throughout reasonable inflation durations in comparison with low inflation durations by way of market returns and working fundamentals. With the present inflation ranges exceeding 2.5%, the time seems to be ripe for including REITs to funding portfolios.

The under chart exhibits that REITs outpaced the S&P 500 by complete returns of over 3.9% in periods of reasonable inflation. Based on the identical report, when the Shopper Value Index (CPI) jumped over 5% in Q2 and Q3 2021, REITs’ Similar-Retailer Web Working Revenue (SSNOI) outpaced the uptick in annualized inflation by 23 foundation factors and 187 foundation factors, respectively.

reit.com

Firm Overview

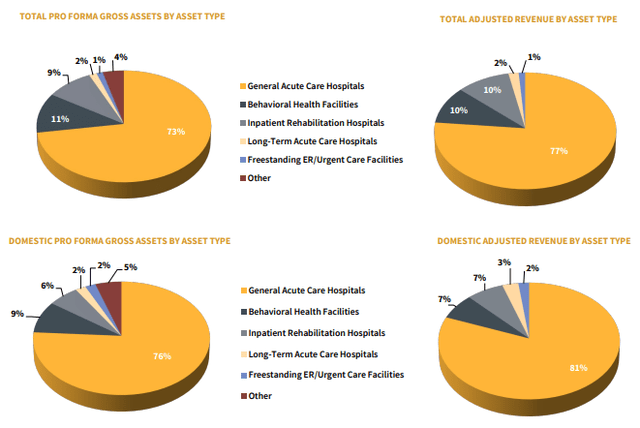

Medical Properties Belief, Inc. is a self-advised Healthcare REIT, buying and growing net-leased hospital services for nearly 2 a long time. The corporate owns 438 properties globally, with most of its holdings in the USA, adopted by the UK. The corporate’s holdings encompass 207 Common Acute Care Hospitals, 111 Inpatient Rehabilitation Hospitals, 58 Behavioral Well being Services, 42 Freestanding ER/Pressing Care Services, and 20 Lengthy-Time period Acute Care Hospitals.

These properties have common lease phrases of 10 to twenty years in the USA, with a number of choices of 5-year extensions, whereas in Europe, 87% of the corporate’s holdings are set to mature after 2030. These lease phrases have a 2% escalation constructed into them to deal with inflationary results. Equally, the corporate additionally banks on long-term fixed-rate debt services that make up an enormous chunk of its stability sheet. Accordingly, this money sits on the driving seat of the corporate’s progress and growth.

In the course of the 4th Quarter earnings name, Firm’s CEO famous that MPW has continued to execute its acquisition technique so as to add $3.9 billion in its investments throughout 5 totally different international locations, with 9 totally different operators, 5 of which had been new. In correlation with the corporate’s Funds from Operations (FFO) and Adjusted FFO (AFFO), this represents the continuation of double-digit progress, “a file nearly unmatched amongst, not solely our friends however all the universe of REITs with an analogous or bigger market cap.”

MPW

Excessive Yield Dividends: Sluggish however Regular Development

MPW distributes roughly all its earnings to its shareholders at a couple of 100% Payout Ratio with 2021 dividends of $1.12 per share towards a DEPS of $1.11 and AFFO of $1.37. The corporate, subsequently, depends closely on managing its money owed which I’ll talk about within the subsequent part.

On the present share worth of $20.5, the annualized Dividend Yield of 5.65% exceeds the Healthcare Actual Property sector’s common yield of 4.05%, virtually double the REIT business common dividend yield of two.85% and 4.7 occasions of S&P 500’s 1.2%.

MPW lately introduced a $0.29 quarterly dividend ($1.16 annualized) for Q1 2022, a 1 penny, or 3.6% QoQ dividend improve. Though a minor improve, the corporate has constantly elevated its dividend distributions in every consecutive 12 months for nearly a decade. Its most up-to-date announcement of an elevated dividend for 2022 will doubtless bolster shareholder confidence within the inventory. Nonetheless, the slow-paced dividend progress may additionally push prudent traders to survey the REIT marketplace for corporations with a greater dividend progress fee.

Excessive Debt however No Crimson Flags

MPW sports activities a debt-to-equity ratio of just about 134%. 96% of MPW’s $11.28 billion debt is mounted, with rates of interest between 2.5% and 5.25%, leading to an curiosity expense of $367 million for 2021. The corporate’s Web Debt to Annualized Adjusted EBITDA additionally demonstrates that it might take MPW, on common, 6.4 years to pay again its debt, assuming web debt and EBITDA are held fixed. Traditionally, this ratio has been maintained on the ‘mid-five occasions vary.’ Therefore, the corporate is at the moment on the higher limits and stated it might doubtless come right down to its historic vary through the earnings name, which should not be any trigger for concern.

The corporate’s 2021 FFO of $811 million provides it curiosity protection of round 2.5, which lags the business common of 4.5 however has elegantly maneuvered the minefield of liabilities by means of meticulous administration. As an example, throughout Q3, the corporate raised a 3.5% mortgage to settle a debt with a 6% rate of interest. Regardless of the debt figures being larger than ultimate, the dangers on this space are outweighed by the rewards.

Valuation

The corporate has a Value to FFO ratio of about 11.7 occasions, less expensive than the Healthcare REIT business common of 19.78. On the P/FFO of 19.78, the share worth can be a little bit over $34, exposing an upside of just about 70%. Nevertheless, the P/FFO ratio can’t be taken in isolation as a measure of valuation although it’s precedented that firm’s with decrease P/E or P/FFO multiples are normally higher rewarded by the inventory market.

As the corporate goals in direction of double-digit progress in its property and FFO with persistently rising dividends, potential traders can count on honest returns with double digits by the tip of this 12 months, contemplating the present valuation.

Conclusion

Including a REIT provides range within the portfolio, bringing down the general portfolio threat and reducing your portfolio beta for optimum returns. With the rising rates of interest, the 40-year excessive inflationary pressures on the economic system will ease down and settle right into a reasonable vary, traditionally excellent for REITs, making the present 12 months exquisitely enticing so as to add REITs into your portfolio.

MPW’s strategic maneuvering round its debt construction, inflationary protectors in its lease phrases, progress, and growth are telltale indicators of robust and meticulous administration. The inventory’s present valuation is a cherry on prime, giving leeway to potential traders for an interesting entry level. As an earnings inventory, MPW is a sound funding for strong and constant returns, particularly for earnings traders in search of dependable passive earnings.