[ad_1]

JHVEPhoto

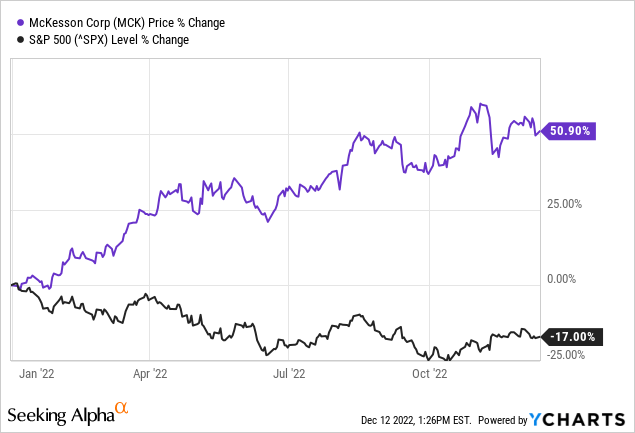

In my last article I called McKesson Corporation (NYSE:MCK) deeply undervalued. The article was published a little more than one year ago and since then the S&P 500 (SPY) lost 13.5% in value while McKesson returned 80% (including dividends). And when looking at the performance in the last 12 months, McKesson was among the 10 best-performing stocks in the S&P 500 (and aside from CF Industries Holdings (CF) it is the only company on the list that had nothing to do with oil and gas).

In my opinion, McKesson was deeply undervalued in the last few years and therefore outperformed the S&P 500 in an impressive way in the last three years. Right now, the stock has reached my calculated intrinsic value of $388 (see last article), and it is time to take another look at the company (and the stock) to determine what to do with McKesson.

Quarterly Results

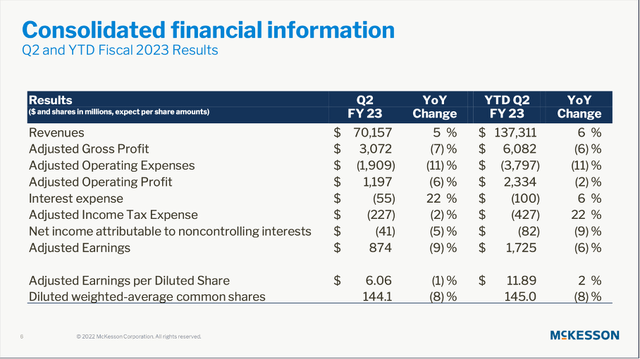

We will start by looking at the quarterly results. At the beginning of November 2022, McKesson reported second quarter results for fiscal 2023 and revenue increased 5.4% year-over-year from $66,576 million in the same quarter last year to $70,157 million this quarter. While revenue increased with a solid pace, operating income more than doubled from $539 million in Q2/22 to $1,124 million in Q2/23 – resulting in 109% YoY growth. And diluted earnings per share increased 275% from $1.71 in the same quarter last year to $6.42 this quarter. But before being carried away by phenomenal growth rates, we can look at adjusted earnings per share, which declined 1% YoY (and increased 11% YoY when excluding certain items).

McKesson Q2/23 Presentation

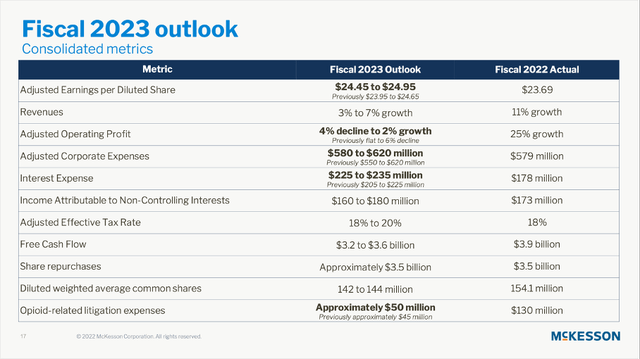

And as a result of the solid performance, the company also raised the guidance range for fiscal 2023 adjusted EPS from $23.95 to $24.65 before to a now updated range of $24.45 to $24.95. Free cash flow is expected to be between $3.2 billion and $3.6 billion.

McKesson Q2/23 Presentation

Recession-Resilient

McKesson Corporation could also be interesting as an investment right now as the company is rather recession resilient. We can start by looking at the stock performance year-to-date: While most stock markets around the world tumbled and most indices declined in the double-digits, McKesson was able to report a solid gain.

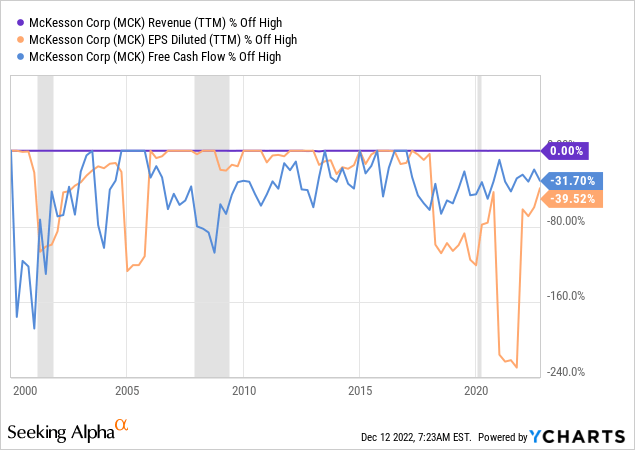

However, the performance of a stock by itself is not proof for the business being recession-resilient (although we also saw an outperformance of McKesson vs. the S&P 500 in the Great Financial Crisis and the crash following the Dotcom Bubble). We should also look at fundamental numbers and when looking at revenue we see an extremely stable and recession-resilient business. In the years since 2000 we saw hardly a decline. Earnings per share and free cash flow fluctuated much more but I would not necessarily draw a connection between a declining bottom line and a recession.

It is also not surprising for McKesson to perform quite well during recessions and economic downturns. The company is providing essential services – delivering pharmaceuticals across the United States. And as the demand for pharmaceuticals is not really declining during economic downturns, the demand for pharmaceutical distribution is also stable.

Opioid Litigation

Another positive news for McKesson is the fact that the opioid litigations have been settled. In the spring of 2022, the three major pharmaceutical distribution companies also reached an agreement and a settlement over $19.5 billion, which must be paid over 18 years. While Cardinal Health (CAH) must pay “only” $6.0 billion and AmerisourceBergen (ABC) must pay $6.1 billion, McKesson must pay $7.4 billion over 18 years. For fiscal 2023, opioid-related litigation expenses will be approximately $50 million for McKesson.

In the previous earnings call, management also provided an update on the opioid litigations:

Before I turn over – before I turn my attention to our first quarter results, I did want to just provide everyone a quick update on the progress of the opioid related litigations. This past quarter, we reached agreements in principle with the State of Washington and the State of Oklahoma. With the recent developments, we have settled or we’ve reached agreements to settle the opioid related claims of all 50 states, the District of Columbia and all eligible territories. The majority of the payments that will fund as part of these settlements will be used on opioid relief programs. We’re particularly proud of that. And we’ll support a wide variety of strategies in local communities to help fight opioid crisis.

In July, after a full trial, a federal judge ruled that McKesson, along with two other distributors, could not be held liable to two West Virginia subdivisions for contributing to the opioid crisis. This ruling is significant as the court confirmed that McKesson did not cause an oversupply of opioids in these communities. As we move forward, our role in combating opioid abuse is not over. McKesson will remain part of the solution when it comes to relief across the country and in preventing opioid diversion within the pharmaceutical supply chain.

I don’t know if the amount is too low, but it is certainly an amount that will probably not cause any headaches for McKesson – a business that will generate about $3.4 billion in free cash flow this year.

Intrinsic Value Calculation

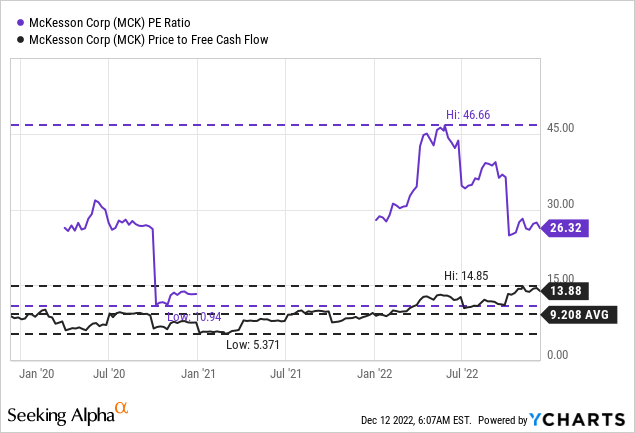

Since the lows close to $100 in 2018, the stock has almost quadrupled in value and after such an increase it seems like a natural conclusion to assume the stock is overvalued. And when looking at the price-earnings ratio, McKesson is trading for 26 times earnings and certainly isn’t cheap. However, when looking at the price-free-cash-flow ratio instead (which is the better metric in my view), McKesson is trading for only about 14 times free cash flow, and this is rather cheap. Compared to the last three years, McKesson is trading for the highest P/FCF ratio of the last three years right now. But this should not blind us to the fact that a P/FCF of 14 is a rather low valuation multiple for a high-quality business like McKesson.

And we can validate this assessment by using a discount cash flow calculation to determine an intrinsic value for McKesson. When using the midpoint of McKesson’s guidance for fiscal 2023 ($3.4 billion in FCF), and use 144.1 million in outstanding shares, McKesson must grow its free cash flow only 4% annually from now till perpetuity to be fairly valued right now.

Growth

As we saw in our calculation above, McKesson must grow its free cash flow only about 4% annually from now till perpetuity to be fairly valued. And not only are these growth rates achievable for McKesson – we can actually make the case that McKesson can grow with a higher pace.

One of the most important ways for any business to grow is by increasing the top line. And when looking at the past, McKesson could grow revenue with a stable pace in the high single digits (the 10-year CAGR is fluctuating between 7.23% and 9.39% in the last ten years).

And although this is not really contributing to growth, it is a good sign that McKesson extended the relationship with CVS Health (CVS) to distribute pharmaceuticals to mail order specialty pharmacies, retail pharmacies, and distribution centers. The two companies have been partners for more than 20 years and the new agreement goes through June 2027. This is important as CVS accounted for 21% of total revenue and losing that revenue stream would be a problem.

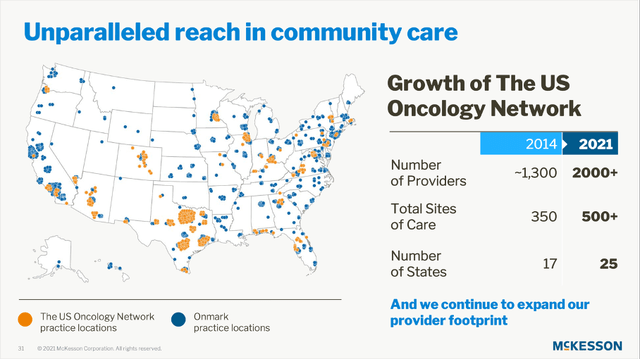

McKesson Corporation Investor Day 2021

Two contributors to top line growth in the years to come are the biopharma services as well as the oncology ecosystem. And the oncology market is large and growing. About 18 million people in the United States of America are living with cancer today and about 1.9 million are diagnosed annually. McKesson has built a network with over 2,000 provider and more than 500 sites of care in 25 states. And McKesson is expecting the oncology drug market to grow with a CAGR of 14% in the next five years. Right now, there are more than 300 oncology drugs on the market.

McKesson Corporation Investor Day 2021

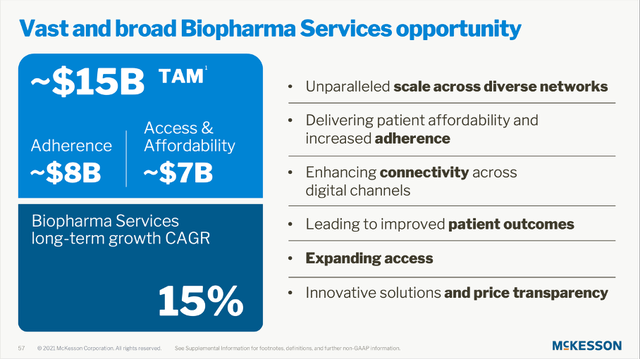

Another driver of growth could be the biopharma services market, which has a total addressable market of $15 billion and is expected to grow with a CAGR of 15% for the years to come.

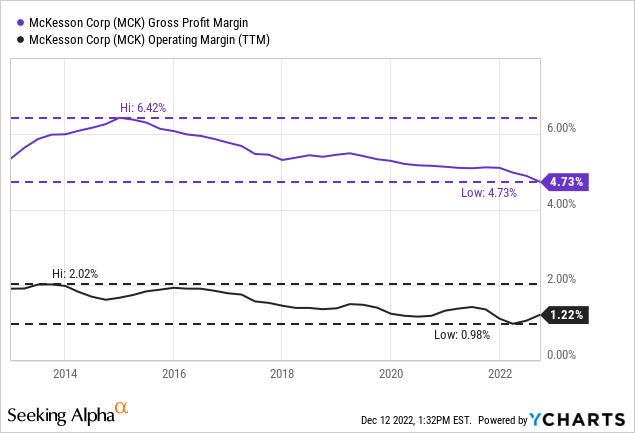

Additionally, McKesson is trying to focus on margin efficiency as well as a focused cost management, which is delivering operating leverage. While these are solid goals, we should also not ignore that McKesson’s gross margin and operating margin constantly declined during the last ten years. It certainly seems possible for McKesson to turn the trend around, but so far, the company appears to be struggling.

McKesson Corporation Investor Day 2021

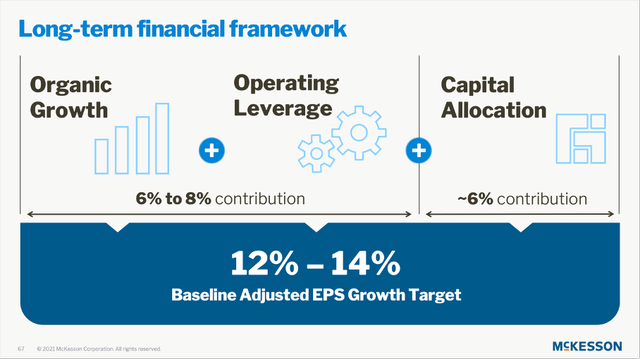

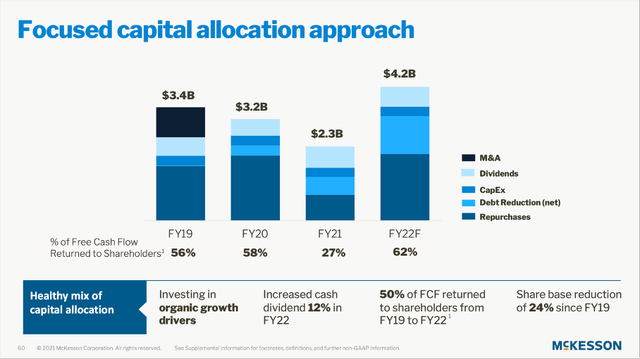

During its 2021 Investor Day, management expected that organic growth as well as operating leverage should contribute between 6% and 8% growth to the bottom line. While these two components were one part of the long-term financial framework, capital allocation is the second part and will also contribute about 6% growth in the years and decades to come. Among the different capital allocation tools, we can mention two with a measurable effect on the bottom line – merger & acquisitions as well as share repurchases. And especially share repurchases is a tool McKesson was using constantly in the past.

McKesson Corporation Investor Day 2021

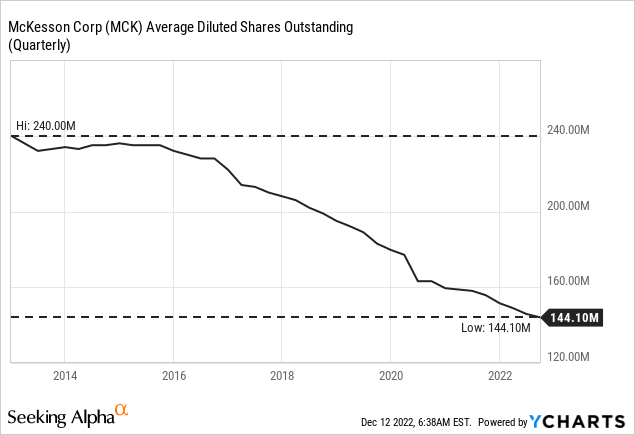

In the last ten years, McKesson reduced the number of outstanding shares from 240 million in 2012 to 144.1 million outstanding shares right now, which resulted in a CAGR of almost 5%. To put it differently: McKesson reduced the number of outstanding shares about 5% every single year for the last ten years and as a result earnings per share also increased 5% every single year just by share buybacks (of course, EPS was not just impacted by share buybacks).

Share buybacks by itself would be enough to make McKesson undervalued right now. And when assuming a free cash flow of $3.2 billion to $3.6 billion (according to the company’s guidance), it would be enough to repurchase between 6% and almost 7% of all outstanding shares – assuming all FCF is spent on share buybacks.

Intrinsic Value Calculation II

We can offer another intrinsic value calculation. Management is expecting adjusted EPS to grow between 12% and 14% in the years to come. But let’s be more pessimistic and assume only growth rates in the high single digits – let’s say 8% annually for the next ten years followed by 6% growth till perpetuity (the growth rate I always use for high-quality businesses). When using these assumptions and $3.4 billion in free cash flow as a base (midpoint of guidance), we get an intrinsic value of $680 for McKesson and the stock would still be trading for a 45% discount right now.

I don’t know if I want to be so bullish right now. The stock might still be undervalued, but I don’t know if the stock will continue to grow in the coming quarters. With the looming recession and a potential bear market around the corner, it seems likely that McKesson will be affected as well and the stock might also decline or have troubles to increase in the next few quarters.

Conclusion

Although I am not as bullish about McKesson as I was in my last article, the stock still seems to be trading below its intrinsic value. We should just consider the possibility of setbacks in the coming quarters. With the risk of a steep bear market in 2023, McKesson’s stock could also decline – despite the stock still being undervalued. But over the next few years, higher stock prices seem likely for McKesson.

[ad_2]

Source link