kazuma seki/iStock via Getty Images

A few thoughts here, as we head into the end of October.

Don’t be misled by daily moves

There’s a lot of noise in markets. Commentators (of all sorts) report every market move with breathless significance, but the reality is that most day-to-day moves just don’t matter. Furthermore, given current price levels and volatility, an 80-point swing in the S&P can be “no big deal”.

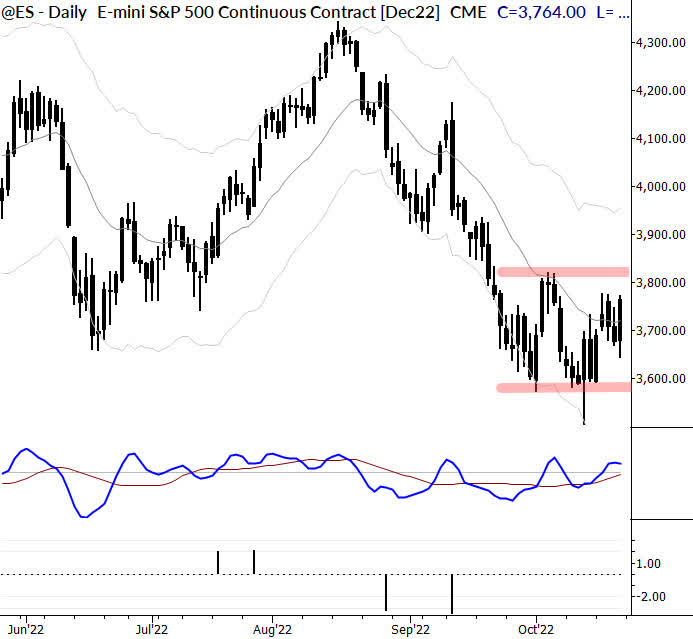

One of the things we are watching to help us know when it’s time to pay attention is this current range on the daily chart of stock indexes. (See chart at top of this post.) There are certainly other ways action could develop, but as long as we are snugly within the range, we’re thinking the day-to-day moves are largely meaningless.

Our bigger-picture bias still points to risks lurking in the wings, but near-term is highly uncertain. Regardless of your bias, this is really a spot where you have to be flexible but only act on clear signals.

Remember, for active traders, no position is also a valid position!

Keep an eye on sector strength

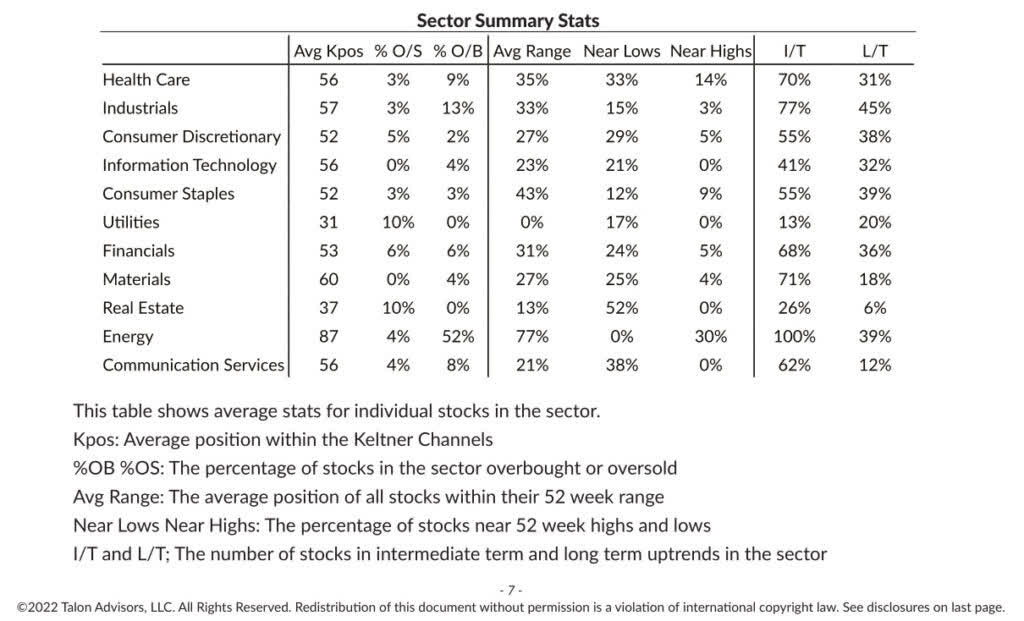

The table below shows one of the ways we like to slice and dice sectors. This is an analysis of the individual stocks of the S&P 500, sorted into major sectors.

Energy’s strength is clear here, with 0% of stocks in the sector near 52-week lows, and 100% of those stocks in intermediate-term uptrends! Exceptional, especially given the broad market action.

A look at other sectors might also give you some other ideas, if you work with a longer-term perspective.

Big currency moves

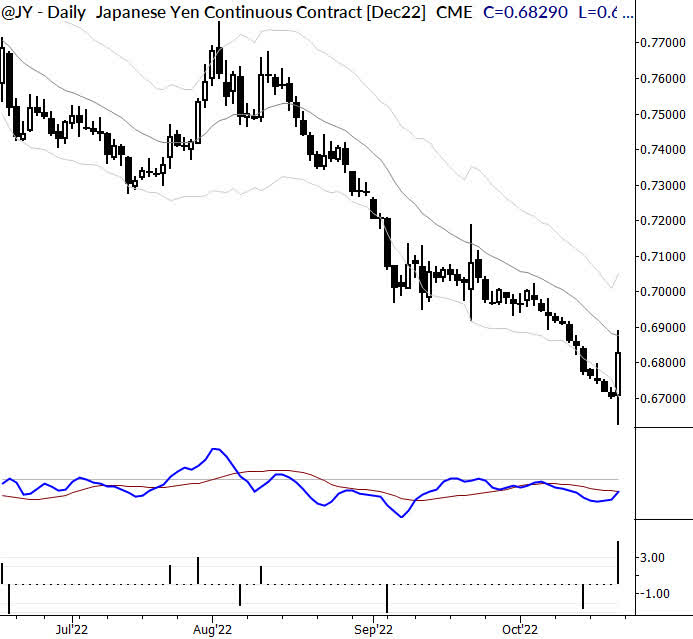

We’ve traded in and out of the Japanese yen a bit in recent weeks, and have had a short on for our MarketLife members since late September. We have been increasingly concerned about the possibility of an intervention, and this emerged Friday with a gigantic single-day rally.

This is one of the risks of trading currencies. All assets have potential issues, but central bank or other political interventions can result in stunning moves in currencies, which may sometimes see significant slippage on stops.

In this case, no real damage was done, but it’s a reminder of the risks in fx trading.

The week ahead (potentially market-moving data releases)

- Monday: none

- Tuesday: Case-Shiller Home Price Index

- Wednesday: New Home Sales, EIA Crude Oil Inventories

- Thursday: GDP, Jobs numbers, Durable Goods

- Friday: Personal Income & Spending, PCE, Pending Home Sales

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.