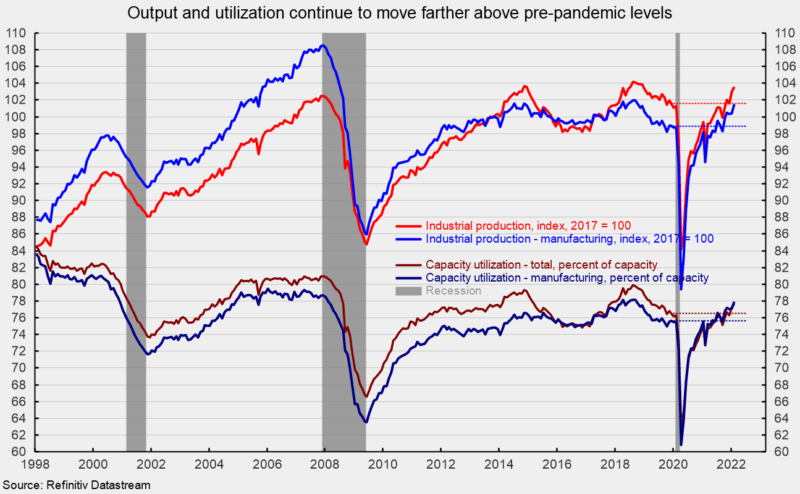

Industrial manufacturing gained 0.5 % in February regardless of a reversal of the weather-related surge in utility output in January. The achieve pushes complete industrial output to its highest stage since December 2018, and clearly above the December 2019 stage previous to the pandemic (see first chart). Over the previous 12 months, complete industrial output is up 7.5 %.

Complete industrial capability utilization elevated 0.3 factors to 77.6 % from 76.3 % in January, the best since March 2019 (see first chart). Nevertheless, complete capability utilization stays properly under the long-term (1972 via 2021) common of 79.5 %.

Manufacturing output – about 74 % of complete output – posted a extra sturdy 1.2 % improve for the month (see first chart). Manufacturing output is at its highest stage since September 2018 and is 2.9 % above its January 2019 pre-pandemic stage (see first chart). From a 12 months in the past, manufacturing output is up 7.4 %.

Manufacturing utilization elevated 0.9 factors to 78.0 %, properly above the December 2019 stage of 75.6 % and the best stage since September 2018, however simply barely under its long-term common of 78.1 %. Nevertheless, it stays properly under the 1994-95 excessive of 84.7 % (see first chart).

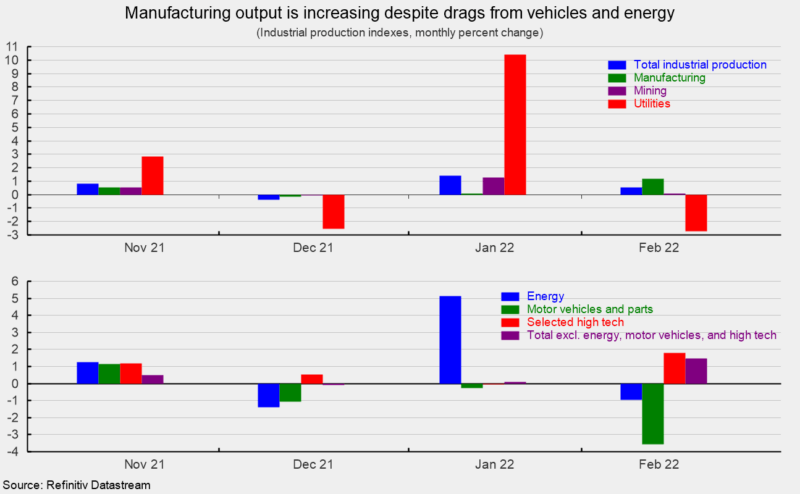

Mining output accounts for about 14 % of complete industrial output and posted a modest 0.1 % improve final month (see high of second chart). Over the past 12 months, mining output is up 17.3 %. Utility output, which is usually associated to climate patterns and is about 12 % of complete industrial output, sank 2.7 %, partially reversing the January surge of 10.4 % (see high of second chart) with pure fuel off 12.1 % and electrical down 0.9 %. From a 12 months in the past, utility output is off 1.2 %.

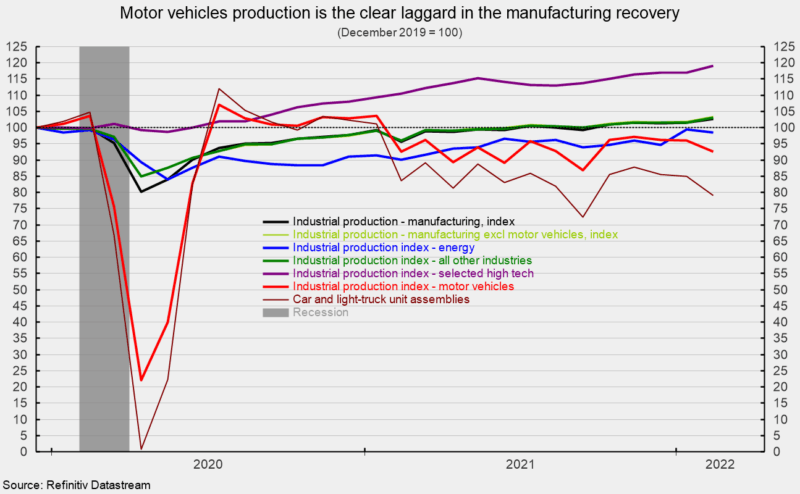

Among the many key segments of commercial output, power manufacturing (about 27 % of complete output) fell 1.0 % for the month (see backside of second chart) with declines throughout 4 of the 5 elements. Complete power manufacturing is up 9.3 % from a 12 months in the past and is again barely under the December 2019 stage (see third chart).

Motor-vehicle and elements manufacturing (just below 5 % of complete output), one of many hardest-hit industries throughout the lockdowns and post-lockdown restoration, continues to wrestle with a semiconductor chip scarcity. Motor-vehicle and elements manufacturing fell 3.5 % in February following a 0.3 % drop in January and a 1.1 % fall in December (see backside of second chart). From a 12 months in the past, car and elements manufacturing is unchanged, however in comparison with December 2019, output is off 7.4 % (see third chart).

Complete car assemblies fell to eight.43 million at a seasonally-adjusted annual price. That consists of 8.15 million mild automobiles and 0.28 million heavy vehicles. Inside mild automobiles, mild vehicles have been 6.66 million whereas automobiles have been 1.49 million. Gentle-vehicle assemblies are nonetheless greater than 20 % under December 2019 ranges (see third chart).

The chosen high-tech industries index jumped 1.8 % in February (see backside of second chart), and is up 7.8 % versus a 12 months in the past, and about 19 % above December 2019 (see third chart). Excessive-tech industries account for simply 1.9 % of complete industrial output.

All different industries mixed (complete excluding power, high-tech, and motor automobiles; about 67 % of complete industrial output) rose a powerful 1.4 % in February (see backside of second chart). This essential class is 7.3 % above February 2021 and three.1 % above December 2019 (see third chart). Industrial output posted a achieve in February regardless of a major drop in utility output. Industries exterior of power and motor automobiles usually posted a powerful achieve for the month. Nevertheless, ongoing disruptions to labor provide, rising prices and shortages of supplies, and logistics and transportation bottlenecks proceed to be challenges for the economic sector. Whereas cresting numbers of recent Covid circumstances in late January and early February had the potential to assist companies’ efforts to enhance provide chains and broaden manufacturing, geopolitical turmoil surrounding the Russian invasion of Ukraine has had a dramatic affect on capital and commodity markets, launching a brand new wave of potential disruptions to companies.