[ad_1]

Matthew Lloyd/Getty Photos Information

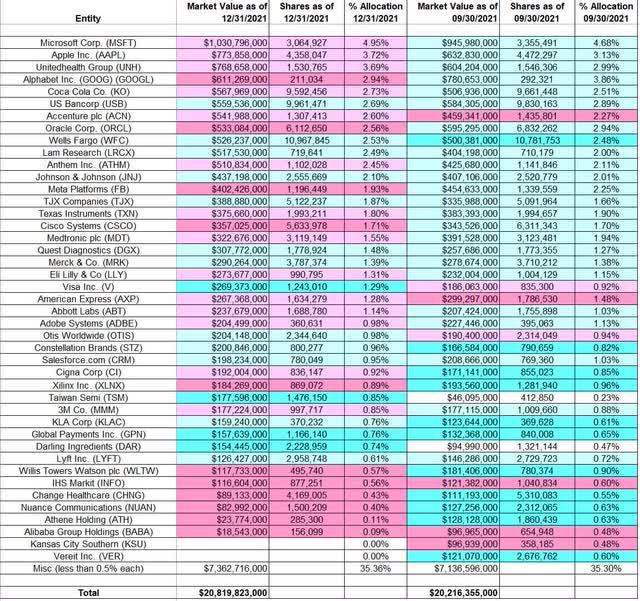

This text is a part of a sequence that gives an ongoing evaluation of the adjustments made to GMO’s 13F inventory portfolio on a quarterly foundation. It’s primarily based on GMO’s regulatory 13F Kind filed on 2/11/2021. Jeremy Grantham’s 13F portfolio worth elevated marginally from $20.22B to $20.82B this quarter. The portfolio is diversified with latest 13F experiences exhibiting properly over 500 completely different positions though most of them are very small. There are 41 securities which might be considerably giant (greater than 0.5% of the portfolio every) and they’re the main focus of this text. The most important 5 stakes are Microsoft Company, Apple, UnitedHealth, Alphabet, and Coca-Cola. They add as much as ~18% of the portfolio. Please go to our Monitoring Jeremy Grantham’s GMO Portfolio sequence to get an concept of their funding philosophy and our final report for the fund’s strikes throughout Q3 2021.

As of EOY 2021, GMO’s 7-year asset class actual return forecast is for US Giant Cap asset class to have a damaging 7.3% annualized return on one finish and Rising Worth asset class to have a constructive 5% annualized return on the different excessive. Your entire bond class can be forecasted to have damaging annualized actual returns over the following 7 years. The agency at present has ~$65B below administration, a far cry from ~$120B that they’d on the peak. The property are distributed amongst individually managed, institutional, and mutual fund accounts. Their flagship mutual fund is GMO Benchmark-Free Allocation Fund (MUTF:GBMFX) which was incepted in 2003.

Observe 1: It was reported in December 2020 that Jeremy Grantham has a ~4.8M share stake in QuantumScape (QS). The ~$12.5M funding was made 7 years in the past as a part of a sequence of bets on early-stage “inexperienced know-how” firms.

Observe 2: Jeremy Grantham has repeatedly stated the US inventory market is in a bubble since June 2020. Their This fall 2021 letter recognized the next errors to keep away from within the present setting: “1) piling into development and the US and out of Chinese language and Rising Equities, 2) piling into personal fairness and enterprise capital by copying portfolios of just lately profitable establishments, 3) assuming that property that made it by the pandemic will carry low elementary danger, and 4) utilizing an unrealistically excessive anticipated return on your portfolio.”

Stake Disposals:

Kansas Metropolis Southern and VEREIT: These two very small (lower than ~0.6% of the portfolio every) stakes had been eradicated this quarter. Canadian Pacific (CP) acquired Kansas Metropolis Southern in a cash-and-stock deal ($90 money and a couple of.884 shares of CP for every share held) that closed in December. Realty Revenue (O) acquired VEREIT in an all-stock deal (0.705 shares of Realty Revenue for every share held) that closed in November.

Stake Will increase:

U.S. Bancorp (USB): The two.69% USB stake was bought in 2017 at costs between $50 and $56 and the inventory at present trades at $56.16. Q1 2020 noticed a ~50% stake improve at costs between ~$29 and ~$55. That was adopted with minor will increase over the following 4 quarters. Final three quarters have seen solely minor changes.

Wells Fargo (WFC): The two.53% WFC place was bought in Q3 2017 at costs between $49.50 and $56. Q1 2020 noticed a ~25% stake improve at costs between ~$25 and ~$49. That was adopted with a ~30% stake improve in This fall 2020 at costs between ~$21 and ~$30. There was a ~18% promoting over the following two quarters at costs between ~$30 and ~$48 whereas final quarter noticed a ~10% improve. The inventory is now at $51.14. This quarter additionally noticed a minor improve.

Lam Analysis (LRCX): The two.49% LRCX stake was in-built Q3 2020 at costs between ~$294 and ~$385 and the inventory is now properly above that vary at ~$537. There have been minor will increase in the previous few quarters.

Johnson & Johnson (JNJ): JNJ is a really long-term stake. Of their first 13F submitting in 2005, the place was at ~170K shares. The sizing peaked at round 26M shares in 2009. The stake was bought down by ~40% in 2014 at costs between $88 and $109. 2016 noticed one other ~50% promoting at costs between $97 and $125. The ten quarters by Q2 2019 additionally noticed minor promoting virtually each quarter. The sample reversed in Q3 2019: 23% stake improve in H2 2019 at costs between $127 and $146. H1 2020 noticed a ~15% trimming whereas the final six quarters have seen solely minor changes. The inventory at present trades at ~$176 and the stake is at 2.10% of the portfolio.

TJX Firms (TJX): TJX is a 1.87% of the portfolio place that has been within the portfolio for properly over fifteen years. The place has wavered. Final main exercise was a ~25% stake improve in H1 2020 at costs between ~$37 and ~$63. The inventory is now at $60.99. Previous few quarters have additionally seen minor will increase.

Quest Diagnostics (DGX): DGX is a 1.48% of the portfolio stake bought in Q1 2020 at costs between ~$73 and ~$116 and the inventory at present trades at ~$144. Q3 2020 noticed a ~22% stake improve at costs between ~$73 and ~$123. Final two quarters noticed one other ~15% stake improve at costs between ~$127 and ~$158. This quarter noticed a marginal additional improve.

Merck & Co. (MRK): MRK is a really long-term stake. In 2014, it was bought all the way down to a really small place at costs between $50 and $62. It was rebuilt in H1 2018 at costs between $53 and $63. Q1 2020 noticed a ~20% promoting at costs between ~$66 and ~$92. The inventory at present trades at ~$79 and the stake is at 1.39% of the portfolio. Final six quarters have seen a ~28% stake improve at costs between ~$69 and ~$88.

Eli Lilly (LLY): LLY is a really long-term 1.31% of the portfolio place. The stake was minutely small until 2008. The next yr noticed a ~3.5M share buy at costs between $30.50 and $38. The place has wavered. Latest exercise follows: Q1 2019 noticed the place virtually bought out at costs between $107 and $116. The stake was rebuilt subsequent quarter at costs between $111 and $129. Q1 2020 noticed a ~25% discount at costs between ~$119 and ~$147. This fall 2020 additionally noticed a ~15% trimming. It at present trades at ~$290. There was a ~16% promoting in Q2 2021 at costs between ~$180 and ~$234. Final two quarters have seen solely minor changes.

Constellation Manufacturers (STZ), Darling Substances (DAR), International Funds (GPN), KLA Corp. (KLAC), Lyft, Inc. (LYFT), Otis Worldwide (OTIS), salesforce.com (CRM), Taiwan Semi (TSM), and Visa Inc. (V): These very small (lower than ~1.5% of the portfolio every) stakes had been elevated this quarter.

Stake Decreases:

Microsoft Company (MSFT): MSFT is at present the highest place within the portfolio at 4.95%. It’s a very long-term stake. The 2007-2008 interval noticed the stake constructed from ~5.6M shares to over 59M shares at costs between $19 and $35. The place dimension peaked in 2011 at ~68M shares. The subsequent 4 years noticed the stake bought down by ~80% at costs between $28 and $56. Latest exercise follows: the three years by Q3 2020 noticed a ~70% promoting at costs between ~$88 and ~$232. The inventory at present trades at ~$299. There was a ~9% trimming this quarter.

Apple Inc. (AAPL): AAPL is a prime three 3.72% long-term stake. It was a big stake in 2005 however was bought down subsequent yr. The place was rebuilt in 2007 however was once more bought down subsequent yr. Related buying and selling sample continued over the following a number of years. The 4 years by 2019 noticed a ~75% discount at costs between ~$23 and ~$82. Q3 2020 noticed one other ~30% promoting at costs between ~$91 and ~$134. The inventory is now at ~$165. Final a number of quarters have seen solely minor changes.

Observe: The costs quoted above are adjusted for the 4-for-1 inventory break up final month.

UnitedHealth Group (UNH): The highest three 3.69% of the portfolio stake in UNH was already a really giant ~18M share place in 2005. The place dimension peaked in 2007 at over 20.5M shares. The 5 years by 2019 had seen a ~75% promoting at costs between $102 and $296. The inventory is now at ~$508. Final two years have seen solely minor changes.

Alphabet Inc. (GOOGL): GOOG is a prime 5 2.94% place. The long-term stake was constructed in the course of the 2007-2014 timeframe at low costs. The place dimension peaked at ~2.6M shares in 2014. Since then, the stake was diminished to ~211K shares at costs between ~$510 and ~$3014. The inventory at present trades at ~$2730.

Coca-Cola (KO): KO is a 2.73% of the portfolio stake. The place was already a big 7M share stake in 2005. That unique stake was constructed to 23.7M shares in the course of the 2007-2008 timeframe at worth between $20 and $32. The sizing peaked at virtually 39M shares in 2012. The subsequent 5 years noticed the place bought down by ~90% to a ~3.7M share stake at costs between $37 and $47. Latest exercise follows. Q1 2020 noticed a ~75% stake improve at costs between $37.50 and $60. That was adopted with a ~37% improve in Q3 2020 at costs between ~$44 and ~$51. The inventory is now at $60.58. Final 5 quarters have seen solely minor changes.

Accenture plc (ACN): ACN turned a big a part of the portfolio in the course of the 2013-2014 timeframe when round 3.8M shares had been bought at costs between $69 and $85. The subsequent 5 years had seen a mixed ~50% discount by minor promoting most quarters. Final two quarters noticed one other ~24% discount at costs between ~$295 and ~$415. The inventory at present trades at ~$325 and the stake is at 2.60% of the portfolio.

Oracle Company (ORCL): The two.56% ORCL place is a really long-term stake. The place was already at round 14M shares in 2007. The subsequent two years noticed the stake constructed to a a lot bigger 62M share place at costs between $15.50 and $24.50. Subsequent few years noticed promoting at greater costs and by 2017 the stake was again at 14M shares. The 5 quarters by Q2 2019 noticed one other ~45% promoting at costs between $44 and $57. Q1 2020 additionally noticed a ~18% discount at costs between ~$40 and ~$56. The inventory is at present at ~$81. This quarter additionally noticed a ~11% trimming.

Anthem Inc. (ANTM): ANTM place was first bought in 2014. The majority of the present ~2% portfolio stake was established in 2017 at costs between $144 and $232. The inventory at present trades at ~$476. Final a number of quarters have seen solely minor changes.

Meta Platforms (FB), beforehand Fb: FB is a 1.93% of the portfolio place bought in Q1 2018 at costs between ~$160 and ~$190. The stake had seen incremental shopping for since. The inventory is now at ~$212. This quarter noticed a ~11% trimming.

Texas Devices (TXN): TXN is a 1.80% of the portfolio place. The vast majority of the stake was bought in Q3 & This fall 2016 at costs between $63 and $75. The inventory at present trades at ~$181. Final a number of quarters have seen solely minor changes.

Cisco Techniques (CSCO): CSCO is a 1.71% of the portfolio very long-term stake. The place dimension peaked at round 37M shares in 2009. Since then, most years noticed reductions and by 2019 the share rely was all the way down to 4.2M shares. Q1 2020 noticed a ~35% stake improve at costs between ~$33 and ~$50. Since then, the exercise had been minor. This quarter noticed a ~11% trimming. The inventory at present trades at $56.

Medtronic (MDT): The very long-term 1.55% MDT stake was bought down in 2014 at costs between $56 and $76. It was constructed again up subsequent yr at costs between $66.50 and $80. Final six years have seen minor changes each quarter. The inventory at present trades at ~$109.

American Specific (AXP): AXP turned a big a part of the portfolio in the course of the three quarters by Q2 2016 when round 6.5M shares had been bought at costs between $59.50 and $66. Subsequent yr noticed a ~50% promoting at costs between $52.50 and $75. There was a ~15% promoting Q1 2021 at costs between ~$114 and ~$150. Final quarter noticed one other comparable discount at costs between ~$159 and ~$178. This quarter additionally noticed a ~9% trimming. The inventory at present trades at ~$189 and the stake is at 1.28% of the portfolio.

3M Firm (MMM), Adobe Techniques (ADBE), Abbott Labs (ABT), Alibaba Group Holding (BABA), Athene Holding (ATH), Change Healthcare (CHNG), Cigna (CI), Eli Lilly (LLY), IHS Markit (INFO), Nuance Communications (NUAN), Willis Towers Watson (WTW), and Xilinx Inc. (XLNX): These very small (lower than ~1% of the portfolio every) positions had been diminished this quarter.

Stored Regular:

None.

Observe: Though the positions sizes relative to the general portfolio may be very small, it’s vital that GMO has sizable possession stakes within the following companies: Clear Vitality Fuels (CLNE), Canadian Photo voltaic (CSIQ), Kosmos Vitality (KOS) and Gyrodyne (GYRO).

Under is a spreadsheet that exhibits the adjustments to Jeremy Grantham’s GMO Capital 13F portfolio holdings as of This fall 2021:

Jeremy Grantham – GMO Capital’s This fall 2021 13F Report Q/Q Comparability (John Vincent (creator))

Supply: John Vincent. Knowledge constructed from GMO Capital’s 13F filings for Q3 2021 and This fall 2021.

[ad_2]

Source link