Yevhenii Orlov

Investment Thesis

Our portfolio is heavily tilted toward real estate and financials. Nevertheless, we understand the importance of diversification, as this is the only “free lunch” that is offered in the business of investing.

We have had exposure towards telecom for years, and took the plunge into technology too this year, as we took a small position in Alibaba (BABA) which has gone from being a growth company to one looking more like a value proposition in our opinion.

Within the telecom sector, we hold Singtel (OTCPK:SGAPY) and China Mobile (OTCPK:CHLKF) which is no longer trading in the U.S. We hold these companies through their listings in Singapore and Hong Kong. Both are great companies with good prospects.

In our search to widen our exposure in telecom, we came across Chunghwa Telecom (NYSE:CHT) in Taiwan.

Introduction

Chunghwa Telecom logo (Chunghwa Telecom)

CHT was established in 1996 and is Taiwan’s largest integrated telecommunication service provider.

It offers fixed communication, mobile communication, broadband, and internet services. In addition, the Company also provides information and communication technology services to enterprise customers with big data, cybersecurity, cloud computing, and IDC capabilities, and is expanding businesses into emerging technology services such as big data, cloud services, artificial intelligence, and blockchain.

Here is what we found when we started to look under the hood.

2022 Q3 Financial Results

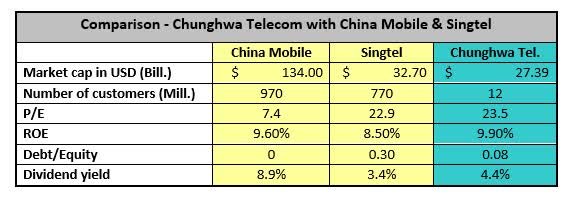

Let us start by stating that CHT is much smaller than both Singtel and China Mobile. Nevertheless, we have made a quick comparison between the three.

Comparison between CHT, Singtel & China Mobile (Author)

CHT’s market share in the mobile phone market in Taiwan is 39.4%.

After the introduction of 5G, they have managed to grow ARPU, which is the average revenue per unit, by 4.2% for the mobile phone sector. Its churn rate is the lowest amongst its peers in Taiwan with only 0.4%.

Fixed broadband services are also seeing good growth in ARPU.

Their enterprise business group division grew revenue by 5.1% year on year. An area of growth for many telecom companies now lies in big data and cloud services. CHT is no different. These grew by 73.3% and 26.4% respectively.

The international business group division grew by 22.6%.

In 2021 CHT had an EPS for the full year of NT$4.61.

So far this year their EPS was NT$3.62 as of Q3 was slightly higher than the NT$3.50 it had in EPS the year before.

The free cash flow up to and including Q3 was NT$27 billion. This is 8.3% higher than the corresponding period of 2021.

Their EBITDA margin was 41.6%.

The company has a good balance sheet with a debt ratio of 23.7% with zero debt in relation to its EBITDA when we take into account all its liabilities minus its cash and cash equivalents. Cash stood at NT$ 32.9 billion at the end of Q3. This equates to about USD 1.1 billion.

Potential catalysts and risks to the thesis

We do believe that CHT can continue to grow its top and bottom line modestly for the next few years.

The market for both broadband internet and mobile subscriptions is fairly saturated and large investments are required for new developments similar to that of 5G. This will put a cap on the margin they can squeeze out of this.

The area of a larger growth will be cloud computing and servicing the business community in Taiwan. This is set to be the catalyst.

Potential risks are geopolitical events such as its relation with China. After what we witnessed in Ukraine this year, some speculate as to whether China one day will invade Taiwan. It is in our opinion, highly unlikely. Peaceful reunification is what they seek, although it is hard to see how Taiwan with its self-governance would want to give up this.

It is more likely going to be a continuation of the present status.

Conclusion

CHT’s numbers are not bad. They do have good organic growth from their business divisions.

However, when we compare CHT to the much larger China Mobile, we see that China Mobile is a better value proposition in terms of P/E and dividend yield.

Therefore, we would for time being hold off from buying CHT until we could see a more attractive proposition from them in terms of a lower P/E.