LumiNola/E+ through Getty Pictures

We’re placing the ending touches on the primary quarter. The previous few months have been vastly totally different from the exuberance seen in Q1 2021. Recall meme inventory mania, the grand reopening optimism, and a seemingly regular rise within the US 10yr yield again then.

This time round, now we have seen speculative progress shares proceed to crash (albeit with a rebound within the final a number of days), indifference towards what’s now a post-Covid world, and unbelievable risky bond markets.

Shares & Bonds See Main Q1 Promoting Strain

The 60/40 portfolio has been beneath siege after the primary buying and selling day of the yr. IShares Core U.S. Mixture Bond Index ETF (AGG), a broad measure of the whole US bond market, exhibits that it’s enduring its worst stretch of actual returns since its 2003 inception. Globally, the worldwide mixture bond index has notched its worst whole return drop in historical past.

All of us knew the time would come when bonds would start to ship horrid returns—all it took was some inflation to point out how dangerous some fixed-income investments have been. Nonetheless, greater yields proper now imply that bonds could possibly be considered as rather more enticing belongings in comparison with richly-valued shares.

Sentiment Drops Onerous

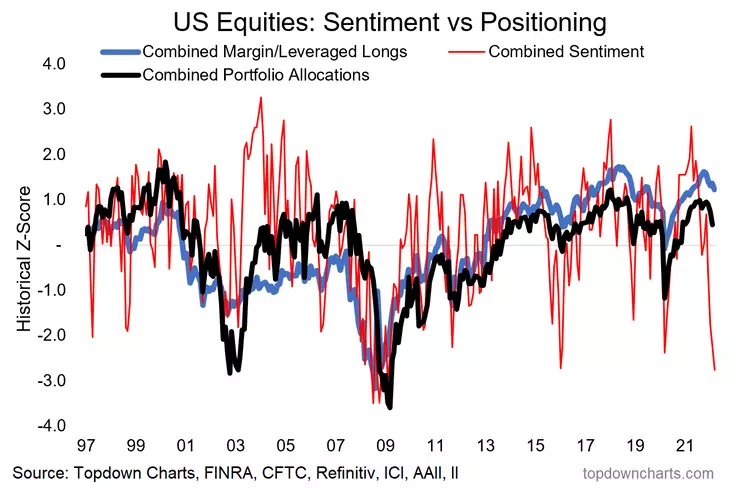

How do traders really feel about what has transpired within the first quarter? They’ve had it! Sentiment surveys present simply how bitter individuals are. We monitor a number of measurements to get a real really feel. We additionally carry out weekly Twitter surveys designed to disclose fairness and bond market sentiment. Lastly, analyzing what individuals are really doing with their portfolio versus how bullish/bearish they report back to be is essential.

Featured Chart: Emotions vs. Allocations

Topdown Charts, Refinitiv Datastream

Our featured chart suggests warning. Mixed sentiment survey knowledge is extremely bearish, little question about it. Is {that a} contrarian bullish signal? Possibly, however we’re simply now beginning to see a rollover in bullish fairness allocations. Check out historical past within the above chart: It typically takes time and larger capitulation washouts to mark a low in shares. It’s possible we aren’t there but. Folks can say they’re pessimistic all they need, however we prefer to see that backed up by bearish portfolio positioning, too.

Weekend Survey Exhibits a Bounce Again in Optimism

The Twitter sentiment polls we conduct are usually extra well timed than these from AAII and II. Ours are carried out over the weekend – on this case, that totally captures the large snapback in shares seen from Tuesday by way of Friday final week. Certainly, we discover that the “Finance Twitter” crowd abruptly turned a lot much less bearish from prior weeks.

Backside Line: Bearish sentiment readings shouldn’t be utilized in isolation when making portfolio choices. Traders ought to analyze how the market is positioned earlier than executing contrarian trades. Our weekly World Cross Asset Market Monitor report dives into the nuances we see and what clues they will present merchants as we head into Q2.