New Delhi, India – A 12 months after the federal government led by Narendra Modi’s BJP got here to energy in 2014, the highest finance ministry official accused the Reserve Financial institution of India of setting rates of interest to profit developed nations and sought a probe into its conduct, a trove of official paperwork obtained by The Reporters’ Collective reveals.

Finance secretary Rajiv Mehrishi, working below the then-finance minister, the late Arun Jaitley, made the declare after the RBI opted to prioritise controlling rising costs over reducing rates of interest, which might have made borrowing cheaper for companies and residents.

Though the federal government and the RBI having completely different views isn’t uncommon, the revelations mark the primary time a prime authorities official has accused the RBI of working to profit “the white man” in “developed nations” and sought an investigation into the “actual objective” behind the central financial institution’s choices.

The paperwork, which had been accessed by The Reporters’ Collective (TRC) below the Proper to Info Act, are being made public for the primary time as a part of a three-part investigative sequence.

On the time in 2015, the RBI governor was Raghuram Rajan, an appointee of the earlier, Congress-led authorities. The BJP authorities selected Urjit Patel as Rajan’s successor.

However the RBI didn’t reduce the curiosity as sharply as the federal government needed, even below Patel. So the finance ministry known as a gathering with the financial institution’s newly arrange financial coverage committee (MPC) to push it to chop rates of interest, in accordance with the paperwork. The unprecedented assembly fell by when committee members declined to attend, a growth extensively reported in 2017.

The try and affect the central financial institution got here regardless of the Modi authorities having amended the Reserve Financial institution of India Act in 2016 to strengthen the firewall between the RBI’s major perform of controlling costs and the federal government’s political impulse to spur progress even at the price of rising inflation.

The RBI’s then-governor Patel pushed again, wrote to the federal government saying it ought to cease attempting to affect the RBI as a way to protect the “integrity and credibility” of the brand new financial framework “within the public eye and our parliament”. In any other case, the federal government could be in violation of the letter and spirit of the legislation that protected the RBI’s independence.

As disagreements piled up on this and different points, Patel resigned on December 10, 2018, citing “private causes”. The federal government changed him with Shaktikanta Das who, as a prime finance ministry bureaucrat, had justified growing the federal government’s affect within the RBI’s rate-setting perform, official paperwork reveal.

Completely different roles

One of many RBI’s key roles is to manage the sum of money and credit score out there within the economic system by the rate of interest at which it lends to banks – that is the central financial institution’s financial coverage perform. Decrease rates of interest spur financial progress within the brief time period however may result in a rise within the costs of products and companies, or inflation. Untamed inflation erodes the worth of cash within the palms of residents, notably the poor, appearing like a hidden tax that hits poorer and lower-income residents greater than the wealthy.

Financial coverage is often stored unbiased of presidency management as a result of politicians face the temptation to create more cash and spend past their means on populist schemes and self-importance initiatives. In the long term, extra spending by the federal government harms the economic system.

Differing analyses of the place inflation could also be headed and the way rates of interest ought to be set usually create stress between central banks and governments in lots of components of the world, together with India. However in New Delhi, the controversy took an unpleasant flip when the Modi authorities got here to energy in Could 2014 as India was witnessing one of many highest ranges of inflation on the planet.

Newly appointed finance minister Arun Jaitley introduced that the federal government would set up a financial coverage regime that will deal with preserving inflation in examine with transparency and accountability. This might be a departure from the present system the place the RBI governor alone set rates of interest, with out an inflation goal at hand.

In February 2015, as a primary step in direction of establishing an MPC, Mehrishi and then-RBI Governor Rajan signed an settlement outlining an inflation goal for the primary time. The central financial institution dedicated to bringing inflation down to six % by January 2016 and 4 % in subsequent years, with a aim of sustaining it inside a spread of two to six %. If the RBI failed to satisfy the goal, it will be required to ship a proof letter to the federal government.

‘Subsidised’ the wealthy overseas

In 2014, Rajan stored the repo price – the speed at which the RBI lends to banks – unchanged at 8 % on account of inflationary considerations. As inflationary pressures eased in 2015, he began chopping the speed, bringing it all the way down to 7.25 % by June. However within the August 2015 assembly, he maintained the established order.

The Modi authorities was not glad with the cuts, with Jaitley and chief financial adviser Arvind Subramanian usually publicly criticising the RBI and complaining that borrowing prices had been nonetheless too excessive.

Their public venting, nevertheless, was solely a touch of the stress being utilized behind the scenes, paperwork present.

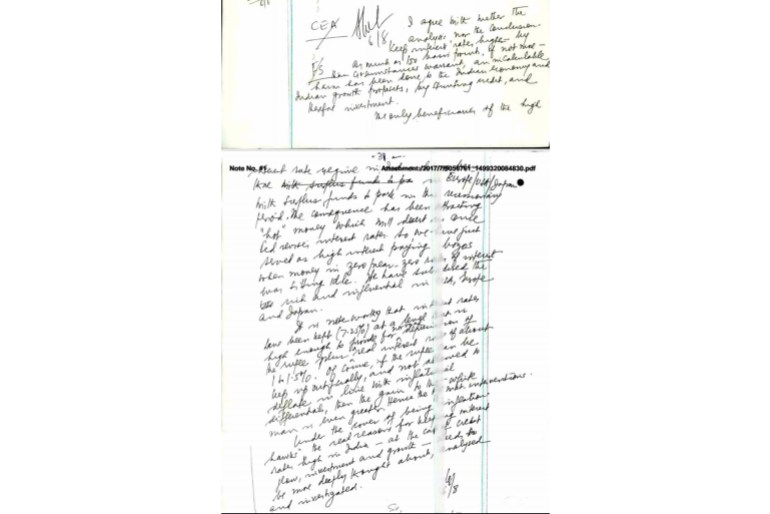

On August 6, 2015, two days after the RBI introduced its newest price resolution, finance secretary Mehrishi wrote an inside notice, asking for the rate of interest to be reduce sharply to five.75 %.

“I agree with neither the evaluation nor the conclusion [of the Reserve Bank of India’s monetary policy committee] to maintain rates of interest increased by as a lot as 150 foundation factors [or 1.5 percentage points], if no more,” Mehrishi stated in his notice. “An incalculable injury has been carried out to the Indian economic system and Indian progress prospects, by stunting credit score, and due to this fact funding,” he added.

Mehrishi then accused the RBI of serving to rich overseas companies at the price of Indian companies and residents, claiming the “solely beneficiaries” of India’s excessive rates of interest had been developed nations.

“Now we have subsidised the wealthy and influential within the USA, Europe and Japan.”

In developed nations, rates of interest are sometimes decrease than in India, encouraging some traders to briefly park their funds within the Indian monetary system to mint earnings from the upper curiosity.

“Beneath the quilt of being ‘inflation hawks’, the actual motive for preserving rates of interest excessive in India – at the price of credit score move, funding and progress – must be extra deeply thought of, analysed and investigated,” Mehrishi stated in his concluding remarks.

Finance minister Jaitley acknowledged Mehrishi’s notice on the file and “desired a dialogue”.

The MPC lastly got here into place in September 2016, days after Rajan moved again to the College of Chicago’s Sales space College of Enterprise to show finance. He was changed by Deputy Governor Urjit Patel who was additionally concerned within the making of the brand new financial framework.

A month later, when Patel chaired the primary MPC, it reduce the rate of interest by 0.25 proportion factors. In its November board assembly, the central financial institution led by Patel permitted Modi’s resolution to invalidate in a single day a lot of the current foreign money, the so-called demonetisation, wherein 500 and 1,000 Indian rupee notes ceased to exist as authorized tender.

Some economists accused Patel of letting Modi railroad the RBI into approving one of many greatest home financial disasters and denting the central financial institution’s autonomy. Rajan would later declare that the federal government had consulted the RBI throughout his tenure on demonetisation however by no means requested it for the nod.

Virtually as if responding to the criticism of diluting its autonomy, the MPC adopted a tricky stance in its subsequent assembly in February 2017 when it modified the “financial coverage stance” from accommodative to impartial. That change in “stance”, which stunned analysts, was a sign to the monetary markets that the MPC would not be open to price cuts.

The central financial institution stored the charges unchanged within the subsequent assembly of the MPC in April 2017, whereas the federal government scrambled to resuscitate an economic system hit by demonetisation.

Rising tensions

With Patel resisting authorities stress, the finance ministry tried to affect the RBI’s unbiased Financial Coverage Committee which units the rates of interest.

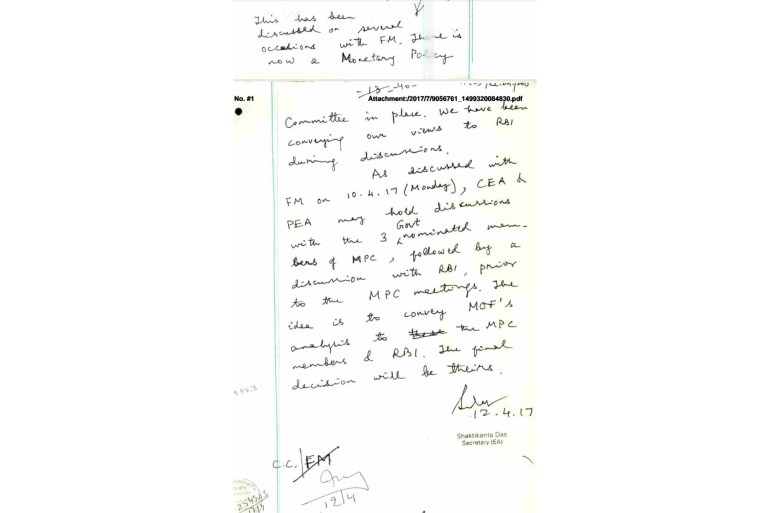

On April 10, 2017, Jaitley held a gathering along with his financial affairs secretary Shaktikanta Das throughout which they determined that then-chief financial adviser Arvind Subramanian and then-principal financial advisor Sanjeev Sanyal would maintain a gathering with the “three government-nominated members of MPC, adopted by a dialogue with RBI, previous to the MPC conferences,” paperwork present.

In a notice on April 12, Das wrote, “The thought is to convey MOF’s [ministry of finance] evaluation to the MPC members and RBI. The ultimate resolution can be theirs [RBI].”

The MPC contains three members from throughout the RBI, together with the governor, and three exterior specialists appointed by the federal government. MPC choices, that are imagined to be made unbiased of presidency affect, are based mostly on a majority vote. In a tie, the governor has a casting vote.

Beneath the Modi authorities’s legislation establishing the MPC, the federal government is just allowed to current its views to the committee in writing. Authorities officers can’t meet with the committee or affect it by another means.

Ignoring the legislation, on Could 17, 2017, the finance ministry despatched a letter to every of the MPC members stating that “with the approval of the Finance Minister, it has been determined to evolve an institutionalised framework below which the federal government might, sometimes, interact with the members of MPC to supply the federal government perspective on macroeconomic state of affairs together with financial progress and inflation”.

The MPC’s exterior members had been summoned for a gathering chaired by Subramanian on June 1, 2017, days earlier than the committee was scheduled to satisfy. A separate letter was written to Urjit Patel telling him concerning the finance ministry’s resolution to carry a dialogue with the RBI officers on the MPC at its headquarters in Mumbai.

Three days later, the finance ministry reversed course and stated in a file notice that the discussions would solely be casual due to the “sensitivities concerned”.

“A revised letter could also be despatched to the MPC…with out mentioning that we want to institute a mechanism for casual dialogue with them,” the notice stated.

A brand new letter was issued to all of the MPC members, which specified that the assembly to be chaired by the federal government’s chief financial adviser is just to “talk about the general macroeconomic state of affairs within the nation and developments within the international economic system.” Any direct reference to rates of interest, the actual objective of the assembly, had now been overlooked.

The letter

On Could 22, 2017, Patel wrote again to Jaitley opposing the assembly. He stated the RBI was “stunned and dismayed by this growth on two counts”, in accordance with the paperwork reviewed by The Reporters’ Collective.

“Firstly, we’ve got not mentioned the matter with one another, though we’ve got interacted a number of instances in latest weeks on work issues; and second, it’s addressed to and seeks to arrange conferences with MPC members, and individually so with non-RBI and RBI members,” Patel stated.

He harassed that the transfer “violates the letter and spirit of the amended RBI Act (to arrange an unbiased committee for financial coverage) and tarnishes the constructive engagement since 2014 between RBI and the Ministry of Finance on points regarding financial coverage”.

“In truth, communication with or from (the) authorities ought to be scrupulously averted if the integrity and credibility of the financial coverage resolution needs to be preserved within the public eye and our Parliament,” Patel wrote, including that traders will “probably” take a dim view of any direct intervention in financial coverage.

“Frankly, that is avoidable as we search, within the nationwide curiosity, to nurture establishments befitting a contemporary economic system,” the ex-RBI governor stated.

Patel reminded Jaitley of the clause that the federal authorities can convey its views solely in writing to the MPC sometimes and stated that another construction for communication will violate the legislation.

“This clause (the place the working phrases are “writing to the MPC”) was, you could recollect, exactly formulated in order that, in a departure from the previous, casual and non-transparent “course” by authorities officers on financial coverage is disallowed,” his letter stated.

Al Jazeera despatched a listing of inquiries to the Ministry of Finance, the RBI, Rajiv Mehrishi, Raghuram Rajan and Urjit Patel. None of them responded.

Das’s parting phrases

Within the finance ministry’s ultimate inside notice on the matter, Das, the then-economic affairs secretary, wrote that an “interplay between (the) finance ministry and members of MPC can’t be interpreted as coming in the way in which of the RBI Act.”

“In the end, accountability about (the) functioning of the economic system lies on the doorsteps of the federal government, notably the finance ministry,” Das stated in a notice dated Could 29, 2017, whereas giving the approval to ship the finance ministry’s evaluation of the economic system to the MPC members in writing.

Das, toeing the federal government line, would turn out to be RBI governor one and a half years after his departure in Could 2017 from the finance ministry. He was appointed barely 24 hours after Patel abruptly resigned in December 2018.

Half 2 of the investigative sequence can be out tomorrow.

Somesh Jha is a member of The Reporters’ Collective.