As of Friday’s shut, Japan’s Nikkei 225 is down 15 per cent from its all-time highs reached a simply few weeks again, on July 11. Its 5.8 per cent decline on Friday is certainly one of its worst single day decline ever.

And if the comply with by way of had been to maintain on Monday’s opening — as indicated by the Nikkei Futures buying and selling down by one other 5 per cent following weak financial information from the US on Friday — it might be knocking on the doorways of a bear market in lower than a month from its peak.

Throughout the Pacific, the Nasdaq Composite entered correction territory on Friday, having fallen greater than 10 per cent from its peak of 18,671 on July 11. The Magnificent Seven and lots of different AI shares are already both in deep bear market or correction territory.

Add to this, the spike within the volatility index within the US represented by CBOE VIX (referred to as the ‘concern gauge’) through the course of Friday by as a lot as a staggering 60 per cent.

Whereas it did get well, at its closing worth of 23.39, it’s now buying and selling across the ranges the place it was when Silicon Valley Financial institution and Credit score Suisse folded up.

Three elements are driving this turbulence.

AI economics

The billions of {dollars} spent by corporations like Microsoft, Alphabet and Amazon in constructing AI Hyperscalers for both growing proprietary capabilities or to broaden cloud service enterprise has rapidly change into investor discomfort.

Practically two years after the launch of Chat GPT and greater than a 12 months after Nvidia’s outcomes ignited the AI rally, the economics of AI stay unclear.

Whereas the views of specialists are divided given no transformative modifications as a consequence of AI but, one consensus that’s rising is that the advantages of investing will take a very long time to yield financial outcomes and justify the economics of enormous outlays. Buyers are actually starting to issue this.

Tesla’s Q2 outcomes had been disappointing. Then again, Alphabet, Microsoft and Amazon’s outcomes/outlook had been modestly under expectation. Nonetheless, given the optimism baked into the shares on AI potential, these had been triggers for a correction.

Unwinding of yen carry commerce

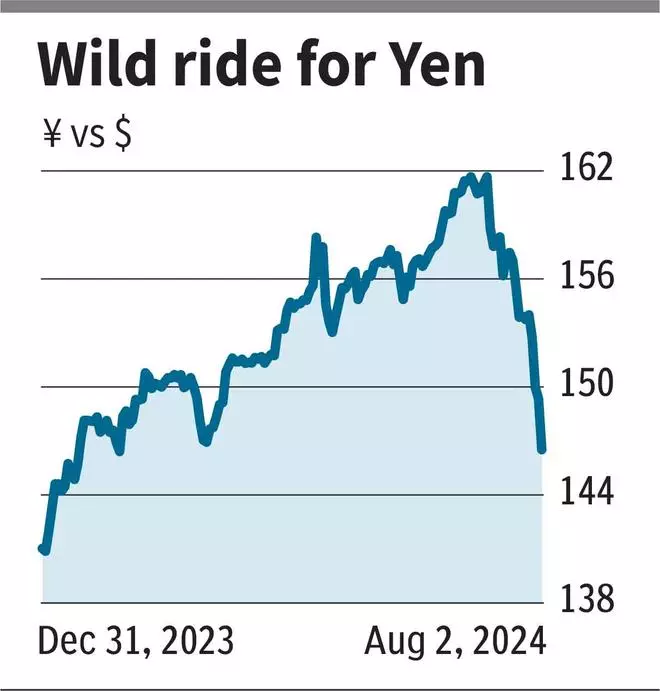

Through the course of this 12 months, the Japanese yen fell by almost 14 per cent to 161.6 in opposition to the US greenback to succeed in its lowest ranges since 1986. Since reaching that backside on July 10, foreign money intervention and charge hikes by the Japanese central financial institution, Financial institution of Japan, together with hawkish messaging by its Governor Kazuo Ueada, triggered a 9 per cent up transfer to 146.9, with a lot of the beneficial properties concentrated in the previous few days.

A weak Japanese yen for lengthy has been a device for the worldwide yen carry commerce the place buyers borrow in yen (given its weak spot and low borrowing prices) and put money into different belongings — equities, greater yield authorities debt like that of the US and stronger currencies. The arbitrage was theirs to pocket, with the one threat being an appreciation within the yen which might eat into their earnings or end in outright losses.

So the sudden surge within the yen in current weeks appears to have brought on a large-scale unwinding within the carry commerce, that’s, buyers promote their different belongings to repay their yen borrowings.

Within the course of, the opposite belongings, together with equities, have been underneath stress final week.

Sahm Rule crimson flag

International markets acquired one other shock from the US month-to-month jobs report launched on Friday, which indicated the unemployment charge had elevated to 4.3 per cent.

Whereas nonetheless remaining amongst the bottom stage, it spooked markets as a result of at 4.3 per cent, it triggered the ‘Sahm Rule’.

This rule states that when the three-month common of the unemployment charge is 0.5 bps above its 12-month low, a recession is underway.

Traditionally, it has been a really correct indicator. Friday’s chaotic transfer throughout equities, bonds and concern gauge was as a consequence of this single issue.

What subsequent?

The irony although is that Caludia Sahm, the economist who created the Sahm Rule, was on file yesterday noting that ‘this time it might be totally different’ as a consequence of few particular elements and that the economic system might not be in a recession,though she believes it’s slowing to regarding ranges.

Additional, just a few others have identified that the Sahm Rule was triggered as a consequence of rounding off of decimals!

However, heightened uncertainty prevails, with current tensions within the Center East including to dangers to markets from worsening geopolitics.

Recession or not, turbulent international economic system and monetary markets shouldn’t be excellent news for Indian markets. US recessions prior to now have all the time resulted in deep bear markets in India as effectively.

With markets at peak valuations when dangers abound, robust home macros might not be a ample cushion.