undefined undefined/iStock by way of Getty Pictures

A “bull market” in a monetary asset means there’s a rising value uptrend with greater highs and better lows. Conversely, a “bear market” in a monetary asset means there’s a falling value downtrend with decrease highs and decrease lows.

THE Main Drawback For Traders

Bear markets are THE main drawback for traders. If shares and different monetary belongings have been at all times in bull market uptrends, the lifetime of an investor could be simple, stress-free and crammed with unicorns and rainbows! However that isn’t the case, sadly.

Along with inflicting big losses and many stress, the injury from bear markets can final for many years. For instance, it took the S&P 500 about 25 years to return to its 1929 peak. It took the NASDAQ about 15 years to return to its 2000 “tech bubble” peak. It took gold about 28 years to return to its 1980 peak. And the Japanese inventory market continues to be about 35% beneath its 1989 peak, 32 years later — after having been down 80% 20 years after that peak (and that is regardless of a few a long time of 0% rate of interest coverage)! Two or three a long time of losses is greater than most traders can deal with emotionally or financially, significantly these approaching or in retirement.

However what can traders do about bear markets? Is there an answer to this important drawback?

Most Wall Road advisors will let you know to at all times keep absolutely invested in shares “for the long term” (which retains their charges flowing uninterrupted) since it’s “not possible to time the market”.

They’re proper that it’s not possible to “time the market” or persistently choose tops and bottoms. However they’re improper once they lead you to imagine that you would be able to’t make plenty of cash (or at the least keep away from big losses) by studying establish the important thing indicators of bear markets and appearing properly on these indicators.

This is essential, since we see many components that time to the following bear market being the worst because the Nice Melancholy, as we mentioned on this Looking for Alpha article. It’s also very well timed, given the weak spot we’ve seen in international inventory markets and most different “risk-on” belongings to this point this yr, together with Bitcoin, which we mentioned on this Looking for Alpha article.

Key Bull & Bear Market Technical Indicators

There are lots of technical indicators we observe that present goal proof that the inventory market is in a bull or bear market development, together with breadth indicators corresponding to advance-decline traces, new highs and lows, and many others.

Along with these indicators, that are extraordinarily helpful for figuring out inventory market developments, there’s a quite simple and confirmed technical instrument that can be utilized to find out bull and bear market developments for any monetary asset: easy shifting averages.

A easy shifting common is just a line on a value chart that reveals the typical value for the asset over a given time interval. It “strikes” each buying and selling day as a brand new day is added and the oldest day drops off. Shifting averages are very helpful for assessing developments as a result of they easy out the noise of day by day value actions and show you how to see developments extra clearly.

We prefer to deal with these key easy shifting common time durations:

1. 20-day shifting common (20-dma) — roughly one month of buying and selling days to evaluate the short-term development

2. 60-dma — roughly three months of buying and selling days to evaluate the intermediate-term development

3. 250-dma — roughly 12 months of buying and selling days to evaluate the long-term development

To easy out developments and cut back the chance of “head fakes”, we typically use the next technical guidelines to find out when a bull market uptrend is in place:

1. value is above the 250-dma,

2. 20-dma is above the 250-dma,

3. 60-dma is above the 250-dma and

4. slope of 250-dma is optimistic

Conversely, we typically use the next technical guidelines to find out when a bear market downtrend is in place:

1. value is beneath the 250-dma,

2. 20-dma is beneath the 250-dma,

3. 60-dma is beneath the 250-dma and

4. slope of 250-dma is unfavourable

Now let’s see how these easy technical guidelines may help you earn substantial income in each bull and bear markets.

S&P 500 Bull & Bear Markets

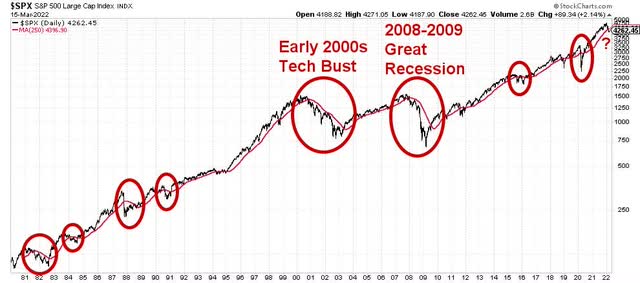

The chart beneath reveals the worth of the S&P 500 (black line) with its 250-dma since 1980. We put pink circles round durations when the worth fell beneath the 250-dma and the slope of the 250-dma was declining.

S&P 500 since 1980 (StockCharts.com)

Six of those eight “bear market” durations have been comparatively short-lived. Appearing on them would have typically led to break-even outcomes, roughly.

However two of them — the early 2000s Tech Bust and the 2008-2009 Nice Recession — have been main bear markets the place substantial income might have been earned by investing in “inverse” ETFs that earn cash in bear markets. We mentioned these ETFs in our earlier Looking for Alpha article.

Early 2000s Tech Bust

The early 2000s Tech Bust bear market is proven within the chart beneath of the SPDR S&P 500 ETF (SPY). The worth of SPY is proven in orange with the 250-dma proven in pink, the 60-dma proven in inexperienced and the 20-dma proven in blue.

SPY Throughout Early 2000s (StockCharts.com)

From November 2000 when the worth of SPY, in addition to the 20-dma and 60-dma all fell beneath the 250-dma, till the underside almost two years later in October 2002, SPY fell about 41%. By June 2003, when the worth of SPY, in addition to the 20-dma and 60-dma all rose above the 250-dma, SPY had fallen about 24%.

If one had owned SPY through the interval of these clear alerts from November 2000 to June 2003, $100 of portfolio worth would have fallen to $76. If as an alternative, one had acted on these alerts by merely shopping for an inverse ETF corresponding to ProShares Quick S&P 500 (SH) — which didn’t exist then, however does now — in November 2000 after which exiting SH in June 2003, $100 of portfolio worth would have risen to $124.

That might have created 63% extra wealth than merely “shopping for and holding”, nicely definitely worth the effort and time of constructing these two trades! Moreover, extra income throughout that bear market might have been made utilizing different easy technical indicators we observe that assist establish when bear market rallies start and finish.

2008-2009 Nice Recession

The 2008-2009 Nice Recession bear market is proven within the chart beneath of SPY. Once more, the worth of SPY is proven in orange with the 250-dma proven in pink, the 60-dma proven in inexperienced and the 20-dma proven in blue.

SPY Throughout 2008-2009 (StockCharts.com)

From January 2008 when the worth of SPY, in addition to the 20-dma and 60-dma all fell beneath the 250-dma, till the underside in March 2009, SPY fell about 49%. By August 2009, when the worth of SPY, in addition to the 20-dma and 60-dma all rose above the 250-dma, SPY had fallen about 23%.

If one had owned SPY through the interval of these alerts from January 2008 to August 2009, $100 of portfolio worth would have fallen to $77. If as an alternative, one had acted on these alerts by merely shopping for an inverse ETF corresponding to ProShares Quick S&P 500 (SH) — which did exist then — in January 2008 after which exiting SH in August 2009, $100 of portfolio worth might have risen to $123. That might have created 60% extra wealth than shopping for and holding — not unhealthy for a few trades! And once more, extra income might have been made throughout that point by utilizing different easy technical indicators we observe.

Implications For Traders

By correctly understanding and utilizing technical indicators, you may earn substantial income throughout bull markets. Much less well-known is that you would be able to additionally earn substantial income throughout bear markets, as an alternative of struggling crushing losses.

Whereas these easy guidelines gained’t show you how to choose the precise prime or backside of a bull or bear market, nothing else will both. However you can create plenty of wealth by understanding these guidelines and appearing on them to compound excessive returns over time.