Vertigo3d/E+ through Getty Photographs

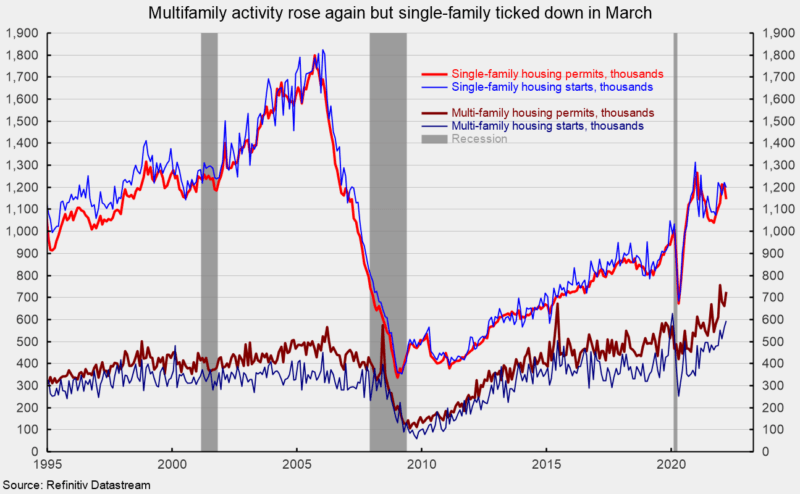

Complete housing begins rose to a 1.793 million annual charge in March from a 1.788 million tempo in February, a 0.3 p.c improve. From a 12 months in the past, complete begins are up 3.9 p.c. Complete housing permits additionally rose in March, posting a 0.4 p.c acquire to 1.873 million versus 1.865 million in February. Complete permits are up 6.7 p.c from the March 2021 degree. Each classes had been led by multifamily housing.

Begins within the dominant single-family section posted a charge of 1.200 million in March versus 1.221 million in February, a drop of 1.7 p.c and are off 4.4 p.c from a 12 months in the past (see first chart). Single-family permits fell 4.8 p.c to 1.147 million versus 1.205 million in February (see first chart).

Begins of multifamily buildings with 5 or extra items elevated 7.5 p.c to 574,000 and are up 28.1 p.c over the previous 12 months whereas begins for the two- to four-family-unit section fell 42.4 p.c to a 19,000-unit tempo versus 33,000 in February. Mixed, multifamily begins had been up 4.6 p.c to 593,000 in March and present a acquire of 26.2 p.c from a 12 months in the past (see first chart).

Multifamily permits for the 5-or-more group jumped 10.9 p.c to 672,000 whereas permits for the two-to-four-unit class had been unchanged at 54,000. Mixed, multifamily permits had been 726,000, up 10.0 p.c for the month and up 29.4 p.c from a 12 months in the past (see first chart).

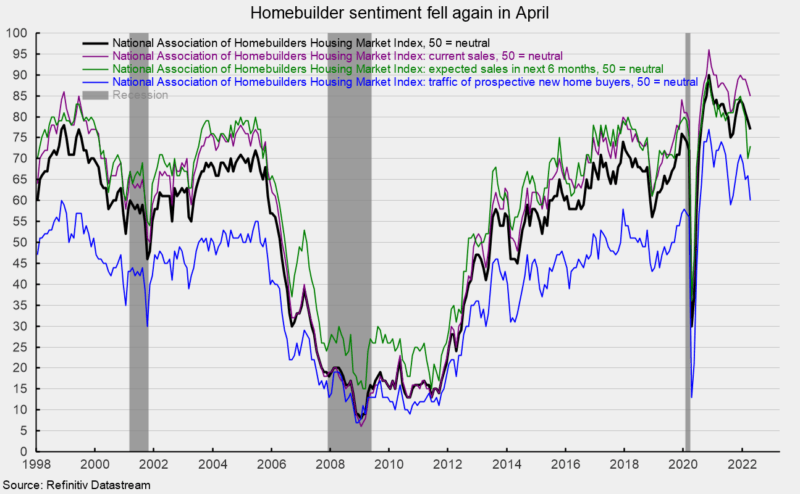

In the meantime, the Nationwide Affiliation of Residence Builders’ Housing Market Index, a measure of homebuilder sentiment, fell once more in April, coming in at 77 versus 79 in March, however nonetheless at a considerably favorable degree. Total sentiment stays constructive, however rising mortgage charges, elevated house costs, and better enter prices are main issues.

Two of the three elements of the Housing Market Index fell in April. The anticipated single-family gross sales index rebounded barely, rising to 73 from 70 within the prior month, however the present single-family gross sales index was all the way down to 85 from 87 in March whereas the site visitors of potential patrons index fell six factors to 60 (see second chart).

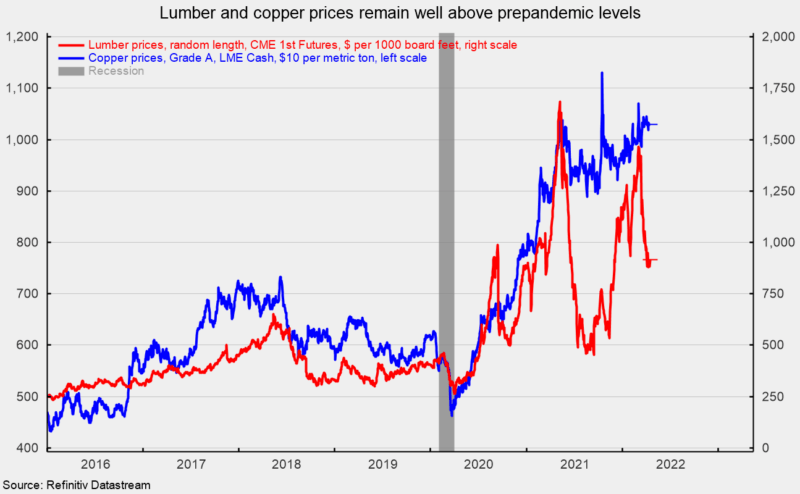

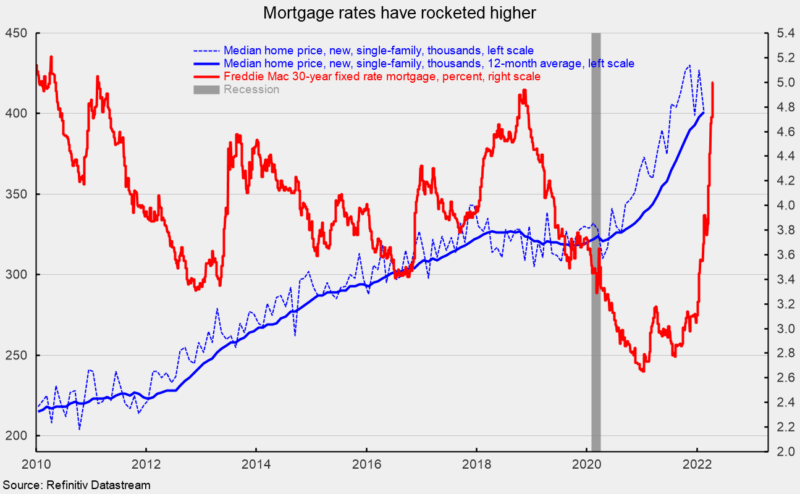

Enter prices are a priority for builders, with lumber coming in at round $915 per 1,000 board ft in mid-April, down from peaks round $1,700 in Might 2021 and $1,500 in early March 2022 whereas copper was holding at simply over $10,000 per metric ton (see third chart). The excessive enter prices will stress income at builders and should result in extra value will increase for brand new properties (see fourth chart).

Moreover, mortgage charges have rocketed increased lately, with the speed on a 30-year mounted charge mortgage coming in at 5.00 p.c in mid-April, almost double the lows in early 2021 (see fourth chart). Larger house costs and better mortgage charges are prone to be vital headwinds for future housing exercise.

After a pullback in exercise within the first three quarters of 2021, single-family exercise has proven renewed power. Whereas the implementation of everlasting distant working preparations for some staff could also be offering continued help for housing demand, ongoing house value will increase mixed with the current surge in mortgage charges will possible work to chill exercise in coming months. Threats to future demand mixed with elevated enter prices are weighing on homebuilder sentiment. The outlook for housing is changing into extra guarded.

Authentic Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.