Oleksandr Filon/iStock by way of Getty Photographs

GEO Group Has Obtained Ample Money Move For A Deal

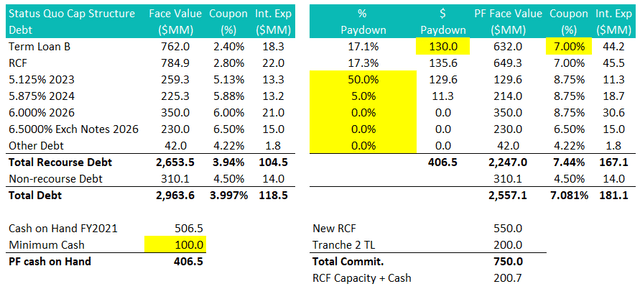

Given the FY2022 steerage, a profitable out-of-court restructuring is sort of a certainty at this level. Within the beforehand disclosed cleaning materials the time period mortgage lenders requested for L+775 bps with 100 bps ground (i.e. 8.75%) and $191 million money paydown. I assume the revolving credit score facility lender will ask for a similar remedy. The bondholder advert hoc group requested for 9.5% coupon, 1-1.5% PIK curiosity, and completely different ranges of money paydown for the three senior unsecured bonds (50% for the 2023s and 5% for the 2024s). A fast modeling train would counsel that these phrases are reasonably priced to GEO (NYSE:GEO), however it may restrict how a lot GEO can delever going ahead.

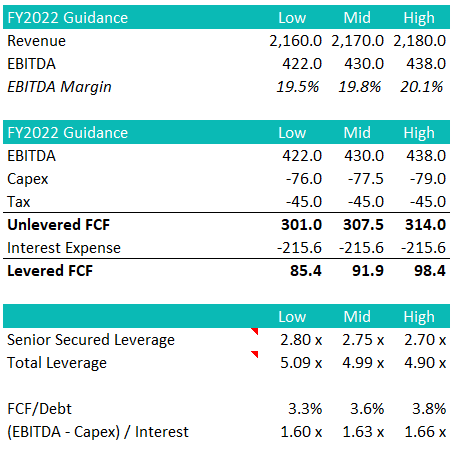

FY2022 Steerage & FCF Stroll (Investor Presentation)

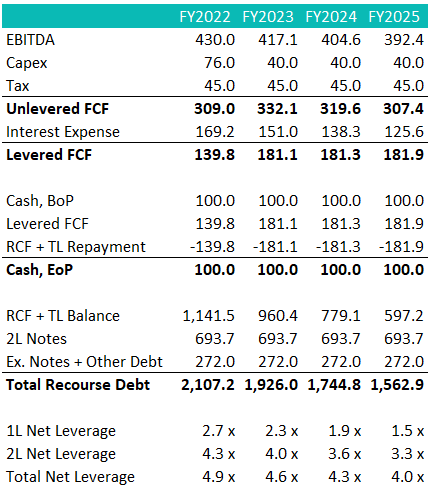

Accepting the advert hoc group’s proposal would imply virtually doubling the annual curiosity expense and leaving on $85-100 million levered free money movement to delever the steadiness sheet in FY2022 (~$130 million within the out years as all FCF are used to pay down the time period mortgage and RCF, saving curiosity bills). Beneath this state of affairs, the whole web leverage will drop by 0.6x from the present 5.0x over the following 4 years.

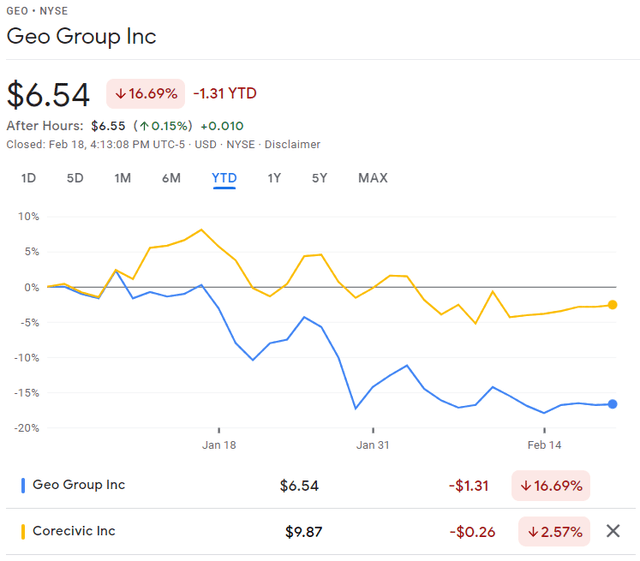

Whereas I do not consider this deleveraging trajectory goes to make the fairness work in the long term, this does imply that GEO can afford to take probably the most punitive deal and nonetheless depart itself with some free money movement to delever slowly. In anticipating a reduction rally from the elimination of this debt restructuring overhang, I am overlaying my GEO quick place. This doesn’t essentially imply that I like to recommend rewinding this pair commerce (+14% YTD) as a result of I nonetheless see CXW outperforming GEO within the medium-to-long time period. In impact I am altering from a market impartial place to a web lengthy place.

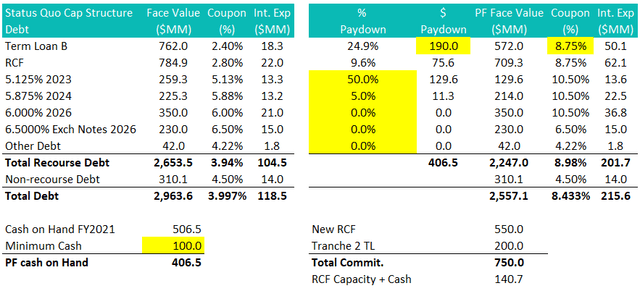

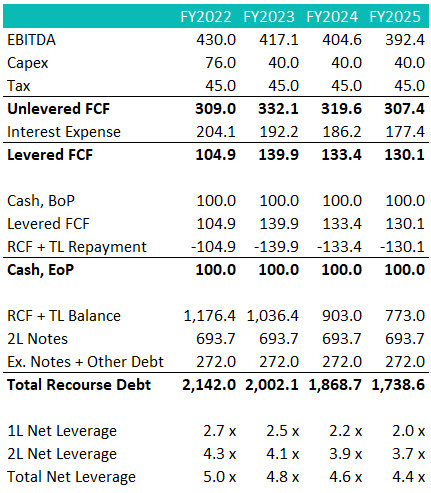

Professional Forma Capital Construction (Creator’s Estimates) Money Move & Leverage Forecast (Creator’s Estimates)

Supply: Investor Presentation and Creator’s Estimates

GEO vs. CXW YTD Efficiency (Google Finance)

Supply: Google Finance

The place I see Phrases Will Be Settled

Whereas the whole lot continues to be attainable, we usually know the beginning factors of the 2 sides and I consider the ultimate phrases will likely be someplace within the center however favoring the collectors as GEO does not actually have a lot negotiation energy. I do not consider the time period lenders will settle for something decrease than 7% coupon however maybe they are going to settle for a decrease money paydown (I assumed $130 million) to offer GEO extra liquidity. The bondholders requested for +1.75% for being within the second lien place behind the time period mortgage and RCF, which interprets to a 8.75% coupon.

I believe the 7% and eight.75% coupon are honest given the near-term COVID-related occupancy danger and the lingering political danger. This additionally offers GEO ample liquidity (~$200 million) and a possibility to pay down debt. Admittedly, the deleveraging will nonetheless happen at a sluggish tempo however at the very least GEO has a line of sight to 1.5x first lien leverage and 4.0x complete web leverage, each are wholesome leverage ratios, in 4 years. Observe that I am additionally assuming a 3% YoY EBITDA lower. If I assume EBITDA stays flat at $430, the 1.5x and 4.0x leverage ratio might be achieved in 3 years.

Professional Forma Capital Construction (Creator’s Estimates) Money Move & Leverage Forecast (Creator’s Estimates)

Supply: Investor Presentation and Creator’s Estimates

Conclusion

GEO can afford probably the most punitive phrases but it surely simply implies that it will not be capable of delever very quick. I consider the secured lenders will settle for a coupon that is honest for the basic danger whereas giving GEO some room to pay down the secured debt in an affordable timeframe – a 7% coupon will allow GEO to scale back the primary lien leverage from the present 2.7x to 1.5x in 4 years. I anticipate the bondholders will simply add 1.75-2% on prime for being junior to the time period mortgage and RCF. In any state of affairs, I do not see how GEO is ready to return any capital to shareholders within the subsequent few years, however I am (partially) overlaying my GEO quick place in anticipation of a profitable out-of-court restructuring within the close to time period.