mgstudyo

Funding Thesis

I feel that Genie Vitality Ltd. (NYSE:GNE) is a worthwhile firm as a result of it has set document profitability and robust returns over the previous few months, and its valuation implies that it’s at the moment buying and selling under the truthful worth, which leads me to price the inventory as a Purchase. The corporate is doing moderately nicely even when vitality costs are risky. I additionally assume administration is superb in danger administration attributable to hedging methods (lowering commodity volatility danger) and enhancing its place by lessening its ahead obligations out there.

Document Quarter Outcomes

GNE has set document second-quarter outcomes which have been the corporate’s strongest second-quarter leads to the corporate’s historical past. The corporate’s income decreased by 1.8% ($1.35 million) from $75 million in comparison with Q2’21’s results of $76 million. Nonetheless, gross revenue did improve in its second-quarter outcomes by a whopping 218.2% to $67.5 million (impacted by the market-to-market acquire on worldwide hedges), growing the gross margin by 89.9% in comparison with Q2’21’s 27.7% gross margin. The will increase mirror the corporate’s danger administration portfolio of “Hedging methods to scale back commodity volatility danger” again within the first quarter of 2022 to be efficient upfront of a rise in current vitality costs.

Genie Vitality Segments

GNE operates in three completely different segments:

Genie Retail Vitality (‘GRE’) – provides electrical energy and pure gasoline to residential and small enterprise clients in sure parts of deregulated markets inside the USA.

Genie Retail Vitality Worldwide (GRE Worldwide) provides electrical energy to Scandinavia residential and small enterprise clients.

Genie Renewables – 4 traces of companies:

-

Genie Photo voltaic Vitality (Genie Photo voltaic) – Designs and builds a neighborhood photo voltaic set up for commercial-size clients.

-

CityCom Photo voltaic – Recruits clients to buy electrical energy generated by group photo voltaic fields.

-

Prism Photo voltaic Applied sciences – Designs and manufactures area of interest photo voltaic panels for wholesale distribution.

-

Diversegy (Diversegy) – An vitality dealer for business clients.

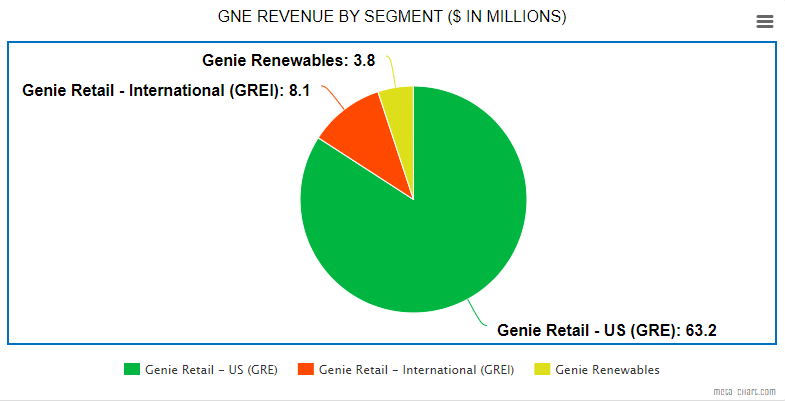

Writer – Knowledge from Sec.Gov – Chart from mega-chart

Within the Q2’22 outcomes, GRE accounted for many of the firm’s income and had a income of $63.2 million, whereas GRE Worldwide had second-quarter income of $8.1 million, adopted by Genie Renewables of $3.8 million.

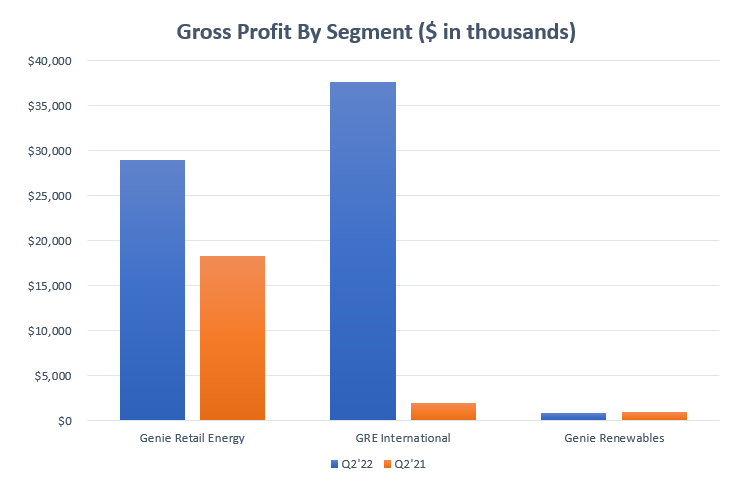

Writer – Knowledge From GNE Second-Quarter Outcomes

Gross revenue by phase (three months ended June 2022 & 2021):

GRE: 2022 second-quarter outcomes gross revenue of $29 million vs. $18.3 million in Q2’21.

GRI: 2022 second-quarter outcomes gross revenue of $37.8 million vs. $1.9 million in Q2’21 (appreciation of the worth of the ahead hedges).

Genie Renewables: 2022 second-quarter outcomes gross revenue of $818,000 vs. $922,000 in Q2’21.

Working revenue elevated from $4.5 million to $48.5 million attributable to a rise in consolidated SG&A bills (company overhead included), which elevated from $16.7 million in Q2’21 to $19 million in Q2’22, reflecting a rise in GRE’s buyer acquisition bills and basic overhead.

Working revenue by phase (three months ended June 2022 & 2021):

GRE: 2022 second-quarter working revenue of $14.4 million vs. $5.4 million in Q2’21.

GRI: 2022 second-quarter working revenue of $36.4 million vs. $144,000 in Q2’21.

Genie Renewables: 2022 second-quarter working revenue lack of $519,000 vs. $334,000 in Q2’21.

GNE additionally introduced that they are going to be paying a quarterly dividend of $0.075 for sophistication A and sophistication B stockholders and has repurchased 639,000 class B frequent inventory shares amounting to $4.4 million, averaging about $6.90 per share.

I feel GNE’s hedging methods proved efficient in vitality worth volatility and elevated the corporate’s profitability over the second quarter of 2022. GNE’s share worth was round $6.30 again in Could and is at the moment buying and selling at $10.69 or a 69% improve prior to now quarter, and surprisingly sufficient, the corporate continues to be under truthful worth.

The corporate’s stability sheet is wanting strong. The corporate has been strengthening its stability sheet by having low debt ranges and growing its money development. Based on Michael Stein, the CEO of GNE:

“Our photo voltaic technique consists of creating worth with strong returns by placing our robust stability sheet to work.”

– GNE Q2 2022 Outcomes – Earnings Name Transcript

The corporate has whole money & money equivalents of $67 million or $2.58 per diluted share. Though the corporate’s money grew 32% in comparison with final 12 months’s second quarter outcomes, GNE’s money stability declined by $28.1 million, a 29% lower in comparison with the previous quarter. Avi Goldin, the corporate’s CFO, has this to say concerning the lower in money:

“Money stability declined in comparison with final quarter as we transfer money to the administrator of our former UK enterprise because the insolvency course of there strikes ahead.”

– GNE Q2 2022 Outcomes – Earnings Name Transcript

Total, administration means that the expansion in profitability will proceed within the following quarters. A lot of the success within the second quarter outcomes was from mark-to-market features on the corporate’s ahead electrical energy hedges. On account of volatility in vitality costs, geopolitical dangers, and the general international financial scenario, the corporate is additional enhancing its place by lessening its ahead obligations out there, beginning with promoting the Swedish ebook (which sort of implies that they’re lowering their geographic range, however I feel it’s a step into the precise course given the volatility and dangers with working in these areas). Michael Stein, GNE’s CEO, additionally said:

“In abstract, we had document backside line outcomes through the first half of the 12 months and we anticipate to proceed to generate robust year-over-year consolidated adjusted EBITDA enlargement within the second half. We’ve additionally taken a number of steps to put the muse for long-term development in our rising renewable companies. And at last, we proceed to meet our dedication to return capital to shareholders.”

– GNE Q2 2022 Outcomes – Earnings Name Transcript

This may be seen by the corporate’s share repurchasing and a dividend of $0.075 per share to be paid within the quarter. Total, I feel GNE is doing nicely in danger administration. I consider the corporate shall be worthwhile within the coming months and hopefully proceed to be worthwhile within the coming years when it might develop its geographic range as soon as the financial conditions stabilize.

Valuation

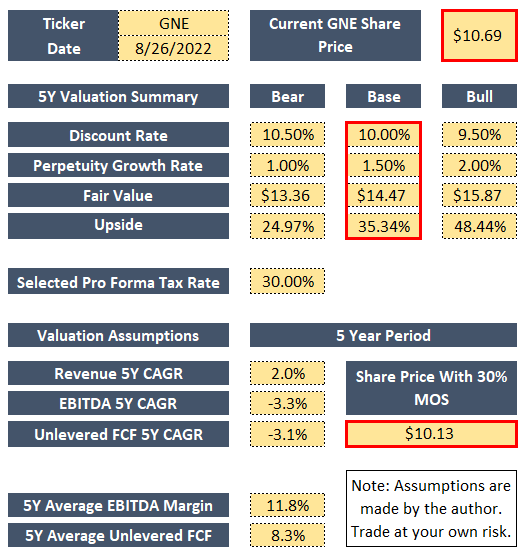

Writer – Knowledge from Sec.Gov

I feel that GNE is at the moment buying and selling under its truthful worth. Through the use of a DCF mannequin, the inventory’s truthful worth is $14.47, which contains a 35% upside in comparison with right this moment’s worth of $10.69. As proven within the picture above, I used a reduction price of 10% and a perpetuity development price of 1.50%. With my income assumptions of two% and common unlevered FCF of 8.3% (with a professional forma tax price which is barely greater in comparison with the tax price in current quarters), I’ve the truthful worth for the next situations:

Bear: Honest worth of $13.36, add a 30% MOS, and we get a goal worth of $9.35, which is 14% much less the present share worth.

Base: Honest worth of $14.47, add a 30% MOS, and we get a goal worth of $10.13, which is -6% much less the present share worth.

Bull: Honest worth of $15.87, add a 30% MOS, and we get a goal worth of $11.11, which is 4% above the present share worth.

Total, the inventory’s share worth is buying and selling under its truthful worth, main me to price the inventory as a Purchase. Administration is doing fairly nicely with danger administration by lessening its ahead obligations in a few of its risky markets and its hedging methods.

Dangers

A risky international financial scenario and geopolitical dangers are the present dangers for GNE. The vitality markets are risky, and we will moderately anticipate that pure gasoline and vitality costs shall be topic to fluctuations sooner or later. Till the worldwide financial scenario stabilizes, GNE will at all times be topic to those dangers. Volatility in vitality costs can expose GNE to huge features or huge losses, and buyers ought to think about this earlier than partaking with the inventory.

Conclusion

Total, I feel GNE is a worthwhile firm doing nicely in unfavorable market circumstances whereas nonetheless setting document revenue from operations. Administration is doing fairly nicely with danger administration as nicely. The inventory is at the moment buying and selling under its truthful worth, which leads me to a Purchase ranking. If GNE can pull off nice leads to unfavorable markets, they will definitely pull off higher leads to extra stabilized markets.

Thanks a lot to your time, have an incredible day.