eyegelb

It was a blended Q2 Earnings Season for the Gold Miners Index (GDX), and solely a handful of corporations reported upside beats and steerage raises (exterior of elevating price steerage). Nonetheless, Galiano (NYSE:GAU) was one title that reported a shock beat, ending H1 with 92,300 ounces produced, monitoring effectively forward of steerage even after adjusting for reliance on stockpiled materials in H2. Moreover, its metallurgical take a look at work seems to be going following a tough Q1. These constructive developments have actually improved the inventory’s outlook, however with GAU rallying 42% off its lows and inching in the direction of resistance, I’d view rallies above US$0.60 earlier than October as promoting alternatives.

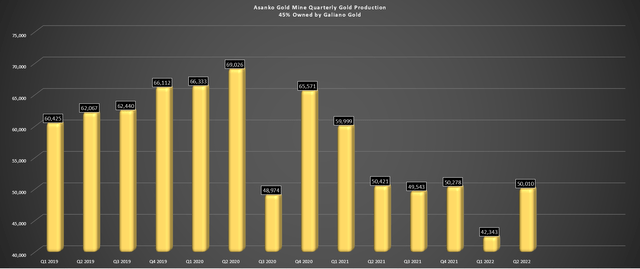

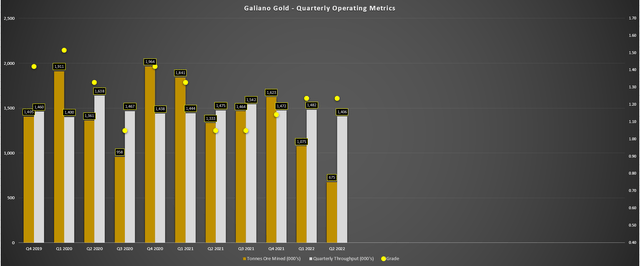

Until in any other case famous, all figures are on a 100% foundation for the Asanko Gold Mine JV. The Joint Enterprise is cut up 50/50 for the 90% financial curiosity, with Ghana holding 10%. Subsequently, all figures are attributable on a forty five% foundation to Galiano.

Asanko Gold Mine Operations (Firm Presentation)

Practically 4 months in the past, I wrote on Galiano Gold (GAU), noting that whereas the corporate was low-cost with a market cap simply north of $100 million, there was a scarcity of constructive catalysts for a re-rating, making it an inferior solution to play the sector. For the reason that article, Galiano noticed a 34% drawdown, however has since recovered a lot of its losses. This may be attributed to a better-than-expected H1 efficiency, the metallurgical take a look at work that seems to be going effectively (pending third-party outcomes), and a big enhance in steerage. Let’s take a more in-depth take a look at the newest quarter under:

Q2 Manufacturing

Galiano Gold had a strong Q2 efficiency, a shock for a corporation that simply got here off a really tough Q1 and couldn’t declare mineral reserves attributable to metallurgical uncertainty at its shared Asanko Gold Mine. This was evidenced by the manufacturing of ~50,000 ounces of gold in Q2, a big enchancment from Q1 ranges (~42,300 ounces). The sharp enhance in manufacturing was associated to a 1500 foundation level enhance in restoration charges, with the mine reporting a gold restoration price of 84%, up from a depressing 69% in Q1 2022, prompting the corporate to lift FY2022 steerage to 150,000 ounces (mid-point) vs. 110,000 ounces beforehand.

Asanko Gold Mine – Quarterly Manufacturing (Firm Filings, Creator’s Chart)

Galiano famous that this enhance in recoveries was associated to revising the mill feed mix regime, growing the mass pull within the gravity circuit, and adjusting working parameters and reagent additions within the CIL circuit. The corporate additionally famous in early July that the corporate’s personal work on metallurgy at Esaase confirmed encouraging outcomes from an preliminary evaluation that decided the cyanide soluble gold content material of pulverized intervals by way of Bulk Leach Extractable Gold method and adopted by hearth assay of strong residue. The takeaway of this testing, which is but to be confirmed by a 3rd get together on the opposite half-core materials, is that the outcomes align with historic metallurgical take a look at work accomplished on the Esaase deposit.

Asanko Gold Mine – Quarterly Working Metrics (Firm Filings, Creator’s Chart)

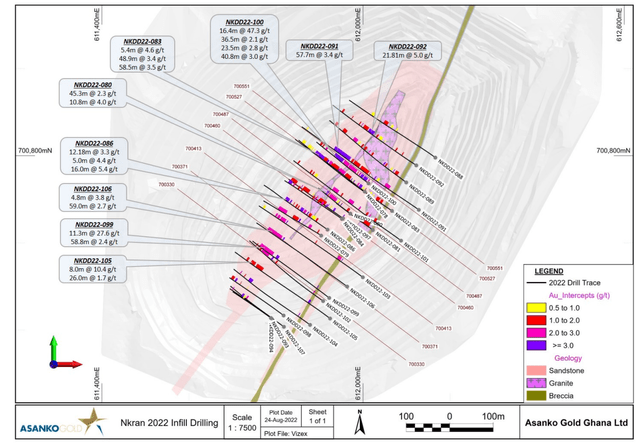

This is good news for the corporate, given {that a} 1500+ foundation level decline in restoration charges would have considerably affected profitability on the lower-grade Esaase deposit. The ultimate outcomes from unbiased laboratory testing ought to be obtainable in Q3, which can inform a brand new Lifetime of Mine Plan that is set to be unveiled early subsequent yr. Whereas this up to date Technical Report is prone to see increased working prices attributable to inflationary pressures (gas, reagents, supplies), we might see some partial offset from the Nkran deposit, which not too long ago reported some phenomenal drill outcomes from inside and under the present useful resource shell:

- 16 meters at 47.3 grams per tonne of gold / 41 meters at 3.0 grams per tonne of gold

- 11 meters at 27.6 grams per tonne of gold

- 49 meters at 3.4 grams per tonne of gold / 58.5 meters at 3.5 grams per tonne of gold

- 16 meters at 5.4 grams per tonne of gold

- 59 meters at 2.7 grams per tonne of gold

Clearly, these outcomes will not be indicative of the common grade, or this is able to be one of many highest-grade gold deposits globally. Nonetheless, these spotlight intercepts from infill drilling are undoubtedly encouraging, serving to to verify the above-average grades at Nkran. It is a constructive growth for the corporate, provided that this layer has been a cash-flow machine, sitting near the processing plant and benefiting from a lot increased grades and restoration charges. Assuming a 1.6 gram per tonne head grade and 92% recoveries with a mix of Nkran ore with different lower-grade deposits, the mine might simply ramp again as much as above 250,000 ounces each year (FY2022 steerage: 150,000 ounces).

Nkran Drilling (Firm Information Launch)

Whereas these outcomes are very encouraging and level to 2.0+ gram per tonne grades from Nkran being greater than achievable, the one damaging is that Nkran makes up lower than 20% of present measured & indicated sources. So, whereas this layer can be utilized to spike grades vs. the opposite lower-grade deposits, it will not be straightforward to take care of a 250,000-ounce manufacturing price with out including vital tonnes at this high-grade deposit. The excellent news is that if Esaase’s previous restoration charges may be maintained, we can’t see a drag on recoveries from this asset, which presently makes up the majority of tonnes on the asset.

Prices & Margins

Transferring over to prices, Galiano additionally managed to buck the pattern right here, with all-in-sustaining prices [AISC] coming in at $1,431/oz, a 4% enchancment from final yr’s ranges regardless of inflationary pressures. It is value noting that this was partially associated to being up in opposition to straightforward year-over-year comps, with AISC growing 40% from Q2 2020 to Q2 2021 ($1,497/ouncesvs. $1,067/oz). That mentioned, the corporate reported decrease labor prices, which was a shock in a sector the place labor prices have been creeping increased by double-digits for some corporations. This was associated to workforce restructuring, and this optimization is predicted to proceed to enhance prices.

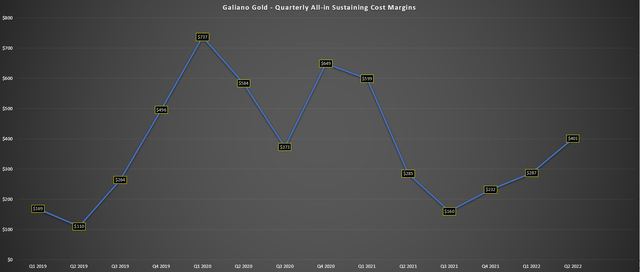

Galiano Gold – All-in Sustaining Value Margins (Firm Filings, Creator’s Chart)

From a margin standpoint, Galiano noticed its AISC margins enhance for the third consecutive quarter to $401/oz, helped by the next common realized gold value of $1,832/oz. Nonetheless, whereas this represented a big enchancment sequentially and year-over-year, we’ve seen a substantial margin degradation since 2020, with Galiano once more up in opposition to straightforward year-over-year comps. Lastly, from a monetary standpoint, the asset reported a quarterly free money influx of $25.3 million (~$11 million attributable to Galiano). Whereas a strong enchancment, Q3 and This autumn ought to look a lot completely different, with decrease manufacturing and a a lot weaker gold value. Let’s have a look at whether or not the uncertainty associated to the up to date Lifetime of Mine Plan is baked into the inventory:

Valuation & Abstract

Based mostly on an estimated year-end totally diluted share rely of 236 million, Galiano Gold has a market cap of ~$118 million. This valuation is usually reserved for an early-stage developer, not a producer, and is definitely effectively under the loopy valuations we’re seeing for some explorers like Snowline Gold (OTCQB:SNWGF) at ~$300 million. Based mostly on ~1.45 million ounces of measured & indicated sources in the newest replace (50% foundation), Galiano trades at a valuation of simply $81.40/oz, an inexpensive determine even when its all-in prices to extract gold are above $1,500/oz, translating to $250/oz+ all-in price margins.

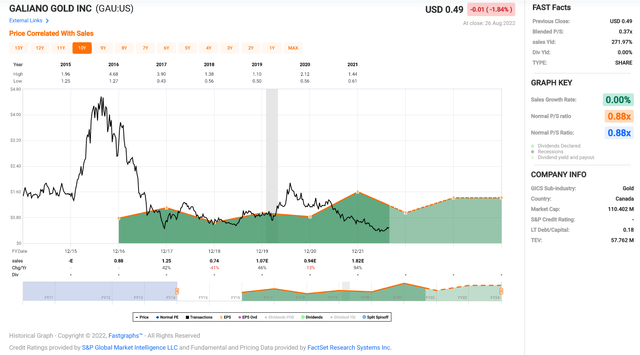

Galiano Gold – Worth-to-Gross sales Ratio (FASTGraphs.com)

From a monetary standpoint, the Asanko Gold Mine ought to generate at the least $85 million in money stream in FY2023, with Galiano’s 45% curiosity translating to ~$38 million. This leaves Galiano at barely 3x ahead money stream estimates, a really affordable valuation even when this can be a Tier-3 jurisdiction, single-asset gold producer, inserting it within the highest-risk class amongst its friends. Lastly, from a income standpoint, Galiano ought to see attributable gross sales of $120+ million in FY2023, leaving the corporate buying and selling at lower than 1x income. These valuation metrics counsel a number of negativity is priced into the inventory. Let us take a look at the technical image:

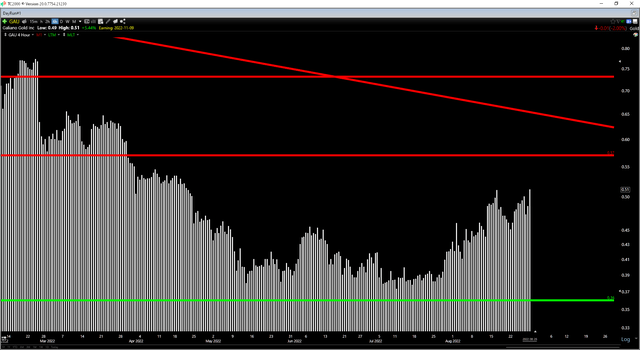

GAU 6-Month Chart (TC2000.com)

Though Galiano’s valuation is enticing and will simply assist a share value of $0.60, the technical image leaves a lot to be desired after its current rally. It’s because the inventory is rallying towards a damaged assist stage at $0.57 and is now prolonged relative to its most not too long ago confirmed assist stage at US$0.36. From a present share value of $0.51, this interprets to a reward/danger ratio of simply 0.40 to 1.0, based mostly on $0.06 in potential upside to resistance and $0.15 in potential draw back to assist. Usually, in relation to micro-cap producers, I desire a minimal reward/danger ratio of 6 to 1, inserting the inventory’s purchase zone at $0.385 or decrease, suggesting GAU is nowhere close to a low-risk shopping for alternative.

Abstract

Galiano had a a lot better H1 than I anticipated, metallurgical testing seems to be going higher than deliberate, and up to date drill outcomes out of Nkran seem to verify phenomenal grades under the present pit. The latter two factors ought to assist to enhance undertaking economics on the Asanko Gold Mine within the Q1 2023 lifetime of mine plan vs. prior expectations and supply some partial offset vs. the influence of inflationary pressures.

That mentioned, whereas Galiano within reason valued, I’d not be stunned to see profit-taking happen if this rally continues. Subsequently, I’d view any rallies above US$0.60 earlier than year-end as promoting alternatives, and I see far more enticing bets elsewhere within the sector. My desire for African gold publicity is Endeavour Mining (OTCQX:EDVMF). It’s because it additionally trades at a reduction to truthful worth however presents diversification (7 mines vs. 1), industry-leading margins (sub $1,000/ouncescosts), and a gorgeous dividend yield (~3.5%).