Paul Butterfield/Getty Photos Leisure

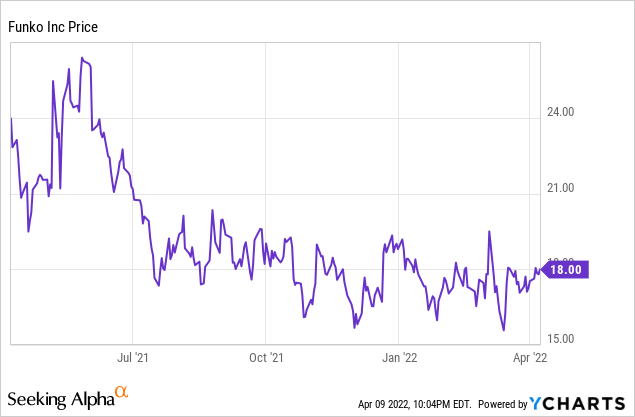

Look throughout the small-cap development class and you will find a sea of purple yr to this point with only a few exceptions: buyers simply do not wish to take their possibilities proper now. Funko (NASDAQ:FNKO), an eclectic toymaker finest identified for its Pop! collectible figurines which are well-featured in toy sections of malls within the U.S. and throughout the globe, is likely one of the few small-cap development shares to be having fun with a latest uptrend and keep away from large year-to-date losses.

Usually, when smaller shares like this outperform, it is normally on account of hype and misguided mania – however within the case of Funko, it is all about fundamentals and worth. This firm has continued to prove spectacular outcomes and drive sturdy execution, which isn’t any small feat in a time interval that has been very difficult for shopper merchandise corporations with constrained provide chains and elevated freight charges. Whereas Funko’s gross margins have additionally taken successful alongside the remainder of the {industry}, its dazzling income development and its plans to consolidate and save money on its operations make it stand out from the pack.

One thing for everybody: the bull case for Funko revisited

I stay bullish on Funko for numerous causes. Particularly, I echo Funko’s most recognizable motto: the corporate provides one thing for everybody. It is essential to remind buyers that Funko’s merchandise span the popular culture universe and enchantment to followers of just about each recognizable model.

Previously, diversification for Funko meant including new “properties” and types to make collectible figurines from. Nonetheless, extra not too long ago, the corporate can be diversifying its merchandise varieties as properly. Its “different” class, proven in the best aspect of the snapshot under, encompasses every thing from attire to plushes and equipment like backpacks and faculty provides. Now roughly one-quarter of Funko’s income, the “different” class grew at a powerful 45% y/y tempo in This autumn.

Funko merchandise (Funko This autumn investor presentation)

This is a full rundown of what I consider to be the important thing bullish drivers for Funko:

- Unparalleled potential to supply and monetize the very best content material. From Fortnite to Pokemon to Marvel and different manufacturers, Funko’s potential to nab the very best content material is unequalled. No single model dominates Funko’s income, so it is properly diversified to be the beneficiary of a basic rise in leisure and popular culture.

- Worldwide development push. Although primarily a U.S. firm now, Funko is driving sturdy development abroad, particularly in Europe the place in the newest quarter, Funko managed to attain ~60% y/y income development.

- NFTs. Final yr, Funko acquired an organization referred to as TokenWave, which enabled it to lastly get its pores and skin within the NFT craze that kicked up amid the pandemic. Funko notes that its first few token choices have “offered out in minutes,” probably opening the door to a wholly new and fast-growing income stream going ahead.

- Wholesome profitability. Surprisingly sufficient for a small-cap firm, Funko is worthwhile from each an adjusted EBITDA foundation in addition to GAAP earnings. For my part, buyers’ hesitation round small-cap shares usually stems from their favoring development over profitability, however in Funko’s case it may brag about having each.

Valuation checkup

Not solely is Funko rising like a weed and exhibiting numerous basic tailwinds, however the firm can be buying and selling at a really engaging worth.

At present share costs of $18, Funko trades at a market cap of $914.2 million – nonetheless very a lot a small-cap firm. After netting off the $83.6 million of money and $173.2 million of debt on the corporate’s most up-to-date steadiness sheet, Funko’s ensuing enterprise worth is $1.00 billion.

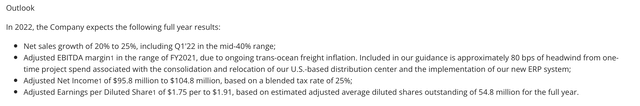

In the meantime, as proven within the snapshot under, Funko is guiding to 20-25% y/y income development (indicating $1.23-1.29 billion in income), $1.75-1.91 in professional forma EPS, and EBITDA margins which are anticipated to be roughly flat to FY21 (which got here in at 14.6%) – translating to adjusted EBITDA of $180-188 million.

Funko FY22 outlook (Funko This autumn investor presentation)

With these parameters, Funko’s valuation stands at:

- 5.4x EV/FY22 adjusted EBITDA

- 9.8x FY22 EPS

For an organization anticipating to keep up ~40% y/y income development by way of Q1, I would say these are fairly engaging multiples to pay.

This autumn obtain

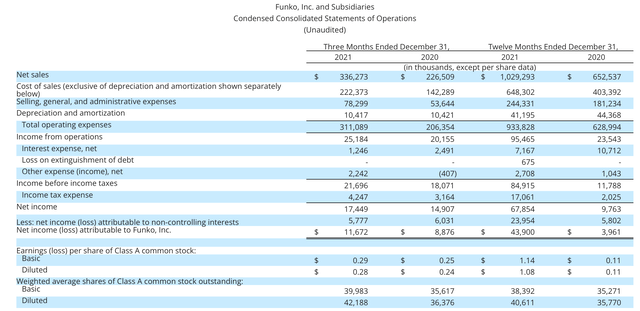

Let’s now undergo Funko’s newest This autumn leads to larger element, which drove loads of renewed enthusiasm for this inventory. The This autumn earnings abstract is proven under:

Funko This autumn outcomes (Funko This autumn investor presentation)

Funko’s income grew at a shocking 49% y/y tempo to $336.3 million, beating Wall Road’s expectations of $271.9 million (+20% y/y). Funko’s income development additionally accelerated considerably versus 40% y/y development in Q3.

Another metrics value mentioning: figurine income grew 50% y/y, whereas “different” merchandise grew 45% y/y. Particularly, Funko famous sturdy efficiency in its comparatively new board video games class. The corporate launched 40 new titles in 2021 alone.

Funko additionally grew in each geographic area, however efficiency was particularly strong in Europe, the place income grew 59% y/y.

This is some commentary from CEO Andrew Perlmutter’s ready remarks on the This autumn earnings name, detailing the corporate’s development drivers for FY22 in addition to the standout efficiency drivers from the fourth quarter:

With this new model construction, we’re higher aligned to execute in opposition to our 4 development pillars. Our first development pillar is sustained innovation inside our core collectible manufacturers class, whereas our second development pillar is sustained income diversification by way of merchandise and types adjoining to our core portfolio.

Our third development pillar is sustained growth of our D2C e-commerce platform. And eventually, our fourth pillar is worldwide growth. Right here we’ll proceed to leverage the breadth of our manufacturers and selectively add sources and capabilities to open up key worldwide markets.

I will now share a number of the highlights from the quarter. Below our first strategic development pillar, we delivered one other wonderful quarter with energy throughout our collectible manufacturers and in all channels. The Pop! model grew 41% year-over-year within the fourth quarter. Our sustained success with Pop! Steps, not solely from our industry-leading breadth of properties but in addition our sturdy fan engagement and innovation we convey to the Pop! product line.

We have launched modern new figures and designs and extremely profitable seasonal product strains. Our participation within the Macy’s Thanksgiving Day Parade with our balloon, that includes Grogu from the hit sequence, The Mandalorian, is a superb instance of the sturdy fan engagement and innovation we proceed to convey to the model.”

The one black mark that marred the sturdy top-line efficiency was freight prices, which is a priority all consumer-products corporations are citing. Resulting from these logistics constraints, Funko’s gross margins fell 330bps to 33.9%.

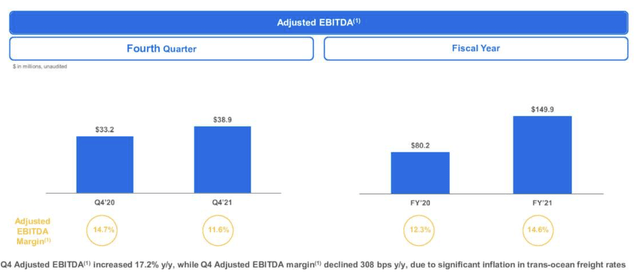

The corporate was, nevertheless, capable of offset this barely with a 40bps discount in promoting, basic and administrative bills within the quarter as a share of income. Adjusted EBITDA margins fell 310bps to 11.6% within the quarter, however nonetheless grew 11% y/y to $38.9 million. Full-year adjusted EBITDA margins, nevertheless, nonetheless expanded 210bps to 14.6%, whereas on a greenback foundation adjusted EBITDA grew 87% y/y to $149.9 million.

Funko adjusted EBITDA (Funko This autumn investor presentation)

Optimistically talking, COVID-driven port logjams and logistics worth spikes are a short lived phenomenon. Funko’s steerage already incorporates heightened freight charges within the first half of 2022, with anticipated easing within the second half of the yr.

Key takeaways

Although hardly recognizable to the mainstream investor, Funko represents an unimaginable mixture of investable deserves: speedy development charges, sturdy bottom-line efficiency, clear drivers for additional growth, and a beautiful valuation. Preserve using the latest upward momentum right here.

:max_bytes(150000):strip_icc()/Health-GettyImages-1060820524-b9fd002a2a4b4506b7fbeafed4361931.jpg)