Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks throughout a Senate Banking Committee affirmation listening to in Washington, D.C., U.S, on Thursday, Feb. 13, 2020.

Andrew Harrer | Bloomberg | Getty Pictures

Federal Reserve Governor Christopher Waller on Friday echoed latest sentiments from his colleagues, saying he expects a giant rate of interest enhance later this month.

He additionally stated policymakers ought to cease attempting to guess the long run and as a substitute keep on with what the info is saying.

“Looking forward to our subsequent assembly, I assist one other vital enhance within the coverage fee,” Waller stated in remarks ready for a speech in Vienna. “However, trying additional out, I can not inform you in regards to the applicable path of coverage. The height vary and how briskly we are going to transfer there’ll rely upon information we are going to obtain in regards to the economic system.”

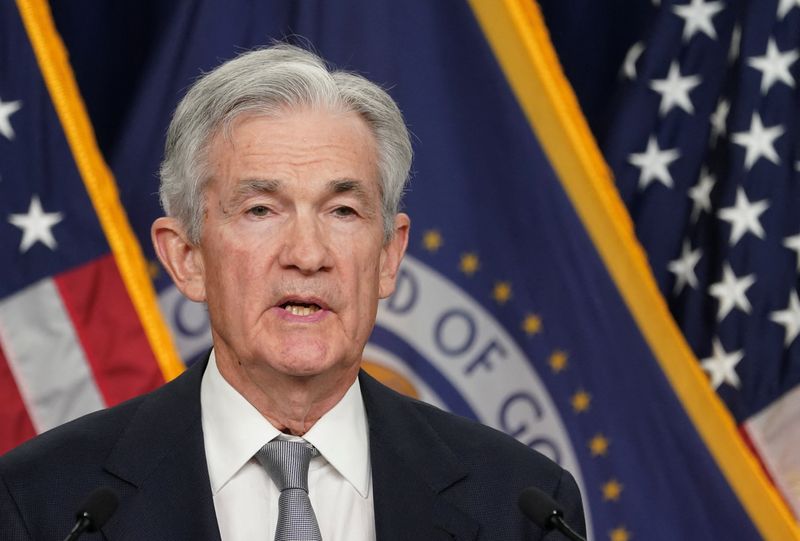

These feedback are just like latest remarks from Fed Chair Jerome Powell, Vice Chair Lael Brainard and others, who stated they’re resolute within the effort to carry down inflation.

Markets strongly anticipate the central financial institution to take up its benchmark borrowing fee by 0.75 p.c level, which might be the third consecutive transfer of that magnitude and the quickest tempo of financial tightening because the Fed started utilizing the benchmark funds fee as its chief coverage device within the early Nineteen Nineties.

Whereas Waller didn’t decide to a selected enhance, his feedback had a largely hawkish tone that indicated he would assist the 0.75-point transfer, versus a half-point enhance.

“Based mostly on the entire information that we now have obtained because the FOMC’s final assembly, I imagine the coverage resolution at our subsequent assembly will likely be simple,” he stated. “Due to the robust labor market, proper now there isn’t a tradeoff between the Fed’s employment and inflation targets, so we are going to proceed to aggressively struggle inflation.

If the Fed does implement the three-quarter level hike, it will take benchmark charges as much as a spread of three%-3.25%. Waller stated that if inflation doesn’t abate by the remainder of the yr, the Fed might should take the speed “nicely above 4%.”

He additional instructed the Fed get away from its apply of offering “ahead steering” on what its future path could be and the components that may come into play to dictate these strikes.

“I imagine ahead steering is turning into much less helpful at this stage of the tightening cycle,” he stated. “Future selections on the dimensions of extra fee will increase and the vacation spot for the coverage fee on this cycle ought to be solely decided by the incoming information and their implications for financial exercise, employment, and inflation.”

Waller identified welcome indicators that inflation is moderating from its highest peak in additional than 40 years.

The private consumption expenditures worth index, which is the Fed’s most well-liked inflation gauge, rose 6.3% from a yr in the past in July — 4.6% excluding meals and vitality. That is nonetheless nicely above the central financial institution’s 2% long-run aim, and Waller stated inflation stays “widespread” even with the latest softening.

He additionally famous that inflation seemed to be softening at one level final yr, then turned sharply larger to the place the buyer worth index rose 9% on a year-over-year foundation at one level.

“The results of being fooled by a short lived softening in inflation could possibly be even higher now if one other misjudgment damages the Fed’s credibility. So, till I see a significant and chronic moderation of the rise in core costs, I’ll assist taking vital additional steps to tighten financial coverage,” he stated.

Kansas Metropolis Fed President Esther George additionally spoke Friday, echoing considerations over inflation but additionally advocating a extra deliberate method to coverage tightening.

“As unsatisfying because it is likely to be, weighing in on the height coverage fee is probably going simply hypothesis at this level,” she stated.

“We must decide the course of our coverage by commentary relatively than reference to theoretical fashions or pre-pandemic developments,” George added. “Given the seemingly lags within the passthrough of tighter financial coverage to actual financial situations, this argues for steadiness and purposefulness over velocity.”

George was the one Federal Open Market Committee member to vote in opposition to June’s three-quarter level fee enhance, advocating as a substitute for a half-point transfer, although she did vote for the July hike.